PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934764

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934764

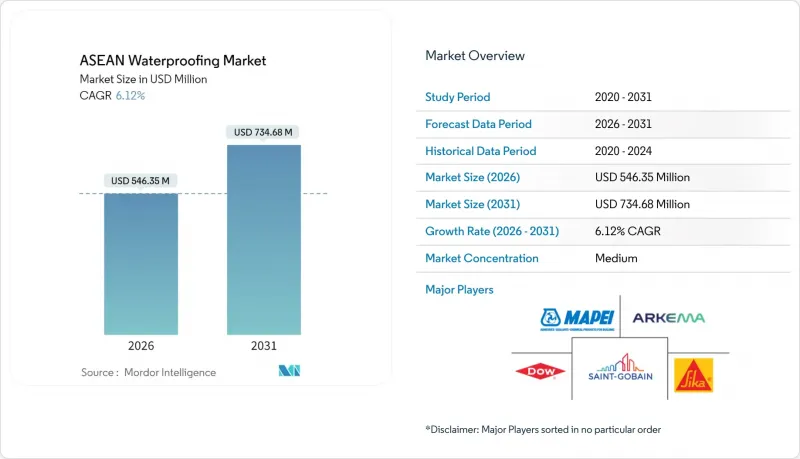

ASEAN Waterproofing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The ASEAN Waterproofing Market is expected to grow from USD 514.86 million in 2025 to USD 546.35 million in 2026 and is forecast to reach USD 734.68 million by 2031 at 6.12% CAGR over 2026-2031.

Robust government capital-expenditure pipelines, a steady residential construction up-cycle, and climate-adaptation priorities converge to keep the ASEAN waterproofing market on a durable growth path. Infrastructure megaprojects in Indonesia, Malaysia, Thailand, and Vietnam are translating directly into procurement of high-performance membranes, liquid-applied systems, and cementitious coatings that secure reinforced-concrete assets in humid, high-rainfall conditions. At the same time, green-building mandates in Singapore and Thailand, together with city-level incentives for vegetated roofs, are accelerating the specification of premium waterproofing assemblies that combine moisture barriers, insulation, and root-resistance layers. Competitive dynamics remain balanced: multinational manufacturers are localizing production to manage freight costs, while regional specialists leverage cost agility and project relationships to win mid-scale work. Raw-material price swings and the shortage of certified applicators cap short-term margins but also catalyze innovation toward simplified, labor-saving products.

ASEAN Waterproofing Market Trends and Insights

Government Infrastructure Spending Surge

Fiscal stimulus is funneling into transport corridors, airports, water-supply schemes, and flood-control projects, creating immediate order books for concrete-integral crystalline admixtures, tunnel-grade membranes, and bridge-deck coatings. Vietnam has lifted its 2025 public-investment disbursement ceiling to VND 743,330 billion, a move supported by a revised Public Investment Law that speeds procurement timelines and opens doors for advanced waterproofing formulas in expressway, port, and metro packages. Capital-project owners typically allocate 70% of construction outlays to materials, of which waterproofing constitutes a small yet mission-critical fraction to secure service-life targets under tropical conditions. The Asian Development Bank pegs the 2016-2030 ASEAN infrastructure gap at USD 2.8-3.1 trillion, assuring long-run demand for construction chemicals, including high-performance moisture-barrier systems.

Residential-Housing Boom in Urban ASEAN

Surging urban populations and tightening land supplies are spawning high-rise condominiums and transit-oriented developments that require robust envelope protection. In Singapore, the Land Transport Master Plan 2040 commits CHF 22.5 billion to rail connections that stimulate adjacent residential construction, where roof-deck membranes must satisfy green-plot ratio rules. The Philippines is experiencing intensified foreign-direct-investment inflows into township projects, driving volume for cost-optimized cementitious coatings that still deliver 10-year warranties. Across the region, developers are upgrading to liquid-applied membranes that contour complex geometries, reducing joint failures and cutting labor hours-an attractive proposition amid tight construction schedules. Demand is also shifting toward hybrid acrylic-polyurethane systems offering elongation above 300% and rain-resistance in under two hours, features prized during the long monsoon season. These residential dynamics ensure recurring procurement cycles for the ASEAN waterproofing market as each condominium phase and refurbishment cycle specifies fresh layers of protection.

Raw-Material Price Volatility

Naphtha derivatives, base bitumen, and polymer resins account for up to 70% of production cost in membrane manufacturing. Polymerupdate recorded Southeast Asian styrene monomer prices at USD 910-920 per metric ton in April 2025, down USD 30 month-on-month, underscoring price whiplash tied to Chinese demand weakness. BitumenMag notes that polymer-modified bitumen producers saw profit squeezes when crude-linked binder prices held firm while SBS and APP modifiers fell, compressing spread margins. Volatile feedstock costs erode EBITDA for smaller ASEAN waterproofing industry participants lacking hedging tools or backward integration, leading to periodic shutdowns and slowed capex on formulation upgrades.

Other drivers and restraints analyzed in the detailed report include:

- Tropical-Climate Moisture Challenges

- Green-Roof Initiatives in Megacities

- Skilled Waterproofing Labor Gap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Membranes claimed a 43.62% ASEAN waterproofing market share in 2025, and the segment is forecast to grow at a 6.78% CAGR through 2031, driving the lion's share of incremental revenue within the ASEAN waterproofing market size. Growth stems from thermoplastic polyolefin (TPO) and ethylene propylene diene monomer (EPDM) innovations that deliver UV stability beyond 15 years, chemical inertia, and weldability at lower temperatures. Daikin's fluoro-polymer additives boost surface reflectance and heat-aging performance, giving tropical rooftops an extended life cycle.

Looking ahead, research and development pipelines feature self-healing membranes integrating microencapsulated polymers that activate upon puncture, thus lowering life-cycle costs for owners and differentiating suppliers in specification-heavy tenders. Emerging hybrid sheets combine TPO topsides with butyl-rubber undersides for dual-mode adhesion, mechanical, and chemical, simplifying detailing at complicated penetrations. Suppliers investing in regional pilot plants to produce such composites gain freight savings and qualify under local-content rules, enhancing bid competitiveness across publicly financed projects.

The ASEAN Waterproofing Report is Segmented by System Type (Cementitious Systems, Membranes, Water Stops, and Chemical Resisting Water Proofing System), Application (Roofing and Walls, Floor and Basement, Water and Waste Management, Tunnel Liner, and More), and Geography (Malaysia, Indonesia, Thailand, Singapore, Philippines, Vietnam, and Myanmar). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ardex Group

- Arkema

- Campbridge Paints Inc.

- Dow

- Henkel AG & Co. KGaA (Henkel Polybit Industries)

- MAPEI S.p.A.

- Minerals Technologies Inc.

- Pidilite Industries Ltd.

- PT. SELARAS CIPTA GLOBAL

- Saint-Gobain

- Sika AG

- Solmax

- SOPREMA Group

- SWC Construction

- Xypex Chemical Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt infrastructure spending surge

- 4.2.2 Residential housing boom in urban ASEAN

- 4.2.3 Tropical climate moisture challenges

- 4.2.4 Green-roof initiatives in megacities

- 4.2.5 Lower import tariffs via ASEAN FTAs

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility

- 4.3.2 Geopolitical trade friction

- 4.3.3 Skilled waterproofing labour gap

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By System Type

- 5.1.1 Cementitious Systems

- 5.1.2 Membranes

- 5.1.3 Water Stops

- 5.1.4 Chemical Resisting Water Proofing System

- 5.2 By Application

- 5.2.1 Roofing and Walls

- 5.2.2 Floor and Basement

- 5.2.3 Water and Waste Management

- 5.2.4 Tunnel Liner

- 5.2.5 Bridge and Highway

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Malaysia

- 5.3.2 Indonesia

- 5.3.3 Thailand

- 5.3.4 Singapore

- 5.3.5 Philippines

- 5.3.6 Vietnam

- 5.3.7 Myanmar

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ardex Group

- 6.4.2 Arkema

- 6.4.3 Campbridge Paints Inc.

- 6.4.4 Dow

- 6.4.5 Henkel AG & Co. KGaA (Henkel Polybit Industries)

- 6.4.6 MAPEI S.p.A.

- 6.4.7 Minerals Technologies Inc.

- 6.4.8 Pidilite Industries Ltd.

- 6.4.9 PT. SELARAS CIPTA GLOBAL

- 6.4.10 Saint-Gobain

- 6.4.11 Sika AG

- 6.4.12 Solmax

- 6.4.13 SOPREMA Group

- 6.4.14 SWC Construction

- 6.4.15 Xypex Chemical Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment