PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934728

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934728

Spain 3PL - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

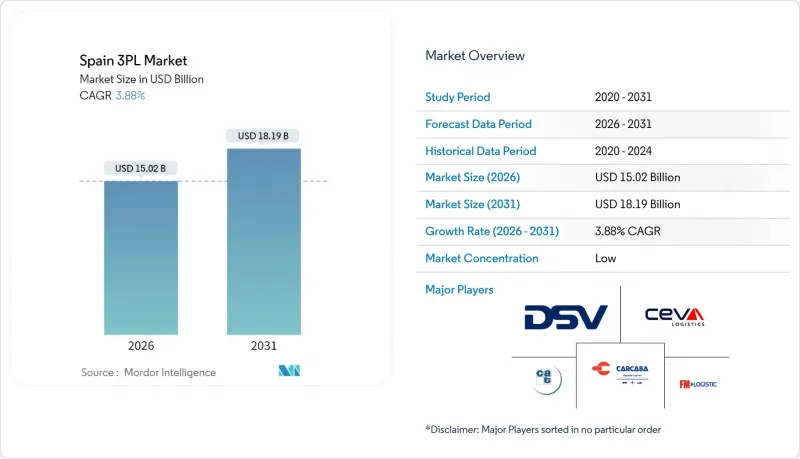

The Spain 3PL Market was valued at USD 14.46 billion in 2025 and estimated to grow from USD 15.02 billion in 2026 to reach USD 18.19 billion by 2031, at a CAGR of 3.88% during the forecast period (2026-2031).

Spain's role as a European gateway, the rapid shift toward outsourced fulfillment, and multimodal corridor upgrades underpin the upward trajectory. E-commerce's geographic spread beyond Madrid and Barcelona, resilient nearshoring inflows from Northern Europe, and government-backed rail electrification projects jointly widen the addressable base for third-party logistics service providers. Digital tax incentives now reward AI-enabled route optimization while green-mobility policies raise demand for electric urban fleets. Heightened competition among domestic and multinational carriers accelerates pricing transparency and forces broader adoption of value-added warehousing, real-time visibility platforms, and asset-light alliances that de-risk capital exposure.

Spain 3PL Market Trends and Insights

Surge in E-commerce Volumes Requiring Outsourced Logistics Services

Spain's online buyer base is expected to climb toward 40 million users in 2025, solidifying nationwide reliance on contracted fulfillment partners. Amazon's USD 327 million logistics center in Asturias typifies the infrastructure scale now demanded by 48-hour delivery guarantees. Third-party providers respond with micro-fulfillment hubs that position inventory nearer to dense consumer pockets, a shift illustrated by studies showing Barcelona needs more than 1,000 such urban sites to meet current parcel volumes. Robotics-enabled sortation lines and AI-driven slotting solutions further compress fulfillment cycle times during peak shopping seasons. Greater delivery frequency, however, compels 3PLs to redesign trunk routes so that high-capacity trailers replenish urban depots overnight, mitigating daytime congestion costs.

Growing Demand for Temperature-Controlled Logistics for Pharma & Food

Heightened vaccine distribution, stricter EU food-safety rules, and a switch to fresh consumer habits combine to lift Spain's cold-chain utilization. Schmitz Cargobull's acquisition of Spanish telematics firm Atlantis Global System demonstrates how trailer makers are embedding sensor networks to keep payload readings verifiable end-to-end. AI demand forecasting now underpins capacity planning so that refrigerated slots are allocated dynamically rather than by static contracts, preserving margins despite energy-price volatility. On the pharmaceutical side, compliance with Good Distribution Practice drives premium tariffs for GDP-certified storage zones, offering revenue defense in an otherwise price-competitive landscape. Emerging controlled-atmosphere chambers broaden produce export options, extending shelf life for Mediterranean perishables shipped northward. Blockchain pilots add immutable traceability, an essential feature as Spanish regulators intensify random cold-chain audits.

High Diesel Fuel Prices Increasing Transport Costs

Fuel accounts for about one-quarter of total road freight expense, and 2025 volatility keeps margins thin despite statutory surcharge clauses. Madrid-Paris contract rates climbed 3.5% in Q4 2024 to USD 1,588 after currency conversion, illustrating the fragile rebound phase. Carriers resort to dynamic routes that weigh tolls, traffic, and refueling points so service-level agreements remain intact without blanket price hikes. Fleet owners test LNG and hybrid trucks on high-volume corridors, leveraging government subsidies to diversify energy exposure. Persistent variability nevertheless prompts shippers to explore rail for predictable budget planning, moderately dampening Spain third-party logistics market demand for long-haul trucking.

Other drivers and restraints analyzed in the detailed report include:

- Government Infrastructure Investments in Intermodal Transport Corridors

- Nearshoring of European Supply Chains to Spain Boosting Warehousing Demand

- Driver Shortage and Wage Pressures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Domestic Transportation Management retained a 52.48% revenue slice in 2025, underscoring Spain's highway-centric freight patterns and the enduring need for nationwide milk-run schedules. Spain third-party logistics market size for Value-Added Warehousing & Distribution is projected to expand at 7.42% CAGR, faster than any other service line. Rising e-commerce returns handling, customization, and kitting tasks push warehouse operators to embed automated sorters, pick-by-voice, and carton right-sizing machines. Meanwhile, International Transportation Management accelerates on the back of refurbished Mediterranean port capacity that funnels Maghreb trade into northern Spain depots. CEVA Logistics' 18,000 m2 Tarragona facility illustrates how sustainability add-ons-photovoltaic roofing and LED lighting-are now table stakes for contract awards.

The resurgence of freight rail, spurred by state electrification grants, sparks integrated service packages where truck drayage at origin and destination bookends a rail middle-haul. Air freight volumes, though minor by tonnage, yield attractive margins for life-science shippers demanding two-to-eight-degree routings. Bulk commodities funnel through coastal Ro-Ro and container terminals, yet many 3PLs cross-sell customs clearance and trade-finance documentation to lift yields above pure tonnage fees, as omnichannel retailers seek one-hour click-to-door delivery, micro-fulfillment add-ons inside legacy DCs proliferate, validating the premium placed on inventory proximity in Spain third-party logistics market contracts.

The Spain Third-Party Logistics (3PL) Market Report is Segmented by Service (Domestic Transportation Management, International Transportation Management, and More), by End User (Automotive, Energy & Utilities, Manufacturing, Life Sciences & Healthcare, Technology & Electronics, E-Commerce, and More), and by Logistics Model (Asset-Light, Asset-Heavy, Hybrid). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Carcaba

- CEVA Logistics

- DSV

- FM Logistic

- Groupe CAT

- Naeko

- OIA Global

- Rhenus Logistics

- TIBA

- XPO Logistics

- DHL Supply Chain

- Kuehne + Nagel

- Grupo Sese

- Logista

- STEF Iberia

- ID Logistics

- Geodis

- Noatum Logistics

- Hellmann Worldwide Logistics

- Transportes Iruna, S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in e-commerce volumes requiring outsourced logistics services

- 4.2.2 Growing demand for temperature-controlled logistics for pharma & food

- 4.2.3 Government infrastructure investments in intermodal transport corridors

- 4.2.4 Nearshoring of European supply chains to Spain boosting warehousing demand

- 4.2.5 Rise of collaborative urban micro-hubs to meet zero-emission zones

- 4.2.6 Digitization tax incentives spurring AI-enabled 3PL operations

- 4.3 Market Restraints

- 4.3.1 High diesel fuel prices increasing transport costs

- 4.3.2 Driver shortage and wage pressures

- 4.3.3 Urban noise & emission regulations limiting night-time deliveries

- 4.3.4 Rail network interoperability constraints reduce multimodal efficiency

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Warehousing Market Trends

- 4.7 E-commerce Growth Impact

- 4.8 Technological Outlook

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service

- 5.1.1 Domestic Transportation Management (DTM)

- 5.1.1.1 Roadways

- 5.1.1.2 Railways

- 5.1.1.3 Airways

- 5.1.1.4 Waterways

- 5.1.2 International Transportation Management (ITM)

- 5.1.2.1 Roadways

- 5.1.2.2 Railways

- 5.1.2.3 Airways

- 5.1.2.4 Waterways

- 5.1.3 Value-Added Warehousing & Distribution (VAWD)

- 5.1.1 Domestic Transportation Management (DTM)

- 5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Energy & Utilities

- 5.2.3 Manufacturing

- 5.2.4 Life Sciences & Healthcare

- 5.2.5 Technology & Electronics

- 5.2.6 E-commerce

- 5.2.7 Consumer Goods & FMCG

- 5.2.8 Food & Beverages

- 5.2.9 Others

- 5.3 By Logistics Model

- 5.3.1 Asset-Light (Management-Based)

- 5.3.2 Asset-Heavy (Own Fleet & Warehouses)

- 5.3.3 Hybrid

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Carcaba

- 6.4.2 CEVA Logistics

- 6.4.3 DSV

- 6.4.4 FM Logistic

- 6.4.5 Groupe CAT

- 6.4.6 Naeko

- 6.4.7 OIA Global

- 6.4.8 Rhenus Logistics

- 6.4.9 TIBA

- 6.4.10 XPO Logistics

- 6.4.11 DHL Supply Chain

- 6.4.12 Kuehne + Nagel

- 6.4.13 Grupo Sese

- 6.4.14 Logista

- 6.4.15 STEF Iberia

- 6.4.16 ID Logistics

- 6.4.17 Geodis

- 6.4.18 Noatum Logistics

- 6.4.19 Hellmann Worldwide Logistics

- 6.4.20 Transportes Iruna, S.A.

7 Market Opportunities & Future Outlook