PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911699

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911699

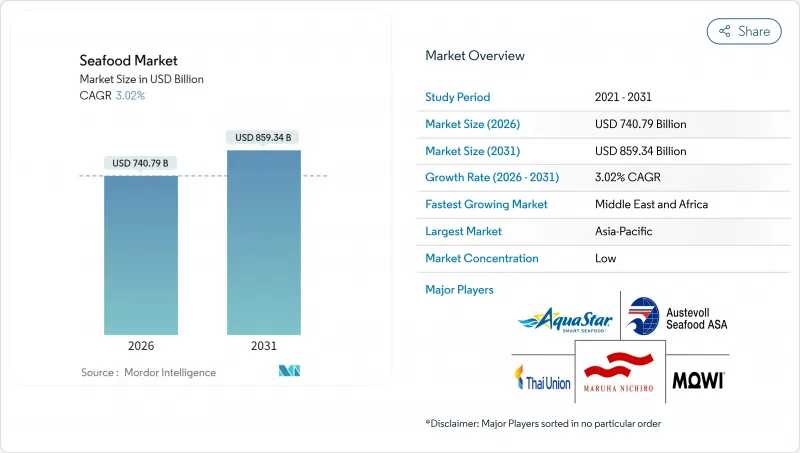

Seafood - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Seafood market size in 2026 is estimated at USD 740.79 billion, growing from 2025 value of USD 719.08 billion with 2031 projections showing USD 859.34 billion, growing at 3.02% CAGR over 2026-2031.

This growth highlights a competitive market where advancements in farmed seafood production and the rising popularity of health-conscious diets are driving factors. Producers are increasingly investing in technologies such as robotics, artificial intelligence, and sensor-based farming methods. These innovations are helping to reduce feed costs, improve operational efficiency, and lower mortality rates, which in turn enhance profitability. At the same time, companies are adapting to stricter environmental regulations. By seafood type, fish remains the dominant category, although shrimp is witnessing significant innovation. In terms of form, frozen seafood leads the market, but advancements in processing techniques are creating new opportunities. Regarding the source, wild-caught seafood continues to hold a traditional appeal, but farmed seafood is gaining traction due to its efficiency and sustainability. For distribution channels, on-trade sales maintain strong performance, while off-trade channels are experiencing notable innovation. The seafood market is fragmented, with numerous players competing for market share. Leading companies are focusing on vertical integration, managing operations across the entire supply chain from hatcheries and grow-out sites to processing facilities and branded distribution networks.

Global Seafood Market Trends and Insights

Rising consumer demand for protein-rich foods

The global demand for seafood is increasing as more consumers focus on eating healthier and incorporating protein-rich foods into their diets. According to the International Food Information Council Food and Health Survey 2024, 71% of consumers are actively working to boost their protein intake, reflecting a significant shift in dietary preferences. Seafood, which contains 20-30% protein by total weight, according to PubMed Central in May 2024, is considered a healthier and leaner protein option compared to red meat and poultry. The World Wildlife Organization highlights that over 3 billion people worldwide depend on wild-caught and farmed seafood as a primary source of animal protein, emphasizing its critical role in ensuring global nutrition security. These factors are driving consistent growth in seafood consumption, prompting increased investments in aquaculture expansion, sustainable fishing methods, and improvements in supply chain efficiency. This growing focus on sustainability and modernization is expected to support the long-term development of the seafood market.

Culinary globalization and foodservice demand

The growing popularity of global cuisines and increased activity in the foodservice sector are driving the demand for seafood across various dining channels. Consumers are showing a greater interest in trying international flavors, prompting quick-service and casual dining restaurants to introduce innovative dishes featuring seafood like shrimp, salmon, and squid. According to the U.S. Bureau of Economic Analysis, spending at eating and drinking establishments reached a record USD 1,249.3 billion in Q2 2025, up from USD 1,223.3 billion in Q1, highlighting strong consumer demand in the foodservice industry. For example, on September 8, 2025, Red Lobster launched its "Ultimate SpendLESS Shrimp," a budget-friendly menu option that includes Garlic Shrimp Scampi, Shrimp Linguini Alfredo, and Popcorn Shrimp for USD 15.99. This demonstrates how restaurants are combining affordability with creative menu offerings to attract more customers. These trends reflect how the growing interest in diverse cuisines and steady dining expenditures are contributing to the expansion of the market.

Competition from alternative proteins

Competition from alternative proteins is becoming a major challenge for the seafood market. Innovations in technologies like extrusion, fermentation, and 3D printing are helping plant-based and lab-grown seafood alternatives closely mimic the taste, texture, and nutritional value of traditional seafood. For instance, in August 2025, Revo Foods introduced "Kinda Salmon," a mycoprotein-based fillet that replicates the flaky texture of salmon while offering a cost-effective option for foodservice buyers. Increased venture capital funding is driving rapid advancements in this space, enabling start-ups to effectively market these alternatives to flexitarian consumers. Younger buyers are increasingly prioritizing environmental sustainability when making purchasing decisions, which is boosting the appeal of these alternatives. However, seafood still holds unique advantages, such as being a natural source of omega-3 fatty acids, and these factors help traditional seafood maintain its market presence, but the growing popularity of alternative proteins continues to pose a significant challenge to the market's long-term growth.

Other drivers and restraints analyzed in the detailed report include:

- Growing consumer demand for sustainable, certified, ethical, and traceable seafood

- Government support and fisheries management

- Feed-price inflation and disease outbreaks at source farms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fish continues to dominate the global seafood market, holding a significant 52.06% share in 2025. This dominance is largely due to strong consumption patterns in regions like Asia-Pacific, North America, and Europe. Popular species such as salmon and tuna account for the majority of this volume, supported by retailers prioritizing well-known species with sustainability certifications. Consumers are drawn to fish for its nutritional benefits, traceability, and clean-label attributes, which align with growing health and environmental awareness. These factors ensure fish remains a stable and essential segment of the seafood market, even during periods of market uncertainty.

Shrimp is rapidly emerging as the fastest-growing segment in the seafood market, with a projected CAGR of 3.49% from 2026 to 2031. This growth is driven by advancements in farming techniques that improve survival rates and reduce production cycles, making shrimp farming more efficient. Shrimp's versatility in various cuisines, particularly in quick-service and fusion dishes, has boosted its global demand. Its widespread acceptance across different consumer markets further supports its growth. These trends position shrimp as a key growth driver in the seafood sector, complementing the steady performance of the fish segment.

Frozen seafood dominated the market in 2025, accounting for 50.08% of the total share. This growth is largely due to the efficiency of cold-chain networks, which ensure the availability of seafood throughout the year while maintaining quality and safety. Frozen seafood is highly favored by retailers and foodservice operators because it offers extended shelf life and convenience. It allows for the global distribution of various seafood species, making it a reliable option for regions with limited local production. These factors make frozen seafood a key segment in the industry, catering to both commercial and consumer needs effectively.

Processed seafood is emerging as one of the fastest-growing segments, with a projected CAGR of 3.78% through 2031. This growth is driven by advancements in packaging and preservation technologies, such as vacuum-skin packaging and high-pressure processing, which enhance product freshness and safety. The introduction of ready-to-eat formats and chef-inspired flavors is increasing consumer interest and expanding the use of processed seafood in everyday meals. These innovations not only improve convenience but also cater to evolving consumer preferences, making processed seafood a dynamic and rapidly growing category in the global market.

The Seafood Market Report is Segmented by Seafood Type (Fish, Shrimp, and More), Form (Canned, Frozen, and More), Source (Farmed and Wild-Caught), Distribution Channel (On-Trade and Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

Geography Analysis

Asia-Pacific held the largest share of the seafood market in 2025, accounting for 45.12%. China led the region with a production of 71.0 million metric tons, including 58.12 million tons from aquaculture systems. The region's dominance is supported by rising middle-class incomes, advancements in processing facilities, and government grants promoting technology adoption. Countries like Japan and South Korea maintain high seafood consumption due to their strong sushi and sashimi culture. Meanwhile, Vietnam and Thailand are expanding their export capabilities by improving compliance standards and enhancing cold-chain infrastructure.

The Middle East and Africa region is expected to grow at the fastest rate, with a projected CAGR of 3.55% through 2031. Gulf Cooperation Council (GCC) countries are heavily investing in hatchery complexes, genetics research, and automation technologies to meet food security goals. Nigeria and Egypt are utilizing international loans to upgrade fish ponds and increase feed production capacity, which is expected to boost both domestic supply and export potential. Morocco is leveraging its Atlantic fishing quotas to cater to European markets, while South Africa is integrating kelp farming with finfish cultivation to diversify its seafood production.

North America and Europe, though mature markets, continue to play a significant role in the global seafood industry. The United States is focusing on expanding recirculating aquaculture systems for salmon to reduce import dependency and improve environmental sustainability. Norway, despite currency fluctuations, achieved growth in export volumes in December 2024, driven by its reputation for responsibly farmed salmon. In Europe, regulatory directives on traceability and carbon footprint disclosure are setting global benchmarks, encouraging investments in compliance. In South America, countries like Chile are regaining their position in salmon exports, while Ecuador is accelerating shrimp exports after securing favorable trade agreements.

- Mazzetta Company, LLC

- Aqua Star Corp

- Austevoll Seafood ASA

- Ocean Garden Products Inc. (Central Seaway Company)

- Mowi ASA

- Apex Frozen Foods Ltd

- Maruha Nichiro Corp. (Umios Corp.)

- Grieg Aqua AS

- Beaver Street Fisheries

- Trident Seafoods Corp.

- Agrosuper S.A.

- The Waterbase Limited

- The Bumble Bee Seafood Company

- Thai Union (Chicken of the Sea)

- Avanti Feeds Limited

- Dulcich Inc.

- Woods Fisheries

- Sysco Corporation

- Cooke Inc.

- High Liner Foods Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumer demand for protein-rich foods

- 4.2.2 Technology and farming innovation

- 4.2.3 Rising global seafood trade and export opportunities

- 4.2.4 Growing consumer demand for seafood that is sustainable, certified, ethical, and traceable sourced

- 4.2.5 Culinary globalization and foodservice demand

- 4.2.6 Government support and fisheries management

- 4.3 Market Restraints

- 4.3.1 Competition from alternative proteins

- 4.3.2 Feed-price inflation and disease outbreaks at source farms

- 4.3.3 Stringent regulatory and quality standards

- 4.3.4 Illegal, unreported, and unregulated (IUU) fishing

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Seafood Type

- 5.1.1 Fish

- 5.1.1.1 Salmon

- 5.1.1.2 Tuna

- 5.1.1.3 Other Fish Type

- 5.1.2 Shrimp

- 5.1.3 Other Seafood

- 5.1.1 Fish

- 5.2 By Form

- 5.2.1 Canned

- 5.2.2 Fresh/Chilled

- 5.2.3 Frozen

- 5.2.4 Processed

- 5.3 By Source

- 5.3.1 Farmed

- 5.3.2 Wild-Caught

- 5.4 By Distribution Channel

- 5.4.1 Off-Trade

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Online Retail Stores

- 5.4.1.3 Convenience Stores

- 5.4.1.4 Others

- 5.4.2 On-Trade

- 5.4.2.1 Hotels

- 5.4.2.2 Restaurants

- 5.4.2.3 Catering

- 5.4.1 Off-Trade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Colombia

- 5.5.2.3 Chile

- 5.5.2.4 Peru

- 5.5.2.5 Argentina

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Poland

- 5.5.3.7 Belgium

- 5.5.3.8 Sweden

- 5.5.3.9 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 Indonesia

- 5.5.4.6 South Korea

- 5.5.4.7 Thailand

- 5.5.4.8 Singapore

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mazzetta Company, LLC

- 6.4.2 Aqua Star Corp

- 6.4.3 Austevoll Seafood ASA

- 6.4.4 Ocean Garden Products Inc. (Central Seaway Company)

- 6.4.5 Mowi ASA

- 6.4.6 Apex Frozen Foods Ltd

- 6.4.7 Maruha Nichiro Corp. (Umios Corp.)

- 6.4.8 Grieg Aqua AS

- 6.4.9 Beaver Street Fisheries

- 6.4.10 Trident Seafoods Corp.

- 6.4.11 Agrosuper S.A.

- 6.4.12 The Waterbase Limited

- 6.4.13 The Bumble Bee Seafood Company

- 6.4.14 Thai Union (Chicken of the Sea)

- 6.4.15 Avanti Feeds Limited

- 6.4.16 Dulcich Inc.

- 6.4.17 Woods Fisheries

- 6.4.18 Sysco Corporation

- 6.4.19 Cooke Inc.

- 6.4.20 High Liner Foods Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK