PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934766

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934766

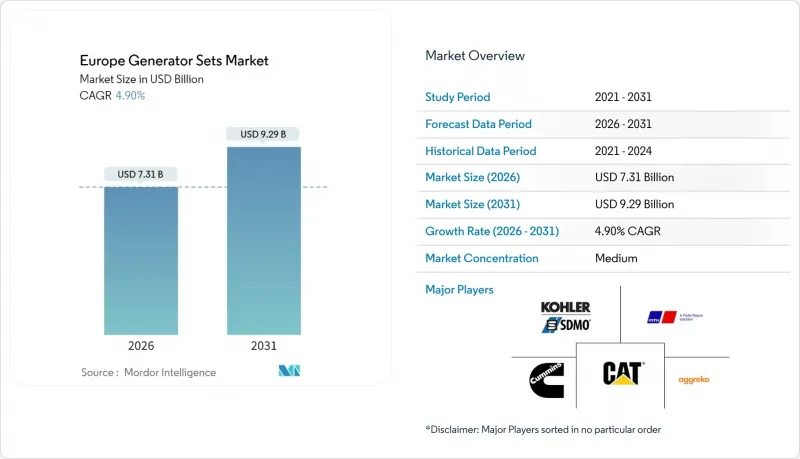

Europe Generator Sets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Generator Sets market size in 2026 is estimated at USD 7.31 billion, growing from 2025 value of USD 6.97 billion with 2031 projections showing USD 9.29 billion, growing at 4.9% CAGR over 2026-2031.

Demand is shifting from diesel-only products to dual-fuel, gas and hydrogen-ready platforms as data centers, healthcare facilities, and renewable energy projects seek lower-carbon back-up power. Corporate sustainability programs, Stage V emissions rules, and grid congestion in metropolitan clusters are accelerating the transition, while battery-genset hybrids and modular architectures are reshaping procurement preferences. Germany remains the single-largest country market, but Spain's rapid renewable build-out and infrastructure programs are creating the fastest incremental growth. At the capacity level, the 75 kVA to 375 kVA segment still dominates shipments, yet hyperscale data centers are driving a swift rise in demand for 750 kVA to 2,000 kVA units. Competitive strategies center on fuel-agnostic engines, hydrogen pilots, and digitally connected rental fleets, which open up opportunities in microgrid deployments, island utilities, and construction sites.

Europe Generator Sets Market Trends and Insights

Growing Demand for Reliable Back-Up Power in Data Centers & Healthcare

Data-center operators in Frankfurt, Amsterdam, Paris, and Dublin are adding multi-megawatt generators to offset grid constraints, satisfy Tier III uptime, and monetize capacity in frequency-response markets. Hospitals are upgrading to modular, parallel-capable gensets to meet EN 50172 switchover rules and 24-hour fuel reserve requirements. Cummins logged a double-digit increase in European data-center orders in 2024, with its 3,500 kVA QSK95 emerging as a preferred platform. Equipment is increasingly specified for both standby and peak-shaving roles, lifting average runtime and driving demand for low-NOx gas units. Healthcare buyers favor units with remote diagnostics to support preventive maintenance and ISO 22301 business continuity audits.

Construction Boom & Infrastructure Upgrades Across Europe

Spain's solar and transport build-out, Poland's rail overhaul, and Italy's National Recovery and Resilience Plan are stretching project timelines and extending rental contracts for mobile power. The European construction sector generated EUR 1.6 trillion of output in 2024, and portable gensets between 100 kVA and 500 kVA remain essential where sites lack a permanent grid supply. Aggreko expanded its European rental fleet by 12% in 2024, with Stage V-compliant diesel-battery hybrids cutting fuel by 30% during low-load hours. Contractors increasingly demand telemetry-enabled sets to monitor runtime, emissions, and fuel use in real time, embedding gensets into broader site-management dashboards.

EU Stage V/VI Emission Norms Heighten CAPEX & OPEX

Stage V rules, fully effective from 2024, compel diesel gensets above 56 kW to add diesel particulate filters, SCR, and EGR, lifting capital cost by up to 18% and adding EUR 0.02-0.04 /kWh in maintenance for DEF replenishment and filter regeneration. Smaller buyers in the 75 kVA-375 kVA range are deferring replacements or shifting to gas units, evidenced by a 9% drop in diesel orders below 200 kVA at Atlas Copco and a 14% rise in gas and hybrid shipments. Proposed Stage VI limits would tighten NOx thresholds by an additional 30% after 2027, prompting OEMs to adopt ammonia-slip catalysts, which would drive further cost escalation and encourage fuel switching.

Other drivers and restraints analyzed in the detailed report include:

- Aging Grid Infrastructure & Climate-Driven Outages

- Hybrid Diesel-Solar Micro-Grids on Islands & Mine Sites

- Battery Storage Cost Plunge Challenges Small Diesel Sets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 75 kVA-375 kVA bracket accounted for 34.62% of the European generator sets market share in 2025, supported by standardized enclosures, high-volume production, and competitive pricing. These units back up HVAC, refrigeration, and point-of-sale systems in retail chains and commercial buildings. Growth is flattening as battery storage penetrates small, grid-connected loads, yet replacement demand persists because Stage V compliance mandates newer hardware.

The 750 kVA-2,000 kVA segment is on track for a 6.25% CAGR, propelled by data-center campuses and large-scale manufacturing that implement modular sets in N+1 layouts to achieve uninterrupted power. Cummins' 3,500 kVA QSK95 enables operators to add 1 MW blocks without re-engineering switchgear, reducing installation timelines. Above 2,000 kVA, applications include grid-balancing and island utilities deploying gas or dual-fuel units from Wartsila and Caterpillar. Below 75 kVA, residential and small commercial demand is shrinking as battery-inverter combinations gain favor in regions with outage durations of four hours or less.

Diesel held 52.88% of the 2025 fuel mix, mostly due to a large installed base and universal fuel availability. Stage V costs, urban low-emission zones, and Scope 2 targets are prompting buyers to adopt dual-fuel sets that emit 30% less CO2 and 50% less particulates. Natural-gas units represent roughly 22% of demand, concentrated in pipeline-dense regions such as Germany and the Netherlands, while bio-fuel-ready models remain below 3% but are scaling with HVO supply increases from Neste.

Hydrogen-ready engines from Cummins, Wartsila, and Rolls-Royce entered commercial portfolios in 2024; adoption is still under 1% but is expected to climb once electrolyzer build-outs and pipeline infrastructure mature. Propane, biogas, and landfill-gas engines serve tighter, niche sectors. Diesel's share is forecast to drop below 47.50% by 2031, not due to outright displacement, but rather because of faster growth in gas and hybrid offerings.

The Europe Generator Sets Market Report is Segmented by Capacity (Below 75 KVA, 75 To 375 KVA, 375 To 750 KVA, 750 To 2, 000 KVA, and Above 2, 000 KVA), Fuel Type (Diesel, Natural Gas, Dual-Fuel and Hybrid, Renewable/Bio-fuel, and Others), Application (Standby Power, Prime/Continuous Power, and More), End-User (Residential, Commercial Buildings, Data Centers, and More), and Geography (Germany, United Kingdom, Spain, and More).

List of Companies Covered in this Report:

- Cummins Inc.

- Caterpillar Inc.

- Rolls-Royce Power Systems (MTU)

- Generac Holdings Inc.

- Kohler Co. / SDMO

- Aggreko plc

- Wartsila Corp.

- Yanmar Holdings Co. Ltd.

- Mitsubishi Heavy Industries Ltd.

- Perkins Engines Company Ltd.

- FG Wilson

- HIMOINSA S.L.

- Volvo Penta

- Kirloskar Oil Engines Ltd.

- Pramac S.p.A.

- Atlas Copco AB

- Doosan Portable Power

- DEUTZ AG

- Honda Power Products

- Briggs & Stratton

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Market Definition & Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for reliable back-up power in data centres & healthcare

- 4.2.2 Construction boom & infrastructure upgrades across Europe

- 4.2.3 Aging grid infrastructure & climate-driven outages

- 4.2.4 Hybrid diesel-solar microgrids adoption on islands & mine sites

- 4.2.5 Corporate sustainability targets boosting gas & biofuel gensets

- 4.2.6 Commercial launch of hydrogen-ready generator engines

- 4.3 Market Restraints

- 4.3.1 EU Stage V/VI emission norms heighten CAPEX & OPEX

- 4.3.2 Grid reliability improvements curb standby demand

- 4.3.3 Battery storage cost plunge (More Than EUR 200/kWh) challenges small diesel sets

- 4.3.4 EU Carbon Border Adjustment Mechanism raises export costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products & Services

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Capacity

- 5.1.1 Below 75 kVA

- 5.1.2 75 to 375 kVA

- 5.1.3 375 to 750 kVA

- 5.1.4 750 to 2,000 kVA

- 5.1.5 Above 2,000 kVA

- 5.2 By Fuel Type

- 5.2.1 Diesel

- 5.2.2 Natural Gas

- 5.2.3 Dual-Fuel and Hybrid

- 5.2.4 Renewable/Bio-fuel

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Standby Power

- 5.3.2 Prime/Continuous Power

- 5.3.3 Peak-Shaving

- 5.3.4 Rental/Temporary Power

- 5.3.5 Micro-grid and Hybrid Support

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Commercial Buildings

- 5.4.3 Industrial and Manufacturing

- 5.4.4 Data Centers

- 5.4.5 Healthcare Facilities

- 5.4.6 Oil and Gas

- 5.4.7 Utilities and Power

- 5.4.8 Mining and Construction

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 NORDIC Countries

- 5.5.7 Russia

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Cummins Inc.

- 6.4.2 Caterpillar Inc.

- 6.4.3 Rolls-Royce Power Systems (MTU)

- 6.4.4 Generac Holdings Inc.

- 6.4.5 Kohler Co. / SDMO

- 6.4.6 Aggreko plc

- 6.4.7 Wartsila Corp.

- 6.4.8 Yanmar Holdings Co. Ltd.

- 6.4.9 Mitsubishi Heavy Industries Ltd.

- 6.4.10 Perkins Engines Company Ltd.

- 6.4.11 FG Wilson

- 6.4.12 HIMOINSA S.L.

- 6.4.13 Volvo Penta

- 6.4.14 Kirloskar Oil Engines Ltd.

- 6.4.15 Pramac S.p.A.

- 6.4.16 Atlas Copco AB

- 6.4.17 Doosan Portable Power

- 6.4.18 DEUTZ AG

- 6.4.19 Honda Power Products

- 6.4.20 Briggs & Stratton

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment