PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934737

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934737

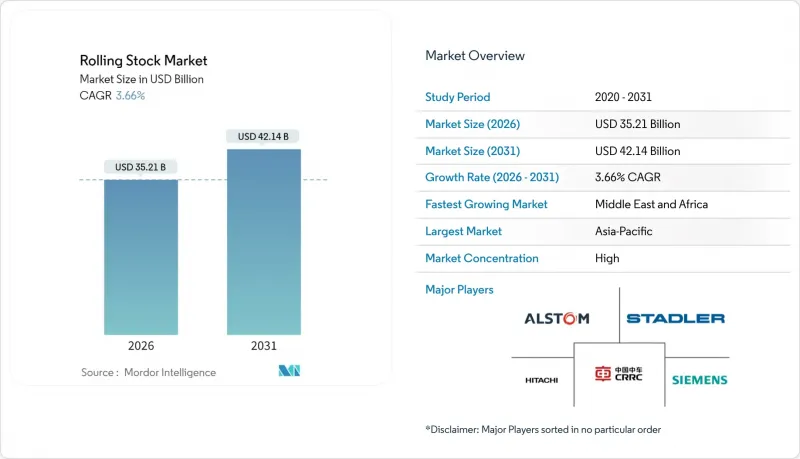

Rolling Stock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Rolling Stock Market was valued at USD 33.97 billion in 2025 and estimated to grow from USD 35.21 billion in 2026 to reach USD 42.14 billion by 2031, at a CAGR of 3.66% during the forecast period (2026-2031).

City planners are responding to rising population density, as evidenced by a surge in metro and light-rail orders. Urban rapid-transit expansions, decarbonization initiatives, and sustained public-sector capital investments primarily drive this growth momentum. These factors collectively highlight the increasing focus on sustainable and efficient urban transportation systems.

Global Rolling Stock Market Trends and Insights

Urbanization-Driven Metro Expansion

Metropolitan agencies deepen rolling stock procurement to relieve overcrowded corridors, shown by Seoul's GTX Line A debut in 2024 with 20 eight-car Hyundai Rotem trainsets operating at 180 km/h. Urban transit agencies already hold 20.11% of the 2024 demand and are the fastest-growing end-user group at 7.13% CAGR by 2030 as cities pivot to driverless networks. The USD 664 million Los Angeles Metro contract with Hyundai Rotem illustrates how global sporting events accelerate order cycles, aligning deliveries for the 2028 Games. Grade of Automation 4 systems raise line capacity by 30% through headways below 100 seconds, as documented by Berlin's U-Bahn CBTC upgrade. Copenhagen's plan to convert its S-bane network to driverless operations by 2033 extends the automation wave to regional commuter services.

Government Investments in High-Speed Rail Corridors

State-funded corridors reshape fleet specifications. Egypt's 2,000 km network will require 41 Velaro and 94 Desiro trainsets inside an EUR 8.1 billion turnkey scope. JR East's E10 Shinkansen, slated for 2030, trims emergency stop distance by 15% and introduces advanced seismic response. California selected Siemens' American Pioneer 220 sets capable of 220 mph, marking North America's first Velaro Novo order. South Korea's KTX-CheongRyong went into service in 2024 with fully localized production, demonstrating domestic industrial policy. A USD 642 billion GCC rail pipeline positions the Middle East for sustained procurement as projects shift from planning to execution.

High Capital Cost and Long Procurement Cycles

Procurement complexity slows delivery. Massachusetts Bay Transportation Authority renegotiated its CRRC contract amid inflation and tariffs that affected the USD 1.1-1.4 billion program. Indian Railways re-tendered Vande Bharat 4.0 after Alstom's bid surpassed the Rs 1.40 billion per set target, lengthening timelines. Kapurthala Rail Coach Factory delivered none of its 32 planned Vande Bharat sets in FY 2022-23 due to capacity limits. Titagarh Rail Systems expects a 6-9-month slip in sleeper-variant prototyping, with the first unit now due March 2026. Amtrak's Inspector General urges stronger risk management for its Long Distance Fleet Replacement to control cost and schedule.

Other drivers and restraints analyzed in the detailed report include:

- Decarbonization Policies Accelerating Electric Locomotives

- Infrastructure Stimulus Packages Boosting Rail CAPEX

- Raw-Material Inflation & Supply-Chain Disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger coaches held 75.98% of 2025 revenue, anchoring intercity and commuter services within the rolling stock market. Metros and light rail, however, record a 12.42% CAGR, underscoring urban capacity demands that align with Grade of Automation investments. Locomotives holds a significant share as operators favor electric or hydrogen variants that meet net-zero goals. Freight wagons slice is supported by Greenbrier's 7,000-unit Q4 2024 deliveries that keep backlogs at a decent value.

The metro boom illustrates how rolling stock market size gains are concentrated in driverless fleets ordered by Seoul, Los Angeles, and Copenhagen. Passenger coach upgrades such as Alstom's EUR 4 billion S-Bahn Cologne contract show operators lock in 34-year maintenance terms to secure lifecycle support. Locomotive suppliers leverage hydrogen pilots for Chile and North America, broadening the propulsion mix. Freight wagon demand rides commodity growth, with mining corridors in Guinea and iron ore routes in Australia booking new orders.

Electric traction controlled 62.10% of 2025 revenue and expands at 5.56% CAGR, maintaining the largest rolling stock market share as grid-powered operations scale. Diesel remains at forefront but faces retirement; hydrogen fuel cells and battery-electric both are offering modular pathways toward net zero. Dual-mode locomotives provide a decent share, blending catenary and diesel for transitional corridors.

Battery-electric advances lift rolling stock market size through projects like Dublin's DART+ and Bayern's tilting battery sets. Hydrogen programs in California and Chile signal long-term potential, although infrastructure cost and fuel availability limit near-term uptake. The Federal Railroad Administration frames dual-mode and intermittent electrification as cost-effective steps, sustaining investment in hybrid fleets.

The Rolling Stock Market Report is Segmented by Type (Locomotives, Metros and Light Rail Vehicles, Passenger Coaches, and More), Propulsion Type (Diesel, Electric, and More), Application (Passenger Rail and Freight Rail), End-User (National Rail Operators and More), Technology (Conventional and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific generated 53.20% of 2025 revenue, underpinned by CRRC's dominating global share and India's USD 30 billion modernization budget that widens domestic production. Japan's forthcoming E10 Shinkansen and South Korea's fully localized KTX-CheongRyong illustrate regional high-speed focus, while India's plan for 250 km/h indigenous sets diversifies supply chains. Seoul's GTX expansion and Taiwan's autonomous LRVs confirm technological advancement across city networks.

Europe retained the second position in 2024 due to sustained ICE, TGV, and regional upgrade programs. Germany finalized 137 ICE 4 units valued at EUR 6 billion, while Berlin's CBTC conversion unlocks 30% capacity. France's EUR 850 million Proxima order, Cologne's EUR 4 billion commuter fleet, Copenhagen's automation, and Dublin's battery-electric sets showcase a diverse procurement slate. Middle East and Africa records the fastest 4.81% CAGR to 2031, led by a USD 642 billion GCC rail pipeline and flagship programs in Saudi Arabia, Egypt, and the UAE-Oman corridor. Saudi Arabia alone earmarks USD 45 billion, including the Dream of the Desert luxury train, while Egypt's Velaro order sets a regional high-speed benchmark. Sub-Saharan launches such as Nigeria's Abuja metro revivals and DR Congo's MetroKin highlight nascent urban demand.

North America's slice stems from freight modernization and passenger corridor expansion, with projects such as Brightline West and Amtrak's fleet renewal enlarging the rolling stock market. Wabtec's USD 248 million Guinea order and CSX's locomotive upgrades confirm ongoing freight capital investment.

- CRRC Corporation Limited

- Alstom SA

- Siemens AG

- Wabtec Corporation

- Kawasaki Heavy Industries Ltd

- CJSC Transmashholding

- Stadler Rail AG

- Construcciones y Auxiliar de Ferrocarriles SA (CAF)

- Hyundai Rotem Company

- Mitsubishi Heavy Industries Ltd

- Hitachi Rail Ltd

- Talgo SA

- ABB Ltd

- Greenbrier Companies

- Trinity Industries

- Titagarh Rail Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanization-driven metro expansion

- 4.2.2 Government investments in high-speed rail corridors

- 4.2.3 Decarbonization policies accelerating electric locomotives

- 4.2.4 Infrastructure stimulus packages boosting rail CAPEX

- 4.2.5 Lifecycle service contracts & mid-life modernizations

- 4.2.6 Hydrogen locomotive zero-emission mandates

- 4.3 Market Restraints

- 4.3.1 High capital cost and long procurement cycles

- 4.3.2 Raw-material inflation & supply-chain disruptions

- 4.3.3 Regulatory uncertainty in cross-border certification

- 4.3.4 Grid-capacity limits for large-scale electrification

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Type

- 5.1.1 Locomotives

- 5.1.1.1 Diesel Locomotives

- 5.1.1.2 Electric Locomotives

- 5.1.1.3 Hybrid / Hydrogen Locomotives

- 5.1.2 Metros and Light Rail Vehicles

- 5.1.3 Passenger Coaches

- 5.1.4 Freight Wagons

- 5.1.1 Locomotives

- 5.2 By Propulsion Type

- 5.2.1 Diesel

- 5.2.2 Electric

- 5.2.3 Electro-diesel / Dual-mode

- 5.2.4 Hydrogen Fuel Cell

- 5.2.5 Battery-electric

- 5.3 By Application

- 5.3.1 Passenger Rail

- 5.3.2 Freight Rail

- 5.4 By End-user

- 5.4.1 National Rail Operators

- 5.4.2 Private Freight Operators

- 5.4.3 Urban Transit Agencies

- 5.5 By Technology

- 5.5.1 Conventional

- 5.5.2 Autonomous / Driver-Assist

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 CRRC Corporation Limited

- 6.4.2 Alstom SA

- 6.4.3 Siemens AG

- 6.4.4 Wabtec Corporation

- 6.4.5 Kawasaki Heavy Industries Ltd

- 6.4.6 CJSC Transmashholding

- 6.4.7 Stadler Rail AG

- 6.4.8 Construcciones y Auxiliar de Ferrocarriles SA (CAF)

- 6.4.9 Hyundai Rotem Company

- 6.4.10 Mitsubishi Heavy Industries Ltd

- 6.4.11 Hitachi Rail Ltd

- 6.4.12 Talgo SA

- 6.4.13 ABB Ltd

- 6.4.14 Greenbrier Companies

- 6.4.15 Trinity Industries

- 6.4.16 Titagarh Rail Systems

7 Market Opportunities & Future Outlook

- 7.1 High-speed freight concepts (200 km/h freight)

- 7.2 Digital twins & predictive maintenance platforms

- 7.3 Retrofit hydrogen/battery power-packs for legacy fleets

- 7.4 African trans-continental corridor investments

- 7.5 North American inter-city passenger rail revival

- 7.6 Europe-wide ERTMS Baseline 3 full rollout