PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911402

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911402

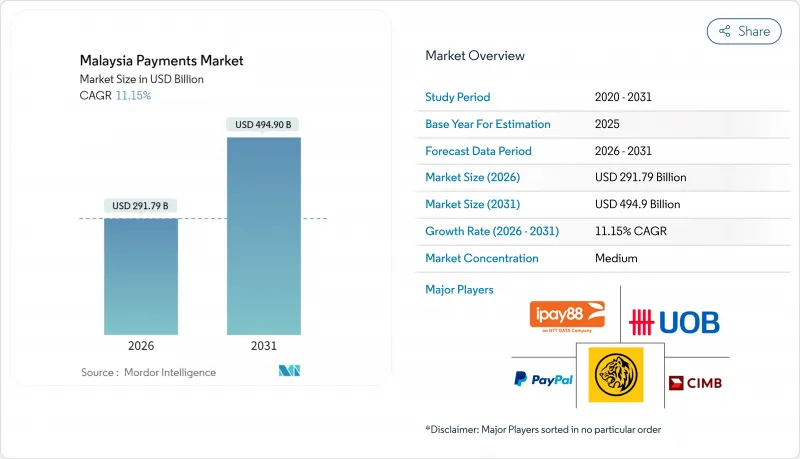

Malaysia Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Malaysia payments market size in 2026 is estimated at USD 291.79 billion, growing from 2025 value of USD 262.5 billion with 2031 projections showing USD 494.9 billion, growing at 11.15% CAGR over 2026-2031.

The upward curve is anchored in the government's interoperable QR strategy, a real-time rails network that underpins instant transfers, and aggressive cashless incentives targeted at rural micro-merchants. Continuous e-commerce expansion, 88% urban e-wallet penetration, and the rise of Islamic fintech propositions together create reinforcing feedback that keeps digital volumes on a double-digit trajectory. Account-to-account (A2A) rails, already embedded in popular super-apps, draw incremental traffic from Malaysia's gig workforce that demands nightly payouts while cross-border corridors funnel inbound tourist spending over shared QR infrastructure. Incumbent card schemes retain relevance in high-ticket online purchases, yet their strongest growth stems from tokenized credentials that ride on contactless point-of-sale terminals now blanketing Klang Valley hypermarkets. Cyber-security remains a capex priority as QR scam sophistication rises, but the National Fraud Portal's coordinated response is beginning to close authentication gaps in banking apps.

Malaysia Payments Market Trends and Insights

Government Push for Interoperable QR and Contactless Cards

DuitNow's nationwide QR standard now spans 80 million Alipay-enabled merchants, with bilateral links active in Indonesia, Singapore, Thailand, and Cambodia. Bank Negara Malaysia mandates a single merchant display QR, shrinking terminal clutter and onboarding costs for micro-enterprises. By May 2025, rural wet-market stalls across Perak and Kelantan accepted contactless payments, reflecting targeted subsidy programs for NFC terminals. Cross-border transaction limits rose sharply after the People's Bank of China lifted caps to USD 5,000 per scan, allowing Touch 'n Go users to execute higher-value purchases during outbound tourism peaks. Merchants gain through a single integration that auto-routes transactions to the cheapest rail, improving margins and accelerating digital penetration into cash-heavy districts.

Rapid E-commerce Expansion and Mobile-Shopping Adoption

Malaysia's online retail GMV jumped amid social-commerce live selling and free-shipping campaigns that funnel more cart checkouts toward stored-value wallets. ShopeePay and Touch 'n Go's direct embedding into Google Pay's autofill layer strips out manual card entry, lifting mobile conversion rates for F&B and pharmacy merchants. An 88% e-wallet adoption rate in 2024 signals a tipping point where digital checkout is now default for discretionary spend. E-commerce platforms extend into grocery and on-demand services, illustrated by Grab's Jaya Grocer acquisition that brings high-frequency fresh-food baskets onto its wallet rail. The shift also accelerates buy-now-pay-later (BNPL) uptake as BigPay Later enters the licensed online moneylender pool, offering installment options to first-jobbers traditionally underserved by credit cards.

Persistent Cash Preference Among SMEs and Rural Consumers

Seventy-seven percent of SMEs remain at basic digital maturity, citing MDR fees and unreliable cellular coverage as barriers to adopting QR codes. In Sabah and Sarawak, vendors at pasar tani still settle mostly in cash because float management is simpler than reconciling daily e-wallet payouts. Fragmented acquiring keeps merchant rates above 2% for micro-tickets, eroding slim produce margins and reinforcing cash loyalty. Government voucher schemes improved uptake during festive seasons yet many hawkers revert to cash once subsidies lapse. As a result, two parallel systems persist, slowing the Malaysia payments market penetration curve outside urban clusters.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Islamic Fintech and Sharia-Compliant Payment Propositions

- ASEAN Cross-Border E-Wallet Interoperability Initiatives

- Rising Fraud and Cybersecurity Concerns Lowering Trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital wallets held 35.10% of the Malaysia payments market share in 2025, translating to a USD 92.14 billion slice of total transaction value. The Malaysia payments market size for wallets is forecast to expand at an 11.15% CAGR in lockstep with smartphone penetration gains. A2A payments, riding on DuitNow instant rails, post the fastest growth at 12.02% CAGR, pulling salary disbursements for 1.5 million gig workers into near-instant clearing cycles. Card rails remain sticky in high-ticket airline and electronics segments due to chargeback protection, yet continuous issuance of contactless MyDebit cards shifts small-value rides on mass transit away from tokens. Cash-on-delivery's relevance is falling as rural logistics networks now accept parcel locker QR settlement, cutting driver float losses. BNPL volumes, though from a small base, climbed 40% in 2024 after BigPay Later acquired an online moneylender license, signaling regulator comfort with installment credit embedded in wallet flows.

Second-generation wallets embed closed-loop loyalty, overseas roaming via Alipay+ and micro-investment modules, keeping users inside a single super-app. GrabPay's API partnership with PayPal extends acceptance into global marketplaces while retaining local MDR economics under the PayNet interchange cap. Competitive differentiation now tilts to fraud-rate performance and gig payout latency, areas where legacy banks invest in faster-payments "overlay services" to retain deposit flow. A2A providers push Request-to-Pay functionality that lets merchants sidestep QR stickers and pop invoices directly into consumer banking apps, signaling the next wave of wallet-rails cannibalization.

The Malaysia Payments Market Report is Segmented by Mode of Payment (Point of Sale [Debit Card, Credit Card, A2A, Digital Wallet, Cash, and More], Online Sale [Debit Card, Credit Card, A2A, Digital Wallet, Cash-On-Delivery, and More]) and End-User Industry (Retail, Entertainment and Media, Hospitality and Travel, Healthcare, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Malayan Banking Berhad (Maybank)

- CIMB Group Holdings Berhad

- Touch 'n Go Digital Sdn Bhd

- PayPal Holdings, Inc.

- Visa Inc.

- Mastercard Incorporated

- UnionPay International Co., Ltd.

- Payments Network Malaysia Sdn Bhd (PayNet)

- Ipay88 (m) Sdn Bhd

- Boost Holdings Sdn Bhd

- Razer Merchant Services Sdn Bhd

- Huawei Technologies Co., Ltd. (Huawei Pay)

- Samsung Electronics Co., Ltd. (Samsung Pay)

- Stripe, Inc.

- BigPay Later Sdn Bhd

- Pine Labs Private Ltd. (FavePay)

- Ant Group Co., Ltd. (Alipay)

- United Overseas Bank (Malaysia) Bhd

- Bank Islam Malaysia Berhad

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid e-commerce expansion and mobile-shopping adoption

- 4.2.2 Government push for interoperable QR (DuitNow) and contactless cards

- 4.2.3 Contactless card penetration and NFC terminal rollout

- 4.2.4 Rise of Islamic fintech and Sharia-compliant payment propositions

- 4.2.5 ASEAN cross-border e-wallet interoperability initiatives

- 4.2.6 Instant payouts for gig-economy via real-time rails

- 4.3 Market Restraints

- 4.3.1 Persistent cash preference among SMEs and rural consumers

- 4.3.2 Rising fraud and cybersecurity concerns lowering trust

- 4.3.3 Fragmented acquiring market keeps MDR high for micro-merchants

- 4.3.4 e-KYC hurdles for migrant and foreign workers

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Industry Stakeholder Analysis

- 4.9 Evolution of the Payments Landscape in Malaysia

- 4.10 Key Trends Driving Cashless Adoption

- 4.11 Porter's Five Forces Analysis

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Intensity of Competitive Rivalry

- 4.12 Key Regulations and Standards

- 4.13 Major Case Studies and Use Cases

- 4.14 Demographic Influences on Payment Preferences

- 4.15 Customer Experience and Global Trend Convergence

- 4.16 Cash Displacement and Contactless Momentum

- 4.17 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (Value)

- 5.1 By Mode of Payment

- 5.1.1 Point of Sale

- 5.1.1.1 Debit Card Payments

- 5.1.1.2 Credit Card Payments

- 5.1.1.3 Account-to-Account (A2A) Payments

- 5.1.1.4 Digital Wallet

- 5.1.1.5 Cash

- 5.1.1.6 Other Point of Sale Payment Modes

- 5.1.2 Online Sale

- 5.1.2.1 Debit Card Payments

- 5.1.2.2 Credit Card Payments

- 5.1.2.3 Account-to-Account (A2A) Payments

- 5.1.2.4 Digital Wallet

- 5.1.2.5 Cash-on-Delivery

- 5.1.2.6 Other Online Sales Payment Modes

- 5.1.1 Point of Sale

- 5.2 By End-User Industry

- 5.2.1 Retail

- 5.2.2 Entertainment

- 5.2.3 Hospitality

- 5.2.4 Healthcare

- 5.2.5 Transport and Logistics

- 5.2.6 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Malayan Banking Berhad (Maybank)

- 6.4.2 CIMB Group Holdings Berhad

- 6.4.3 Touch 'n Go Digital Sdn Bhd

- 6.4.4 PayPal Holdings, Inc.

- 6.4.5 Visa Inc.

- 6.4.6 Mastercard Incorporated

- 6.4.7 UnionPay International Co., Ltd.

- 6.4.8 Payments Network Malaysia Sdn Bhd (PayNet)

- 6.4.9 Ipay88 (m) Sdn Bhd

- 6.4.10 Boost Holdings Sdn Bhd

- 6.4.11 Razer Merchant Services Sdn Bhd

- 6.4.12 Huawei Technologies Co., Ltd. (Huawei Pay)

- 6.4.13 Samsung Electronics Co., Ltd. (Samsung Pay)

- 6.4.14 Stripe, Inc.

- 6.4.15 BigPay Later Sdn Bhd

- 6.4.16 Pine Labs Private Ltd. (FavePay)

- 6.4.17 Ant Group Co., Ltd. (Alipay)

- 6.4.18 United Overseas Bank (Malaysia) Bhd

- 6.4.19 Bank Islam Malaysia Berhad

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment