PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934685

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934685

Europe Sports Nutrition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

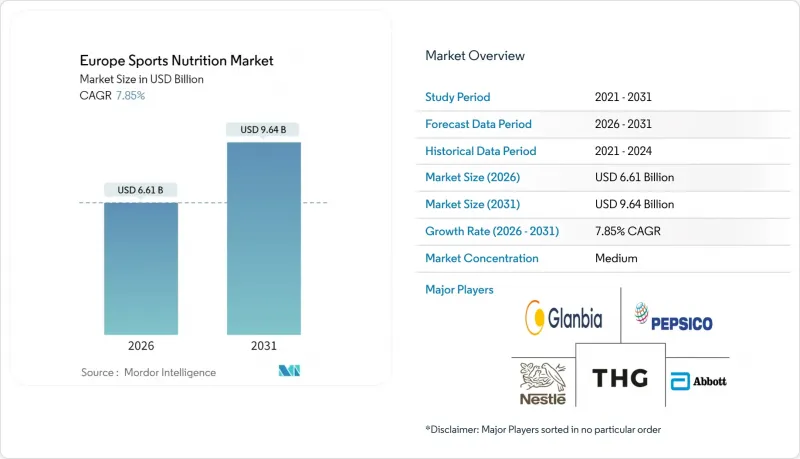

The Europe sports nutrition market is expected to grow from USD 6.13 billion in 2025 to USD 6.61 billion in 2026 and is forecast to reach USD 9.64 billion by 2031 at 7.85% CAGR over 2026-2031.

The robust outlook reflects a broadening consumer base that now includes millennials, Gen Z, and active seniors who integrate performance products into daily wellness routines. The rising popularity of gym memberships, recreational activities, and endurance sports is driving the demand for performance-enhancing nutritional supplements such as pre-workouts and protein products. Product innovations, including ready-to-drink formats, bars, and clinically tested ingredients, improve convenience and effectiveness, appealing to a broader range of consumers. Additionally, sports nutrition is increasingly being used by non-athletes for general wellness, weight management, and healthy aging, thereby expanding its consumer base. Fitness culture investments, a shift toward plant-based, clean-label ingredients, and omnichannel retail advances also reinforce consumption momentum. Meanwhile, intensified enforcement against counterfeit goods bolsters consumer trust and favors compliant brands.

Europe Sports Nutrition Market Trends and Insights

Rising health and fitness consciousness among millennials and gen Z

Demographic transformation drives market expansion as younger consumers integrate sports nutrition into daily wellness routines rather than limiting usage to athletic performance. This generational shift creates sustained demand beyond traditional gym-centric consumption patterns. Growing participation in gym workouts, outdoor sports, yoga, and fitness challenges is driving consistent demand for performance-enhancing and recovery products. Sport England reported that 6,695,500 individuals attended fitness classes in England during the 2023-2024 period . Millennials and Gen Z are fueling the need for products designed to meet their specific dietary preferences and health goals, fostering innovation and diversification within the market. The World Health Organization's 2024 report highlighting potential savings of EUR 8 billion annually through increased physical activity reinforces policy support for fitness initiatives, creating favorable conditions for market growth. Social media amplifies this trend, with studies demonstrating that influencer trustworthiness and content quality significantly enhance exercise intentions and supplement purchasing behavior among younger consumers.

Expansion of plant-based and clean-label formulations

The European Food Safety Authority streamlined approvals for novel proteins, including duckweed, crickets, and soy leghemoglobin, during 2024-2025, promoting ingredient diversification. As consumers increasingly prioritize products with a reduced environmental impact, manufacturers are shifting towards plant-based formulations due to their lower carbon emissions compared to animal-based proteins. Improved processing technologies are enhancing the taste, texture, and digestibility of plant-based sports nutrition products, addressing previous consumer concerns and boosting adoption. Plant-based protein consumption in Europe now exceeds 1.1 million tonnes annually , with soy and pea proteins leading in commercial applications, according to the European Vegetable Protein Association. The regulatory framework is evolving, with EFSA's updated guidance for novel food applications, effective February 2025, streamlining market entry for innovative protein sources while upholding safety standards.

Stringent EFSA Claims approval process

Regulatory complexities create barriers that benefit established players while hindering innovation for smaller firms. The European Food Safety Authority requires extensive scientific evidence for health claims, yet cognitive benefits of creatine remain unapproved despite increasing consumer interest. Post-Brexit regulatory divergence adds to the challenge, as companies must navigate separate approval processes for the UK and EU, leading to higher compliance costs that disproportionately affect smaller enterprises. The Netherlands' proposed notification system for food supplements, modeled after Belgium and Romania, reflects growing regulatory scrutiny across EU member states. EFSA's updated guidance, effective February 2025, aims to enhance the quality of novel food applications but also extends assessment timelines. An EU task force working to harmonize maximum permitted levels across member states offers potential for regulatory streamlining, though implementation remains uncertain.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization of protein snacks and RTD beverages

- Rising participation in fitness activities and sports

- High cost and variability of raw materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sports Protein Products represented 68.24% of the Europe sports nutrition market in 2025, anchored by whey and casein powders widely accepted among gym users. This dominance stems from a robust demand for protein supplements, which are pivotal for muscle recovery, maintenance, and overall fitness, resonating with both athletes and fitness aficionados. However, sports non-protein products are on a growth trajectory, boasting an impressive 8.35% CAGR through 2031, underscoring a burgeoning consumer interest in specialized ergogenic aids. While whey retains its lead due to taste and bioavailability, plant-based alternatives are gaining momentum, championed by sustainability and allergen-friendly labels.

Leading the non-protein demand are creatine, branched-chain amino acids, and colostrum. Meanwhile, ready-to-drink hybrids, merging protein with electrolytes, cater to convenience-seeking consumers and expand usage scenarios. Premium ready-to-drinks (RTDs) are making a mark on upscale shelves, harnessing glucosyl hesperidin for its vascular and energy benefits. With a growing emphasis on consumer education, brands are diversifying their offerings in terms of textures and delivery formats, further propelling the expansion of Europe's sports nutrition market size.

The Europe Sports Nutrition Market Report is Segmented by Product Type (Sports Protein Products Including Protein/Energy Bars, Sports Protein Powder With Whey and Casein Variants, Plant-Based Protein Powder, and More), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography (United Kingdom, Germany, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Glanbia plc

- PepsiCo Inc.

- Nestle SA

- Abbott Laboratories

- The Hut Group (Myprotein)

- Post Holdings Inc.

- Red Bull GmbH

- Coca-Cola Co.

- Atlantic Grupa dd

- Science in Sport plc

- Herbalife Nutrition Ltd.

- MusclePharm Corp.

- Clif Bar and Company

- Bulk Powders

- OTE Sports Ltd.

- Prozis Group

- Optimum Nutrition

- German Sports Nutrition GmbH

- KONZEPT Nutrition

- Olimp Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising health and fitness consciousness among Millennials and Gen Z

- 4.2.2 Expansion of plant-based and clean-label formulations

- 4.2.3 Premiumisation of protein snacks and RTD beverages

- 4.2.4 Rising participation in fitness activities and sports

- 4.2.5 Influence of social media and fitness influencers

- 4.2.6 Demand for personalized nutrition and niche products

- 4.3 Market Restraints

- 4.3.1 Stringent EFSA claims approval process

- 4.3.2 High cost and variability of raw materials

- 4.3.3 Intense competition and market saturation

- 4.3.4 Prevalence of counterfeit and substandard products

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Sports Protein Products

- 5.1.1.1 Protein/Energy Bars

- 5.1.1.2 Sports Protein Powder

- 5.1.1.2.1 Whey and Casein Powder

- 5.1.1.2.1.1 Concentrate

- 5.1.1.2.1.2 Isolate

- 5.1.1.2.1.3 Others

- 5.1.1.2.2 Plant-Based Protein Powder

- 5.1.1.2.3 Other Sports Protein Powders

- 5.1.1.2.1 Whey and Casein Powder

- 5.1.2 Sports Protein RTD

- 5.1.3 Sports Non-Protein Products

- 5.1.3.1 Creatine

- 5.1.3.2 BCAA

- 5.1.3.3 Others

- 5.1.1 Sports Protein Products

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets / Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Specialist Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels (Gyms, Vending, Pharmacies)

- 5.3 By Geography

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 Sweden

- 5.3.8 Belgium

- 5.3.9 Poland

- 5.3.10 Netherlands

- 5.3.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Glanbia plc

- 6.4.2 PepsiCo Inc.

- 6.4.3 Nestle SA

- 6.4.4 Abbott Laboratories

- 6.4.5 The Hut Group (Myprotein)

- 6.4.6 Post Holdings Inc.

- 6.4.7 Red Bull GmbH

- 6.4.8 Coca-Cola Co.

- 6.4.9 Atlantic Grupa dd

- 6.4.10 Science in Sport plc

- 6.4.11 Herbalife Nutrition Ltd.

- 6.4.12 MusclePharm Corp.

- 6.4.13 Clif Bar and Company

- 6.4.14 Bulk Powders

- 6.4.15 OTE Sports Ltd.

- 6.4.16 Prozis Group

- 6.4.17 Optimum Nutrition

- 6.4.18 German Sports Nutrition GmbH

- 6.4.19 KONZEPT Nutrition

- 6.4.20 Olimp Laboratories

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK