PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934634

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934634

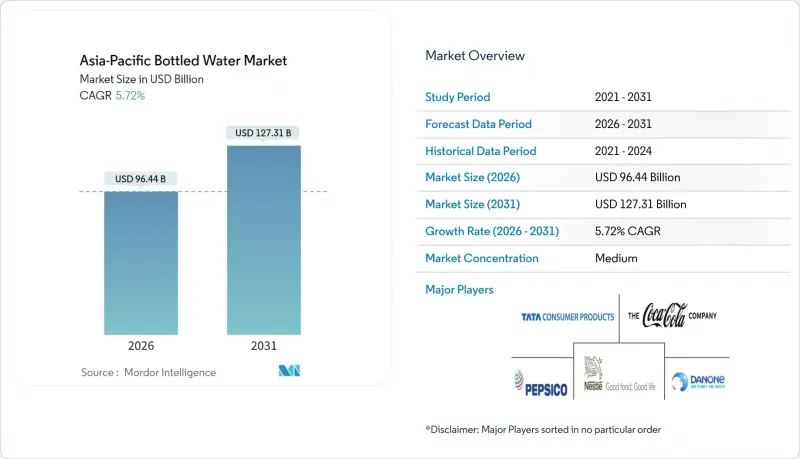

Asia-Pacific Bottled Water - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia Pacific bottled water market was valued at USD 91.22 billion in 2025 and estimated to grow from USD 96.44 billion in 2026 to reach USD 127.31 billion by 2031, at a CAGR of 5.72% during the forecast period (2026-2031).

Market growth is driven by rising health awareness, urbanization, and changing consumer preferences across the region. The demand for convenient, safe, and premium water products in urban centers is changing consumption patterns, supported by distribution networks and product innovations. Environmental concerns and regulations are pushing the industry toward sustainable packaging solutions and responsible practices. While China, India, and Japan lead the market, countries like Indonesia and Australia are experiencing growth due to population density, lifestyle changes, and quality regulations. The market faces challenges from regulatory requirements and the increasing adoption of water purifiers. However, the Asia Pacific bottled water market continues to demonstrate strong growth potential.

Asia-Pacific Bottled Water Market Trends and Insights

Growing health and wellness awareness drives market growth

Health and wellness awareness significantly drives the Asia-Pacific bottled water market growth. Consumers in the region prioritize healthy lifestyles, focusing on hydration, nutrition, and avoiding sugary or artificially flavored beverages. This consumer behavior increases the demand for bottled water, which serves as a convenient and pure hydration option aligned with wellness trends. The demand for calorie-free beverages, detoxification, and balanced nutrition positions bottled water as an essential daily consumption item. The increasing cases of lifestyle-related health issues, including obesity, diabetes, and cardiovascular diseases, are accelerating the shift from sugary soft drinks to healthier alternatives, increasing bottled water consumption. Supporting this trend, the Australian Beverages Council reports that following the non-alcoholic beverage industry's voluntary Sugar Reduction Pledge, sugar elimination reached 222,530 tonnes from Australian diets . This reduction demonstrates the industry's adaptation to consumer health preferences and regulatory guidelines, strengthening bottled water's position as a healthy beverage choice.

Innovative packaging solutions for convenience and environmental impact

The Asia-Pacific bottled water market growth is driven by packaging solutions that prioritize convenience and environmental sustainability. Consumers seek packaging that provides ease of use, portability, and freshness while addressing environmental concerns. Government regulations on plastic waste management and increasing consumer environmental awareness compel beverage companies to develop alternatives to traditional plastic bottles. Companies are implementing packaging innovations, including lightweight bottles, recyclable materials, biodegradable options, and aluminum containers. These solutions maintain product functionality through leak-proof designs and extended shelf life while reducing plastic pollution in the region. The shift toward sustainable packaging enhances brand reputation and consumer loyalty among environmentally conscious customers. For instance, in February 2025, Fuji Mineral Water launched aluminum bottled water to reduce plastic waste, demonstrating the industry's commitment to environmental responsibility in the Asia-Pacific region.

Stringent regulations and compliance requirements

Regulatory requirements across the Asia-Pacific bottled water market pose significant constraints. Governments in the region enforce strict standards for water quality, safety, labeling, and packaging to safeguard consumer health. These regulations, while necessary, increase production costs and operational complexity, particularly affecting smaller manufacturers who must meet extensive compliance requirements. The varying regulatory frameworks across different countries in the region create additional challenges for companies operating in multiple markets. Environmental regulations regarding packaging waste and plastic reduction require companies to invest in sustainable packaging solutions, increasing operational costs. These regulatory factors extend product launch timelines, restrict rapid scaling capabilities, and create entry barriers for new market participants, limiting market growth despite increasing consumer demand.

Other drivers and restraints analyzed in the detailed report include:

- International tourism boosts premium bottled water consumption

- Growing on-the-go hydration in emerging megacities

- Growing popularity of water purifiers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Still water holds a 45.22% market share in the Asia Pacific bottled water market in 2025, driven by health consciousness, safety concerns, and convenience factors. Consumers view still water as the purest form of hydration, free from sugars, calories, and additives, making it popular among fitness enthusiasts, families, and health-conscious individuals. Water quality concerns in developing regions of the Asia Pacific have increased the demand for bottled still water as a safe alternative to potentially contaminated tap water. Urban populations particularly value the portability and accessibility of bottled water for daily hydration needs.

The sparkling water segment is projected to grow at a CAGR of 7.41% through 2031 in the Asia Pacific bottled water market. This growth stems from increasing consumer preference for healthier beverage alternatives, particularly among millennials and Gen Z, who seek low-calorie, sugar-free options instead of traditional soft drinks. The segment offers refreshing hydration without artificial ingredients or added sugars. This trend was exemplified in April 2024 when Bisleri International partnered with Gauri Khan to launch a limited-edition sparkling water. The partnership capitalized on the growing demand for premium sparkling water by introducing a sugar-free beverage that catered to health-conscious consumers seeking sophisticated alternatives to conventional soft drinks.

The Asia-Pacific Bottled Water Market is Segmented by Product Type (Still Water, Sparkling Water, Functional Water, Flavored Water, and Others), Packaging Type (PET Bottles, Glass Bottles, Aluminum Cans, and Others), Distribution Channel (On-Trade, and Off-Trade), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle S.A.

- Danone S.A.

- PepsiCo Inc.

- The Coca-Cola Company

- Tata Consumer Products Limited

- Nongfu Spring Co. Ltd

- Suntory Beverage & Food Ltd

- Bisleri International

- Asahi Group Holdings Ltd

- Hangzhou Wahaha Group

- Fiji Water Company LLC

- Voss of Norway AS

- Tibet Water Resources Ltd

- CG Roxane LLC

- Otsuka Pharmaceutical Co. Ltd

- Kirin Holdings Co. Ltd

- Vitasoy International

- Nongshim Co. Ltd

- Primo Water Corporation

- Aava Water

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing health and wellness awareness drives market growth

- 4.2.2 Innovative packaging solutions for convenience and environmental impact

- 4.2.3 International tourism boosts premium bottled water consumption

- 4.2.4 Growing on-the-go hydration in emerging megacities

- 4.2.5 Urbanization leading to busier lifestyles and demand for convenient hydration

- 4.2.6 Product innovation expands market opportunities

- 4.3 Market Restraints

- 4.3.1 Stringent regulations and compliance requirements

- 4.3.2 Growing popularity of water purifiers

- 4.3.3 Counterfeit and low-quality products

- 4.3.4 High transportation and logistics costs

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Still Water

- 5.1.2 Sparkling Water

- 5.1.3 Functional Water

- 5.1.4 Flavored Water

- 5.1.5 Others

- 5.2 By Packaging Type

- 5.2.1 PET Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Aluminum Cans

- 5.2.4 Others

- 5.3 By Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Home and Office Delivery

- 5.3.2.4 Online Retail Stores

- 5.3.2.5 Other Off-Trade Channels

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 Australia

- 5.4.1.5 Indonesia

- 5.4.1.6 South Korea

- 5.4.1.7 Thailand

- 5.4.1.8 Singapore

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 Danone S.A.

- 6.4.3 PepsiCo Inc.

- 6.4.4 The Coca-Cola Company

- 6.4.5 Tata Consumer Products Limited

- 6.4.6 Nongfu Spring Co. Ltd

- 6.4.7 Suntory Beverage & Food Ltd

- 6.4.8 Bisleri International

- 6.4.9 Asahi Group Holdings Ltd

- 6.4.10 Hangzhou Wahaha Group

- 6.4.11 Fiji Water Company LLC

- 6.4.12 Voss of Norway AS

- 6.4.13 Tibet Water Resources Ltd

- 6.4.14 CG Roxane LLC

- 6.4.15 Otsuka Pharmaceutical Co. Ltd

- 6.4.16 Kirin Holdings Co. Ltd

- 6.4.17 Vitasoy International

- 6.4.18 Nongshim Co. Ltd

- 6.4.19 Primo Water Corporation

- 6.4.20 Aava Water

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK