PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934833

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934833

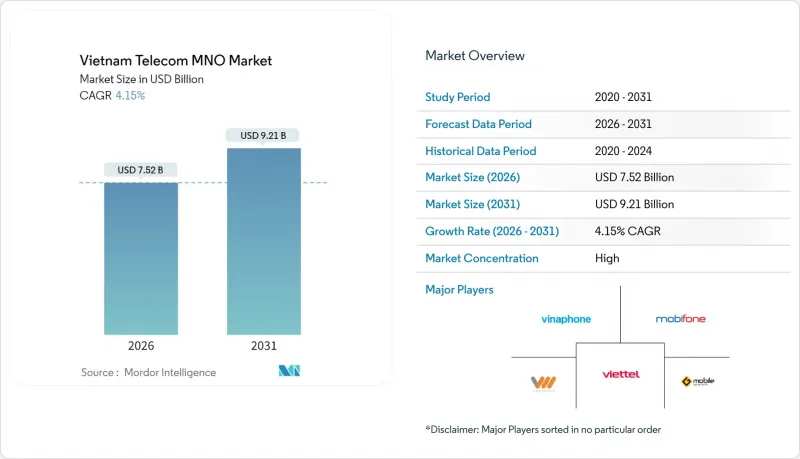

Vietnam Telecom MNO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vietnam Telecom MNO Market size in 2026 is estimated at USD 7.52 billion, growing from 2025 value of USD 7.22 billion with 2031 projections showing USD 9.21 billion, growing at 4.15% CAGR over 2026-2031.

Heightened data consumption, the nationwide 5G roll-out, and supportive government policies are steering the transition from voice to digital services while operators exploit premium enterprise offerings to counter falling voice revenue. Investments in edge computing, private 5G, and satellite-enabled rural access are broadening the addressable user base and underpinning steady top-line expansion across the Vietnam telecom MNO market. Price competition remains intense, yet disciplined infrastructure sharing contains opex and capex, preserving operating margins. A high concentration ratio-three state-backed carriers hold more than 95% of subscriptions-creates the scale needed for rapid technology upgrades and shields the Vietnam telecom MNO market from disruptive entrants.

Vietnam Telecom MNO Market Trends and Insights

Rapid 4G and 5G rollout drives mobile-data surge

Early 5G tests delivered median speeds of 364.43 Mbps in April 2025, propelling user demand for high-bandwidth services. The mandated sunset of 2G in 2026 and 3G in 2028 channels subscribers onto higher-value 4G and 5G plans, naturally lifting ARPU. Viettel captured 4 million 5G users within months, with 70% experiencing speeds above 1.5 Gbps, proving consumers will pay premiums for performance. Infrastructure sharing reduced deployment costs and enabled coverage in all 63 provinces. Surging traffic is spurring edge-computing nodes and CDNs, so carriers evolve into broader digital-infrastructure firms inside the Vietnam telecom MNO market.

National Digital Transformation programme accelerates broadband uptake

Government targets pushed fiber penetration to 82.4% of households by October 2024, already above the 2025 goal. Issuance of 20 million electronic ID cards in 2024 amplified demand for reliable broadband to access e-government services. A population database that handled 1.3 billion queries proves the scale of digital activity requiring sturdy networks. Forty-eight smart-city projects and Da Nang's semiconductor investments are transferring predictable traffic to carriers. Positive network effects emerge as each new digital service spurs further connectivity demand, assuring durable revenue expansion across the Vietnam telecom MNO market.

Intensifying price wars compress ARPU

Bandwidth upgrades at unchanged prices-FPT Telecom doubled speeds for residential users in April 2025-accelerated the decline in price-per-megabit. VNPT and Viettel replicated the strategy, pushing voice and SMS income lower as OTT apps dominate messaging. Operators chase cost efficiencies through network sharing, but sustained ARPU pressure forces a pivot toward enterprise and vertical solutions within the Vietnam telecom MNO market.

Other drivers and restraints analyzed in the detailed report include:

- Data-centre build-outs elevate wholesale fibre demand

- Private 5G/IoT adoption in manufacturing parks

- High spectrum costs and slow refarming

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Data and internet offerings captured 48.62% of Vietnam telecom MNO market share in 2025, confirming the structural pivot from voice to digital connectivity. IoT and M2M already produce the fastest 4.32% CAGR, and the Vietnam telecom MNO market size for that niche is projected to scale rapidly as factories automate and cities deploy smart-infrastructure platforms. Voice and SMS continue their secular decline, displaced by OTT messaging and calling. Pay-TV and bundled OTT video ride on expanded fibre footprints, accelerating household ARPU growth.

5G unlocks edge computing, AR/VR, and network slicing, giving carriers tools to price premium speeds and latency guarantees. Wholesale backhaul to hyperscale data centers adds high-margin accounts, while VAS such as digital wallets broaden cross-sell revenue. These adjacent income streams de-risk falling legacy cash flows, yet successful capture hinges on upgrading customer-experience platforms across the Vietnam telecom MNO market.

The Vietnam Telecom MNO Market is Segmented by Service Type (Voice Services, Data and Internet Services, Messaging Services, Iot and M2M Services, OTT and PayTV Services, Other Services), End User (Enterprises, Consumers). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Subscribers).

List of Companies Covered in this Report:

- Viettel Group

- Vinaphone

- Mobifone Corporation

- Vietnamobile

- Gmobile

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Regulatory and Policy Framework

- 4.3 Spectrum Landscape and Competitive Holdings

- 4.4 Telecom Industry Ecosystem

- 4.5 Macroeconomic and External Drivers

- 4.6 Porter's Five Forces

- 4.6.1 Competitive Rivalry

- 4.6.2 Threat of New Entrants

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Bargaining Power of Buyers

- 4.6.5 Threat of Substitutes

- 4.7 Key MNO KPIs (2020-2025)

- 4.7.1 Unique Mobile Subscribers and Penetration Rate

- 4.7.2 Mobile Internet Users and Penetration Rate

- 4.7.3 SIM Connections by Access Technology and Penetration

- 4.7.4 Cellular IoT / M2M Connections

- 4.7.5 Broadband Connections (Mobile and Fixed)

- 4.7.6 ARPU (Average Revenue Per User)

- 4.7.7 Average Data Usage per Subscription (GB/month)

- 4.8 Market Drivers

- 4.8.1 Rapid 4G and 5G rollout drives mobile-data surge

- 4.8.2 National Digital Transformation programme accelerates broadband uptake

- 4.8.3 Smartphone affordability boosts data consumption

- 4.8.4 Data-centre build-outs elevate wholesale fibre demand

- 4.8.5 Private 5G/IoT adoption in manufacturing parks

- 4.8.6 Pay-TV fibre bundles lift household ARPU

- 4.9 Market Restraints

- 4.9.1 Intensifying price wars compress ARPU

- 4.9.2 High spectrum costs and slow refarming

- 4.9.3 Mountainous right-of-way costs stall rural fibre

- 4.9.4 Nascent MVNO rules delay service innovation

- 4.10 Technological Outlook

- 4.11 Analysis of key business models in Telecom

- 4.12 Analysis of Pricing Models and Pricing

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Overall Telecom Revenue and ARPU

- 5.2 Service Type

- 5.2.1 Voice Services

- 5.2.2 Data and Internet Services

- 5.2.3 Messaging Services

- 5.2.4 IoT and M2M Services

- 5.2.5 OTT and PayTV Services

- 5.2.6 Other Services (VAS, Roaming and International Services, Enterprise and Wholesale Services, etc.)

- 5.3 End-User

- 5.3.1 Enterprises

- 5.3.2 Consumer

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Investments by key vendors, 2023-2025

- 6.3 Market share analysis for MNOs, 2024

- 6.4 Product Benchmarking Analysis for mobile network services

- 6.5 MNO snapshot (subscribers, churn rate, ARPU, etc.)

- 6.6 Company Profiles* of MNOs (Includes Business Overview | Service Portfolio | Financials | Business Strategy and Recent Developments | SWOT Analysis)

- 6.6.1 Viettel Group

- 6.6.2 Vinaphone

- 6.6.3 Mobifone Corporation

- 6.6.4 Vietnamobile

- 6.6.5 Gmobile

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment