PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934727

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934727

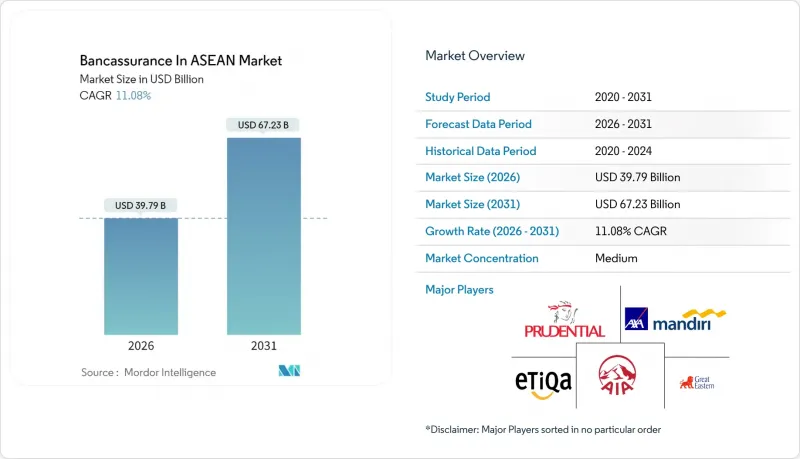

Bancassurance In ASEAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The bancassurance market in ASEAN is expected to grow from USD 35.82 billion in 2025 to USD 39.79 billion in 2026 and is forecast to reach USD 67.23 billion by 2031 at 11.08% CAGR over 2026-2031.

Digital acceleration, demographic aging, and regulatory modernization act in concert to shift distribution from product-centric, branch-led models toward mobile-first ecosystems that embed insurance in everyday banking touchpoints. Rapid protection-gap awareness pushes life and health coverage to the forefront, while open-finance application programming interfaces (APIs) enable real-time underwriting that shortens policy issuance to minutes. Incumbent banks defend their role as trusted advisors through data-driven cross-sell capabilities, yet super-apps and fintech platforms intensify competitive pressure by offering low-friction alternatives. Growing participation by Islamic digital banks widens the addressable customer base and introduces specialized takaful solutions that meet rising demand for Shariah-compliant products.

Bancassurance In ASEAN Market Trends and Insights

Rapid Growth of Life Insurance Penetration in Emerging ASEAN

Life insurance take-up in Indonesia, the Philippines, Vietnam, and Thailand is rising because regulators use mandates and incentives to close protection gaps. Indonesia's Financial Services Authority required third-party liability motor coverage from January 2025, setting a precedent that accelerates broader insurance adoption and improves risk pooling economics. Banks leverage branch reach for trust building in rural areas where agency channels remain thin, while mobile onboarding cuts acquisition costs. Government financial-inclusion targets reinforce bancassurance partnerships as a preferred delivery route, and regional insurers funnel resources into simplified products that match first-time-buyer budgets. As market familiarity improves, policy sizes grow, leading to higher recurring premiums that lift lifetime value for banks and insurers.

Aging Population & Retirement-Wealth Demand

Singapore, Malaysia, and Thailand face rising old-age dependency ratios that strain public pension systems; individuals, therefore, seek private solutions to fund longer lifespans. RGA's "Aging in Asia" study finds that household savings alone can cover only a fraction of expected retirement medical expenses, positioning bank-distributed annuities and whole-life plans as practical supplements. Banks already manage customer savings and lending relationships, giving them data to recommend suitable coverage levels. Insurers respond with hybrid products that bundle life protection and long-term-care riders, and regulators encourage such innovation by offering tax incentives for retirement-linked premiums. The demographic shift supports sustained double-digit premium growth through 2030 as the region's middle class prioritizes health and longevity.

Tighter Commission & Fair-Dealing Rules

The Monetary Authority of Singapore updated its fair-dealing guidelines in 2024, compelling banks to justify suitability for every policy sold and to provide product comparison documents that enhance transparency. Source: Monetary Authority of Singapore, "Fair Dealing Outcomes Review," mas.gov.sg. Malaysia introduced similar consumer-protection rules that require vulnerability assessments before recommending insurance, increasing advisory time and compliance costs. Reduced commission ceilings squeeze bancassurance profit margins and may deter aggressive cross-selling campaigns in the near term. Banks invest in staff accreditation and digital disclosure tools to meet the new standards, which raises fixed costs but mitigates mis-selling risks. Over time, transparent practices are expected to deepen customer trust and support sustainable premium growth.

Other drivers and restraints analyzed in the detailed report include:

- Digital Banking Platforms Enabling Integrated Sales

- Islamic Digital Banks Accelerating Takaful Uptake

- Super-Apps Cannibalizing Bank Channels

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The life segment generated 76.22% of 2025 premiums, reflecting long-standing bancassurance market share leadership anchored in savings-linked and protection-cum-investment products. Health coverage now sets the growth pace at a 12.33% CAGR, narrowing the gap as rising medical costs push households toward supplemental plans that cover hospitalization and critical-illness expenses. Mandatory motor liability policies in Indonesia spur modest gains in non-life lines, but their absolute contribution to the bancassurance market size remains comparatively small. Banks leverage claims and payment data to cross-sell surgical or hospital-cash riders at points when clients most appreciate medical protection. The life segment continues to contribute reliable renewal income, yet product design evolves toward flexible payout structures that combine survivorship benefits with living-benefit accelerators.

Demand nuances sharpen across customer cohorts. Younger, digitally savvy consumers prefer term-life policies with simple features and transparent pricing, bought through mobile apps that facilitate five-minute enrolment. Affluent clients maintain interest in unit-linked plans that provide estate-planning features and access to global investment funds. Health insurers hone underwriting models using electronic health record partnerships that reduce anti-selection risk. Collaboration across bank, insurer, and health-tech ecosystems improves customer retention because wellness-program engagement drives premium discounts and loyalty rewards funded by bank card cash-back pools. Over 2026-2031, the bancassurance market size for health policies is projected to more than double, contributing a rising share of total fee income for partner banks.

The Bancassurance in ASEAN Market Report is Segmented by Insurance Type (Life Insurance, Non-Life P&C, Health/Accident), Distribution Channel (Branch/In-Person, Digital Banking/Mobile App, and More), End User (Retail Customers, SME, Corporate & Affluent), and Geography (Singapore, Malaysia, Indonesia, Thailand, Philippines, Vietnam, Rest of ASEAN). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AIA Group

- Prudential plc

- AXA Mandiri Financial Services

- Etiqa (Maybank)

- Great Eastern Holdings

- Manulife Financial

- FWD Group

- Allianz SE

- Tokio Marine

- Chubb

- Sun Life Financial

- HSBC Life

- CIMB SunLife

- BRI Life

- SCB Protect

- Sompo Japan

- Hanwha Life Indonesia

- Vietnam Prosperity - AIA JV

- Pru Life UK (Philippines)

- Krungthai-AXA Life

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of life-insurance penetration in emerging ASEAN

- 4.2.2 Aging population & retirement-wealth demand

- 4.2.3 Digital banking platforms enabling integrated sales

- 4.2.4 Islamic digital banks accelerating takaful uptake

- 4.2.5 SME-credit embedded insurance via supply-chain platforms

- 4.2.6 Open-finance APIs powering real-time underwriting

- 4.3 Market Restraints

- 4.3.1 Tighter commission & fair-dealing rules

- 4.3.2 Declining branch footfall

- 4.3.3 Certified advisor talent shortages

- 4.3.4 Super-apps cannibalising bank channel

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Insurance Type

- 5.1.1 Life Insurance

- 5.1.2 Non-Life (P&C)

- 5.1.3 Health / Accident

- 5.2 By Distribution Channel

- 5.2.1 Branch / In-Person

- 5.2.2 Digital Banking / Mobile App

- 5.2.3 Mobile Banking Apps

- 5.2.4 Contact-Centre / Phone

- 5.2.5 Affinity & Embedded (FinTech / Retail)

- 5.3 By End User

- 5.3.1 Retail Customers

- 5.3.2 Small & Medium Enterprises (SMEs)

- 5.3.3 Corporate & Affluent

- 5.4 By Geography

- 5.4.1 Singapore

- 5.4.2 Malaysia

- 5.4.3 Indonesia

- 5.4.4 Thailand

- 5.4.5 Philippines

- 5.4.6 Vietnam

- 5.4.7 Rest of ASEAN

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AIA Group

- 6.4.2 Prudential plc

- 6.4.3 AXA Mandiri Financial Services

- 6.4.4 Etiqa (Maybank)

- 6.4.5 Great Eastern Holdings

- 6.4.6 Manulife Financial

- 6.4.7 FWD Group

- 6.4.8 Allianz SE

- 6.4.9 Tokio Marine

- 6.4.10 Chubb

- 6.4.11 Sun Life Financial

- 6.4.12 HSBC Life

- 6.4.13 CIMB SunLife

- 6.4.14 BRI Life

- 6.4.15 SCB Protect

- 6.4.16 Sompo Japan

- 6.4.17 Hanwha Life Indonesia

- 6.4.18 Vietnam Prosperity - AIA JV

- 6.4.19 Pru Life UK (Philippines)

- 6.4.20 Krungthai-AXA Life

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment