PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934829

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934829

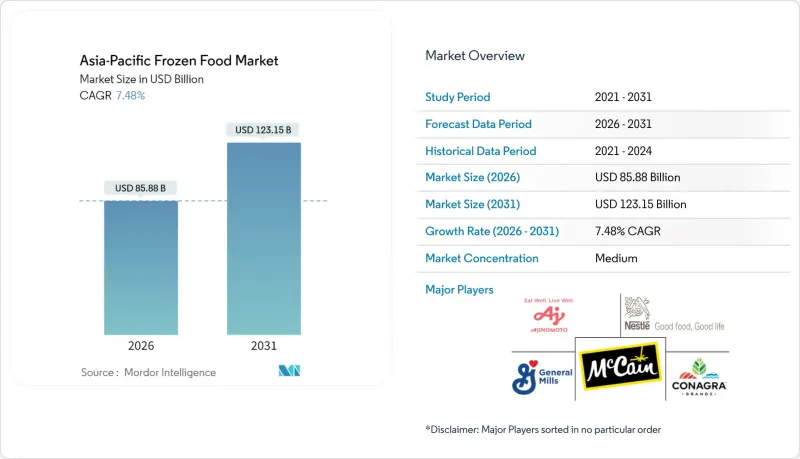

Asia-Pacific Frozen Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific frozen food market was valued at USD 79.90 billion in 2025 and estimated to grow from USD 85.88 billion in 2026 to reach USD 123.15 billion by 2031, at a CAGR of 7.48% during the forecast period (2026-2031).

This robust expansion reflects the region's rapid urbanization, evolving consumer preferences toward convenience foods, and substantial investments in cold chain infrastructure across key markets, including China, India, Japan, and Southeast Asia. Rising urban populations, shifting household structures, and continuing investments in temperature-controlled logistics underpin sustained demand growth. Large cities across China and India now support modern supermarkets and quick-commerce platforms that keep frozen assortments front-of-mind for busy consumers. Retailers leverage improved last-mile delivery networks to extend assortment depth into second-tier cities, while manufacturers roll out premium ready meals that offer familiar regional flavors in convenient formats. Cold-chain capital spending by private operators and governments remains a primary catalyst because it lowers spoilage, expands geographic reach, and raises consumer confidence in product safety. Competitive intensity continues to build as global multinationals scale Asian production hubs and local specialists enhance branding around provenance, nutrition, and sustainability, creating favorable conditions for mergers and strategic alliances throughout the forecast window.

Asia-Pacific Frozen Food Market Trends and Insights

Growth In Convenient Meal Solutions Demand

Urbanization across the Asia-Pacific drives unprecedented demand for convenient meal solutions as working populations seek time-efficient food options. Thailand's ready-to-eat food industry exemplifies this trend, with domestic ready meals growing annually through 2026, supported by economic recovery and changing household structures. Urban centers in China and India particularly drive this demand as nuclear families and single-person households increase, creating substantial market opportunities for frozen convenience products. The trend accelerates as modern retail formats expand and cold chain infrastructure improvements enable broader distribution of frozen ready meals to previously underserved markets. The rise of e-commerce platforms has further amplified market accessibility, allowing consumers to order frozen meals directly to their homes. Increased female workforce participation across the region has created additional demand for quick meal solutions that reduce cooking time. According to the World Bank data, the female labor participation rate has grown from 27.72% in 2021 to 32.80% in 2024 . Consumer awareness of food safety and quality has also grown, pushing manufacturers to develop premium frozen meal options with cleaner labels and healthier ingredients.

Innovations In Freezing And Packaging Technology

Technological advancements in Individual Quick Freezing (IQF) and packaging solutions enhance product quality while extending shelf life. McCain Foods' recent launch of SureCrisp Max in Singapore demonstrates how proprietary coating technologies deliver enhanced crispiness for up to 30 minutes, specifically targeting delivery and takeaway formats. These innovations address critical foodservice needs while enabling manufacturers to differentiate products and command premium pricing in competitive markets. The integration of automation and artificial intelligence in IQF systems has significantly improved processing efficiency and reduced operational costs across the frozen food industry. Advanced sensor technologies and precise temperature control mechanisms ensure consistent product quality and minimize freeze damage during the IQF process. The implementation of sustainable packaging solutions, combined with IQF technology, has helped manufacturers reduce food waste and meet growing consumer demand for environmentally responsible products.

Competition From Fresh Foods

Fresh food alternatives maintain competitive pressure on frozen products, particularly in markets with strong traditional food cultures and established fresh supply chains. Thailand's food service sector demonstrates this challenge, where restaurants' correlation with tourist spending and preference for fresh ingredients limit frozen food adoption in traditional segments. However, improved cold chain logistics and product innovation gradually address quality perceptions while convenience factors increasingly favor frozen alternatives in urban markets. The emergence of modern retail formats and changing consumer lifestyles has created new opportunities for frozen food manufacturers to penetrate traditional markets. Food service operators are increasingly adopting hybrid approaches, incorporating both fresh and frozen ingredients to optimize operational efficiency while maintaining quality standards. Additionally, investments in advanced freezing technologies have significantly improved the texture and nutritional retention of frozen products, narrowing the perceived quality gap with fresh alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Rising Health-Consciousness Lead to Clean Label Preferences

- Longer Shelf Life Enhances Demand

- Complex Regulatory And Labeling Compliance Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Frozen meat, poultry, and seafood retained a leading 31.10% share of the Asia-Pacific frozen food market in 2025, driven by steady protein consumption across coastal economies and inland urban centers. Continuous improvements in blast-chilling and filleting automation lower unit costs and stabilize supply, encouraging supermarkets to stock wider assortments. The segment capitalizes on established import pipelines for salmon, beef, and chicken, which shield retailers from occasional domestic shortages and price volatility. Modern cold chain infrastructure development in tier-2 cities has expanded distribution reach beyond metropolitan areas. According to PIB (Press Information Bureau), the cold chain storage capacity across India in 2023 was Uttar Pradesh -15,045.87 metric tons, West Bengal-5,948.32 metric tons, Gujarat- 3,974.59 metric tons, and so on . Consumer trust in frozen protein quality continues to strengthen as manufacturers adopt transparent sourcing practices and implement rigorous temperature monitoring systems.

In parallel, ready-meal innovation propels category diversification, delivering a 7.52% CAGR that eclipses traditional protein growth. Bento-style bowls, noodles, and rice dishes tailored to regional tastes increase presence on app menus for office lunch delivery. Microwave-safe compartment trays and steam-release films maintain plating aesthetics, encouraging repeat purchases. Manufacturers leverage centralized culinary labs to develop limited-edition flavors timed with festivals, using social media polls to co-create recipes, thereby deepening engagement and raising brand equity within the Asia-Pacific frozen food market. The integration of traditional Asian cuisines into frozen formats has created new market segments targeting young urban professionals. Regional players are investing in advanced packaging technologies that extend shelf life while preserving authentic flavors and textures.

Ready-to-cook SKUs captured 67.25% of Asia-Pacific frozen food market share in 2025 due to customer desire for culinary control combined with time savings. Marinated proteins and pre-cut vegetables give home cooks flexibility to adjust spices and cooking levels, aligning with culturally embedded preferences for "freshly prepared" meals. Retail chains promote bundle deals pairing raw proteins with seasoning sachets to stimulate incremental sales of condiments. The ready-to-cook segment particularly appeals to multi-generational households where cooking traditions remain important cultural touchpoints. Manufacturing innovations in flash-freezing technology have improved texture retention and nutrient preservation, further strengthening consumer acceptance of these products.

Conversely, ready-to-eat alternatives advance swiftly at 7.55% CAGR as single-person households and student populations escalate. These offerings benefit from shelf-stable sauces and flash-grilled proteins that reduce microwave warm-up to under four minutes. Portion-controlled packaging minimizes waste and aligns with calorie management goals. The combination of convenience, portion accuracy, and diverse regional flavors keeps the ready-to-eat segment on a steep upward trajectory, adding vigor to the overall Asia-Pacific frozen food market. Urban professionals increasingly rely on these products during peak workweeks, driving steady demand across major metropolitan areas. Market research indicates that ready-to-eat frozen meals are becoming a staple for time-pressed consumers who still prioritize authentic taste profiles.

The Asia-Pacific Frozen Food Market is Segmented by Product Type (Frozen Fruits and Vegetables, Frozen Meat, Poultry and Seafood, Frozen Bakery and Confectionery, and Other Types), Category (Ready-To-Eat and Ready-To-Cook), Nature (Conventional and Organic), and Distribution Channel (HoReCa/On-Trade and Retail/Off-Trade), and Geography (China, Japan, India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- McCain Foods Limited

- Ajinomoto Co., Inc.

- General Mills Inc.

- Conagra Brands, Inc.

- Lantmannen (Lantmannen)

- Nestle S.A.

- Sanquan Food

- Maruha Nichiro Group

- Apex Frozen Foods Ltd

- Shandong Huifa Food Co. Ltd.

- Aryzta AG

- Kraft Foods Group Inc.

- Cargill Incorporated

- Europastry S.A.

- JBS S.A.

- Kellogg's Company

- Flower Foods

- Bonduelle Group

- Thai Union Group PCL

- CJ CheilJedang Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth In Convenient Meal Solutions Demand

- 4.2.2 Innovations In Freezing And Packaging Technology

- 4.2.3 Longer Shelf Life Enhances Demand

- 4.2.4 Rising Health-Consciousness Lead to Clean Label Preferences

- 4.2.5 Expansion of Plant-Based Frozen Food Options

- 4.2.6 Online Grocery And Delivery Channel Adoption

- 4.3 Market Restraints

- 4.3.1 Competition From Fresh Foods

- 4.3.2 Limited Rural Market Cold Chain Penetration

- 4.3.3 Complex Regulatory And Labeling Compliance Barriers

- 4.3.4 Sensory Texture And Taste Acceptance Concerns

- 4.4 Consumer Demand Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Frozen Meat, Poultry and Seafood

- 5.1.2 Frozen Bakery and Confectionery

- 5.1.3 Frozen Fruits and Vegetables

- 5.1.4 Frozen Ready Meals

- 5.1.5 Frozen Dairy Products

- 5.1.6 Other Types

- 5.2 By Category

- 5.2.1 Ready-to-Eat (RTE)

- 5.2.2 Ready-to-Cook (RTC)

- 5.3 By Nature

- 5.3.1 Conventional

- 5.3.2 Organic

- 5.4 By Distribution Channel

- 5.4.1 HoReCa/On-Trade

- 5.4.2 Retail/Off-Trade

- 5.4.2.1 Supermarkets/ Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Australia

- 5.5.5 New Zealand

- 5.5.6 South Korea

- 5.5.7 Thailand

- 5.5.8 Singapore

- 5.5.9 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Positioning Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 McCain Foods Limited

- 6.4.2 Ajinomoto Co., Inc.

- 6.4.3 General Mills Inc.

- 6.4.4 Conagra Brands, Inc.

- 6.4.5 Lantmannen (Lantmannen)

- 6.4.6 Nestle S.A.

- 6.4.7 Sanquan Food

- 6.4.8 Maruha Nichiro Group

- 6.4.9 Apex Frozen Foods Ltd

- 6.4.10 Shandong Huifa Food Co. Ltd.

- 6.4.11 Aryzta AG

- 6.4.12 Kraft Foods Group Inc.

- 6.4.13 Cargill Incorporated

- 6.4.14 Europastry S.A.

- 6.4.15 JBS S.A.

- 6.4.16 Kellogg's Company

- 6.4.17 Flower Foods

- 6.4.18 Bonduelle Group

- 6.4.19 Thai Union Group PCL

- 6.4.20 CJ CheilJedang Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK