PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934778

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934778

Europe Plant-Based Food And Beverage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

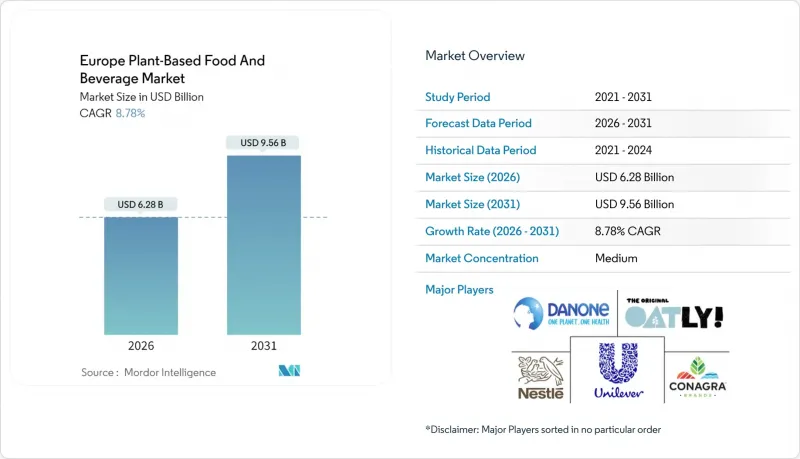

The Europe plant-based food and beverages market is expected to grow from USD 5.77 billion in 2025 to USD 6.28 billion in 2026 and is forecast to reach USD 9.56 billion by 2031 at 8.78% CAGR over 2026-2031.

This growth is driven by increasing consumer adoption of flexitarian and vegan diets, and the implementation of stronger sustainability policies by the European Union. Investments by multinational brands, the use of locally sourced ingredients, and advancements in sensory technologies have enabled companies to launch new products successfully, even amidst fluctuating food prices caused by inflation. By product type, dairy alternatives continue to lead the market, while meat substitutes are experiencing rapid growth. In terms of ingredients, soy remains the most widely used due to its scalability, while oat-based products are gaining popularity as allergen-friendly options. Regarding form, refrigerated plant-based products dominate the market, but convenience-focused product lines are growing at a faster pace. For distribution channels, off-trade (such as supermarkets and convenience stores) remains the primary sales channel, while on-trade (such as restaurants and cafes) is increasingly being used to introduce consumers to plant-based options. The European plant-based food and beverages market is moderately fragmented, with the top five players accounting for a significant share of the total revenue.

Europe Plant-Based Food And Beverage Market Trends and Insights

Rising vegan and flexitarian population

The increasing number of vegans and flexitarians is driving the European plant-based food and beverages market. In 2024, approximately 3.2% of the European population identified as vegan, according to the World Animal Foundation. This rise in the vegan population and the growing number of flexitarians is boosting the demand for plant-based alternatives across various categories. For instance, in 2024, Arla Foods launched Lurpak plant-cased spread in both the United Kingdom and Denmark. This introduction of a plant-based product under one of Europe's most well-known dairy brands highlights how established companies are adapting to changing consumer preferences. In Denmark, government initiatives are playing a significant role in promoting this shift. A national action plan, supported by approximately 170 million euros, is funding efforts such as product development, research projects for public kitchens, and campaigns to raise consumer awareness about plant-based options.

Increasing prevalence of lactose intolerance and food allergies

The rising prevalence of lactose intolerance and food allergies, with Northern and Eastern Europe having some of the highest rates of lactose intolerance, is leading many consumers to choose dairy-free alternatives such as plant-based beverages and yogurts that fit seamlessly into their daily routines. According to the National Center for Biotechnology Information (NCBI) in 2024, approximately 5 to 15% of the European population is lactose-intolerant, highlighting the substantial demand for such alternatives. Finland has the highest rate of food allergies in Europe, with 11.7% of its population affected as of June 2024, according to Frontiers. This growing awareness of allergens is influencing consumer preferences and reshaping food choices across the region. Retailers are adapting to this trend by allocating more shelf space to lactose-free and allergen-free products, positioning them as premium offerings to attract health-conscious consumers willing to pay a higher price.

Higher price compared with traditional products

Higher price compared with traditional products continues to limit the adoption of plant-based foods in Europe. Plant-based meat and milk alternatives are often more expensive than their traditional counterparts, making them less accessible to consumers in lower-income markets. While consumers in wealthier countries may be more willing to pay the higher prices, affordability remains a significant challenge for broader market penetration. The higher costs are primarily due to expensive raw materials, smaller production scales, and specialized manufacturing processes. However, efforts are underway to address this issue. Producers are gradually scaling up operations, exploring alternative ingredients, and introducing private-label products through retailers to make plant-based options more affordable. Although these measures are helping to reduce the price gap, achieving cost parity with traditional products will take time.

Other drivers and restraints analyzed in the detailed report include:

- Innovations in plant-based product offerings

- Sustainability and environmental concerns

- Regulatory and labeling conflicts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plant-based dairy products led the Europe plant-based food and beverages market in 2025, accounting for 38.24% of the total market share. This category includes alternatives like plant-based milk, yogurt, cheese, and cream, which have gained popularity due to increasing health awareness and the rise in lactose intolerance. Consumers are drawn to these products because they fit seamlessly into traditional dairy consumption habits. Both established dairy brands and new players are introducing a wider variety of options, making these products more accessible and appealing to a broader audience.

Plant-based meat substitutes are the fastest-growing segment in the market, with a projected CAGR of 9.39% from 2026 to 2031, nearly double the overall market growth rate. Advances in technology, such as extrusion and fermentation, are improving the taste and texture of these products, making them more similar to conventional meat. This has attracted not only vegans but also flexitarians and mainstream consumers. The growing availability of diverse options, including ready-to-cook and whole-muscle alternatives, along with declining production costs, is expected to drive further growth and expand their reach across Europe.

Soy remained the leading ingredient in the Europe plant-based food and beverages market in 2025, accounting for 45.05% of the total market share. Its dominance is due to its well-established supply chains, high protein content, and versatility in creating alternatives for dairy, meat, and beverages. Soy is widely used because it provides a reliable source of plant-based protein and works well in various products, making it a popular choice for both manufacturers and consumers. Its affordability and availability further strengthen its position in the market.

Oat-based ingredients are quickly gaining traction as the fastest-growing segment in the market, with a projected CAGR of 9.12% through 2031. Oats are favored for their mild flavor, creamy texture, and adaptability in products like plant-based beverages, yogurts, and desserts. Consumers are increasingly drawn to oats due to their sustainability benefits and familiarity as a staple ingredient. This growing demand is encouraging manufacturers to explore new applications for oats, helping them expand their presence in the European plant-based food and beverages market.

The Europe Plant-Based Food and Beverages Market Report is Segmented by Product Type (Plant-Based Dairy, Meat Substitutes, and More), Ingredient (Soy, Oat, and More), Form (Refrigerated/Chilled, Frozen, and More), Distribution Channel (On-Trade and Off-Trade), and Country (United Kingdom, Germany, France, Italy, Spain, Netherlands, Sweden, Poland, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Danone SA

- Nestle SA

- Unilever plc

- Taifun-Tofu GmbH

- Oatly Group AB

- Beyond Meat Inc.

- Monde Nissin Corporation

- JBS SA

- Veganz Group AG

- Impossible Foods Inc.

- MET Foods Limited

- Planted Foods AG

- Valsoia SpA

- Heura Foods SL

- Conagra Brands Inc.

- Amy's Kitchen Inc.

- Hain Celestial Group

- Julienne Bruno

- Riso Scotti SPA

- Fruttagel s.c.p.a

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising vegan and flexitarian population

- 4.2.2 Increasing prevalence of lactose intolerance and food allergies

- 4.2.3 Retail expansion and product availability

- 4.2.4 Innovations in plant-based product offerings

- 4.2.5 Sustainability and environmental concerns

- 4.2.6 Increasing investments and product launches

- 4.3 Market Restraints

- 4.3.1 Persistent taste/texture gap

- 4.3.2 Allergen concerns around soy and tree-nuts

- 4.3.3 Higher price compared to traditional products

- 4.3.4 Regulatory and labeling conflicts

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Plant-based Dairy

- 5.1.1.1 Yogurt

- 5.1.1.2 Cheese

- 5.1.1.3 Frozen Desserts and Ice-Cream

- 5.1.1.4 Other Plant-based Dairy

- 5.1.2 Meat Substitutes

- 5.1.2.1 Tofu

- 5.1.2.2 Tempeh

- 5.1.2.3 Textured Vegetable Protein

- 5.1.2.4 Other Meat Substitutes

- 5.1.3 Plant-based Nutrition/Snack Bars

- 5.1.4 Plant-based Bakery Products

- 5.1.5 Plant-based Beverages

- 5.1.5.1 Packaged Milk

- 5.1.5.2 Packaged Smoothies

- 5.1.5.3 Coffee

- 5.1.5.4 Tea

- 5.1.5.5 Other Plant-based Beverages

- 5.1.6 Other Food and Beverages

- 5.1.1 Plant-based Dairy

- 5.2 By Ingredient

- 5.2.1 Soy

- 5.2.2 Almond

- 5.2.3 Pea

- 5.2.4 Oat

- 5.2.5 Rice

- 5.2.6 Coconut

- 5.2.7 Other Sources

- 5.3 By Form

- 5.3.1 Refrigerated/Chilled

- 5.3.2 Frozen

- 5.3.3 Shelf-stable/Ambient

- 5.3.4 Ready-to-Eat/Ready-to-Cook

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience Stores

- 5.4.2.3 Online Stores

- 5.4.2.4 Other Off-Trade Channels

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Poland

- 5.5.9 Switzerland

- 5.5.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Danone SA

- 6.4.2 Nestle SA

- 6.4.3 Unilever plc

- 6.4.4 Taifun-Tofu GmbH

- 6.4.5 Oatly Group AB

- 6.4.6 Beyond Meat Inc.

- 6.4.7 Monde Nissin Corporation

- 6.4.8 JBS SA

- 6.4.9 Veganz Group AG

- 6.4.10 Impossible Foods Inc.

- 6.4.11 MET Foods Limited

- 6.4.12 Planted Foods AG

- 6.4.13 Valsoia SpA

- 6.4.14 Heura Foods SL

- 6.4.15 Conagra Brands Inc.

- 6.4.16 Amy's Kitchen Inc.

- 6.4.17 Hain Celestial Group

- 6.4.18 Julienne Bruno

- 6.4.19 Riso Scotti SPA

- 6.4.20 Fruttagel s.c.p.a

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK