PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934837

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934837

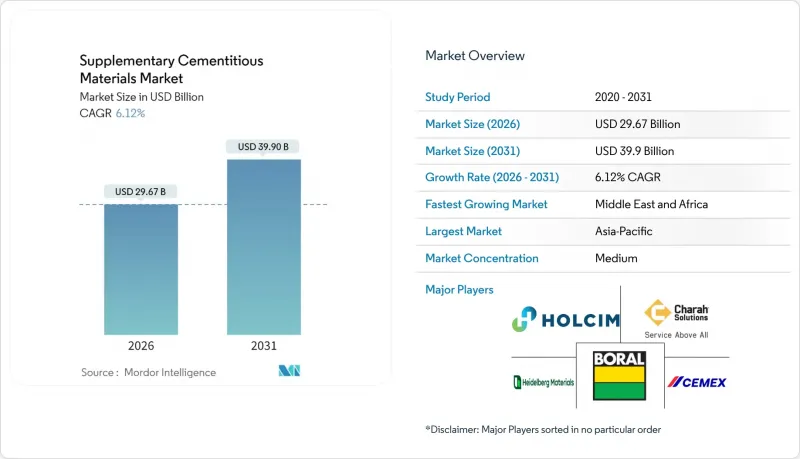

Supplementary Cementitious Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Supplementary Cementitious Materials market is expected to grow from USD 27.96 billion in 2025 to USD 29.67 billion in 2026 and is forecast to reach USD 39.9 billion by 2031 at 6.12% CAGR over 2026-2031.

This expansion reflects the construction sector's rapid shift toward sustainable building practices as governments enforce carbon-pricing schemes and public-sector projects embed low-carbon concrete mandates. Accelerating infrastructure investment programs-such as Saudi Arabia's USD 1.1 trillion Vision 2030 pipeline-collide with the cement industry's need to reduce clinker content amid dwindling coal-fired by-products, creating durable demand for SCMs. Supply-side innovation in calcined clay, volcanic pozzolans, and limestone-blended cements mitigates the shrinking availability of fly ash and slag, while flash-calcination technology lowers processing energy requirements by up to 40% and broadens the viable feedstock base.

Global Supplementary Cementitious Materials Market Trends and Insights

Boom in Global Construction and Infrastructure Spending

Massive public-works funding underpins the supplementary cementitious materials market, with India's infrastructure capital expenditure swelling 5.7 times to USD 36.1 billion in 2023-24, Saudi Arabia's Vision 2030 exceeding USD 1.1 trillion, and African infrastructure outlays averaging USD 93 billion each year. These programs specify higher SCM substitution in concrete-Sydney Metro achieved 38-52% replacement, resulting in a 120,000-tonne CO2-e reduction across projects . The construction surge, therefore, multiplies SCM demand, enabling suppliers to secure long-term contracts that justify investments in flash-calciner capacity and logistics optimization.

Stricter CO2-Emissions Regulations and Carbon-Pricing Schemes

Regulatory pressure is intensifying. France's RE2020 caps embodied carbon in new buildings at 640-740 kg CO2-e/m2, while the EU's Carbon Border Adjustment Mechanism prices imports on a carbon basis. US Buy Clean rules require Environmental Product Declarations for federally funded concrete, and California applies carbon pricing to construction materials, creating premium markets for high-SCM mixes. These regulations make decarbonized concrete economically attractive, locking in structural demand for SCMs as a compliance pathway.

Dwindling Supply of Quality Fly Ash and Slag as Coal and BF Steel Decline

Coal-power output in the U.S. has fallen 60% since 2010, slashing high-grade fly ash volumes, while blast-furnace slag shrinks as steel producers pivot to electric arc furnaces. Remaining ash stockpiles command a 40-60% price premium, and transport distances lengthen, eroding cost advantages. Concrete producers must therefore re-engineer mix designs around alternative SCMs or pay higher inputs, constraining short-term growth until new supply sources mature.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Blended/Green Cements

- Government Green-Procurement Incentives

- High Variability in SCM Quality/Specifications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fly ash held a 41.72% market share of the Supplementary Cementitious Materials market in 2025, supported by well-established logistics networks and predictable pozzolanic properties, despite declining coal generation. Slag cement (GGBFS) follows, supplying high-performance concrete segments even as blast-furnace output contracts. Calcined clay, however, is expanding at a 6.88% CAGR as flash-calciner units proliferate, lowering energy costs and enabling economic processing of clay with only 15-25% kaolinite. This trajectory positions calcined clay as the primary substitute for dwindling coal-derived sources, restructuring regional supply portfolios and inviting new entrants backed by mineral-rich deposits.

Manufacturers are funneling capital toward purpose-built calcination and grinding plants capable of ultraprecise particle-size control, raising pozzolanic reactivity indexes above 800 mg Ca(OH)2/g and drawing premium pricing. Silica fume and high-reactivity metakaolin maintain niche roles in ultra-high-performance concrete, while limestone filler underpins the global rollout of Portland Limestone Cement, reinforcing incremental de-clinkerization pathways. Collectively, these trends signal a pivot from opportunistic use of industrial waste toward deliberate, scalable supplementary cementitious materials market production strategies.

The Supplementary Cementitious Materials Report is Segmented by SCM Type (Fly Ash, Slag Cement, Silica Fume, and More), End User (Residential Construction, Commercial and Institutional, Industrial Facilities, and More), Material Form (Powder, Slurry/Suspension, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region remains the epicenter of the supplementary cementitious materials market, capturing 47.88% of the 2025 value, driven by China's continued but moderating construction activities and India's surge in infrastructure expenditure to USD 36.1 billion during 2023-24. Ready access to coal ash and blast-furnace slag once underpinned low-cost supplies; however, environmental policies are accelerating coal retirements, prompting regional cement majors to prioritize calcined-clay hubs near kaolinite-rich deposits. ASEAN economies are leveraging Belt and Road funding to build transport corridors that require high-SCM concrete volumes, while Japan and South Korea are deploying premium metakaolin blends in seismic-resistant and marine infrastructure.

The Middle East & Africa is projected to post the fastest 6.42% CAGR through 2031, underwritten by Saudi Arabia's NEOM, the Red Sea Project, and regional mandates for low-carbon materials. UAE's Estidama and Egypt's green-building codes codify SCM thresholds, attracting investment in volcanic-ash processing in East Africa and calcined-clay projects throughout the Sahel. Logistics hurdles and quality assurance gaps impede immediate scale-up; however, mineral abundance positions the region for self-sufficiency once the processing infrastructure matures. North America faces a tightening fly-ash pipeline after 60% coal-generation decline, driving exploration of natural pozzolan sources in Nevada and Utah, alongside increased slag imports from Europe. Federal Buy Clean rules and state-level tax credits reward early adopters of high-SCM mixes, keeping demand buoyant despite supply friction. Europe, with mature carbon-pricing and RE2020 building codes, pushes technical boundaries by integrating limestone-calcined clay and recycled fines at industrial scale, cementing its role as a decarbonization laboratory. South America, though smaller, gains momentum as Brazil's coastal resilience projects and Chile's mining infrastructure demand durable, low-carbon concrete, stimulating regional pozzolan and rice-husk ash ventures that gradually connect into global supply chains.

- Advanced Cement Technologies LLC

- ArcelorMittal SA

- Bharathi Cement Corporation Private Limited

- BASF SE

- Boral Ltd.

- CEMEX S.A.B. de C.V.

- CemGreen ApS

- Charah Solutions

- CR Minerals Company LLC

- Dangote Cement Plc.

- Ecocem

- Ferroglobe PLC

- HeidelberCement

- Hoffmann Green Cement Technologies

- Holcim Group

- JSW Cement Ltd.

- Tata Steel Ltd.

- TITAN

- UltraTech Cement Ltd.

- Votorantim Cimentos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Boom in global construction and infrastructure spending

- 4.2.2 Stricter CO2-emissions regulations and carbon-pricing schemes

- 4.2.3 Rapid adoption of blended/green cements (e.g., PLC)

- 4.2.4 Government green-procurement incentives

- 4.2.5 Surging projects in calcined clay and natural pozzolans unlocking new supply

- 4.3 Market Restraints

- 4.3.1 Dwindling supply of quality fly ash and slag as coal and BF steel decline

- 4.3.2 High variability in SCM quality/specifications

- 4.3.3 Competition from novel low-clinker binders that bypass traditional SCM chains

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By SCM Type

- 5.1.1 Fly Ash

- 5.1.2 Slag Cement (Ground-granulated Blast-Furnace Slag)

- 5.1.3 Silica Fume

- 5.1.4 Calcined Clay / Metakaolin

- 5.1.5 Limestone Filler

- 5.1.6 Other Products

- 5.2 By End User

- 5.2.1 Residential Construction

- 5.2.2 Commercial and Institutional

- 5.2.3 Industrial Facilities

- 5.2.4 Transport Infrastructure (roads, rail, ports, airports)

- 5.2.5 Energy and Utilities Infrastructure

- 5.3 By Material Form

- 5.3.1 Powder

- 5.3.2 Slurry/Suspension

- 5.3.3 Granulated Pellets

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Nordic Countries

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Advanced Cement Technologies LLC

- 6.4.2 ArcelorMittal SA

- 6.4.3 Bharathi Cement Corporation Private Limited

- 6.4.4 BASF SE

- 6.4.5 Boral Ltd.

- 6.4.6 CEMEX S.A.B. de C.V.

- 6.4.7 CemGreen ApS

- 6.4.8 Charah Solutions

- 6.4.9 CR Minerals Company LLC

- 6.4.10 Dangote Cement Plc.

- 6.4.11 Ecocem

- 6.4.12 Ferroglobe PLC

- 6.4.13 HeidelberCement

- 6.4.14 Hoffmann Green Cement Technologies

- 6.4.15 Holcim Group

- 6.4.16 JSW Cement Ltd.

- 6.4.17 Tata Steel Ltd.

- 6.4.18 TITAN

- 6.4.19 UltraTech Cement Ltd.

- 6.4.20 Votorantim Cimentos

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-need Assessment