PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911449

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911449

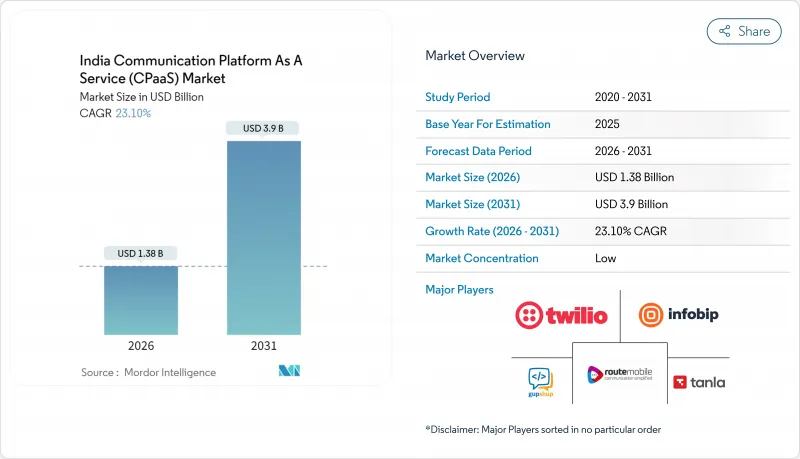

India Communication Platform As A Service (CPaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India CPaaS market is expected to grow from USD 1.12 billion in 2025 to USD 1.38 billion in 2026 and is forecast to reach USD 3.9 billion by 2031 at 23.1% CAGR over 2026-2031.

Enterprise adoption surged as real-time payments, sovereign-cloud mandates, and 5G network-API exposure converged to make programmable communication a board-level priority. BFSI use cases for authentication and fraud alerts, omnichannel engagement on WhatsApp and RCS, and low-code development tooling are among the strongest growth catalysts. Hybrid-cloud deployments, generative-AI features, and industry-specific compliance requirements are reshaping competitive strategies. Implementation complexity across legacy stacks, volatile A2P SMS pricing, and heightened data-security scrutiny remain the chief obstacles.

India Communication Platform As A Service (CPaaS) Market Trends and Insights

Rising Demand for Pay-Per-Use Model to Minimise Capital Spending

Consumption-based pricing is redefining procurement as Indian organizations prefer variable opex over fixed telecom capex commitments. SMEs with thin margins implement CPaaS in weeks, riding Digital India incentives that subsidize cloud usage and streamline onboarding. The model improves cost visibility, releases cash for core operations, and supports seasonal traffic spikes without renegotiating contracts. Enterprises also value granular analytics that correlate spend with campaign performance, accelerating adoption of the India CPaaS market across retail and logistics sectors. Vendors are responding by publishing transparent rate cards and bundling free developer credits, lowering the entry barrier even further.

Exponential Surge in Omnichannel Engagement (WhatsApp and RCS) Adoption

WhatsApp Business API's audience of 487 million Indian users made it indispensable for customer service and commerce in 2024. Pricing revisions enacted in July 2025, however, raised the total cost of ownership, nudging brands to integrate RCS for transactional flows. RCS offers read receipts, verified sender IDs, and rich cards natively on Android, delivering parity with over-the-top apps minus proprietary lock-in. Early pilots by large e-commerce firms show 30% higher click-through than SMS, pushing the India CPaaS market toward multi-channel orchestration. CPaaS platforms now embed routing logic that optimizes channel selection by cost, deliverability, and user preference, ensuring continuity if one path fails.

Implementation Complexity Across Heterogeneous Legacy Stacks

Large enterprises often juggle mainframe-era ERPs, custom CRMs, and proprietary middleware that cannot natively consume modern REST or gRPC endpoints. CPaaS rollouts, therefore, require adapters, queuing layers, and data-mapping that inflate project budgets. Stakeholders may discover hidden technical debt, such as hard-coded SMS gateways embedded in monolithic codebases, extending timelines beyond initial business-case assumptions. Compliance audits under the Data Protection Act mandate traceability of every data hop, adding further engineering overhead. The perception that CPaaS is plug-and-play fades once discovery workshops reveal system-of-record constraints, making change management a critical success factor.

Other drivers and restraints analyzed in the detailed report include:

- Low-Code/API-Led Digital Transformation Across Enterprises

- RBI Real-Time-Payments Push Boosting Mission-Critical Messaging APIs

- Security and Data-Privacy Concerns Amid Rising Cyber-Attacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SMEs added momentum by posting a 24.1% CAGR through 2031 while large enterprises retained 67.12% revenue share in 2025. Cost-aligned pay-per-use contracts, bundled templates, and government start-up incubators remove entry barriers, allowing small firms to offer enterprise-grade experiences without telecom capex. Seasonal businesses in travel and retail spike usage during festival periods, showcasing the elastic billing models that define the India CPaaS market. In parallel, large enterprises scale omnichannel platforms across hundreds of departments, integrating AI-driven personalization engines with CRMs to enhance upsell conversions. Their sizeable traffic yields volume-discounted contracts that anchor vendor revenues, even as implementation remains complex due to multilayer governance and data residency requirements.

Heightened compliance defenses in BFSI and healthcare push many corporates toward hybrid architectures that route regulated data through sovereign zones while leveraging public cloud for peak offload. Pilot projects with generative-AI copilots for call-center agents exhibit double-digit improvements in average handling time, signaling further wallet-share gains for CPaaS. SMEs, meanwhile, tap low-code builders to craft WhatsApp storefronts and automated invoicing bots, shrinking development cycles from months to weeks. This democratization of programmable communications enlarges the India CPaaS market funnel beyond metro hubs into Tier-2 entrepreneurship clusters.

BFSI accounted for 28.22% of 2025 revenue as regulatory mandates for OTP, e-mandate alerts, and fraud notifications demand ultra-reliable delivery. Banks deploy multi-channel redundancy, SMS, push, and in-app to meet Reserve Bank circulars stipulating real-time customer communication. AI-enriched chatbots now triage routine queries, reserving human agents for complex cases, trimming support costs, and bolstering customer satisfaction. Sovereign-cloud platforms that satisfy data-localization statutes are prerequisites, narrowing vendor selection and heightening service-quality expectations.

Logistics recorded the fastest 24.6% CAGR, propelled by e-commerce growth and the National Logistics Policy's digitization targets. Real-time shipment visibility, driver coordination, and exception handling rely on event-driven APIs that stream updates across SMS, RCS, and voice channels. Unified Logistics Interface Platform standards spur interoperability, reinforcing demand for API-centric frameworks. Warehouse operators explore IoT sensors tied to CPaaS alerts, generating automated replenishment messages that tighten supply-chain loops. Healthcare and retail maintain steady expansion as telemedicine and omnichannel marketing mature, yet their growth trails the hyper-vertical momentum seen in logistics.

The India Communication Platform As A Service (CPaaS) Market is Segmented by Organization Size (Small and Medium Enterprises and Large Enterprises), End-User Industry (IT and Telecom, BFSI, and More), Communication Channel (SMS, Voice, and More), Deployment Model (Public Cloud, Hybrid Cloud, and On-Premise), Cpaas Function (Messaging API, Voice API, and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Twilio Inc.

- Tanla Platforms Limited

- Route Mobile Limited

- Gupshup Technology India Private Limited

- Infobip Ltd.

- Sinch AB

- MessageBird B.V.

- Vonage Holdings Corp.

- Telnyx LLC

- Plivo Inc.

- Netcore Cloud Private Limited

- Exotel Techcom Pvt. Ltd.

- EnableX.io Pte Ltd.

- Tata Communications Limited (Kaleyra)

- Bharti Airtel Limited (Airtel IQ)

- Bandwidth Inc.

- Link Mobility Group ASA

- ValueFirst Digital Media Private Limited (Tanla)

- Karix Mobile Private Limited

- CM.com N.V.

- Clickatell Inc.

- Unifonic Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for pay-per-use model to minimise capital spending

- 4.2.2 Exponential surge in omnichannel engagement (WhatsApp and RCS) adoption

- 4.2.3 Low-code/API-led digital transformation across enterprises

- 4.2.4 RBI real-time-payments push boosting mission-critical messaging APIs

- 4.2.5 Emergence of sovereign-cloud offerings enabling compliant CPaaS uptake

- 4.2.6 5G network-API exposure creating new programmable-communication use-cases

- 4.3 Market Restraints

- 4.3.1 Implementation complexity across heterogeneous legacy stacks

- 4.3.2 Security and data-privacy concerns amid rising cyber-attacks

- 4.3.3 Fragmented state-level telecom rules raising compliance cost

- 4.3.4 Volatile telco A2P-SMS wholesale pricing squeezing margins

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing and Business-Model Analysis

- 4.8 Key Trends

- 4.9 Industry Ecosystem Analysis

- 4.9.1 Pure-Play CPaaS Providers

- 4.9.2 Telco-Driven CPaaS Providers

- 4.9.3 Enterprise-Grade CPaaS Providers

- 4.9.4 Service-Provider-Based CPaaS Integrators

- 4.10 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Organisation Size

- 5.1.1 Small and Medium Enterprises (SMEs)

- 5.1.2 Large Enterprises

- 5.2 By End-user Industry

- 5.2.1 IT and Telecom

- 5.2.2 BFSI

- 5.2.3 Retail and E-commerce

- 5.2.4 Healthcare

- 5.2.5 Government and Public Sector

- 5.2.6 Logistics and Transportation

- 5.2.7 Other End-user Industries

- 5.3 By Communication Channel

- 5.3.1 SMS

- 5.3.2 Voice

- 5.3.3 WhatsApp Business

- 5.3.4 RCS Business Messaging

- 5.3.5 Video API

- 5.3.6 Email

- 5.3.7 Push Notifications

- 5.4 By Deployment Model

- 5.4.1 Public Cloud

- 5.4.2 Hybrid Cloud

- 5.4.3 On-premise

- 5.5 By CPaaS Function

- 5.5.1 Messaging API

- 5.5.2 Voice API

- 5.5.3 Video API

- 5.5.4 Verification and Security API

- 5.5.5 Omnichannel Orchestration API

- 5.6 By Region

- 5.6.1 North India

- 5.6.2 West India

- 5.6.3 South India

- 5.6.4 East and North-East India

- 5.6.5 Central India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Twilio Inc.

- 6.4.2 Tanla Platforms Limited

- 6.4.3 Route Mobile Limited

- 6.4.4 Gupshup Technology India Private Limited

- 6.4.5 Infobip Ltd.

- 6.4.6 Sinch AB

- 6.4.7 MessageBird B.V.

- 6.4.8 Vonage Holdings Corp.

- 6.4.9 Telnyx LLC

- 6.4.10 Plivo Inc.

- 6.4.11 Netcore Cloud Private Limited

- 6.4.12 Exotel Techcom Pvt. Ltd.

- 6.4.13 EnableX.io Pte Ltd.

- 6.4.14 Tata Communications Limited (Kaleyra)

- 6.4.15 Bharti Airtel Limited (Airtel IQ)

- 6.4.16 Bandwidth Inc.

- 6.4.17 Link Mobility Group ASA

- 6.4.18 ValueFirst Digital Media Private Limited (Tanla)

- 6.4.19 Karix Mobile Private Limited

- 6.4.20 CM.com N.V.

- 6.4.21 Clickatell Inc.

- 6.4.22 Unifonic Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment