PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934830

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934830

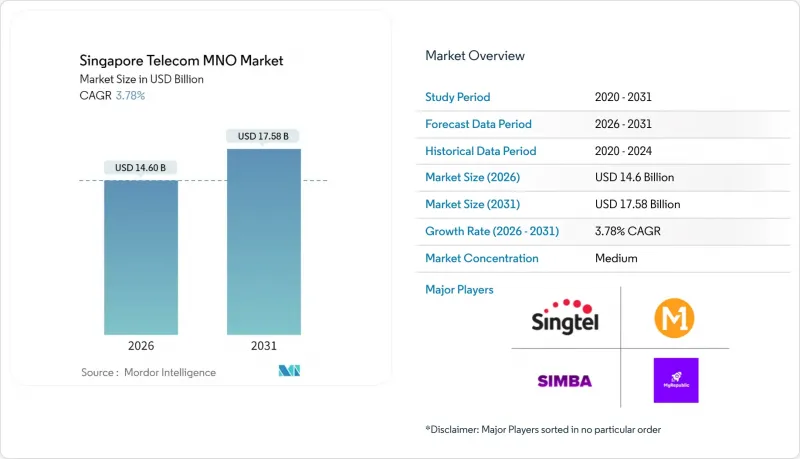

Singapore Telecom MNO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Singapore Telecom MNO Market is expected to grow from USD 14.07 billion in 2025 to USD 14.6 billion in 2026 and is forecast to reach USD 17.58 billion by 2031 at 3.78% CAGR over 2026-2031.

In terms of subscriber volume, the market is expected to grow from 10.09 million units in 2025 to 11.69 million units by 2030, at a CAGR of less than 2.98% during the forecast period (2025-2030). This steady trajectory reflects resilient infrastructure investment, nationwide 5G standalone coverage, and aggressive cloud-first public initiatives that jointly lift enterprise demand while sustaining premium consumer upgrades. Household fiber penetration sits at 100%, enabling operators to bundle gigabit-class broadband with 5G mobile tiers, which in turn supports average monthly mobile data consumption above 50 GB. Intensifying digitalization across government and industry pushes demand for secure, high-capacity connectivity, and operators are responding with network-slicing products for mission-critical workloads and AI-enabled cybersecurity bundles. Competitive tension, sparked by the entry of Simba and more than ten MVNOs, has driven data prices to the lowest level in Southeast Asia, yet prudent capex cycles and new enterprise revenue streams help sustain margins. Maritime and port private-network pilots, plus aggressively funded cloud-edge rollouts, position the Singapore MNO telecom market as a regional showcase for industrial 5G use cases.

Singapore Telecom MNO Market Trends and Insights

Nationwide 5G standalone roll-out with network slicing

Singapore became the first country to blanket all populated areas with 5G standalone in 2025, giving operators the architectural freedom to allocate dedicated slices for latency-sensitive traffic. Singtel's 700 MHz layer lifted indoor coverage by 40% while permitting ultra-low-bandwidth IoT slices that cost only a fraction of regular mobile plans, expanding addressable enterprise use cases. Network slicing also underpins premium consumer "5G +" bundles that guarantee bandwidth during peak hours, generating a 23% ARPU uplift among early adopters in 2025

Digital-first public-sector initiatives and cloud migration

More than 80% of eligible government systems ran on the commercial cloud by late-2024, a milestone that immediately multiplied secure connectivity demand from agencies and their vendors. The Shared Responsibility Framework launched in December 2024 further compels financial institutions to co-innovate with telecom operators on anti-phishing defenses, spawning new compliance-driven messaging and API-security revenues.

Hyper-competition from MVNOs and Simba

Simba's SGD 10-for-50 GB plan re-anchored consumer price expectations and helped the fourth operator exceed 10% subscriber share by 2024. With more than ten MVNOs targeting micro-segments, churn has risen above 1.7% monthly, curbing the ability of any provider to push list prices upward despite rising radio-access energy costs.

Other drivers and restraints analyzed in the detailed report include:

- Full fiber-to-the-home saturation enabling 10 Gbps upgrades

- Surging per-capita mobile data use (>50 GB monthly)

- OTT substitution of voice/SMS and Pay-TV

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Data products commanded 52.64% of Singapore telecom MNO market share in 2025, reflecting ubiquitous mobile broadband adoption and 100% household fiber access. IoT and M2M posted the highest 3.94% CAGR, fueled by smart-factory pilots and city-wide sensor grids that demand ultrareliable low-latency connectivity. Voice held 19.74% yet lagged in growth as OTT erosion persisted. OTT and PayTV represented 10.08%, bolstered modestly by streaming bundles. Other value-added services including managed security and GPU-as-a-Service grew at 3.88% as operators diversified revenue. This breadth underscores how the Singapore MNO telecom market size increasingly tracks enterprise digital-transformation budgets rather than legacy consumer voice trends.

The competitive configuration encourages convergence. Operators package unlimited-data SIM-only plans with 2 Gbps home broadband and cloud storage at price points equal to 2019 single surfaces, driving multi-product take-rates above 65%. Industrial 5G use cases from automated guided vehicles at Tuas Port to AR-guided aircraft checks at Changi are projected to inject USD 340 million incremental service revenue by 2031, reinforcing the structural pivot toward high-margin platform services.

The Singapore Telecom MNO Market is Segmented by Service Type (Voice Services, Data and Internet Services, Messaging Services, Iot and M2M Services, OTT and PayTV Services, and Other Services), and End User (Enterprises, Consumer). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Subscribers).

List of Companies Covered in this Report:

- Singtel

- M1 (Keppel)

- Simba Telecom

- MyRepublic

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 Market Landscape

- 4.1 Market Overview

- 4.2 Regulatory And Policy Framework

- 4.3 Spectrum Landscape And Competitive Holdings

- 4.4 Telecom Industry Ecosystem

- 4.5 Macroeconomic And External Drivers

- 4.6 Porter's Five Forces

- 4.6.1 Competitive Rivalry

- 4.6.2 Threat of New Entrants

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Bargaining Power of Buyers

- 4.6.5 Threat of Substitutes

- 4.7 Key MNO KPIs (2020-2025)

- 4.7.1 Unique Mobile Subscribers And Penetration Rate

- 4.7.2 Mobile Internet Users And Penetration Rate

- 4.7.3 SIM Connections by Access Technology And Penetration

- 4.7.4 Cellular IoT / M2M Connections

- 4.7.5 Broadband Connections (Mobile And Fixed)

- 4.7.6 ARPU (Average Revenue Per User)

- 4.7.7 Average Data Usage per Subscription (GB/month)

- 4.8 Market Drivers

- 4.8.1 Nationwide Stand-alone 5G roll-out unlocks premium consumer and enterprise use-cases

- 4.8.2 Intensifying digital-first public-sector initiatives driving secure high-capacity connectivity demand

- 4.8.3 Rapid fibre-to-the-home (FTTH) saturation enabling gigabit-class bundled offers

- 4.8.4 Surging mobile data consumption per-capita (>50 GB/mo) supports ARPU uplift

- 4.8.5 Maritime And port private-network pilots catalyse Industrial 5G adoption (UNDER-RADAR)

- 4.8.6 5G network-slicing -priority lanes- for gamers And fintech users creates new B2C monetisation (UNDER-RADAR)

- 4.9 Market Restraints

- 4.9.1 Hyper-competition from MVNOs And fourth MNO (Simba) keeps consumer price elasticity high

- 4.9.2 OTT substitution erodes legacy voice/SMS and Pay-TV revenues

- 4.9.3 High spectrum-renewal And energy costs compress EBITDA margins

- 4.9.4 Limited domestic market size caps scale economics for heavy-capex 5G standalone (UNDER-RADAR)

- 4.10 Technological Outlook

- 4.11 Analysis of key business models in Telecom

- 4.12 Analysis of Pricing Models and Pricing

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Overall Telecom Revenue and ARPU

- 5.2 Service Type

- 5.2.1 Voice Services

- 5.2.2 Data and Internet Services

- 5.2.3 Messaging Services

- 5.2.4 IoT and M2M Services

- 5.2.5 OTT and PayTV Services

- 5.2.6 Other Services (VAS, Roaming & International Services, Enterprise And Wholesale Services, etc.)

- 5.3 End-user

- 5.3.1 Enterprises

- 5.3.2 Consumer

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Investments by key vendors, 2023-2025

- 6.3 Market share analysis for MNOs, 2024

- 6.4 MNO snapshot (subscribers, churn rate, ARPU, etc.)

- 6.5 Company Profiles* of MNOs (Includes Business Overview | Service Portfolio | Financials | Business Strategy and Recent Developments | SWOT Analysis)

- 6.5.1 Singtel

- 6.5.2 M1 (Keppel)

- 6.5.3 Simba Telecom

- 6.5.4 MyRepublic

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space And Unmet-Need Assessment