PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934772

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934772

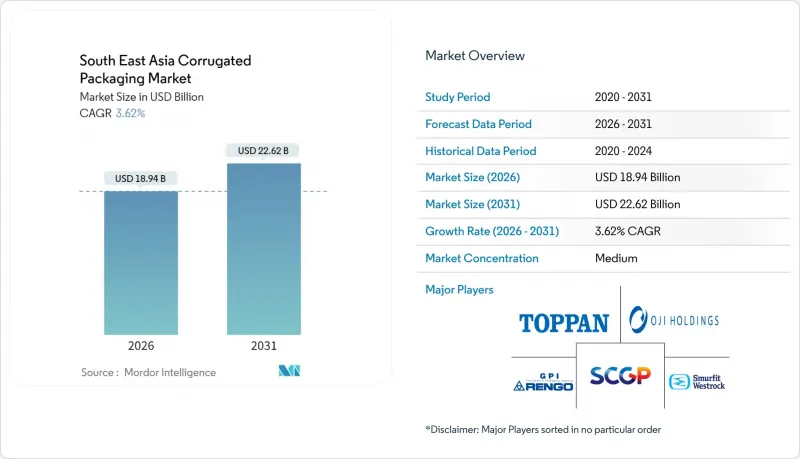

South East Asia Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The South-East Asia corrugated packaging market is expected to grow from USD 18.28 billion in 2025 to USD 18.94 billion in 2026 and is forecast to reach USD 22.62 billion by 2031 at 3.62% CAGR over 2026-2031.

Escalating parcel volumes from e-commerce platforms, the rise of food-delivery ecosystems, and regulatory pressure on single-use plastics continue to steer procurement budgets toward fiber-based formats. Indonesia's integrated supply chains, Vietnam's export-oriented manufacturing base, and Thailand's food-processing clusters drive geographic momentum, while investments in high-speed digital flexo lines compress lead times that once hampered regional converters. Material cost volatility linked to kraft liner and recycled OCC supplies remains the primary margin headwind, yet plantation-based fast-growing fiber grades and AI-enabled design software offset part of the squeeze through lower input costs and higher yield efficiencies. Competition centers on technology adoption rather than price warfare as converters chase long-term contracts with food-delivery platforms and 3PL operators.

South East Asia Corrugated Packaging Market Trends and Insights

Explosive B2C E-commerce Parcel Volumes Demanding Right-Sized Shipping Boxes

E-commerce logistics transformation drives corrugated demand through dimensional weight optimization and standardized packaging requirements. PT Pos Indonesia processed over 2.8 billion parcels in 2024, representing 15% year-over-year growth, with corrugated packaging comprising approximately 65% of total parcel volume. The state postal service has invested in automated sorting facilities across Jakarta, Surabaya, and Medan, creating standardized packaging specifications that favor corrugated solutions. Cross-border e-commerce through platforms like Shopee and Lazada generates varied packaging requirements, with 3PLs standardizing box sizes to optimize warehouse space and shipping costs. Regional infrastructure challenges including rural delivery networks, tropical climate conditions, and extended transit times increase preference for robust corrugated grades and moisture-resistant treatments that maintain structural integrity during logistics cycles.

Shopee Indonesia implemented a packaging standardization program in 2024, reducing box size variations from 47 to 12 standard dimensions across its fulfillment network. This initiative resulted in 23% reduction in packaging material usage and 18% improvement in truck loading efficiency, demonstrating how e-commerce platforms drive corrugated demand through operational optimization rather than pure volume growth.

Food-Delivery Boom Accelerating Need for Leak-Resistant Corrugated Meal Boxes

Vietnam's food delivery market expansion to USD 1.8 billion in 2024 with 26% growth exemplifies regional demand acceleration for specialized food packaging solutions, with corrugated meal boxes representing approximately 40% of packaging volume by weight. Grab Holdings reported 2.4 billion food delivery orders across Southeast Asia in 2024, with Vietnam and Indonesia accounting for 67% of total volume, creating massive demand for standardized corrugated meal containers. The shift from heavy discounting to sustainable growth models among major platforms emphasizes operational efficiency initiatives, creating opportunities for corrugated suppliers offering moisture-resistant treatments, grease-proof coatings, and stackable designs that maintain food safety during extended delivery cycles.

Gojek partnered with Indonesian corrugated manufacturer PT Fajar Surya Wisesa in 2024 to develop biodegradable meal boxes with enhanced grease resistance. The collaboration resulted in 30% reduction in packaging-related customer complaints and 15% improvement in food temperature retention during delivery, while reducing material costs by 8% through optimized box design and local sourcing

Kraft Liner and Recycled OCC Price Volatility Squeezing Converter Margins

Raw material cost pressures intensified in early 2025 with kraft paper mills experiencing production disruptions and price volatility affecting regional supply chains. The Indonesian Pulp and Paper Association reported average kraft liner prices increased 18% in Q4 2024 compared to Q3, while recycled OCC prices fluctuated between USD 180-240 per tonne, creating margin compression for downstream converters. PT Fajar Surya Wisesa reported EBITDA margin compression of 2.3 percentage points in 2024 due to raw material cost volatility, despite implementing dynamic pricing mechanisms for major customers.

The volatility stems from supply-demand imbalances as regional demand growth of 4.2% annually outpaces capacity additions of 2.8%, creating structural tightness that amplifies price swings during supply disruptions. Converter profitability faces additional pressure from limited pricing power with major food delivery platforms and e-commerce operators who maintain annual contracts with fixed pricing terms.

Other drivers and restraints analyzed in the detailed report include:

- Mandated Phase-Out of Single-Use Plastics in Indonesia, Vietnam and Thailand

- Installation of High-Speed Digital Flexo Lines Slashing Lead-Times for SMEs

- Inferior Humidity Resistance During Monsoon Logistics Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food and beverage applications commanded 34.62% of the South-East Asia corrugated packaging market share in 2025, benefiting from the region's expanding food service sector and cold chain infrastructure development. The South-East Asia corrugated packaging market size for food and beverage applications reached USD 6.33 billion in 2025, with growth accelerating in Vietnam and Indonesia where food delivery platforms generate consistent demand for specialized packaging solutions. E-commerce packaging emerges as the fastest-growing segment with 5.17% CAGR through 2031, driven by platform consolidation and standardization requirements from major operators including Shopee, Lazada, and regional postal services.

Nestle Indonesia implemented new corrugated packaging specifications in 2024 for its instant noodle products, reducing packaging material usage by 12% while improving shelf stability through enhanced moisture barrier properties. The optimization resulted in annual cost savings of USD 3.2 million while maintaining product protection standards across Indonesia's diverse climate zones. Electrical and electronics packaging serves regional manufacturing hubs, particularly in Malaysia and Thailand, where export-oriented production requires robust corrugated solutions for component protection during international shipping.

Healthcare and pharmaceutical applications gain momentum from regulatory compliance requirements and cold chain integrity demands, with specialized corrugated designs incorporating antimicrobial coatings and temperature-resistant properties. Cosmetics and personal care packaging reflects rising disposable incomes and urbanization trends across the region, while automotive and industrial segments benefit from manufacturing diversification and supply chain regionalization initiatives. The convergence of food delivery growth and e-commerce expansion creates cross-segment opportunities for converters offering multi-application solutions, with digital printing technologies enabling rapid customization across diverse end-user requirements.

Single wall corrugated boards maintained 38.64% of the South-East Asia corrugated packaging market share in 2025, reflecting cost-effectiveness for medium-duty shipping applications and food delivery packaging where weight optimization remains critical for last-mile logistics efficiency. The South-East Asia corrugated packaging market size for single wall applications reached USD 7.06 billion in 2025, with food delivery and e-commerce segments driving consistent demand. Triple wall configurations experience the fastest growth at 4.36% CAGR, driven by heavy-duty industrial applications and export packaging requirements where enhanced crush resistance and stackability provide competitive advantages.

Double wall boards serve intermediate applications including electronics packaging and retail displays, while single face corrugated finds niche applications in protective wrapping and void fill solutions. Advanced corrugator installations enable regional converters to produce consistent triple wall products with precise flute formation and adhesive application. Thai Containers Group's investment in high-speed corrugating equipment demonstrates how manufacturers upgrade capabilities to serve demanding export markets requiring superior packaging performance.

Mitsubishi Motors Vietnam upgraded its export packaging specifications in 2024, transitioning from double wall to triple wall corrugated containers for automotive parts shipments to reduce damage rates during ocean transport. The change increased packaging costs by 23% but reduced product damage claims by 67%, resulting in net savings of USD 1.8 million annually. The trend toward triple wall adoption reflects increasing quality requirements from multinational manufacturers establishing regional production facilities, creating opportunities for converters with advanced manufacturing capabilities.

The South-East Asia Corrugated Packaging Market Report is Segmented by End-User Industry (Food and Beverage, Electronics, Personal Care, Healthcare, Automotive, and More), Board Type (Single Face, Single Wall, Double Wall, and Triple Wall), Flute Type (A, B, C, E, and F-Flute and Micro-Flutes), Printing Technology (Flexographic, Digital, Litho-Lamination, and More), and Country. Market Forecasts in Value (USD).

List of Companies Covered in this Report:

- SCG Packaging Public Company Limited

- Rengo Co., Ltd.

- Oji Holdings Corporation

- Toppan Inc.

- Smurfit WestRock

- International Paper Company

- Amcor plc

- Huhtamaki Oyj

- Bobst Group SA

- Thai Packaging & Printing Public Company Limited

- Sarnti Packaging Co., Ltd.

- Thai Containers Group Co., Ltd.

- PT Pura Barutama

- Harta Packaging Industries (Selangor) Sdn Bhd

- Trio Paper Mills Sdn. Bhd.

- Vina Kraft Paper Co., Ltd.

- New Asia Industries Co., Ltd.

- Nine Dragons Paper (Holdings) Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive B2C e-commerce parcel volumes demanding right-sized shipping boxes

- 4.2.2 Food-delivery boom accelerating need for leak-resistant corrugated meal boxes

- 4.2.3 Mandated phase-out of single-use plastics in Indonesia, Vietnam and Thailand

- 4.2.4 Installation of high-speed digital flexo lines slashing lead-times for SMEs

- 4.2.5 Adoption of AI-enabled box-design software reducing trim waste

- 4.2.6 Region-wide shift to plantation-based fast-growing fibre grades

- 4.3 Market Restraints

- 4.3.1 Kraft liner and recycled OCC price volatility squeezing converter margins

- 4.3.2 Inferior humidity resistance during monsoon logistics cycles

- 4.3.3 Fragmented panel-board logistics inflating back-haul empty-run costs

- 4.3.4 Skilled-operator shortage for Industry-4.0 corrugators

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-User Industry

- 5.1.1 Food and Beverage

- 5.1.2 Electrical and Electronics

- 5.1.3 Cosmetics and Personal Care

- 5.1.4 Healthcare and Pharmaceutical

- 5.1.5 Automotive and Industrial

- 5.1.6 Other End-User Industries

- 5.2 By Board Type

- 5.2.1 Single Face

- 5.2.2 Single Wall

- 5.2.3 Double Wall

- 5.2.4 Triple Wall

- 5.3 By Flute Type

- 5.3.1 A-Flute

- 5.3.2 B-Flute

- 5.3.3 C-Flute

- 5.3.4 E-Flute

- 5.3.5 F-Flute and Micro-Flutes

- 5.4 By Printing Technology

- 5.4.1 Flexographic

- 5.4.2 Digital (Inkjet)

- 5.4.3 Litho-lamination

- 5.4.4 Other Printing Technologies

- 5.5 By Country

- 5.5.1 Indonesia

- 5.5.2 Thailand

- 5.5.3 Malaysia

- 5.5.4 Vietnam

- 5.5.5 Philippines

- 5.5.6 Singapore

- 5.5.7 Rest of South-East Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SCG Packaging Public Company Limited

- 6.4.2 Rengo Co., Ltd.

- 6.4.3 Oji Holdings Corporation

- 6.4.4 Toppan Inc.

- 6.4.5 Smurfit WestRock

- 6.4.6 International Paper Company

- 6.4.7 Amcor plc

- 6.4.8 Huhtamaki Oyj

- 6.4.9 Bobst Group SA

- 6.4.10 Thai Packaging & Printing Public Company Limited

- 6.4.11 Sarnti Packaging Co., Ltd.

- 6.4.12 Thai Containers Group Co., Ltd.

- 6.4.13 PT Pura Barutama

- 6.4.14 Harta Packaging Industries (Selangor) Sdn Bhd

- 6.4.15 Trio Paper Mills Sdn. Bhd.

- 6.4.16 Vina Kraft Paper Co., Ltd.

- 6.4.17 New Asia Industries Co., Ltd.

- 6.4.18 Nine Dragons Paper (Holdings) Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment