PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911795

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911795

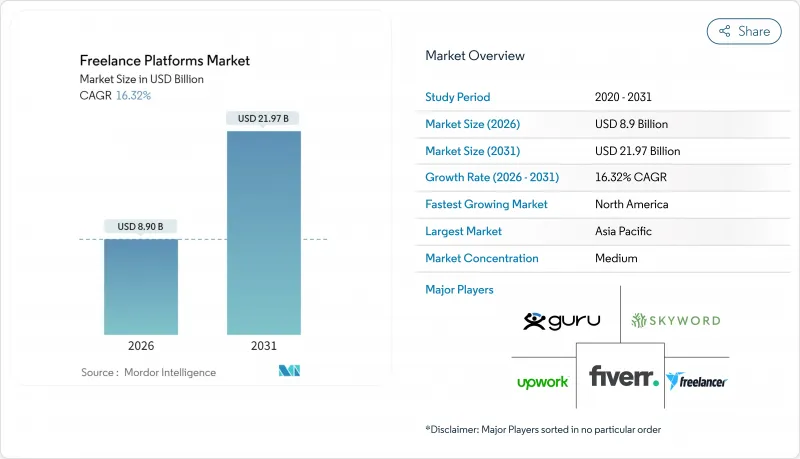

Freelance Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Freelance platforms market size in 2026 is estimated at USD 8.9 billion, growing from 2025 value of USD 7.65 billion with 2031 projections showing USD 21.97 billion, growing at 16.32% CAGR over 2026-2031.

Shifts toward hybrid work, rising demand for niche digital skills, and growing cost-optimization pressures keep the momentum strong for the freelance platforms market. Enterprise buyers increasingly favor platform-mediated talent engagement because it delivers compliance, variable cost structures, and rapid access to specialized capabilities. AI-powered matching and productivity tools now underpin most competitive differentiation, while emerging cross-border invoicing rules reduce friction in global payments. Geographically, North America retains leadership in penetration rates, yet Asia-Pacific is expanding fastest as enterprises in the region accelerate digital transformation plans.

Global Freelance Platforms Market Trends and Insights

Shift toward hybrid and flexible workforce models.

Platform adoption accelerated after the U.S. Department of Labor's 2024 rule clarified contractor classification, giving enterprises a compliant path to blend internal and external talent . A global advertising group saved USD 9.6 million in one year by shifting consultant spend to a managed marketplace. Large corporations now bake contingent workforce planning into core strategy, using platforms to secure emerging skills faster than conventional hiring cycles allow. Surveyed firms report an 84% jump in non-employee talent use since the pandemic. The freelance platforms market, therefore, benefits from a structural rather than cyclical re-allocation of labor budgets.

Rising demand for specialized digital skills

Demand for AI, machine learning, and advanced programming skills rose 60% year-over-year, pushing freelance hourly rates up 44% above platform averages. Japanese data shows Go and Ruby specialists commanding monthly pay near JPY 852,000 (USD 5,680) and JPY 839,000 (USD 5,593), respectively. Enterprises prize cross-functional experts who can connect technology build-outs with business value, motivating platforms to refine AI-driven matching to surface niche talent. High pricing power and scarce supply combine to sustain premium fee structures, reinforcing growth prospects for the freelance platforms market.

Trust and payment-security concerns

Escrow tools and two-factor identity verification now form baseline requirements for platforms expanding into geographies with weak payment rails. SafePay adoption on Guru and similar services shows improvement, yet fraud techniques continue to evolve, forcing ongoing investment in compliance and anti-money-laundering safeguards. Trust issues therefore remain a near-term drag on the freelance platforms market.

Other drivers and restraints analyzed in the detailed report include:

- Cost-optimization pressure on enterprises

- Generative-AI copilots boost platform worker productivity.

- Algorithm-bias lawsuits are increasing compliance costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform revenue streams captured 59.72% of the freelance platforms market share in 2025 on the strength of commission-based models that scale with transaction volume. Marketplaces such as Upwork and Freelancer rely on network effects, reinforcing their lead as user rolls deepen. The services component, however, is outpacing at an 18.05% CAGR, propelled by enterprise demand for managed solutions that guarantee compliance and project outcomes.

Managed service providers like CXC Global administer over 12,000 contractors monthly, showcasing an appetite for turnkey workforce orchestration. Hybrid models now blend marketplace agility with curated service layers, creating tiered offerings for large buyers. This evolution signals that the freelance platforms industry is widening its value capture along the full talent-management lifecycle.

Project management tools held 23.12% of the freelance platforms market size in 2025, reflecting universal demand for agile execution across functions. Yet web and graphic design is expanding at 18.78% CAGR, fueled by AI-assisted creative workflows that lower entry barriers for SMEs seeking premium visuals.

Software development assignments continue to command premium budgets in emerging tech stacks, while sales and marketing freelancers gain ground as firms migrate to performance-linked contracts. Niche domains such as legal compliance and financial modeling surface within "other applications," underscoring opportunities for vertical specialization. Platforms that deepen expertise within each application tier stand to capture higher wallet share and retention.

Freelance Platforms Market Report is Segmented by Component (Platform and Services), Application (Project Management, Sales and Marketing, IT and Software, Web and Graphic Design, and Other Applications), End-User (Employers, and Freelancers), Organization Size (Large Enterprises, and Small and Medium Enterprises (SMEs)), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific posted the highest 18.22% CAGR outlook, underpinned by rapid digitalization and policy frameworks such as ViDA electronic invoicing that simplify cross-border transactions. Companies in Japan routinely pay skilled freelancers more than USD 5,000 monthly, signaling a robust willingness to pay for top talent . Growth in Southeast Asia is likewise accelerating as local firms leapfrog traditional hiring constraints.

North America remains the revenue leader with a 32.64% share, supported by mature infrastructure and an early-adopter enterprise culture. The U.S. regulatory environment, though complex, offers clear federal frameworks that encourage compliant contractor engagement. Canada adds momentum with supportive provincial guidelines around remote work taxation.

Europe sustains steady expansion as GDPR-aligned data safeguards increase trust and as the forthcoming 2030 ViDA mandate ensures seamless intra-EU invoicing. In Latin America, currency volatility poses challenges, yet localized wallets prove effective at promoting freelance adoption. The Middle East and Africa present nascent but promising pockets, especially among tech hubs in the Gulf Cooperation Council, where government innovation agendas boost demand for specialized gig talent.

- Upwork Inc.

- Fiverr International Ltd.

- Freelancer Limited

- Toptal LLC

- Guru.com LLC

- PeoplePerHour.com Ltd.

- DesignCrowd Pty Ltd.

- Contently Inc.

- WorkGenius GmbH

- WorkMarket, Inc.

- Catalant Technologies, Inc.

- 99designs by Vista

- Behance (Adobe Inc.)

- TaskRabbit, Inc.

- Amazon Mechanical Turk (Amazon.com, Inc.)

- UpStack Technologies, Inc.

- Workana Inc.

- Gigster LLC

- Aquent LLC

- FlexJobs Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward hybrid and flexible workforce models

- 4.2.2 Rising demand for specialised digital skills

- 4.2.3 Cost-optimisation pressure on enterprises

- 4.2.4 Cross-border e-invoicing regulation simplifying freelancer payments

- 4.2.5 Generative-AI copilots boosting platform worker productivity

- 4.2.6 AI-powered matching algorithms improving hire speed

- 4.3 Market Restraints

- 4.3.1 Trust and payment-security concerns

- 4.3.2 Regulatory ambiguity on worker classification

- 4.3.3 Algorithm-bias lawsuits increasing compliance costs

- 4.3.4 Escalating customer-acquisition costs on digital ad channels

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Platform

- 5.1.2 Services

- 5.2 By Application

- 5.2.1 Project Management

- 5.2.2 Sales and Marketing

- 5.2.3 IT and Software

- 5.2.4 Web and Graphic Design

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Employers (Enterprises and SMBs)

- 5.3.2 Freelancers

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Upwork Inc.

- 6.4.2 Fiverr International Ltd.

- 6.4.3 Freelancer Limited

- 6.4.4 Toptal LLC

- 6.4.5 Guru.com LLC

- 6.4.6 PeoplePerHour.com Ltd.

- 6.4.7 DesignCrowd Pty Ltd.

- 6.4.8 Contently Inc.

- 6.4.9 WorkGenius GmbH

- 6.4.10 WorkMarket, Inc.

- 6.4.11 Catalant Technologies, Inc.

- 6.4.12 99designs by Vista

- 6.4.13 Behance (Adobe Inc.)

- 6.4.14 TaskRabbit, Inc.

- 6.4.15 Amazon Mechanical Turk (Amazon.com, Inc.)

- 6.4.16 UpStack Technologies, Inc.

- 6.4.17 Workana Inc.

- 6.4.18 Gigster LLC

- 6.4.19 Aquent LLC

- 6.4.20 FlexJobs Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment