PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939162

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939162

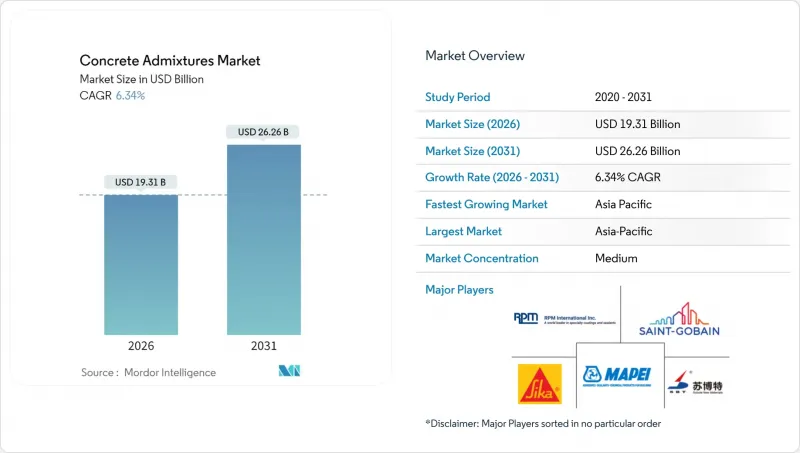

Concrete Admixtures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Concrete Admixtures Market was valued at USD 18.16 billion in 2025 and estimated to grow from USD 19.31 billion in 2026 to reach USD 26.26 billion by 2031, at a CAGR of 6.34% during the forecast period (2026-2031).

The market's growth is driven by government-backed infrastructure programs in the Asia-Pacific region, stricter water-reduction standards in developed economies, and the rapid adoption of self-consolidating concrete, which boosts productivity while reducing material waste. Contractors are broadening the adoption of AI-guided dosage platforms, which refine mix consistency and trim admixture overuse. The residential sector's rebound and mounting preference for bio-based chemistries further widen opportunity windows. Competitive intensity remains moderate because regional producers occupy niche positions based on logistics advantages and local regulatory familiarity, even as global suppliers strive to patent polymer innovations and integrate digital features. Volatile petrochemical feedstock prices and evolving formaldehyde emission limits pose short-term cost and compliance challenges that can squeeze margins and lengthen formulation timelines.

Global Concrete Admixtures Market Trends and Insights

Infrastructure Mega-Projects in Asia-Pacific

Government outlays for regional rail corridors, airports, and smart-city programs are redefining specification criteria, moving demand toward admixtures that deliver extended slump retention and durability across varied climatic zones. China's Belt and Road Initiative amplifies cross-border project pipelines, while Indonesia's new capital and India's National Infrastructure Pipeline add steady order visibility. Project owners favor premium additives that maintain rheology under long haul times, enabling suppliers with technical documentation to secure higher margins. The concrete admixtures market benefits from average selling price uplift because public tenders list performance clauses rather than commodity grades, and value-engineered alternatives must clear rigorous test protocols.

Rapid Adoption of High-Performance and SCC Concrete

Self-consolidating concrete has shifted from precast exclusivity to cast-in-place usage as contractors seek labor savings and quality reliability. Placement cycle times decrease by up to 40%, and surface defects noticeably drop, making SCC a preferred option in high-rise cores and complex formwork applications. Projects exceeding 8,000 psi compressive strength targets increasingly combine superplasticizers with supplementary cementitious materials, nudging the concrete admixtures market toward higher technical support bundles. European durability codes act as global reference points, pushing multinationals operating in North America and Asia to align with stricter mix performance thresholds.

Volatile Petrochemical Feedstock Prices

Quarterly swings of 30% or more in ethylene and propylene derivatives directly inflate superplasticizer cost structures, especially for producers without hedging capacity. Logistics surcharges and customs duties exacerbate regional disparities, resulting in spot-price spreads that complicate tender quotations. Smaller enterprises struggle to absorb shocks, sometimes ceding share to vertically integrated majors that lock in term contracts. The concrete admixtures market thus faces temporary margin compression and heightened interest in non-petroleum alternatives, albeit at higher initial price points.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Water-Reduction Regulations

- AI-Guided Dosage Optimization Platforms

- Formaldehyde-Emission Compliance Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The infrastructure segment retained 39.62% of the concrete admixtures market share in 2025, fueled by sovereign spending on transit corridors and utility upgrades. Residential construction, aided by pandemic-era housing stimulus packages, is progressing at a 6.78% CAGR and is on track to narrow the gap by 2031. The expansion of the concrete admixtures market size in housing aligns with the adoption of prefabricated panels, where stringent mix consistency is crucial. Single-family foundations increasingly specify water-reducing agents that cut bleed while boosting durability, whereas multifamily towers incorporate superplasticizers for pumpability at heights exceeding 30 stories.

Commercial projects, notably office retrofits and data centers, occupy about one-quarter of demand, selecting admixtures that balance early strength with low-shrinkage finishes. Industrial and institutional builds round out the remainder, seeking chemical resistance in floors and structural components. The segment mix implies stable base volume from public works, with upside from a healthier mortgage market and urban residential densification trends.

The Concrete Admixtures Market Report is Segmented by End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), Product Type (Accelerator, Air-Entraining, High-Range Water-Reducer, Retarder, Shrinkage-Reducing, Viscosity Modifier, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region carried 31.58% of the concrete admixtures market in 2025 and is projected to grow at a 6.79% CAGR. China remains pivotal, yet its regulatory shift toward quality and environmental stewardship intensifies demand for premium admixtures that meet multi-decade durability benchmarks. India and Indonesia provide incremental momentum through marquee transport and city-building programs, while Japan and South Korea lead the way in digital batching adoption. Regional suppliers benefit from lower logistics hurdles; however, the penetration of foreign superplasticizer brands widens as performance standards integrate international norms.

North America's mature construction ecosystem registers steady volume tied to infrastructure refurbishments and residential starts. Labor constraints have driven the adoption of self-consolidating concrete, making digital dosage control a must-have in large ready-mix fleets. Federal infrastructure bills shift spending toward bridge and roadway rehabilitation, steering admixture demand toward corrosion-inhibiting and shrinkage-reducing categories.

Europe's share stems from robust sustainability regulations, such as the EU Taxonomy, which push for carbon-optimized mixes. Germany and the United Kingdom lead the way in consumption, with rail extensions and urban renewal plans, whereas France and Italy are advancing architectural applications that require color consistency and exposed finishes. Eastern Europe offers growth headroom through cohesion fund-backed highway projects, which increasingly stipulate low-permeability concrete.

South America, the Middle East, and Africa collectively hold a smaller slice, yet they provide pockets of double-digit expansion aligned with megaproject calendars in Brazil and the UAE. Currency fluctuations and commodity cycles complicate procurement; yet, local producers often secure higher utilization rates thanks to import tariffs that favor domestic sourcing.

- CEMEX S.A.B. de C.V.

- CICO Group

- CMB

- Guangdong Redwall New Materials Co.,Ltd

- Jiangsu Subote New Materials Co., Ltd.

- Kao Corporation

- MAPEI S.p.A.

- MC-Bauchemie

- MUHU (China) Construction Materials Co., Ltd.

- Pidilite Industries Limited

- RPM International

- Saint-Gobain

- Sika AG

- SOCHEM

- Xypex Chemical Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure mega-projects in Asia-Pacific

- 4.2.2 Rapid adoption of high-performance and SCC concrete

- 4.2.3 Stricter water-reduction regulations

- 4.2.4 AI-guided dosage optimisation platforms

- 4.2.5 Bio-based admixtures from agri-waste streams

- 4.3 Market Restraints

- 4.3.1 Volatile petro-chemical feedstock prices

- 4.3.2 Low-cost conventional concrete alternatives

- 4.3.3 Formaldehyde-emission compliance risks

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By End-Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 By Product Type

- 5.2.1 Accelerator

- 5.2.2 Air-Entraining

- 5.2.3 High-Range Water-Reducer (Superplasticizer)

- 5.2.4 Retarder

- 5.2.5 Shrinkage-Reducing

- 5.2.6 Viscosity Modifier

- 5.2.7 Water-Reducer (Plasticizer)

- 5.2.8 Other Types

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 South Korea

- 5.3.1.8 Thailand

- 5.3.1.9 Vietnam

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CEMEX S.A.B. de C.V.

- 6.4.2 CICO Group

- 6.4.3 CMB

- 6.4.4 Guangdong Redwall New Materials Co.,Ltd

- 6.4.5 Jiangsu Subote New Materials Co., Ltd.

- 6.4.6 Kao Corporation

- 6.4.7 MAPEI S.p.A.

- 6.4.8 MC-Bauchemie

- 6.4.9 MUHU (China) Construction Materials Co., Ltd.

- 6.4.10 Pidilite Industries Limited

- 6.4.11 RPM International

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 SOCHEM

- 6.4.15 Xypex Chemical Corp.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOS