PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934717

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934717

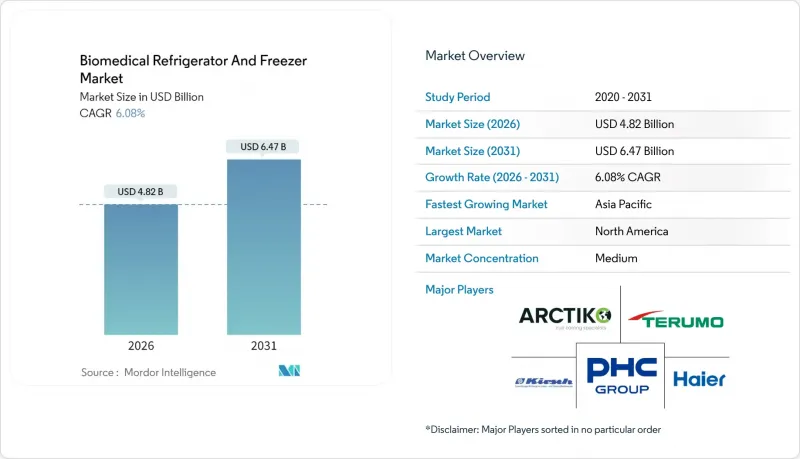

Biomedical Refrigerator And Freezer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Biomedical refrigerator & freezer market was valued at USD 4.54 billion in 2025 and estimated to grow from USD 4.82 billion in 2026 to reach USD 6.47 billion by 2031, at a CAGR of 6.08% during the forecast period (2026-2031).

This growth reflects rising investments in cell and gene therapies that rely on ultra-precise temperature control, stricter global vaccine-storage mandates, and an accelerating shift toward decentralized clinical trials that require portable, IoT-enabled cold-chain assets. Compressor technology still underpins most installed capacity, yet sustainability regulations are propelling rapid adoption of magnetic refrigeration and other refrigerant-free approaches. Supply-chain resilience is a recurring theme: helium scarcity constrains cryogenic capacity, while semiconductor shortages lengthen lead times for smart freezers. As a result, buyers now evaluate vendors not only on cooling performance but also on component traceability, remote monitoring, and predictive-maintenance features that limit downtime.

Global Biomedical Refrigerator And Freezer Market Trends and Insights

Growing Burden of Chronic Diseases

More than 537 million adults live with diabetes, and many require insulin that must remain between 2 °C and 8 °C. This single-therapy storage requirement alone keeps a continuous stream of orders flowing into the biomedical refrigerator & freezer market. Government-sponsored non-communicable disease programs are funding the installation of new pharmaceutical-grade cold rooms, particularly in India and Southeast Asia, while European hospitals are upgrading to multi-zone cabinets that can segregate biologics, vaccines, and blood products without requiring additional floor space. Oncology wards are another growth node; a single batch of temperature-excursion-sensitive monoclonal antibodies can exceed USD 70,000 in replacement cost, which heightens willingness to pay for redundant compressors, battery backups, and 24/7 cloud telemetry.

Increasing Demand for Organ Transplantation & Cell and Gene Therapy Storage

CAR-T, CRISPR-edited cell products, and ex vivo gene therapies must often be maintained at temperatures below -150 °C from manufacturing to the bedside. Fusion-style freezers that forgo liquid nitrogen while maintaining temperatures of -165 °C are gaining traction because they ease lab safety checks and reduce operating expenses. Logistics chains now embed GPS and continuous-temperature data streams, allowing a transplant coordinator to verify, in real-time, whether a donor heart remains within its mandated 2 °C to 8 °C temperature envelope during cross-country flights. Each incremental regulatory guideline, such as the FDA's 2024 cell-therapy manufacturing guidance, elevates the equipment specification baseline and accelerates replacement of legacy freezers that cannot document uniformity or rapid temperature recovery.

High Capital & Maintenance Costs

A state-of-the-art ULT freezer can list for USD 50,000, and annual service contracts often reach 15% of the purchase price. Electricity adds a further burden: one 80 °C box may consume 15 kWh per day, equivalent to USD 1,500 in yearly energy expenses at average US commercial rates. Smaller clinics and NGOs often defer purchases or opt for leasing to avoid upfront capital budget hits. Import tariffs compound the challenge in Africa and parts of South Asia, where duties can exceed 15% on medical equipment. These factors lengthen replacement cycles and slow penetration of advanced IoT-enabled units, especially in price-sensitive geographies.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Blood Banks & Biobanks in Emerging Markets

- Regulatory Mandates for Temperature-Sensitive Vaccine Logistics

- Global Helium Shortage Limiting Cryogenic Freezer Uptake

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Laboratory refrigerators captured the largest slice of the Biomedical refrigerator & freezer market in 2025 at 23.12% because virtually every clinical, academic, and industrial health facility must store reagents, vaccines, or patient samples within the 2 °C-8 °C band. These units now ship with microprocessor controllers, door-opening sensors, and fan-assisted airflow that keeps temperature variance below +-1 °C. At the same time, the ULT category is growing at a 10.25% CAGR as biobanks, contract-development organizations, and hospital pathology labs expand cryogenic capacity for cell lines, stem cells, and mRNA therapeutics. ULT freezers already account for USD 1.11 billion of the Biomedical refrigerator & freezer market size, and their share will climb because regulatory filings for ATMPs require validated sub--80 °C storage audits.

Plasma freezers and blood bank refrigerators sustain mid-single-digit growth by replacing aging stock in transfusion centers, whereas shock freezers-niche devices that drop from ambient to -40 °C within 10 minutes-are finding new demand in advanced oncology research protocols. Manufacturers increasingly bundle cloud dashboards and service-level agreements that guarantee four-hour on-site technician response, a feature especially valued by high-throughput COVID-19 genomic surveillance labs.

The Biomedical Refrigerator and Freezer Market is Segmented by Product Type (Plasma Freezers, Blood Bank Refrigerators, and More), Refrigeration Technology (Compressor-Based, Absorption/Adsorption, Magnetic Refrigeration, Stirling Engine), End User (Hospitals & Clinics, Blood Banks, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 26.95% of worldwide revenue in 2025. FDA quality-management reforms, effective February 2026, require device makers to harmonize with ISO 13485; forward-thinking hospitals and CROs are pre-emptively replacing legacy stock to avoid qualification headaches. The United States also houses leading biopharma clusters that consume significant cryogenic capacity; Thermo Fisher's USD 2 billion multi-site investment underscores confidence in sustained demand. Semiconductor shortages remain a downside risk; nearly 80% of manufacturers report 12-month lead times for Wi-Fi-enabled temperature-loggers, hampering rollouts of smart cabinets.

Asia Pacific records the fastest 6.75% CAGR on the strength of health-system capital spending and a thriving clinical-research outsourcing sector. China scales local biomanufacturing, India expands transfusion services, while Indonesia receives multilateral funding to install rural vaccine fridges with solar-direct-drive compressors. Regional governments often bundle cold-chain upgrades with broader infectious-disease preparedness, effectively underwriting initial equipment procurement. Domestic manufacturing is ramping: Chinese vendors now export ENERGY STAR-certified ULT models across ASEAN, intensifying price competition but also driving product innovation.

Europe grows steadily on the back of stringent environmental policies. EU F-gas phase-down regulations discourage high-GWP refrigerants, pushing labs toward natural-refrigerant compressors or emerging magnetocaloric systems. Cold Chain Technologies opened a Netherlands plant with an A+++ energy rating, allowing same-day distribution.

- Aegis Scientific

- Angelantoni Life Science

- Arctiko

- B Medical Systems

- Blue Star Limited

- Dometic Group

- Eppendorf

- EVERmed S.r.l.

- Froilabo

- Haier Biomedical

- Helmer Scientific

- LabRepCo

- Liebherr-International AG

- Panasonic Healthcare (PHC Holdings)

- Philipp Kirsch

- So-Low Environmental Equipment Co.

- Terumo

- Thermo Fisher Scientific

- Vestfrost Solutions

- Zhongke Meiling Cryogenics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden Of Chronic Diseases

- 4.2.2 Increasing Demand For Organ Transplantation & Cell and Gene Therapy Storage

- 4.2.3 Expansion Of Blood Banks & Biobanks In Emerging Markets

- 4.2.4 Regulatory Mandates For Temperature-Sensitive Vaccine Logistics

- 4.2.5 Decentralized Clinical Trials Driving Portable, IoT-Enabled Cold Chain

- 4.2.6 Adoption Of Magnetic Refrigeration For Green, Energy-Efficient Labs

- 4.3 Market Restraints

- 4.3.1 High Capital & Maintenance Costs

- 4.3.2 Stringent Phase-Out Of High-GWP Refrigerants

- 4.3.3 Global Helium Shortage Limiting Cryogenic Freezer Uptake

- 4.3.4 Chip-Set Supply Crunch Delaying Smart-Freezer Roll-Outs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Plasma Freezers

- 5.1.2 Blood Bank Refrigerators

- 5.1.3 Laboratory Refrigerators

- 5.1.4 Laboratory Freezers

- 5.1.5 Ultra-Low Temperature Freezers

- 5.1.6 Shock Freezers

- 5.1.7 Pharmaceutical Refrigerators

- 5.1.8 Others

- 5.2 By Refrigeration Technology

- 5.2.1 Compressor-based

- 5.2.2 Absorption/Adsorption

- 5.2.3 Magnetic Refrigeration

- 5.2.4 Stirling Engine

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Blood Banks

- 5.3.3 Biobanks & Gene Banks

- 5.3.4 Pharma & Biotech Companies

- 5.3.5 Academic & Research Labs

- 5.3.6 Others (Diagnostic / IVF Centers)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Aegis Scientific Inc.

- 6.3.2 Angelantoni Life Science

- 6.3.3 Arctiko A/S

- 6.3.4 B Medical Systems

- 6.3.5 Blue Star Limited

- 6.3.6 Dometic Group

- 6.3.7 Eppendorf AG

- 6.3.8 EVERmed S.r.l.

- 6.3.9 Froilabo SAS

- 6.3.10 Haier Biomedical

- 6.3.11 Helmer Scientific Inc.

- 6.3.12 LabRepCo

- 6.3.13 Liebherr-International AG

- 6.3.14 Panasonic Healthcare (PHC Holdings)

- 6.3.15 Philipp Kirsch GmbH

- 6.3.16 So-Low Environmental Equipment Co.

- 6.3.17 Terumo Corporation

- 6.3.18 Thermo Fisher Scientific Inc.

- 6.3.19 Vestfrost Solutions

- 6.3.20 Zhongke Meiling Cryogenics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment