PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934847

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934847

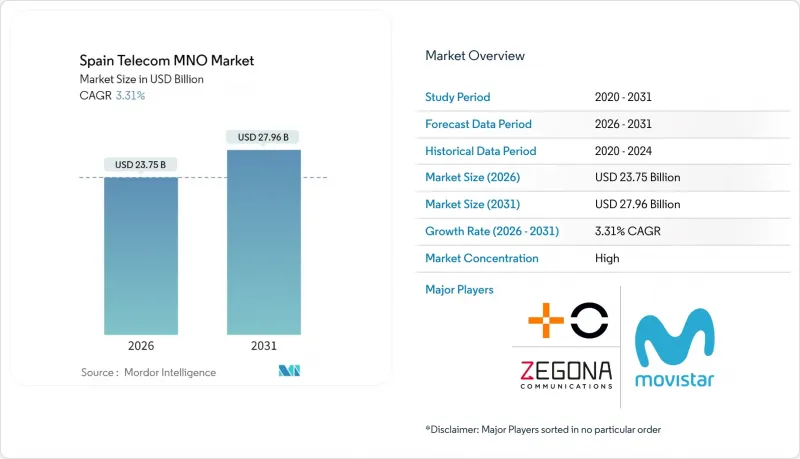

Spain Telecom MNO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Spain Telecom MNO Market size in 2026 is estimated at USD 23.75 billion, growing from 2025 value of USD 22.99 billion with 2031 projections showing USD 27.96 billion, growing at 3.31% CAGR over 2026-2031.

Moderate growth reflects a mature environment where operators focus on data-centric revenues, network-sharing efficiency, and disciplined capital allocation. Intensifying fiber-to-the-home penetration, which now covers 95.2% of premises, sustains premium converged bundles that lift average revenue per user despite price competition. Consolidation has reshaped rivalry after the Orange-MasMovil tie-up created MasOrange with 42% subscriber share, narrowing the gap with Telefonica's 25% stake while prompting new partnering models such as the EUR 9-10 billion FibreCo with Vodafone. Energy-cost volatility, which absorbs 10-15% of operating expenses, and unresolved spectrum-fee litigation temper margin expansion. Meanwhile, government-backed EUR 1 billion funding for rural standalone 5G ensures 96% population coverage, reinforcing Spain's leadership in advanced mobile technology.

Spain Telecom MNO Market Trends and Insights

5G Coverage Expansion and Spectrum Refarming

Spain leads Europe in standalone 5G, achieving 96% population coverage by 2025 on the strength of EUR 1 billion public funding for rural base-stations. Joint use of the 700 MHz band by Movistar, MasOrange, and Vodafone reduces deployment cost while speeding suburban roll-outs. MasOrange's Open RAN program with Ericsson ushers in software-defined networks capable of elastic capacity scaling. The European Commission's 5G Observatory confirms Spain's 92.3% household coverage by March 2024, well ahead of the EU mean . These achievements allow operators to pivot resources toward 5G-SA monetization in enterprise and low-latency applications.

Rising Mobile-Data Demand and Unlimited Plans

Unlimited bundles priced at USD 17.39 purchasing-power-parity rank among Europe's cheapest, stimulating heavy usage in metropolitan corridors. Although traffic growth slowed to 12% year-over-year in early-2024, operators defend value through tiered 5G propositions with superior cost-per-GB economics. Competitive migration toward low-cost brands intensified, with incumbents losing share to price-focused challengers. The strategic response centers on value-added bundles, premium content, and loyalty programs that elevate perceived service quality without relying solely on heavy discounts.

Saturated Subscriber Base

Active SIMs reached 61.62 million by March 2025, equating to 125.6 lines per 100 residents and signaling limited room for organic user growth. Portability volumes climbed 7.6% year-over-year, underlining a zero-sum battle for share rather than net additions. Fixed broadband likewise nears total household penetration, intensifying operators' hunt for incremental revenue in digital services. Demographic aging compounds stagnation because older cohorts adopt fewer data-intensive offerings. Consequently, the Spain telecom MNO market shifts capital toward enterprise, IoT, and edge-cloud propositions that sidestep consumer saturation.

Other drivers and restraints analyzed in the detailed report include:

- FTTH Boom Enabling Converged Bundles

- Enterprise IoT Uptake in Smart Grids and Logistics

- ARPU Pressure from Price Wars and Low-Cost Brands

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Data and internet generated 50.39% of Spain telecom MNO market share in 2025, reflecting unmatched fiber penetration and aggressive unlimited mobile bundles. Voice remains sticky via converged offers, whereas SMS revenue declines continue. IoT and M2M lines constitute a smaller base but post the fastest 3.40% CAGR, propelled by logistics, energy, and smart-city solutions. The Spain telecom MNO market size for IoT-centric connectivity is projected to expand steadily as satellite NTNs remove rural coverage barriers. OTT and PayTV services leverage ubiquitous FTTH, enabling operators to embed premium video and cloud gaming that absorb bandwidth within existing allowances.

Operators monetize the Spain telecom MNO market size differential between best-effort 4G and guaranteed 5G-SA slices for corporate users. Network APIs open incremental revenue as developers integrate quality-on-demand features into applications. As latency-sensitive services such as cloud gaming mature, operators expect double-digit growth in premium tiers that counterbalance the commoditization of legacy voice.

The Spain Telecom MNO Market is Segmented by Service Type (Voice Services, Data and Internet Services, Messaging Services, Iot and M2M Services, OTT and PayTV Services, and Other Services), and End User (Enterprises, Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Telefonica Spain (Movistar)

- MASORANGE, S.L.

- Zegona Communications (Vodafone Spain)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Regulatory and Policy Framework

- 4.3 Spectrum Landscape and Competitive Holdings

- 4.4 Telecom Industry Ecosystem

- 4.5 Macroeconomic and External Drivers

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Competitive Rivalry

- 4.6.2 Threat of New Entrants

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Bargaining Power of Buyers

- 4.6.5 Threat of Substitutes

- 4.7 Key MNO KPIs (2020-2025)

- 4.7.1 Unique Mobile Subscribers and Penetration Rate

- 4.7.2 Mobile Internet Users and Penetration Rate

- 4.7.3 SIM Connections by Access Technology and Penetration

- 4.7.4 Cellular IoT / M2M Connections

- 4.7.5 Broadband Connections (Mobile and Fixed)

- 4.7.6 ARPU (Average Revenue Per User)

- 4.7.7 Average Data Usage per Subscription (GB/month)

- 4.8 Market Drivers

- 4.8.1 5G coverage expansion and spectrum refarming

- 4.8.2 Rising mobile-data demand and unlimited plans

- 4.8.3 FTTH boom enabling converged bundles

- 4.8.4 Enterprise IoT uptake (smart grids, logistics)

- 4.8.5 MVNO-friendly wholesale rules boosting lease revenue

- 4.8.6 EU RRF funds for rural 5G and neutral hosts

- 4.9 Market Restraints

- 4.9.1 Saturated subscriber base

- 4.9.2 ARPU pressure from price wars and low-cost brands

- 4.9.3 Spectrum-fee litigation uncertainty

- 4.9.4 Energy-cost volatility inflating OPEX

- 4.10 Technological Outlook

- 4.11 Analysis of key business models in Telecom Sector

- 4.12 Analysis of Pricing Models and Pricing

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Overall Telecom Revenue and ARPU

- 5.2 Service Type

- 5.2.1 Voice Services

- 5.2.2 Data and Internet Services

- 5.2.3 Messaging Services

- 5.2.4 IoT and M2M Services

- 5.2.5 OTT and PayTV Services

- 5.2.6 Other Services (VAS, Roaming and International Services, Enterprise and Wholesale Services, etc.)

- 5.3 End-user

- 5.3.1 Enterprises

- 5.3.2 Consumer

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Investments by key vendors, 2023-2025

- 6.3 Market share analysis for MNOs, 2024

- 6.4 Product Benchmarking Analysis for mobile network services

- 6.5 MNO snapshot (subscribers, churn rate, ARPU, etc.)

- 6.6 Company Profiles* of MNOs (Includes Business Overview | Service Portfolio | Financials | Business Strategy and Recent Developments | SWOT Analysis)

- 6.6.1 Telefonica Spain (Movistar)

- 6.6.2 MASORANGE, S.L.

- 6.6.3 Zegona Communications (Vodafone Spain)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment