PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934708

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934708

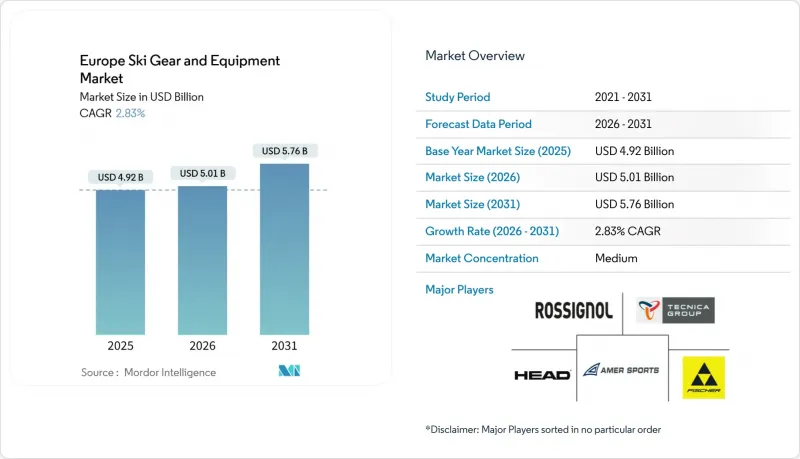

Europe Ski Gear And Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European ski equipment market is expected to grow from USD 4.81 billion in 2025 to USD 4.94 billion in 2026 and is forecast to reach USD 5.66 billion by 2031 at 2.74% CAGR over 2026-2031.

The market expansion is attributed to heightened winter sports participation across Europe, facilitated by the development of ski tourism infrastructure and increased engagement in outdoor recreational pursuits. Primary European skiing destinations, notably the Alps and Pyrenees, maintain their position in attracting both domestic and international clientele, thereby stimulating the procurement of ski equipment and associated apparel. Market advancement is further reinforced by elevated female participation rates, technological enhancements in equipment manufacturing, and the proliferation of digital commerce platforms. Furthermore, governmental policies supporting sports development, environmental sustainability initiatives, and specialized programs targeting youth and adaptive skiing demographics are instrumental in expanding the consumer base and stimulating market demand.

Europe Ski Gear And Equipment Market Trends and Insights

Growing popularity of winter sports tourism

The rise in winter sports tourism significantly drives the European ski gear and equipment market. The increasing number of visitors to winter destinations for skiing, snowboarding, and other cold-weather sports creates a natural increase in demand for equipment and apparel. This tourism growth promotes consistent equipment sales throughout the year, as seasonal visitors require new or specialized ski gear for their slope activities. The development of transport infrastructure and the increased promotion of winter sports activities have contributed to higher participation rates. According to Statistics Austria, overnight stays in Austrian winter tourism accommodations from November 2024 to February 2025 reached 51.35 million, representing a 1.5% increase from the previous year . Austria, a premier European ski destination, demonstrates how winter tourism growth directly correlates with equipment demand. The increase in tourist stays indicates stronger consumer participation and purchasing power in winter sports, leading to consistent equipment purchases and investments in quality ski gear. This pattern reflects a broader European trend where winter tourism strengthens both local economies and the ski gear market, establishing itself as a key factor in the market's growth.

Expansion of ski resorts and facilities

The growth of the European ski gear and equipment market is driven by the expansion of ski resorts and facilities. The opening of new resorts and the modernization of existing facilities, including improved lifts, snowmaking capabilities, and diverse trails, increases skiing accessibility and attracts participants across all skill levels. This development creates demand for various ski equipment categories, from beginner gear to advanced performance products. Modern facilities with enhanced safety features and comfort amenities encourage longer stays and more frequent visits, leading to increased spending on ski gear and apparel. For instance, in September 2025, Ikon Pass added five new ski resorts in the Italian Alps to its network for the 2025 season. This expansion provides skiers with greater access and options, attracting both international visitors and local enthusiasts. The integration of these resorts into a multi-resort pass system increases skier mobility and encourages more frequent visits, driving equipment usage. The expansion benefits local economies and tourism while increasing demand in the ski gear market through diverse user requirements. The addition of these Italian Alps resorts reflects the broader trend of resort development and consolidation that continues to drive market growth.

Seasonal dependence of skiing activities

The seasonal nature of skiing activities significantly constrains the European ski gear and equipment market. Since skiing primarily occurs during winter months when snow conditions are suitable, the market experiences concentrated sales periods within a limited timeframe each year. Climate change has intensified this challenge through warmer winters and decreased snowfall, leading to shorter ski seasons and operational uncertainties for ski resorts. Lower altitude resorts particularly struggle to maintain adequate snow coverage, resulting in canceled ski days, reduced visitor numbers, and decreased equipment demand. These conditions create cyclical revenue patterns for manufacturers and retailers while complicating inventory management and production planning. The market's dependence on winter conditions makes it vulnerable to seasonal variations, with consumers often shifting towards last-minute purchases or equipment rentals rather than ownership. This behavioral adaptation, combined with the seasonal limitations and climate-related challenges, creates substantial constraints on market growth.

Other drivers and restraints analyzed in the detailed report include:

- Rising participation in recreational skiing

- Expansion of ski gear rental models

- Intense competition from alternative winter sports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ski apparel holds 36.12% market share in the European ski gear and equipment market in 2025. This significant share stems from increasing consumer participation in outdoor and adventure sports, where functional ski clothing is essential. Ski apparel serves dual purposes - meeting performance requirements like insulation, waterproofing, and breathability through advanced fabric technologies, while satisfying consumer preferences for aesthetics and brand identity. The product category encompasses jackets, pants, thermal wear, and gloves, serving both professional athletes and recreational skiers. The growth in winter tourism and expanding ski enthusiast base across Europe drives regular product replacement and upgrades.

Ski helmets represent the fastest-growing product category in the European ski gear and equipment market, with a projected CAGR of 3.68% through 2031. This growth primarily results from increased safety awareness and injury prevention consciousness among winter sports participants. The implementation of mandatory helmet regulations at numerous European ski resorts supports this expansion. Technological advancements in helmet design, including enhanced impact absorption, lighter materials, improved ventilation systems, and smart features, have increased their appeal to consumers. The segment also benefits from urban fashion trends incorporating ski-wear elements, extending helmet use beyond skiing activities. The combination of safety requirements, technological improvements, and consumer preferences establishes ski helmets as a rapidly expanding market segment.

The male segment holds a dominant position in the European ski gear and equipment industry with a 58.62% market share in 2025. Men demonstrate higher participation rates in skiing and winter sports, both recreationally and competitively. This drives demand for high-quality, advanced gear and apparel focused on performance, safety, and durability. Male consumers show strong brand loyalty and demonstrate a higher propensity to invest in premium and specialized ski equipment. Their higher disposable income levels and greater willingness to spend on sports gear contribute to the segment's market share. Men also view skiing as part of their lifestyle and social identity, leading to regular equipment upgrades aligned with technological advancements and fashion trends.

The female segment is experiencing the highest growth rate in the European ski gear and equipment market, with a projected CAGR of 4.27% through 2031. This growth stems from increased awareness and initiatives promoting women's participation in skiing and winter sports, coupled with rising demand for female-specific ski gear and apparel. Women are expanding their presence in recreational skiing, professional roles, and coaching positions, broadening the market base and driving product innovation. For instance, in January 2025, Snowsport England introduced SheLeads, a 12-month coaching program to increase qualified female coaches and instructors across England . This program represents the broader institutional efforts to increase women's participation in winter sports, which directly influences the growth of the female ski gear and equipment market.

The Europe Ski Gear and Equipment Market Report is Segmented by Product Type (Skis and Poles, Ski Boots, Ski Helmets, and More), End User (Male, and Female), Age Group (Under 25 Years, 25 To 40 Years, 40 To 55 Years, and Above 55 Years), Distribution Channel (Offline Retail Stores, and Online Retail Stores), and by Geography (United Kingdom, Germany, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amer Sports, Inc.

- Rossignol S.A.

- Fischer Sports GmbH

- Tecnica Group S.p.A.

- Clarus Corporation

- Marker Dalbello Volkl GmbH

- UVEX Group

- Head Sport GmbH

- Burton Europe

- Scott Sports SA

- K2 Sports

- Faction Skis SA

- Elan d.o.o.

- Stockli Swiss Sports AG

- Decathlon S.A.

- Blizzard Sports GmbH

- Nordica S.p.A.

- Black Crows SAS

- Oberalp Group (Dynafit)

- Salewa Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing popularity of winter sports tourism

- 4.2.2 Expansion of ski resorts and facilities

- 4.2.3 Rising participation in recreational skiing

- 4.2.4 Expansion of ski gear rental models

- 4.2.5 Focus on sustainability and eco-friendly products

- 4.2.6 Technological innovations in design and materials

- 4.3 Market Restraints

- 4.3.1 Seasonal dependence of skiing activities

- 4.3.2 High cost of ski gear and equipment

- 4.3.3 Intense competition from alternative winter sports

- 4.3.4 High upfront cost of premium equipment

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Skis and Poles

- 5.1.2 Ski Boots

- 5.1.3 Ski Helmets

- 5.1.4 Ski Apparel

- 5.1.5 Others

- 5.2 By End-User

- 5.2.1 Male

- 5.2.2 Female

- 5.3 By Age Group

- 5.3.1 Under 25 Years

- 5.3.2 25 to 40 Years

- 5.3.3 40 to 55 Years

- 5.3.4 Above 55 Years

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail Stores

- 5.4.2 Online Retail Stores

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Switzerland

- 5.5.8 Austria

- 5.5.9 Sweden

- 5.5.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amer Sports, Inc.

- 6.4.2 Rossignol S.A.

- 6.4.3 Fischer Sports GmbH

- 6.4.4 Tecnica Group S.p.A.

- 6.4.5 Clarus Corporation

- 6.4.6 Marker Dalbello Volkl GmbH

- 6.4.7 UVEX Group

- 6.4.8 Head Sport GmbH

- 6.4.9 Burton Europe

- 6.4.10 Scott Sports SA

- 6.4.11 K2 Sports

- 6.4.12 Faction Skis SA

- 6.4.13 Elan d.o.o.

- 6.4.14 Stockli Swiss Sports AG

- 6.4.15 Decathlon S.A.

- 6.4.16 Blizzard Sports GmbH

- 6.4.17 Nordica S.p.A.

- 6.4.18 Black Crows SAS

- 6.4.19 Oberalp Group (Dynafit)

- 6.4.20 Salewa Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK