PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937325

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937325

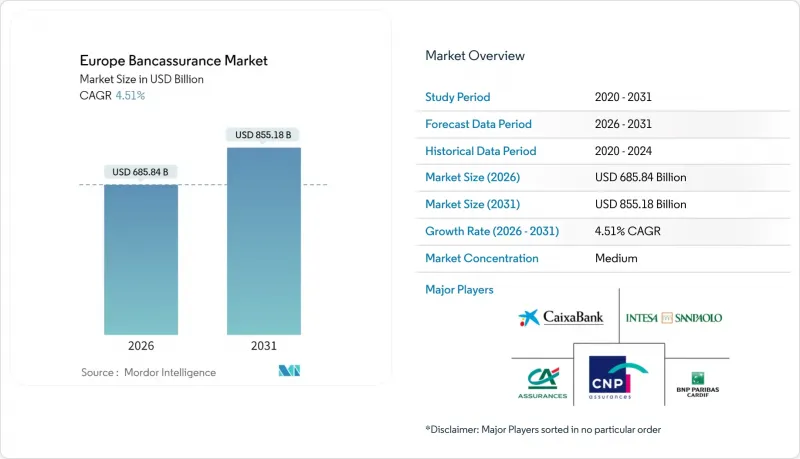

Europe Bancassurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Bancassurance market is expected to grow from USD 656.25 billion in 2025 to USD 685.84 billion in 2026 and is forecast to reach USD 855.18 billion by 2031 at 4.51% CAGR over 2026-2031.

Growing capital efficiency unlocked by the Danish Compromise and CRR3 reforms lets banks hold insurance subsidiaries with lower risk-weighting, strengthening Common Equity Tier 1 ratios and encouraging deeper insurance integration. Life policies preserve their role as core revenue drivers, while demand for private health coverage accelerates on the back of aging populations and stretched public healthcare. Digital migration continues to reshape distribution as mobile apps embed instant policy issuance inside everyday banking journeys. Meanwhile, artificial intelligence (AI) adoption enables banks and insurers to personalize offers in real-time, reinforce cross-sell ratios, and lower servicing costs. Competitive differentiation, therefore, tilts toward institutions that combine strong capital positions, omnichannel reach, and data-driven underwriting.

Europe Bancassurance Market Trends and Insights

Rising Demand for Retirement & Protection Products

Europe's demographic shift magnifies the funding gap of statutory pension schemes and moves households toward private retirement savings vehicles. Swiss Re estimates an additional USD 1.56 trillion in life-premium potential between 2025 and 2034, creating sizable room for banks to deepen advisory-led sales of whole-life and annuity products. Rising policyholder yields of 3.5% on traditional euro funds in 2025 make life contracts competitive versus deposits, boosting take-up among risk-averse savers. Banks utilize their account-level insights to bundle protection covers alongside personal loans and mortgages, thereby widening fee streams and strengthening customer stickiness. Countries with mature social security systems, such as France and Germany, show the strongest pivot to individual pension plans, a trend expected to persist throughout the decade.

Banks' Search for Fee-Based Income Amid NIM Pressure

Competitive lending practices and uncertainties in macro-policy continue to constrain net interest margins (NIMs). By distributing insurance, banks can generate stable, capital-light fees, helping to offset the volatility in lending. This strategy diversifies revenue streams and reduces reliance on interest-based income, making banks more resilient to market fluctuations. A recent policy change, reducing the risk weight for insurance participation to 250%, has directly boosted returns on equity for integrated bancassurers. This regulatory adjustment enhances the attractiveness of bancassurance models, encouraging banks to forge tighter exclusivity agreements with their in-house or captive insurers to maximize collaboration. As a result, bank executives are now focusing on optimizing their product mix, with a target of elevating the share of non-interest income to over 40% by 2030, particularly among major groups in Western Europe. This shift reflects a broader trend of banks seeking to balance their income portfolios and adapt to evolving market dynamics.

Fragmented EU Regulatory & Tax Rules

Divergent national tax incentives, disclosure obligations, and product labeling raise compliance costs for pan-European bancassurers. Maintaining parallel product shells and IT configurations for each market erodes scale economics and slows time-to-market. Smaller cross-border entrants face heavier proportional burdens, effectively shielding dominant domestic bancassurers from aggressive competition. Progress on a truly harmonized European Insurance Single Market, therefore, remains pivotal to unlocking further growth. A harmonized regime would reduce regulatory friction, enabling firms to distribute standardized products across borders with greater efficiency. It would also enhance consumer confidence through consistent protections and disclosures, fostering deeper integration of the European insurance landscape.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Digital Channel Adoption & Data-Driven Cross-Sell

- AI-Powered Hyper-Personalisation via Open-Banking Data

- BigTech / FinTech Ecosystems Disintermediating Banks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Life products occupied 62.55% of the Europe Bancassurance market share in 2025, cementing their status as the largest revenue stream. Health lines are, however, growing faster at 6.52% CAGR as aging populations, lengthy public-sector waiting lists, and pandemic-induced awareness redirect households toward supplementary cover. For 2026-2031, the health segment is projected to add USD 27.4 billion in incremental premiums, equivalent to almost one-fifth of total market expansion. AXA's blueprint illustrates the pivot: its European health portfolio achieved a 9% premium rise in 2024 and now targets an even split between retail and commercial lives covered.

Digital wellness platforms reinforce this momentum by bundling telemedicine and preventive-care services with insurance, building recurring engagement, and lowering claims ratios. Non-life products such as property and motor continue to benefit from bancassurers' lending relationships. Mortgage origination offers natural cross-sell opportunities for home insurance, while auto loans anchor motor policy propositions. Although these sublines grow more slowly than health, their profit margins remain attractive due to low acquisition costs and bundled sales.

Europe Bancassurance Market is Segmented by Insurance Type (Life Insurance, Non-Life Insurance, Health Insurance), Distribution Channel (Bank Branch, Digital/Online Banking, Mobile Banking Apps, and More), End-User (Retail Customers, Small & Medium Enterprises (SMEs), and More), and Country (France, Italy, Spain, and More). The Market Forecasts are Provided in Value (USD).

List of Companies Covered in this Report:

- Credit Agricole Assurances

- BNP Paribas Cardif

- CaixaBank / SegurCaixa Adeslas

- Intesa Sanpaolo Vita

- CNP Assurances

- Santander Mapfre

- Generali Group

- Zurich Santander

- Allianz SE

- AXA Group

- Aviva plc

- UniCredit Allianz JV

- ING (NN Group)

- KBC Group

- Erste Group / Vienna Insurance Group

- Raiffeisen Bank International / UNIQA

- Societe Generale Assurances

- HSBC Life Europe

- Lloyds Banking Group / Scottish Widows

- Talanx Group (HDI Bancassurance)

- Banca Mediolanum / Eurovita

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for retirement & protection products

- 4.2.2 Banks' search for fee-based income amid NIM pressure

- 4.2.3 Surge in digital channel adoption & data-driven cross-sell

- 4.2.4 Ageing branch networks leverage embedded advisory tools

- 4.2.5 Capital relief from Danish Compromise & CRR3 reforms

- 4.2.6 AI-powered hyper-personalisation via open-banking data

- 4.3 Market Restraints

- 4.3.1 Fragmented EU regulatory & tax rules

- 4.3.2 Shrinking in-branch footfall post-COVID

- 4.3.3 GDPR-driven limits on deep consumer-data mining

- 4.3.4 BigTech / FinTech ecosystems disintermediating banks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Threat of Substitutes

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Bargaining Power of Suppliers

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Insurance Type

- 5.1.1 Life Insurance

- 5.1.2 Non-Life Insurance

- 5.1.3 Health Insurance

- 5.2 By Distribution Channel

- 5.2.1 Bank Branch

- 5.2.2 Digital / Online Banking

- 5.2.3 Mobile Banking Apps

- 5.2.4 Contact-Centre / Phone

- 5.2.5 Affinity & Embedded (FinTech / Retail)

- 5.3 By End-User

- 5.3.1 Retail Customers

- 5.3.2 Small & Medium Enterprises (SMEs)

- 5.3.3 Corporate & Affluent

- 5.4 By Country

- 5.4.1 France

- 5.4.2 Italy

- 5.4.3 Spain

- 5.4.4 Germany

- 5.4.5 United Kingdom

- 5.4.6 Portugal

- 5.4.7 Belgium

- 5.4.8 Poland

- 5.4.9 Netherlands

- 5.4.10 Switzerland

- 5.4.11 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Credit Agricole Assurances

- 6.4.2 BNP Paribas Cardif

- 6.4.3 CaixaBank / SegurCaixa Adeslas

- 6.4.4 Intesa Sanpaolo Vita

- 6.4.5 CNP Assurances

- 6.4.6 Santander Mapfre

- 6.4.7 Generali Group

- 6.4.8 Zurich Santander

- 6.4.9 Allianz SE

- 6.4.10 AXA Group

- 6.4.11 Aviva plc

- 6.4.12 UniCredit Allianz JV

- 6.4.13 ING (NN Group)

- 6.4.14 KBC Group

- 6.4.15 Erste Group / Vienna Insurance Group

- 6.4.16 Raiffeisen Bank International / UNIQA

- 6.4.17 Societe Generale Assurances

- 6.4.18 HSBC Life Europe

- 6.4.19 Lloyds Banking Group / Scottish Widows

- 6.4.20 Talanx Group (HDI Bancassurance)

- 6.4.21 Banca Mediolanum / Eurovita

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment