PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934664

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934664

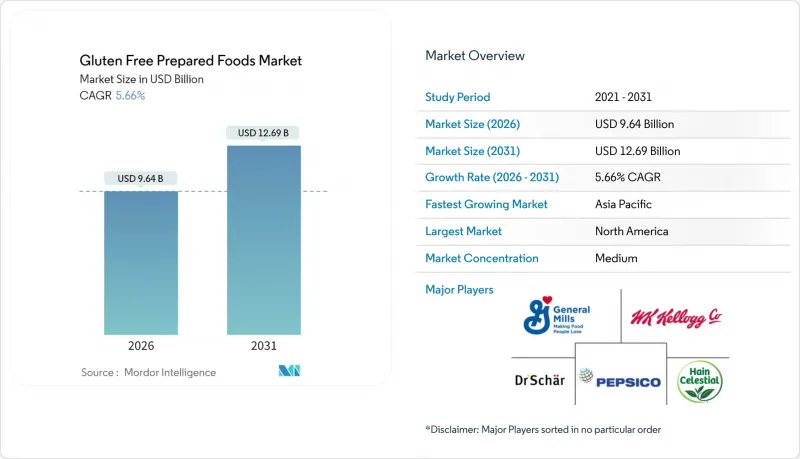

Gluten Free Prepared Foods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The gluten-free prepared foods market size in 2026 is estimated at USD 9.64 billion, growing from 2025 value of USD 9.12 billion with 2031 projections showing USD 12.69 billion, growing at 5.66% CAGR over 2026-2031.

Demand acceleration stems from better celiac diagnostics, regulatory harmonization around the 20 ppm gluten threshold, and lifestyle adoption among health-conscious consumers. Convenience-centric behavior, notably the surge in frozen and chilled meal occasions documented by Conagra, is redirecting purchasing power from traditional bakery staples toward ready-to-eat formats. Producers are scaling more efficiently as enzyme technologies and dedicated production lines lower cross-contamination risks and raise yields. Regionally, North America retains leadership through advanced insurance reimbursement and a mature retail ecosystem, while Asia-Pacific delivers the fastest unit gains as middle-income shoppers turn online for specialty products.

Global Gluten Free Prepared Foods Market Trends and Insights

Increasing prevalence of celiac disease and gluten intolerance worldwide

The medical demand for gluten-free prepared foods primarily stems from celiac disease, an autoimmune disorder that affects approximately 1% of the global population . In the United States., the United States Department of Agriculture estimates that about 3 million Americans live with celiac disease, forming a dedicated consumer base that must strictly avoid gluten to manage their condition. These individuals actively depend on gluten-free products to prevent severe health complications, such as intestinal damage and nutrient malabsorption, and to maintain their overall well-being. This medically driven demand, combined with increasing global awareness, improved diagnostic methods, and rising diagnosis rates, continues to propel the growth of the gluten-free prepared foods market. Manufacturers are responding by actively innovating and expanding their product portfolios to address the specific dietary needs and preferences of this essential consumer segment.

Rising health consciousness and preventive healthcare trends

Rising health consciousness and preventive healthcare trends are significantly driving the Gluten Free Prepared Foods Market. Consumers are increasingly seeking nutritious and clean-label food options that support overall wellness and digestive health. This shift is fueled by growing awareness of gluten-related disorders and the perception that gluten-free diets contribute to better health outcomes, even among individuals without diagnosed gluten intolerance. Additionally, the demand for convenient, ready-to-eat gluten-free products is rising as consumers prioritize both health and lifestyle convenience. Manufacturers are responding by innovating with natural, organic, and minimally processed ingredients that appeal to health-conscious buyers. This convergence of health awareness and lifestyle preferences is fostering sustained growth and diversification within the gluten-free prepared foods sector.

Higher production costs compared to conventional gluten-containing foods

Specialized ingredient sourcing, dedicated production facilities, and rigorous quality control protocols collectively inflate the production expenses of gluten-free prepared foods by 150-500% compared to conventional alternatives. Research from Canada reveals that gluten-free products can cost households over CAD 1,000 more annually than their conventional counterparts. This premium is most pronounced in prepared foods, attributed to their processing complexity. The primary expense differential arises from ingredient costs: specialty flours, binding agents, and certified gluten-free inputs can be 3-5 times pricier than their wheat-based counterparts. To prevent cross-contamination, production facilities must implement dedicated lines, enhanced cleaning protocols, and separate storage systems. These modifications lead to fixed cost burdens, often challenging for smaller manufacturers to shoulder. Quality control expenses escalate due to mandatory testing of both raw materials and finished products. Additionally, third-party certification can add an annual cost of USD 10,000-50,000 per facility, influenced by production volume and the breadth of certification scope.

Other drivers and restraints analyzed in the detailed report include:

- Growing consumer demand for convenient and ready-to-eat gluten-free products

- Expanding product portfolio with taste and texture improvements

- Price sensitivity limiting consumer adoption in developing regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bakery and snacks held the largest share of the gluten-free prepared foods market in 2025, commanding 47.25% of the total. This dominance reflects strong consumer preference for familiar food options that cater to dietary restrictions while still delivering taste and convenience. The widespread availability of gluten-free baked products and snacks across retail channels makes them easily accessible to consumers seeking both health benefits and familiar formats. Additionally, the growth in demand is supported by continuous product innovation, improving texture and flavor to closely mimic traditional gluten-containing foods. The segment also benefits from broader consumer awareness related to gluten intolerance and celiac disease, which reinforces purchasing decisions. As a well-established category, baked goods and snacks continue to anchor the gluten-free market, balancing taste, convenience, and health considerations.

Conversely, ready meals represent the fastest-growing segment, projected to accelerate at a 6.35% CAGR through 2031. This rapid growth is driven by increasing consumer migration toward convenience-oriented gluten-free solutions that fit modern, busy lifestyles. Ready meals offer quick, hassle-free options that meet gluten-free dietary requirements without compromising on nutrition or taste. Advances in product formulations and food technology have expanded the variety and quality of gluten-free ready meals, fueling consumer acceptance and repeat purchases. The growing number of working professionals and on-the-go consumers prioritizing easy meal solutions also plays a pivotal role in segment expansion. As consumer demand shifts toward more convenient yet health-conscious products, gluten-free ready meals are poised to outpace broader market growth and capture a larger share over the forecast period.

The Gluten Free Prepared Foods Market Report is Segmented by Product Type (Bakery and Snacks, Dairy Alternatives, Confectionery, Sauces/Dressings/Seasonings, Ready Meals, Soups and Broths, Others), Distribution Channel (On-Trade, Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America secures a commanding 38.40% share of the market, bolstered by its robust healthcare infrastructure for celiac diagnosis, insurance backing for dietary management, and consumers' readiness to invest in convenient gluten-free foods. The region enjoys regulatory clarity, thanks to the FDA's 20 ppm gluten threshold and voluntary labeling standards, ensuring consistent product positioning nationwide. Major food manufacturers are channeling their Research and Development investments into North American facilities, reaping innovation advantages that lead to superior product quality and quicker market introductions. Canada's provincial coverage for gluten-free food costs further alleviates economic burdens for celiac patients. Meanwhile, Mexico emerges as a promising frontier, with urbanization and increasing disposable incomes driving demand for imported gluten-free foods, despite the country's limited local production.

Asia-Pacific stands out as the region with the fastest growth rate, boasting a 7.10% CAGR. This surge is fueled by urbanization, heightened health awareness, and a burgeoning middle class in pursuit of premium food options. China spearheads the regional expansion, leveraging e-commerce and government-backed food safety initiatives. Japan showcases its consumers' refined taste for functional foods, aligning seamlessly with gluten-free offerings. Australia and New Zealand take the lead in regulatory standards, with FSANZ guidelines shaping a unified approach to gluten-free certification and labeling across the region. Despite grappling with cold chain distribution and retail challenges, online platforms bridge geographic divides, ensuring market access. South Korea and Vietnam emerge as hotspots, with affluent urbanites gravitating towards Western dietary trends, albeit with a need for local taste adaptations.

Europe experiences steady growth, underpinned by established celiac support networks, thorough healthcare coverage, and regulatory mandates for clear allergen labeling. The continent's rich artisanal food traditions seamlessly align with premium gluten-free offerings, bolstered by stringent quality standards that instill consumer trust. Germany and France spearhead market evolution, driven by robust organic movements that dovetail with gluten-free trends. The UK capitalizes on its high celiac diagnosis rates and a specialized retail framework. Meanwhile, South America and the Middle East and Africa emerge as potential goldmines, with economic strides and healthcare enhancements broadening market access. However, challenges like price sensitivity and distribution hurdles temper immediate growth prospects.

- Dr. Schar AG

- General Mills Inc.

- The Hain Celestial Group Inc.

- WK Kellogg Co.

- PepsiCo, Inc.

- Kraft Heinz Company

- Conagra Brands

- Nestle S.A.

- Amy's Kitchen Inc.

- Canyon Bakehouse LLC

- Bob's Red Mill Natural Foods

- Hero Group AG

- Freedom Foods Group

- Barilla S.p.A.

- Enjoy Life Foods Inc.

- Mondelez International, Inc.

- Genius Foods Ltd.

- Feel Good Foods Inc.

- Canyon Frozen Foods

- Sapidum d.o.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing prevalence of celiac disease and gluten intolerance worldwide

- 4.2.2 Rising health consciousness and preventive healthcare trends

- 4.2.3 Growing consumer demand for convenient and ready-to-eat gluten-free products

- 4.2.4 Expanding product portfolio with taste and texture improvements

- 4.2.5 Technological advancements in gluten-free food processing and formulation

- 4.2.6 Demand for clean-label, organic, and non-GMO gluten-free products

- 4.3 Market Restraints

- 4.3.1 Higher production costs compared to conventional gluten-containing foods

- 4.3.2 Price sensitivity limiting consumer adoption in developing regions

- 4.3.3 Challenges in achieving taste and texture parity with gluten foods

- 4.3.4 Regulatory complexities and labeling requirements

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Bakery and Snacks

- 5.1.1.1 Biscuits

- 5.1.1.2 Cookies

- 5.1.1.3 Cakes

- 5.1.1.4 Others

- 5.1.2 Dairy Alternatives

- 5.1.3 Confectionery

- 5.1.4 Sauces, Dressings and Seasonings

- 5.1.5 Ready Meals

- 5.1.6 Soups and Broths

- 5.1.7 Others

- 5.1.1 Bakery and Snacks

- 5.2 By Distribution Channel

- 5.2.1 On-Trade

- 5.2.2 Off-Trade

- 5.2.2.1 Supermarkets/Hypermarkets

- 5.2.2.2 Convenience Stores

- 5.2.2.3 Online Retail Stores

- 5.2.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Netherlands

- 5.3.2.7 Belgium

- 5.3.2.8 Poland

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Vietnam

- 5.3.3.7 Indonesia

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Dr. Schar AG

- 6.4.2 General Mills Inc.

- 6.4.3 The Hain Celestial Group Inc.

- 6.4.4 WK Kellogg Co.

- 6.4.5 PepsiCo, Inc.

- 6.4.6 Kraft Heinz Company

- 6.4.7 Conagra Brands

- 6.4.8 Nestle S.A.

- 6.4.9 Amy's Kitchen Inc.

- 6.4.10 Canyon Bakehouse LLC

- 6.4.11 Bob's Red Mill Natural Foods

- 6.4.12 Hero Group AG

- 6.4.13 Freedom Foods Group

- 6.4.14 Barilla S.p.A.

- 6.4.15 Enjoy Life Foods Inc.

- 6.4.16 Mondelez International, Inc.

- 6.4.17 Genius Foods Ltd.

- 6.4.18 Feel Good Foods Inc.

- 6.4.19 Canyon Frozen Foods

- 6.4.20 Sapidum d.o.o.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK