PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911421

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911421

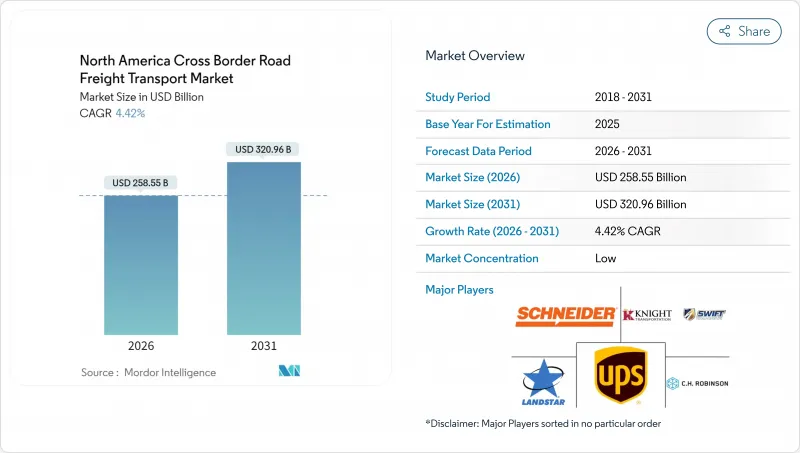

North America Cross Border Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America cross border road freight transport market is expected to grow from USD 247.6 billion in 2025 to USD 258.55 billion in 2026 and is forecast to reach USD 320.96 billion by 2031 at 4.42% CAGR over 2026-2031.

Trade integration under the United States-Mexico-Canada Agreement (USMCA) and the acceleration of nearshoring into Mexico are recalibrating freight corridors, shifting volumes from trans-Pacific lanes toward over-the-road cross-border routes that extend deep into U.S. and Canadian consumer zones. Strong manufacturing linkages, rapid e-commerce adoption, and large-scale public infrastructure programs together bolster the North America cross border road freight transport market by enlarging payload opportunities and shortening order-to-delivery cycles. Carriers that automate customs, deploy real-time visibility tools, and embed predictive analytics into border-crossing routines are outpacing conventional operators, while cybersecurity preparedness and driver recruitment remain critical capability gaps. Investments in megawatt-class charging corridors and digital Complemento Carta Porte compliance platforms further cement smart-border standards, sharpening the technology divide across the competitive field.

North America Cross Border Road Freight Transport Market Trends and Insights

Near-Shoring Boom Reshapes North America Freight Corridors

Manufacturing migration from Asia to Mexico lifted Mexican exports to the United States by 23% in 2024, anchoring heavy freight flows along I-35 and I-10 that bypass Pacific gateways. Specialized carriers now deploy dedicated fleets on these corridors, optimizing round-trip utilization between Mexican plants and U.S. distribution nodes. Northbound stability encourages infrastructure investments at Laredo, El Paso, and San Diego crossings, while U.S. Midwestern hubs receive higher volumes of intermediate components for assembly lines. In parallel, southbound shipments of raw materials create balanced lane density that fortifies asset returns. These structural shifts are embedding permanent trade lanes that underpin long-run expansion of the North America cross border road freight transport market.

E-commerce Acceleration Lifts Cross-Border LTL Volumes

Cross-border e-commerce spending reached CAD 26.1 billion (USD 19.2 billion) in 2024, with 31% tied to U.S. retailers shipping into Canada. The proliferation of small-parcel flows fuels demand for consolidation gateways close to border zones. LTL carriers equipped with automated sortation, broker-of-record services, and tariff optimization engines now capture premium premiums for two-day cross-border delivery. Growth of omnichannel models further links retail storefront replenishment with return-to-vendor loops, adding backhaul cargo density. Consequently, the North America cross border road freight transport market is experiencing rapid segmentation toward higher-frequency, lower-weight consignments that require granular customs data and dynamic scheduling.

Chronic CDL Driver and Technician Gap

The industry entered 2025 with an 80,000+ driver shortfall, and specialized cross-border requirements compound recruitment difficulty. Carriers must offer 18-22% wage premiums for border-certified drivers, yet turnover exceeds 95% as workers chase domestic lanes that avoid documentation delays. Equipment downtime rises as technician shortages lengthen maintenance cycles, squeezing asset availability. High replacement costs drive smaller fleets to consider mergers or exit, accelerating consolidation within the North America cross border road freight transport market.

Other drivers and restraints analyzed in the detailed report include:

- Federal and Provincial Highway Reinvestment

- Digitized Complemento Carta Porte Compliance Drives Adoption of Smart-border Tech

- Diesel-Price and Toll Volatility Compress Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing captured 31.68% of the North America cross border road freight transport market in 2025, underlining the depth of trilateral production networks spanning automotive, electronics, and industrial machinery. This segment benefits from components that cross borders multiple times before final assembly, stabilizing lane volumes and enabling high trailer utilization. The North America cross border road freight transport market size for manufacturing shipments is set to expand as OEMs ramp up Mexico-based final assembly while retaining U.S. and Canadian component sourcing. Carriers with bonded yards, yard-management systems, and certified secure fleet protocols win larger contracts as OEMs enforce stringent vendor scorecards.

Wholesale and retail trade posts the fastest growth at a 5.07% CAGR between 2026-2031, fueled by e-commerce platforms harmonizing catalog offerings across the three countries. Cross-dock facilities positioned within 20 miles of primary ports of entry streamline same-day deconsolidation, enabling retailers to hit promise-date metrics. The North America cross border road freight transport market continues to fragment across SKU profiles, heightening demand for temperature-controlled vans for grocery and high-cube trailers for home-furnishings. Additional segments such as agriculture, oil and gas, and construction also broaden cargo diversity, giving fleets opportunities to calibrate equipment mixes against seasonal cycles and mega-project timelines.

The North America Cross Border Road Freight Transport Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Country (Canada, Mexico, United States, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Bison Transport

- C.H. Robinson

- Cowtown Logistics Freight Management

- CSA Transportation

- DHL Group

- EP Logistics

- Fastfrate Inc.

- Hub Group, Inc.

- Integrity Express Logistics, LLC

- J.B. Hunt Transport, Inc.

- Knight-Swift Transportation Holdings Inc.

- Landstar System Inc.

- Midland

- Ryder System, Inc.

- Schneider National, Inc.

- Trans International Trucking, Inc.

- Trans-Pro Logistics

- United Parcel Service of America, Inc. (UPS)

- Werner Enterprises Inc.

- XPO, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 GDP Distribution by Economic Activity

- 4.3 GDP Growth by Economic Activity

- 4.4 Economic Performance and Profile

- 4.4.1 Trends in E-Commerce Industry

- 4.4.2 Trends in Manufacturing Industry

- 4.5 Transport and Storage Sector GDP

- 4.6 Logistics Performance

- 4.7 Length of Roads

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Pricing Trends

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Road Freight Tonnage Trends

- 4.15 Road Freight Pricing Trends

- 4.16 Modal Share

- 4.17 Inflation

- 4.18 Regulatory Framework

- 4.19 Value Chain and Distribution Channel Analysis

- 4.20 Market Drivers

- 4.20.1 Near-Shoring Boom Reshapes N-America Freight Corridors

- 4.20.2 E-Commerce Acceleration Lifts Cross-Border LTL Volumes

- 4.20.3 Federal and Provincial Highway Reinvestment (IIJA, IFC, etc.)

- 4.20.4 Digitised Complemento Carta Porte Compliance Drives Adoption of Smart-Border Tech

- 4.20.5 Megawatt Charging Corridors Unlock Electric Long-Haul Trucking

- 4.20.6 China-via-Mexico Trans-Shipment Offsets Trans-Pacific Volatility

- 4.21 Market Restraints

- 4.21.1 Chronic CDL Driver and Technician Gap

- 4.21.2 Diesel-Price and Toll Volatility Compress Margins

- 4.21.3 Security Staffing Waves Create Unpredictable Checkpoint Dwell

- 4.21.4 TMS Cybersecurity Breaches Interrupt Load Visibility

- 4.22 Technology Innovations in the Market

- 4.23 Porter's Five Forces Analysis

- 4.23.1 Threat of New Entrants

- 4.23.2 Bargaining Power of Buyers

- 4.23.3 Bargaining Power of Suppliers

- 4.23.4 Threat of Substitutes

- 4.23.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Country

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

- 5.2.4 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Bison Transport

- 6.4.2 C.H. Robinson

- 6.4.3 Cowtown Logistics Freight Management

- 6.4.4 CSA Transportation

- 6.4.5 DHL Group

- 6.4.6 EP Logistics

- 6.4.7 Fastfrate Inc.

- 6.4.8 Hub Group, Inc.

- 6.4.9 Integrity Express Logistics, LLC

- 6.4.10 J.B. Hunt Transport, Inc.

- 6.4.11 Knight-Swift Transportation Holdings Inc.

- 6.4.12 Landstar System Inc.

- 6.4.13 Midland

- 6.4.14 Ryder System, Inc.

- 6.4.15 Schneider National, Inc.

- 6.4.16 Trans International Trucking, Inc.

- 6.4.17 Trans-Pro Logistics

- 6.4.18 United Parcel Service of America, Inc. (UPS)

- 6.4.19 Werner Enterprises Inc.

- 6.4.20 XPO, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment