PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911432

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911432

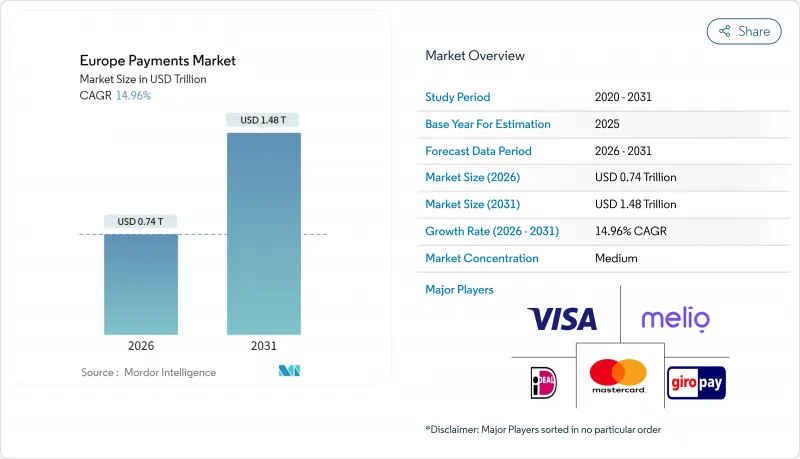

Europe Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe payments market was valued at USD 0.64 trillion in 2025 and estimated to grow from USD 0.74 trillion in 2026 to reach USD 1.48 trillion by 2031, at a CAGR of 14.96% during the forecast period (2026-2031).

Expansion is anchored in the accelerating migration from cash to digital instruments, a trend underscored by the European Central Bank's finding that cash accounted for 52% of point-of-sale transactions in 2024, down from 59% two years earlier. Mandatory real-time payment availability under the Instant Payments Regulation, effective January 2025, is set to widen access to ten-second euro transfers at no extra cost. Surging mobile-wallet adoption-72% of Europeans used one in 2023-plus the roll-out of PSD2-enabled account-to-account rails are redrawing competitive lines. Cross-border initiatives such as the G20 Roadmap cut remittance frictions, while domestic schemes like Poland's BLIK showcase regional innovation. Incumbent banks are reacting through pan-European ventures (for example Wero) aimed at defending revenue pools from global card networks.

Europe Payments Market Trends and Insights

PSD2-Driven Open-Banking APIs Boosting Account-to-Account Payments

Open-banking rules under PSD2 let licensed third parties pull account data through secure APIs, unlocking low-cost, immediate A2A transactions that bypass card rails. UK usage leads, yet German and Nordic banks are rapidly scaling similar frameworks. Banks that move early are bundling white-label APIs for fintech collaboration, whereas laggards risk disintermediation. The forthcoming PSD3 package promises clearer data-access rules that will widen use cases, from payroll to subscription bill pay.

Pan-EU SEPA SCT Inst Rail Accelerating Real-Time Settlement

The SEPA Instant Credit Transfer scheme delivers pan-European euro payments in under ten seconds and is mandatory for euro-area PSPs by January 2025. Volume growth is expected to cannibalize deferred batch card settlements, sharpening price competition and compressing interchange. PSPs are racing to overlay value-added fraud analytics and liquidity-management tools to safeguard revenue.

Interchange-Fee Fragmentation & Local Scheme Complexity

Capped consumer card interchange under the IFR still diverges in practice, forcing merchants to juggle Carte Bancaire, Bancontact and Girocard alongside global brands, raising compliance overhead. PSPs absorb duplicate certification and routing costs that dilute innovation budgets.

Other drivers and restraints analyzed in the detailed report include:

- Embedded Finance Adoption Among EU Retailers

- Rapid E-commerce Expansion in Central & Eastern Europe

- Fraud Exposure in Instant Payments Raising Provision Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

POS card payments retained the largest slice in 2025 at 50.62%, reflecting years of infrastructure investment and consumer habit. Overall Point-of-Sale led with 58.35% revenue share. Yet the Europe payments market is seeing digital wallets and A2A rails compound at an 17.74% CAGR, pulling share from cards online and at point of sale. A rising cohort of 72% of Europeans actively use a wallet, and global e-commerce share for wallets is set to surpass 52.5% by 2025. Cash usage is retreating, though it still holds niche strength for low-value or rural purchases. Wearable and QR-based options are gaining incremental share among early adopters. As consortium wallet Wero scales across major euro economies, incumbents are compelled to harmonize acceptance and loyalty integration.

Cards' entrenched position ensures continued relevance, but issuers are enriching propositions with installment features and crypto reward tie-ins to stem outflow. The Europe payments market size for card-based flows is nevertheless expected to plateau as wallet-based A2A debits capture bill pay, subscription and micro-ticket use cases. Payment gateways that orchestrate a single integration for cards, bank-debited wallets and pay-by-bank are positioned to win merchant preference.

Point-of-sale transactions still dominated with 70.45% share in 2025, mirroring Europe's sizeable brick-and-mortar footprint. Lockdowns accelerated digital engagement, and that momentum persisted: Europe payments market size for e-commerce and m-commerce is advancing at 18.61% CAGR through 2031. Omnichannel journeys blur channel lines, with click-and-collect, QR-initiated in-store pay and pay-by-link in chat fostering continuity. Payment providers that unify risk scoring and token management across channels shield merchants from fraud spikes and boost authorization rates.

Mobile accounts for a growing majority of e-commerce checkouts, led by embedded buttons inside social and gaming apps. The shift forces acquirers to master app-based one-click tokens and to support scheme-level network tokenization. Europe payments market share for purely in-app transactions is forecast to rise fastest within the channel mix, spurring demand for SDKs that compress integration effort for thousands of mid-size merchants.

The Europe Payments Market Report is Segmented by Mode of Payment (Point of Sale, Online), Interaction Channel (Point-Of-Sale, E-commerce/M-commerce), Transaction Type (P2P, C2B, B2B, Remittances and Cross-Border), End-User Industry (Retail, Entertainment and Digital Content, Healthcare, Hospitality & Travel, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Visa Inc.

- Mastercard Incorporated

- Worldline SA

- Nexi Group S.p.A.

- PayPal Holdings Inc.

- Adyen N.V.

- Stripe, Inc.

- Checkout.com Group

- Klarna Bank AB

- Revolut Ltd.

- SumUp Payments Ltd.

- Bancontact Payconiq Company

- Giropay GmbH

- Currence iDEAL B.V.

- Ingenico (Worldline)

- Fiserv, Inc. (Clover)

- Melio Payments Inc.

- Barclays plc (Barclaycard Payments)

- BNP Paribas SA (Axepta, Nickel)

- Deutsche Bank AG (db pay)

- Mollie B.V.

- Block, Inc. (Square)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 PSD2-Driven Open-Banking APIs Boosting Account-to-Account Payments

- 4.2.2 Pan-EU SEPA SCT Inst Rail Accelerating Real-Time Settlement

- 4.2.3 Embedded Finance Adoption Among EU Retailers

- 4.2.4 Rapid E-commerce Expansion in Central and Eastern Europe

- 4.2.5 NFC Limit Hikes Fueling Contactless Card Usage

- 4.2.6 Merchant Uptake of BNPL Plug-ins Elevating AOV

- 4.3 Market Restraints

- 4.3.1 Interchange-Fee Fragmentation and Local Scheme Complexity

- 4.3.2 Fraud Exposure in Instant Payments Raising Provision Costs

- 4.3.3 Legacy Core Banking Systems Slowing Instant Payments Adoption

- 4.3.4 GDPR-Driven Data-Localisation Constraints

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

- 4.7 Pricing Analysis

- 4.8 Evolution of the Payments Landscape in Europe

- 4.9 Cashless-Transaction Growth Trends

- 4.10 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 Segmentation by Mode of Payment

- 5.1.1 Point-of-Sale

- 5.1.1.1 Card (Debit, Credit, Pre-paid)

- 5.1.1.2 Digital Wallets (Apple Pay, Google Pay, Interac Flash)

- 5.1.1.3 Cash

- 5.1.1.4 Other POS (Gift-cards, QR, Wearables)

- 5.1.2 Online

- 5.1.2.1 Card (Card-Not-Present)

- 5.1.2.2 Digital Wallet and Account-to-Account (Interac e-Transfer, PayPal)

- 5.1.2.3 Other Online (COD, BNPL, Bank Transfer)

- 5.1.1 Point-of-Sale

- 5.2 Segmentation by Interaction Channel

- 5.2.1 Point-of-Sale

- 5.2.2 E-commerce/M-commerce

- 5.3 Segmentation by Transaction Type

- 5.3.1 Person-to-Person (P2P)

- 5.3.2 Consumer-to-Business (C2B)

- 5.3.3 Business-to-Business (B2B)

- 5.3.4 Remittances and Cross-border

- 5.4 Segmentation by End-user Industry

- 5.4.1 Retail

- 5.4.2 Entertainment and Digital Content

- 5.4.3 Healthcare

- 5.4.4 Hospitality and Travel

- 5.4.5 Government and Utilities

- 5.4.6 Other End-user Industries

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Poland

- 5.5.7 Nordics

- 5.5.8 Rest of Europe (Eastern Europe, Benelux, Baltics, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Visa Inc.

- 6.4.2 Mastercard Incorporated

- 6.4.3 Worldline SA

- 6.4.4 Nexi Group S.p.A.

- 6.4.5 PayPal Holdings Inc.

- 6.4.6 Adyen N.V.

- 6.4.7 Stripe, Inc.

- 6.4.8 Checkout.com Group

- 6.4.9 Klarna Bank AB

- 6.4.10 Revolut Ltd.

- 6.4.11 SumUp Payments Ltd.

- 6.4.12 Bancontact Payconiq Company

- 6.4.13 Giropay GmbH

- 6.4.14 Currence iDEAL B.V.

- 6.4.15 Ingenico (Worldline)

- 6.4.16 Fiserv, Inc. (Clover)

- 6.4.17 Melio Payments Inc.

- 6.4.18 Barclays plc (Barclaycard Payments)

- 6.4.19 BNP Paribas SA (Axepta, Nickel)

- 6.4.20 Deutsche Bank AG (db pay)

- 6.4.21 Mollie B.V.

- 6.4.22 Block, Inc. (Square)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment