PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934645

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934645

Europe Kitchen Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

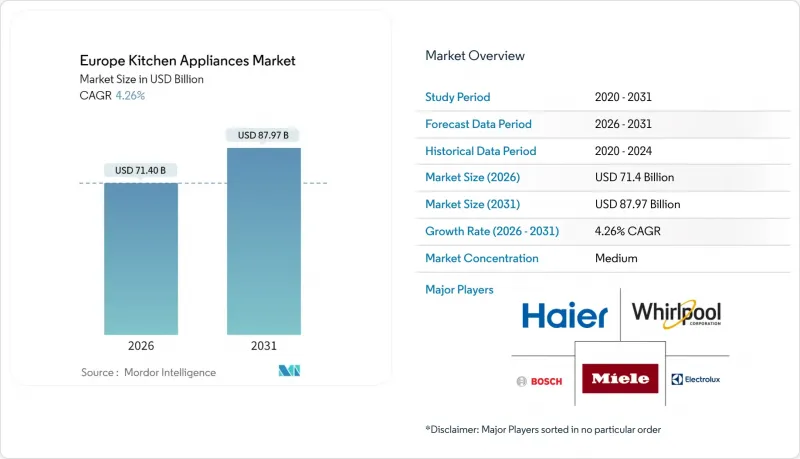

The Europe kitchen appliances market was valued at USD 68.48 billion in 2025 and estimated to grow from USD 71.4 billion in 2026 to reach USD 87.97 billion by 2031, at a CAGR of 4.26% during the forecast period (2026-2031).

Resilience stems from the EU's energy-efficiency framework that rewards A-rated products, the Right-to-Repair Directive that extends appliance lifecycles, and post-pandemic consumer behavior that favors home-cooking convenience. Ongoing digitalization embeds connectivity and predictive diagnostics in refrigerators, ovens, and dishwashers, creating new service revenue streams. Manufacturers mitigate 2024 supply-chain shocks by localizing component sourcing and redesigning electronics to reduce semiconductor reliance. Induction cooktops and smart hoods gain traction as households accelerate the shift away from gas in support of national decarbonization targets.

Europe Kitchen Appliances Market Trends and Insights

Rising Adoption of Smart/Connected Appliances

Penetration of Wi-Fi-enabled ovens, dishwashers, and refrigerators is rising as ecosystem platforms allow remote temperature setting, inventory management, and energy-use optimization. The connected segment is on track to expand 26% between 2022-2027, outpacing the broader Europe kitchen appliances market. German and Nordic households lead adoption because of high broadband coverage and favorable electricity tariffs. Manufacturers such as BSH commit 5.5% of turnover to R&D, focusing on AI cooking algorithms that learn user preferences. EPREL's QR-code database helps shoppers verify energy performance and cybersecurity compliance at the point of sale.

Energy-Efficiency Regulations Accelerating Replacement Cycles

The rescaled A-G label makes pre-2019 appliances appear inefficient, encouraging households to upgrade sooner despite inflation pressure. EU ecodesign rules project EUR 473-736 annual savings per household by 2030, translating into stronger demand for A-rated refrigerators and dishwashers. Range hoods alone are expected to improve efficiency by 28% within the decade, saving EUR 0.2 billion in energy costs. Mandatory 10-year parts availability pushes brands toward modular construction that simplifies field repairs. Compliance with ISO 14001 lifecycle standards becomes a marketing differentiator as consumers equate durability with sustainability.

Inflation-Driven Spending Pull-back

Food-price inflation reached 15% in 2023, squeezing discretionary income and pushing appliance upgrades down household priority lists. Shoppers trade down to essential functions or delay purchases, extending replacement cycles in entry-level refrigerators and washing machines. Private-label penetration in grocery climbed toward 40% in 2025, signaling heightened value sensitivity. Southern European markets feel the pinch most acutely, yet premium buyers in Northern Europe still invest in A-class models that promise long-term savings. Pent-up demand could rebound once wage growth outpaces prices.

Other drivers and restraints analyzed in the detailed report include:

- Home-Cooking & Nesting Trend Post-COVID

- E-Commerce Penetration Expanding Category Reach

- Supply-Chain & Component Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large appliances generated 70.05% of Europe's kitchen appliances market revenue in 2025, anchored by refrigerators, ovens, dishwashers, and induction hobs. Energy label rescaling makes upgrading to A-class cooling and washing equipment financially attractive, compressing the payback period to under six years for many households. Induction penetration reached 35% of European cooktops, far exceeding the 3% level in the United States and underscoring Europe's lead in clean cooking technology. Dishwashers benefit from minimum-performance regulations that reduce water and electricity use per cycle, while extended parts availability supports circularity ambitions. Rangehoods register a 28% efficiency improvement outlook, pairing seamlessly with the surge in induction installations.

Small appliances, while contributing to the balance of sales, outpace the headline Europe kitchen appliances market with a 5.65% CAGR to 2031. Air fryers stand out for combining healthier cooking with 30% lower energy consumption than convection ovens, capturing share from countertop grills. Capsule coffee systems and bean-to-cup machines leverage premiumization and cafe-quality expectations inside the home. Food processors and high-speed blenders ride wellness trends that favor smoothies and plant-based diets. Multifunctional cookers attract urban dwellers seeking space-saving versatility. Specialty devices such as dehydrators and sous-vide sticks expand as hobbyist cooking gains social-media traction.

The Europe Kitchen Appliances Market is Segmented by Product (Large Kitchen Appliances, Small Kitchen Appliances), End User (Residential, Commercial), Distribution Channel (B2C/Retail, B2B), and Geography (United Kingdom, Germany, France, Spain, Italy, BENELUX, NORDICS, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Whirlpool Corp.

- Electrolux AB

- BSH Hausgerate GmbH

- Haier Europe

- Miele & Cie. KG

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Gorenje Hisense Europe

- SMEG S.p.A.

- De'Longhi Group

- Groupe SEB

- Kenwood Ltd.

- Russell Hobbs

- Philips Domestic Appliances

- Sage Appliances

- AEG

- Siemens Home Appliances

- Zanussi

- Beko

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Smart/Connected Appliances

- 4.2.2 Energy-Efficiency Regulations Accelerating Replacement Cycles

- 4.2.3 Home-Cooking & Nesting Trend Post-Covid

- 4.2.4 E-Commerce Penetration Expanding Category Reach

- 4.2.5 EU "Right-To-Repair" Accelerating Modular Designs

- 4.2.6 Shift From Gas To Induction Cooktops Amid Decarbonisation

- 4.3 Market Restraints

- 4.3.1 Inflation-Driven Spending Pull-Back

- 4.3.2 Supply-Chain & Component Shortages

- 4.3.3 Mature Replacement Market In Western Europe

- 4.3.4 Eco-Design Durability Rules Inflating Costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Large Kitchen Appliances

- 5.1.1.1 Refrigerators & Freezers

- 5.1.1.2 Dishwashers

- 5.1.1.3 Range Hoods

- 5.1.1.4 Cooktops

- 5.1.1.5 Ovens

- 5.1.1.6 Other Large Kitchen Appliances

- 5.1.2 Small Kitchen Appliances

- 5.1.2.1 Food Processors

- 5.1.2.2 Juicers and Blenders

- 5.1.2.3 Grills and Roasters

- 5.1.2.4 Air Fryers

- 5.1.2.5 Coffee Makers

- 5.1.2.6 Electric Cookers

- 5.1.2.7 Toasters

- 5.1.2.8 Electric Kettles

- 5.1.2.9 Countertop Ovens

- 5.1.2.10 Other Small Kitchen Appliances

- 5.1.1 Large Kitchen Appliances

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 B2C/Retail

- 5.3.1.1 Multi-brand Stores

- 5.3.1.2 Exclusive Brand Outlets

- 5.3.1.3 Online

- 5.3.1.4 Other Distribution Channels

- 5.3.2 B2B (directly from the manufacturers)

- 5.3.1 B2C/Retail

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX

- 5.4.7 NORDICS

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Whirlpool Corp.

- 6.4.2 Electrolux AB

- 6.4.3 BSH Hausgerate GmbH

- 6.4.4 Haier Europe

- 6.4.5 Miele & Cie. KG

- 6.4.6 Samsung Electronics Co., Ltd.

- 6.4.7 LG Electronics Inc.

- 6.4.8 Gorenje Hisense Europe

- 6.4.9 SMEG S.p.A.

- 6.4.10 De'Longhi Group

- 6.4.11 Groupe SEB

- 6.4.12 Kenwood Ltd.

- 6.4.13 Russell Hobbs

- 6.4.14 Philips Domestic Appliances

- 6.4.15 Sage Appliances

- 6.4.16 AEG

- 6.4.17 Siemens Home Appliances

- 6.4.18 Zanussi

- 6.4.19 Beko

7 Market Opportunities & Future Outlook

- 7.1 Rising Demand for Energy-Efficient and Eco-Friendly Appliances

- 7.2 Growing Adoption of Smart Connected Kitchen Appliance Ecosystems