PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911767

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911767

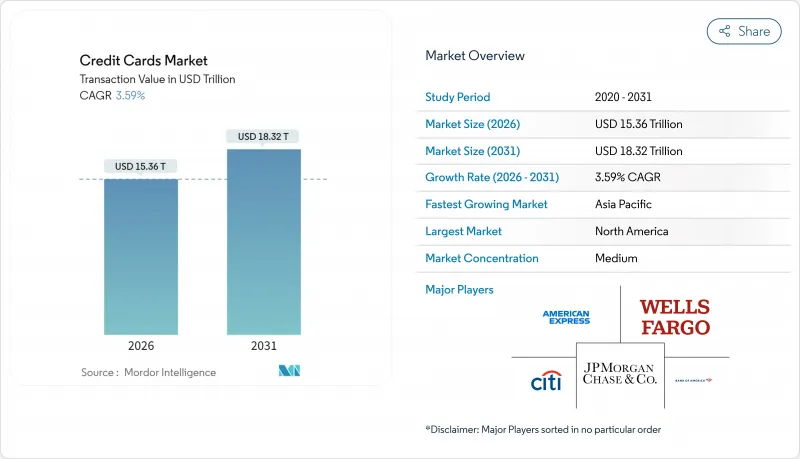

Credit Cards - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Credit Cards market size in 2026 is estimated at USD 15.36 trillion, growing from 2025 value of USD 14.83 trillion with 2031 projections showing USD 18.32 trillion, growing at 3.59% CAGR over 2026-2031.

Credit Cards Market Growth remains steady rather than spectacular because card networks face direct competition from digital wallets and Buy Now Pay Later services that have become mainstream for younger customers. High profitability keeps issuers committed, as the Federal Reserve calculates a 6.8% return on assets from card lending-four times the banking average-despite headline rates hovering near 23%. Regional dynamics are diverging. North America still delivers almost half of global card spending, while Asia-Pacific shows the fastest expansion, driven by India and China's leapfrog adoption of mobile payments. Consolidation and technology investments dominate company strategy because regulatory scrutiny of interchange fees and rewards practices is rising in the United States and Europe.

Global Credit Cards Market Trends and Insights

Growing eCommerce & Contactless Payments Boom

Issuers report double-digit growth in contactless transactions as Tap to Pay services scale across major retail chains. JPMorgan Chase extended Tap to Pay on iPhone to Canadian merchants such as Sephora, showing that incremental volume can be captured with no extra hardware. The bank already processes nearly USD 10 trillion in daily payments, illustrating the throughput advantage large franchises enjoy. Cash usage keeps declining as more merchants refuse notes and coins, and the feedback loop accelerates card adoption in emerging markets. Biometric authentication addresses fraud concerns and helps sustain consumer trust in near-field communication payments.

Digital Wallet & Mobile Provisioning Expansion

Digital wallets have reached critical mass in Asia-Pacific, where 82% of Chinese e-commerce spend now settles through wallets, and India is on track to exceed 70% adoption by 2027. Mastercard responded with a mobile virtual card app for travel and business expenses that uses biometric login and real-time spend controls. Wallet provisioning is now built into onboarding, and more than 60% of new cards are loaded into a mobile wallet within 30 days of issuance. Because the payment function is becoming commoditized, issuers are pivoting toward data insights, lifestyle perks, and instant credit-line adjustments to differentiate. Competitive focus, therefore, shifts to translating wallet data into personalized offers that keep the card in the primary spending position.

Escalating Fraud & Cybersecurity Compliance Costs

Digital payment growth continues to attract sophisticated fraud rings that exploit every channel from card-present terminals to tokenized wallets. Issuers have responded by rolling out AI-driven detection engines and layering biometric and multi-factor checks across mobile, web and call-center touchpoints, yet each upgrade raises complexity and spend. Supervisors are also tightening expectations: the Bank for International Settlements stresses that explainability, human oversight and robust governance must accompany any machine-learning model, which adds additional documentation and audit requirements. Fraud risks multiply across borders because virtual cards and crypto wallets move money in real time, forcing banks to screen transactions under dozens of regulatory regimes almost simultaneously. Smaller issuers struggle the most, as they must meet the same standards without the same scale economies, turning compliance into a structural cost disadvantage. Frequent software patches and threat-intelligence feeds have effectively created a perpetual technology arms race that keeps nudging operating margins lower for the entire industry.

Other drivers and restraints analyzed in the detailed report include:

- Rewards War Among Issuers Intensifying Acquisition

- Virtual/Crypto Cards Enable Cross-Border Spend Efficiency

- Higher Rates Raising Delinquencies & Charge-offs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food and Groceries accounted for 35.38% of the credit card market size in 2025 as households leaned on revolving credit to manage inflation. Spending growth outpaced volume expansion because average transaction values rose with food costs. Urban Institute data links higher grocery prices directly to greater delinquency risk, underlining the segment's systemic importance. Travel and Tourism, while smaller, is forecast to post a 6.12% CAGR to 2031. International arrivals are almost back to 2019 levels, and average trip length has increased by one full day, especially on Middle Eastern and European routes.

Consumer Electronics maintains solid volume in the credit card market due to annual product refreshes and promotional financing. Media and Entertainment benefits from subscription bundling, while Restaurants and Bars have embraced contactless and loyalty integrations that increase ticket size. Health and Pharmacy enjoys demographic tailwinds from aging populations, whereas Other Applications, including government and B2B payments, increasingly rely on virtual cards for reconciliation and control.

General-purpose products still represent 85.06% of credit card market share in 2025, owing to broad acceptance and multi-category rewards that appeal to mainstream users. Federal Reserve analysis of 330 million accounts confirms these cards generate the highest interchange per swipe and the most resilient economics. Specialty & Other cards, however, are projected to grow at a 4.33% CAGR as embedded finance lets brands launch bespoke propositions without owning a bank charter.

Store, co-brand, and private-label offerings rely on merchant subsidies to attract users, boosting loyalty and data capture. Walmart's OnePay illustrates the pivot, providing both Mastercard-branded and closed-loop options through Synchrony. Goldman Sachs backs similar launches via its Enterprise Partnerships APIs. As brand ecosystems mature, niche propositions may seize incremental share from mass-market cards, particularly in lifestyle verticals such as travel, wellness, and gaming.

The Credit Card Market is Segmented by Application (Food and Groceries, Health and Pharmacy, and More), by Card Type (General Purpose Credit Cards, Specialty and Other Credit Cards), by Card Format (Physical, Digital), by Provider (Visa, Mastercard, Other Providers) and by Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 45.72% hold on the credit card market in 2025. Robust rewards ecosystems and deep consumer credit culture keep volumes elevated, and 43% of US adults opened a new card during the year. Regulatory pressure, however, intensifies. The Consumer Financial Protection Bureau is targeting "bait-and-switch" rewards and interchange fees, and large merchants have negotiated a USD 29.8 billion settlement with Visa and Mastercard that temporarily lowers average rates. Buy Now Pay Later usage is rising-Morgan Stanley places penetration above 25%, which may dilute future revolving balances.

Asia-Pacific is the fastest-growing territory in the credit cards market, with a projected 4.24% CAGR to 2031. China processes 82% of e-commerce through wallets and 66% of point-of-sale spend, limiting but not eliminating cards' relevance. India stands out: active cards surpassed 100 million in February 2024, and spending reached USD 220 billion for the fiscal year, partly because the Reserve Bank of India allowed RuPay credit cards to ride on the Unified Payments Interface. Japanese and Korean consumers stay loyal to cards despite digital alternatives, while Australian corporates increasingly prefer virtual cards for travel.

The Credit Card Market in Europe posts mid-single-digit growth, restrained by fee caps and domestic schemes. The UK Payment Systems Regulator says merchants paid over GBP 250 million in unexplained network charges in 2024 as Visa and Mastercard hiked rates more than 30% above 2019 levels. South America's expansion is tied to financial-inclusion programs in Brazil and Mexico, though macro volatility curbs risk appetite. The Middle East and Africa remain in the early innings, but investments in digital rails foreshadow faster electronic payment adoption once regulatory clarity improves.

- JPMorgan Chase & Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing-eCommerce & contactless-payments boom

- 4.2.2 Digital-wallet & mobile-provisioning expansion

- 4.2.3 Rewards-war among issuers intensifying acquisition

- 4.2.4 Virtual/crypto cards enable cross-border spend efficiency

- 4.2.5 Embedded Credit-Card-as-a-Service (CCaaS) for niche brands

- 4.2.6 AI-driven risk-based pricing taps profitable subprime pool

- 4.3 Market Restraints

- 4.3.1 Escalating fraud & cyber-security compliance costs

- 4.3.2 Higher rates raising delinquencies & charge-offs

- 4.3.3 Interchange-fee regulation pressures issuer margins

- 4.3.4 BNPL cannibalising revolving credit among millennials

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Appplication

- 5.1.1 Food & Groceries

- 5.1.2 Health & Pharmacy

- 5.1.3 Restaurants & Bars

- 5.1.4 Consumer Electronics

- 5.1.5 Media & Entertainment

- 5.1.6 Travel & Tourism

- 5.1.7 Other Applications

- 5.2 By Card Type

- 5.2.1 General Purpose Credit Cards

- 5.2.2 Specialty & Other Credit Cards

- 5.3 By Card Format

- 5.3.1 Physical

- 5.3.2 Digital

- 5.4 By Provider

- 5.4.1 Visa

- 5.4.2 Mastercard

- 5.4.3 Other Providers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX

- 5.5.3.7 NORDICS

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South-East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 JPMorgan Chase & Co.

- 6.4.1.1 Citigroup Inc. (Citi)

- 6.4.1.2 American Express Co.

- 6.4.1.3 Wells Fargo & Co.

- 6.4.1.4 Bank of America Corp.

- 6.4.1.5 Capital One Financial Corp.

- 6.4.1.6 Discover Financial Services

- 6.4.1.7 U.S. Bancorp (U.S. Bank)

- 6.4.1.8 Barclays PLC (Barclaycard)

- 6.4.1.9 HSBC Holdings PLC

- 6.4.1.10 Synchrony Financial

- 6.4.1.11 Royal Bank of Canada (RBC)

- 6.4.1.12 Toronto-Dominion Bank (TD Bank)

- 6.4.1.13 Scotiabank (Bank of Nova Scotia)

- 6.4.1.14 Canadian Imperial Bank of Commerce (CIBC)

- 6.4.1.15 Banco Santander SA

- 6.4.1.16 BBVA SA

- 6.4.1.17 Banco Bradesco SA

- 6.4.1.18 Itau Unibanco Holding SA

- 6.4.1.19 Nu Holdings Ltd. (Nubank)

- 6.4.1 JPMorgan Chase & Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment