PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934751

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934751

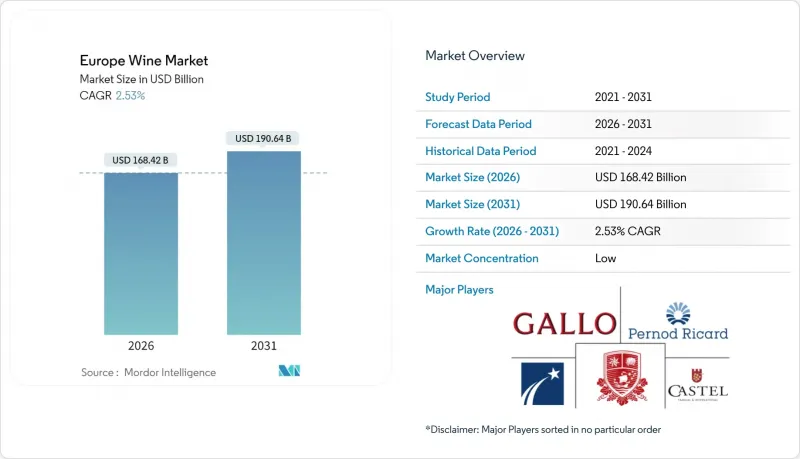

Europe Wine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe wine market size in 2026 is estimated at USD 168.42 billion, growing from 2025 value of USD 164.26 billion with 2031 projections showing USD 190.64 billion, growing at 2.53% CAGR over 2026-2031.

The market demonstrates measured expansion as deeply rooted consumption patterns align with increasing consumer sophistication, particularly in their preference for premium wines and environmentally responsible production methods. The resurgence of the fine dining sector, renewed interest in wine tourism experiences, and the proliferation of digital direct-to-consumer sales platforms have generated substantial revenue diversification opportunities across the European wine industry. Wine producers are responding to stringent EU regulatory requirements and evolving consumer expectations by investing in organic certifications, developing eco-friendly packaging solutions, and implementing QR-code labeling systems to ensure complete supply chain transparency.

Europe Wine Market Trends and Insights

Consumer Preference for Traditional, Terroir-Driven Wines

European consumers are showing a strong inclination towards authentic wines that embody the distinct characteristics of their geographic origins and honor traditional production methods, resulting in increased demand for Protected Designation of Origin (PDO) wines. The European Union's geographical indications regulation (EU) 2024/1143 provides enhanced protection measures for wine regions, with 1,085 European wine regions currently producing PDO-labeled wines . This comprehensive regulatory framework supports the development of premium wine production, as wines that express their unique terroir characteristics generate substantial profit margins and establish lasting consumer relationships through their rich regional heritage. Recent climate change vulnerability assessments have identified significant exposure risks in regions such as Romania, Croatia, and Italy, potentially increasing the market value of wines produced through traditional methods in these areas. This market development aligns with the evolving consumer behavior that emphasizes informed, quality-focused purchasing decisions, where consumers prioritize wine excellence and authenticity rather than volume consumption.

High Quality and Diverse Wine Varieties Produced in Europe

Europe maintains its dominant market position in fine wine production, representing a substantial majority of global fine wine output. This leadership stems from the region's established viticultural heritage, traditional winemaking expertise, and diverse microclimates that create ideal growing conditions. Italian wine producers project notable sales and export increases, with sparkling wines demonstrating particularly robust revenue performance compared to still wines. The market exhibits a clear divide between price segments, with premium wines experiencing substantial growth while mid-range wines face declining sales, indicating a significant consumer migration toward higher-quality offerings. Regional specialization continues to strengthen, highlighted by Prosecco's remarkable export performance and the impressive expansion of English sparkling wine sales over recent years.

Regulatory and Labeling Complexity Across Different EU Member States

The European Union's comprehensive wine labeling regulations, which took effect on December 8, 2023, introduce mandatory requirements for detailed nutritional information and complete ingredient lists on wine products . These requirements present significant compliance challenges for wine producers, particularly due to the diverse language requirements across different member states. Although digital solutions and QR codes offer producers a practical and cost-effective path to compliance, the task of managing multiple regulatory frameworks within EU markets increases operational expenses and establishes substantial market entry barriers, especially impacting small and medium-sized producers. This regulation represents the most substantial modification to wine labeling requirements in more than a century, compelling manufacturers to find an effective balance between maintaining transparent consumer communication and managing their compliance-related expenses. The inconsistent interpretation and enforcement standards among various member states have introduced complications in cross-border trade operations, potentially undermining the unified market advantages that European wine producers have historically benefited from.

Other drivers and restraints analyzed in the detailed report include:

- Established Wine Tourism and Wine-Related Experiences Attracting Consumers

- Growing Popularity of Low and Non-Alcoholic Wines

- Changing Consumer Preferences Towards Beer, Spirits, or Other Beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Still Wine maintains its commanding position in the market with a 77.02% share in 2025, demonstrating its fundamental importance in European wine consumption and cultural traditions. The category's dominance reflects consumer preferences for traditional wine experiences and its integration into daily dining and social occasions across European households.

Sparkling Wine demonstrates robust market performance with a projected CAGR of 3.71% through 2031, driven by increasing consumer preference for celebratory beverages and growing demand for premium products. Prosecco's remarkable performance, exceeding 1 billion bottles in exports during 2024, highlights its successful penetration into Asian markets and resonance with younger consumer demographics. While Champagne experiences market challenges with a 9% sales reduction in 2024, influenced by economic factors and increased competition from alternative sparkling wines, Cremant shows notable market strength with sales reaching 108 million bottles in 2024.

Red wine dominates the European wine market with a 45.94% share in 2025, reflecting its strong cultural significance, particularly in Mediterranean countries. The wine's deep connection to regional gastronomy and traditional dining practices continues to drive consumer preferences, especially in established markets like France, Italy, and Spain, where red wine remains a fundamental element of daily meals and social gatherings.

Rose wine demonstrates remarkable market dynamics, achieving the highest growth rate at 3.49% CAGR through 2031, despite its smaller volume share. This growth trajectory stems from increasing acceptance among younger consumers who value its adaptability across dining occasions and social settings. White wine maintains its market position between these two categories, benefiting from evolving climate conditions that have enhanced grape quality in regions traditionally known for red wine production, leading to improved white wine offerings across European vineyards.

The Europe Wine Market Report is Segmented by Product Type (Fortified Wine, Still Wine, Sparkling Wine, and Others), Color (Red Wine, Rose Wine, and White Wine), End User (Men and Women), Distribution Channel (On Trade and Off Trade), and Geography (Germany, United Kingdom, Italy, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- E. & J. Gallo Winery

- Constellation Brands

- Castel Group

- Pernod Ricard SA

- Treasury Wine Estates

- Financiere Pinault (Groupe Artemis)

- Louis Roederer

- LVMH (Moet Hennessy)

- Baron Philippe de Rothschild

- Freixenet Copestick

- Codorniu

- Torres

- Accolade Wines

- Grupo Matarromera

- Sogrape

- Grupo Penaflor

- Nicolas Feuillatte

- Laurent-Perrier

- Chateau Lafite Rothschild

- Blossom Hill

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consumer preference for traditional, terroir-driven wines

- 4.2.2 High quality and diverse wine varieties produced in Europe

- 4.2.3 Established wine tourism and wine-related experiences attracting consumers

- 4.2.4 Growing popularity of low and non-alcoholic wines

- 4.2.5 Innovation in wine production technologies and vineyard management

- 4.2.6 Rising interest in artisan and natural wines

- 4.3 Market Restraints

- 4.3.1 Regulatory and labeling complexity across different European Union member states

- 4.3.2 Changing consumer preferences towards beer, spirits, or other beverages

- 4.3.3 Rising cost and availability of agricultural inputs and labor shortages

- 4.3.4 Environmental concerns over water use and pesticide application

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Fortified Wine

- 5.1.2 Still Wine

- 5.1.3 Sparkling Wine

- 5.1.4 Others

- 5.2 By Color

- 5.2.1 Red Wine

- 5.2.2 White Wine

- 5.2.3 Rose Wine

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Specialty/Liquor Stores

- 5.4.2.2 Others Off Trade Channels

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Poland

- 5.5.8 Belgium

- 5.5.9 Sweden

- 5.5.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 E. & J. Gallo Winery

- 6.4.2 Constellation Brands

- 6.4.3 Castel Group

- 6.4.4 Pernod Ricard SA

- 6.4.5 Treasury Wine Estates

- 6.4.6 Financiere Pinault (Groupe Artemis)

- 6.4.7 Louis Roederer

- 6.4.8 LVMH (Moet Hennessy)

- 6.4.9 Baron Philippe de Rothschild

- 6.4.10 Freixenet Copestick

- 6.4.11 Codorniu

- 6.4.12 Torres

- 6.4.13 Accolade Wines

- 6.4.14 Grupo Matarromera

- 6.4.15 Sogrape

- 6.4.16 Grupo Penaflor

- 6.4.17 Nicolas Feuillatte

- 6.4.18 Laurent-Perrier

- 6.4.19 Chateau Lafite Rothschild

- 6.4.20 Blossom Hill

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK