PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911292

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911292

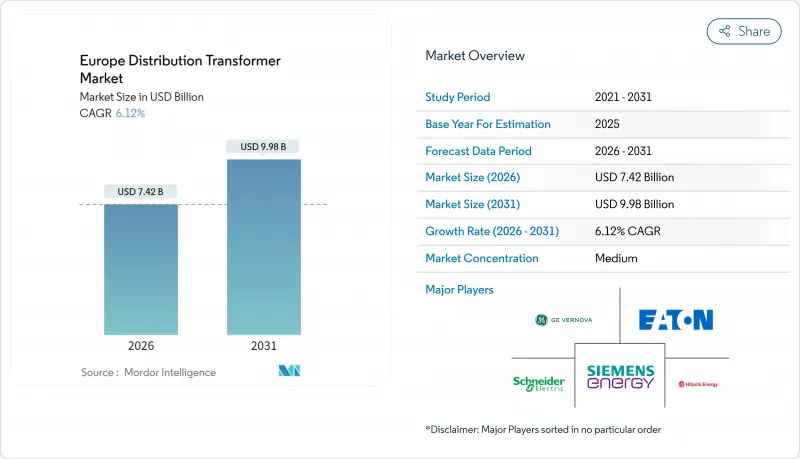

Europe Distribution Transformer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Distribution Transformer Market size in 2026 is estimated at USD 7.42 billion, growing from 2025 value of USD 6.99 billion with 2031 projections showing USD 9.98 billion, growing at 6.12% CAGR over 2026-2031.

Solid momentum stems from grid modernization funding, stricter EU energy-efficiency rules, and surging demand from electric-vehicle charging hubs and hyperscale data center clusters. Utility capital-expenditure pipelines are rising after the pandemic pause as operators deploy digital, high-efficiency units to reduce network losses and increase hosting capacity for renewable energy integration. At the same time, specification shifts triggered by the EU Fit-for-55 package are steering procurement toward premium-efficiency cores and biodegradable insulating fluids, inflating average selling prices yet lowering lifetime losses. Supply-chain tightness in electrical steel remains a brake on output; however, strategic stockpiling, dual sourcing, and incremental capacity additions are tempering the impact on short-term deliveries. Mergers and factory expansions by leading OEMs signal growing competition for geographic reach and cost leadership, while utilities consolidate order books with framework agreements to lock in supply.

Europe Distribution Transformer Market Trends and Insights

Grid-modernization capex rebound post-2024

The European Investment Bank has earmarked EUR 100 billion (USD 107 billion) for 2025, setting aside EUR 11 billion (USD 11.8 billion) specifically for electrical grid upgrades. High-profile projects include the EUR 400 million (USD 428 million) Czech distribution upgrade and Iberdrola's EUR 100 million (USD 107 million) redesign of the Valencia network. Such financing revives deferred utility projects, stimulating bulk procurement of medium-capacity units that match standardized, high-efficiency templates favored for rapid roll-out. As orders solidify, OEMs are ramping plant utilization across Germany, Poland, and Italy, shortening delivery cycles for the European distribution transformer market.

EU Fit-for-55 energy-efficiency mandates

The Fit-for-55 legislative package aims for a 55% reduction in greenhouse gases by 2030, compelling utilities to replace legacy Tier 1 equipment with Tier 2-compliant models and prepare for a likely Tier 3 by 2027. Transformer losses account for 93 TWh, or 2.9% of EU generation, providing a large technical savings pool. Utilities are therefore specifying amorphous-metal cores, advanced step-lap designs, and ester-filled tanks despite 15-20% higher upfront prices. The European distribution transformer market is experiencing longer tender horizons and value-based award criteria that prioritize life-cycle efficiency over initial cost.

Lengthening lead-times for electrical-steel laminations

Global grain-oriented electrical-steel supply remains strained, with lead times stretching to 3-4 years and prices nearly doubling since 2020. Materials now represent 45% of the finished-unit cost, forcing manufacturers to ration allocations and favor high-margin orders. The bottleneck particularly affects the > 100 MVA category, potentially delaying large cross-border interconnection projects that drive demand for the European distribution transformer market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in MV/LV transformer retrofits for data-center clusters

- EV-charge hub roll-outs under TEN-T corridors

- Tightened noise & footprint limits in urban substations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Small units (<= 10 MVA) retained the largest 45.12% share of the European distribution transformer market in 2025, serving rooftop solar interconnections, mixed-use real estate electrification, and suburban feeders. Their short production cycles and catalog-based designs support quick deployment. However, capital-intensive transmission reinforcements under the ENTSO-E Ten-Year Network Development Plan are boosting demand for > 100 MVA equipment at a 6.74% CAGR. The European distribution transformer market size for large units is projected to reach USD 3.31 billion by 2031, driven by the development of new 400 kV corridors and offshore wind landing stations. Manufacturers are dedicating separate production halls and high-voltage test bays to shorten factory acceptance testing for these bespoke models. Utilities balance the higher ticket price with 40-year service life and lower relative losses, preserving total-cost-of-ownership economics.

Oil-cooled designs accounted for 79.85% of the revenue in 2025 and will remain the backbone, thanks to their thermal headroom and cost efficiency. OEMs are upgrading filtration and moisture-monitoring systems to extend oil life to 25 years, helping utilities justify replacements. Pilot projects using natural and synthetic esters are advancing. In 2025, R&S Group shipped a 40 MVA unit filled with Nytro BIO 300X to a Swedish utility, validating field performance. Ester's interest is strongest in fire-sensitive tunnels, ports, and urban substations, where the risk of mineral oil spills is unacceptable. Air-cooled units continue to serve metro rail, semiconductor fabs, and data halls that require zero flammability, but face margin pressure from rising silicon-steel prices. Innovation in solid-state transformer modules, funded by the EU SSTAR program, may open a future niche; however, the high cost keeps deployment marginal for now.

The Europe Distribution Transformer Market Report is Segmented by Power Rating (Large, Medium, and Small), Cooling Type (Air-Cooled and Oil-Cooled), Phase (Single-Phase and Three-Phase), End-User (Power Utilities, Industrial, Commercial, and Residential), and Geography (Germany, United Kingdom, France, Spain, NORDIC Countries, Turkey, Russia, and Rest of Europe). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Hitachi Energy Ltd.

- Siemens Energy AG

- Schneider Electric SE

- Eaton Corporation plc

- GE Vernova

- SGB-SMIT Group

- CG Power Systems Belgium NV

- Westrafo SRL

- SEA SpA (Societa Elettromeccanica Arzignanese)

- GBE SpA

- Brush Transformers Ltd.

- Ormazabal (Velatia)

- Efacec Power Solutions SA

- VEO Oy

- JST Transformateurs

- Koncar D&ST Inc.

- Kolektor Etra d.o.o.

- Wilson Power Solutions Ltd.

- WEG Transformers Europe

- Hyosung Heavy Industries Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Grid-modernization capex rebound post-2024

- 4.2.2 EU Fit-for-55 energy-efficiency mandates

- 4.2.3 Surge in MV/LV transformer retrofits for data-centre clusters

- 4.2.4 EV-charge hub roll-outs under TEN-T corridors

- 4.2.5 Fast-tracking of rural RES hybrid micro-grids

- 4.2.6 Utility-led pilot uptake of biodegradable ester fluids

- 4.3 Market Restraints

- 4.3.1 Lengthening lead-times for electrical-steel laminations

- 4.3.2 Tightened noise & footprint limits in urban substations

- 4.3.3 Volatility in base-oil feedstock for mineral-oil transformers

- 4.3.4 CAPEX deferment amid DSOs' tariff-freeze negotiations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Power Rating

- 5.1.1 Large (Above 100 MVA)

- 5.1.2 Medium (10 to 100 MVA)

- 5.1.3 Small (Up to 10 MVA)

- 5.2 By Cooling Type

- 5.2.1 Air-cooled

- 5.2.2 Oil-cooled

- 5.3 By Phase

- 5.3.1 Single-Phase

- 5.3.2 Three-Phase

- 5.4 By End-User

- 5.4.1 Power Utilities (includes, Renewables, Non-renewables, and T&D)

- 5.4.2 Industrial

- 5.4.3 Commercial

- 5.4.4 Residential

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 NORDIC Countries

- 5.5.6 Turkey

- 5.5.7 Russia

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Hitachi Energy Ltd.

- 6.4.2 Siemens Energy AG

- 6.4.3 Schneider Electric SE

- 6.4.4 Eaton Corporation plc

- 6.4.5 GE Vernova

- 6.4.6 SGB-SMIT Group

- 6.4.7 CG Power Systems Belgium NV

- 6.4.8 Westrafo SRL

- 6.4.9 SEA SpA (Societa Elettromeccanica Arzignanese)

- 6.4.10 GBE SpA

- 6.4.11 Brush Transformers Ltd.

- 6.4.12 Ormazabal (Velatia)

- 6.4.13 Efacec Power Solutions SA

- 6.4.14 VEO Oy

- 6.4.15 JST Transformateurs

- 6.4.16 Koncar D&ST Inc.

- 6.4.17 Kolektor Etra d.o.o.

- 6.4.18 Wilson Power Solutions Ltd.

- 6.4.19 WEG Transformers Europe

- 6.4.20 Hyosung Heavy Industries Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment