PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911342

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911342

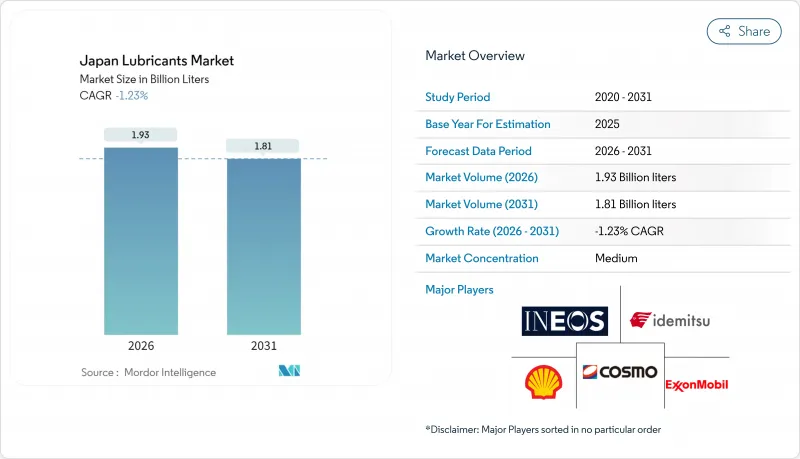

Japan Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Japan lubricants market size in 2026 is estimated at 1.93 billion liters, growing from 2025 value of 1.95 billion liters with 2031 projections showing 1.81 billion liters, growing at -1.23% CAGR over 2026-2031.

The negative trajectory reflects structural changes in vehicle production, the advancement of electrified powertrains, and longer drain intervals, which collectively curb overall volumes in this mature economy. Demand nonetheless remains meaningful because hybrid vehicles still require automatic-transmission fluids, e-axle lubricants, and thermal-management oils, while industrial automation, data-center cooling, and sustainability mandates create pockets of growth that stabilize margins for integrated refiners. Domestic leaders ENEOS, Idemitsu, and Cosmo Energy rely on their refining footprints, extensive distributor networks, and technical relationships with original equipment manufacturers to preserve pricing discipline even as volumes slide. New regulations targeting 175,000 kL of waste-oil recycling by 2035 and 350,000 kL by 2040 have turned re-refined base stocks into a strategic battleground, with incumbents investing in closed-loop supply chains to align with circular economy objectives set by Japan's Ministry of Economy, Trade, and Industry.

Japan Lubricants Market Trends and Insights

Growth in EV and hybrid-specific lubricants

Toyota's hybrid-first strategy, exemplified by hybrids accounting for 40% of the OEM's 2024 domestic sales, preserves demand for automatic-transmission fluids, e-axle greases, and inverter-cooling oils even as conventional engine-oil volumes erode. Hybrid powertrains combine electric motors with internal-combustion engines, meaning each unit still needs small-sump engine oils plus specialized driveline fluids tuned for high-torque, low-viscosity operation. Suppliers able to formulate low-viscosity automatic-transmission fluids with copper-corrosion inhibitors gain share because they extend component life in compact transaxles. Toyota's well-publicized multi-pathway electrification roadmap, which keeps fuel-cell and synthetic-fuel research in scope, further delays an abrupt battery-electric pivot, allowing the Japan lubricants market to sell differentiated chemistries instead of conventional mono-grade oils.

Data-center immersion-cooling fluids adoption

Hyperscale operators based in Tokyo and Osaka are replacing legacy air-cooling racks with single-phase immersion tubs to accommodate rising thermal loads from artificial-intelligence workloads. Dielectric fluids supplied by ENEOS and Idemitsu enable direct-to-chip heat transfer, allowing power densities above 75 kW per rack without performance throttling. These niche fluids deliver oxidation stability, ultra-low volatility, and non-conductivity, letting operators eliminate chillers, reduce fan energy, and raise server life expectancy. Although absolute volumes remain small, unit prices exceed USD 12 per liter, positioning the segment as the highest value pool within the Japanese lubricants market.

Declining ICE vehicle production

Domestic automakers continue to shift final assembly and powertrain production to cost-competitive overseas plants, removing internal-combustion engine output from Japan and thus shrinking in-country fill volumes for factory-fill engine and gear oils. Electric vehicles require as much as 70% fewer lubricants by volume compared with typical ICE models, deepening the consumption slide. The contraction forces lubricant blenders to rationalize local capacity and pivot to higher-value electric-driveline fluids or export-oriented batches.

Other drivers and restraints analyzed in the detailed report include:

- Industrial automation is boosting hydraulic and gear oils

- Corporate net-zero targets driving bio-based lubricants

- Mature industrial output limiting volume expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automotive engine oils held a 33.33% share of the Japanese lubricants market in 2025, but the segment is contracting steadily as hybrids and battery electric vehicles reduce sump sizes and extend oil-change intervals. High-mileage hybrid vehicles still depend on 0W-8 and 0W-12 viscosities to minimize friction, so formulators geared toward ultralow-viscosity synthetics maintain relevance. Industrial engine oils, although growing at a modest 0.02% CAGR, benefit from backup diesel generators that support data center resiliency and hurricane emergency power protocols, adding incremental liters in a flat macroeconomic environment.

Transmission fluids face a bifurcation: demand for conventional automatic-transmission fluids declines in tandem with ICE output, whereas hybrid-transaxle and e-axle coolants expand, prompting suppliers to market copper-friendly, antioxidation packages. Gear oils, especially ISO 320 and ISO 460 grades, benefit from robotics and precision-machinery installations that require long-life, anti-micropitting chemistry. Hydraulic-fluid demand aligns with the renewal of construction equipment and the adoption of fire-resistant phosphate esters in data-center lift systems, slightly moderating the total market decline. Greases remain resilient, powered by wind-turbine pitch bearings and electrified power-steering units. Process oil and metalworking fluid volumes plateau, but synthetics and water-soluble versions command a higher unit value under tighter environmental standards. Turbine and transformer oil turnover follows maintenance cycles within Japan's renewable-energy build-out and grid modernization programs.

The Japan Lubricants Market Report is Segmented by Product Type (Automotive Engine Oil, Industrial Engine Oil, Transmission Fluids, Gear Oil, Brake Fluids, Hydraulic Fluids, Greases, and More), End-User Industry (Automotive, Marine, Aerospace, Heavy Equipment, Industrial), Base Stock Type (Mineral Oil-Based, Synthetic, Semi-Synthetic, Bio-Based), and Geography (Japan). The Market Forecasts are Provided in Terms of Volume (Liters).

List of Companies Covered in this Report:

- ENEOS Corporation

- Idemitsu Kosan Co., Ltd.

- Cosmo Energy Holdings Co., Ltd.

- ExxonMobil Corporation

- BP Plc (Castrol)

- KYODO YUSHI CO., LTD.

- FUCHS SE

- Japan Sun Oil Co. Ltd. (SUNOCO Inc.)

- Mitasu Oil Corporation

- Yushiro Chemical Industry Co., Ltd.

- TotalEnergies SE

- Shell plc

- KYODO YUSHI CO., LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in EV / Hybrid-specific lubricants

- 4.2.2 Rising industrial automation boosting hydraulic and gear lubes

- 4.2.3 Aging vehicle fleet sustaining replacement demand

- 4.2.4 Data-center immersion-cooling fluids adoption

- 4.2.5 Corporate net-zero targets driving bio-based lubricants

- 4.2.6 Circular-economy policies promoting re-refined oils

- 4.3 Market Restraints

- 4.3.1 Declining ICE vehicle production

- 4.3.2 Mature industrial output limiting volume expansion

- 4.3.3 OEM long-drain intervals reduce consumption per vehicle

- 4.3.4 Low-cost imports of re-refined oils

- 4.4 Value Chain Analysis

- 4.5 Regulatory Framework

- 4.6 End-User Trends

- 4.6.1 Automotive Industry

- 4.6.2 Manufacturing Industry

- 4.6.3 Power Generation Industry

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Automotive Engine Oil

- 5.1.2 Industrial Engine Oil

- 5.1.3 Transmission Fluids

- 5.1.4 Gear Oil

- 5.1.5 Brake Fluids

- 5.1.6 Hydraulic Fluids

- 5.1.7 Greases

- 5.1.8 Process Oil (Including Rubber Process Oil and White Oil)

- 5.1.9 Metalworking Fluids

- 5.1.10 Turbine Oil

- 5.1.11 Transformer Oil

- 5.1.12 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.1.1 Passenger Vehicles

- 5.2.1.2 Commercial Vehicles

- 5.2.1.3 Two-Wheelers

- 5.2.2 Marine

- 5.2.3 Aerospace

- 5.2.4 Heavy Equipment

- 5.2.4.1 Construction

- 5.2.4.2 Mining

- 5.2.4.3 Agriculture

- 5.2.5 Industrial

- 5.2.5.1 Power Generation

- 5.2.5.2 Metallurgy and Metalworking

- 5.2.5.3 Textiles

- 5.2.5.4 Oil and Gas

- 5.2.5.5 Other End-Use Industries

- 5.2.1 Automotive

- 5.3 By Base Stock Type

- 5.3.1 Mineral Oil-Based Lubricants

- 5.3.2 Synthetic Lubricants

- 5.3.3 Semi-Synthetic Lubricants

- 5.3.4 Bio-Based Lubricants

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ENEOS Corporation

- 6.4.2 Idemitsu Kosan Co., Ltd.

- 6.4.3 Cosmo Energy Holdings Co., Ltd.

- 6.4.4 ExxonMobil Corporation

- 6.4.5 BP Plc (Castrol)

- 6.4.6 KYODO YUSHI CO., LTD.

- 6.4.7 FUCHS SE

- 6.4.8 Japan Sun Oil Co. Ltd. (SUNOCO Inc.)

- 6.4.9 Mitasu Oil Corporation

- 6.4.10 Yushiro Chemical Industry Co., Ltd.

- 6.4.11 TotalEnergies SE

- 6.4.12 Shell plc

- 6.4.13 KYODO YUSHI CO., LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOs