PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940856

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940856

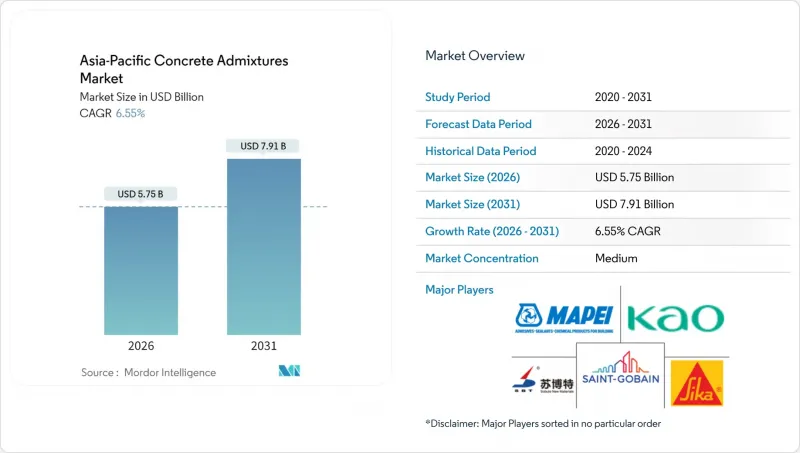

Asia-Pacific Concrete Admixtures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific Concrete Admixtures Market is expected to grow from USD 5.40 billion in 2025 to USD 5.75 billion in 2026 and is forecast to reach USD 7.91 billion by 2031 at 6.55% CAGR over 2026-2031.

Sustained government spending on transport, energy, and urban renewal, fast-rising adoption of ready-mix and precast systems, and tightened durability norms in seismic and coastal zones together anchor current demand. Contractors specify engineered mixes that lower water demand, accelerate strength gain, and accommodate high supplementary cementitious material (SCM) loads, helping owners cut project cycle times and carbon intensity. Competitive intensity remains moderate as global suppliers consolidate through acquisitions, while local specialists capitalize on proximity advantages. Supply-side risks, linked to polycarboxylate ether (PCE) feedstock cost swings and fragmented contractor channels, temper near-term growth. However, the Asia-Pacific concrete admixtures market continues to benefit from the rapid uptake in data-center, battery-gigafactory, and large-scale housing programs.

Asia-Pacific Concrete Admixtures Market Trends and Insights

Government Megaproject Pipeline

Multi-billion-dollar transport corridors, airports, and industrial clusters across China, India, and Indonesia rely on admixture-enhanced concrete to meet tight schedules and 50-year service-life targets. Concrete producers deploy polycarboxylate-ether superplasticizers and shrinkage-reducing additives to achieve rapid strength gain and crack-free mass pours. Malaysia's designation as a regional digital-infrastructure hub accelerates hyperscale build-outs that mandate high-performance mixes with low permeability and superior workability. This convergence of public and private megaprojects keeps the Asia-Pacific concrete admixtures market on a robust growth trajectory, with procurement frameworks increasingly embedding performance-based specifications.

Rapid Penetration of Ready-Mix and Precast Concrete Plants

Standardized batching and automated dosing platforms at new ready-mix and precast facilities heighten demand for consistent, tailor-made admixture solutions. Vietnam and Thailand are now reaching adoption inflection points, where centralized plants outperform site-mixed alternatives in terms of quality and throughput, drawing in continuous volumes of water reducers and accelerators. Singapore's advanced precast ecosystem further showcases the cost and speed dividends of admixture-rich self-compacting concrete, reinforcing a template other Southeast Asian markets seek to replicate.

Volatility in Polycarboxylate Ether Feedstock Prices

Prices for acrylic-acid derivatives that underpin superplasticizer synthesis fluctuate with crude-oil supply dynamics, compressing producer margins and complicating fixed-price contracting. Limited domestic petrochemical capacity across Southeast Asia amplifies exposure to Chinese export policies, prompting higher safety stocks and periodic surcharges in the Asia-Pacific concrete admixtures market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Low-Carbon/SCM-Rich Concrete Blends

- Stricter Durability Specs in Seismic and Coastal Building Codes

- Fragmented Contractor Channel Slows Admixture Specification

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water reducers captured 36.95% of the Asia-Pacific concrete admixtures market in 2025, reflecting universal applicability across mass housing, pavements, and structural frames. Contractors value their predictable 5-10 MPa strength uplift at unchanged water-to-cement ratios, enabling leaner cement content and savings on overall binder cost.

Superplasticizers are projected to post the swiftest 7.02% CAGR to 2031, as data-center basements and giga-factory floors require low-permeability mixes with 150-mm slump retention over two hours. MAPEI, Sika, and Saint-Gobain introduce proprietary polycarboxylate grades that combine high early strength with reduced shrinkage, further extending their competitive lead.

Air-entraining agents remain vital in northern China and Japan, where freeze-thaw cycles pose a significant threat to pavement integrity. Shrinkage-reducing and viscosity-modifying additives gain traction in large-volume pours and underwater placements, respectively. Although niche, these formulations lengthen the value ladder within the Asia-Pacific concrete admixtures market by solving climate- and application-specific challenges.

The Asia-Pacific Concrete Admixtures Market Report is Segmented by Admixture Type (Accelerators, Air-Entraining, High-Range Water Reducers, Water Reducers, Retarders, Shrinkage-Reducing, Viscosity-Modifying, and Others), End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), and Geography (Australia, China, India, Indonesia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cementaid International

- CICO Technologies

- Guangdong Redwall New Materials Co.,Ltd

- Jiangsu Subote New Materials Co., Ltd.

- Kao Corporation

- MAPEI S.p.A.

- Master Builders Solutions Holdings GmbH

- MC-Bauchemie

- P.T. Penta-Chemicals Indonesia

- Pidilite Industries Ltd.

- RPM International

- Saint-Gobain

- Sika AG

- Xypex Chemical Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government megaproject pipeline

- 4.2.2 Rapid penetration of ready-mix and precast concrete plants

- 4.2.3 Shift toward low-carbon/SCM-rich concrete blends

- 4.2.4 Stricter durability specs in seismic and coastal building codes

- 4.2.5 Data-center and battery-gigafactory construction boom

- 4.3 Market Restraints

- 4.3.1 Volatility in polycarboxylate ether (PCE) feedstock prices

- 4.3.2 Fragmented contractor channel slows admixture specification

- 4.3.3 Import-based supply chains vulnerable to geopolitical risk

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 End-use Sector Trends

5 Market Size and Growth Forecasts (Value)

- 5.1 By Admixture Type

- 5.1.1 Accelerators

- 5.1.2 Air-Entraining

- 5.1.3 High-Range Water Reducers (Superplasticizers)

- 5.1.4 Water Reducers

- 5.1.5 Retarders

- 5.1.6 Shrinkage-Reducing

- 5.1.7 Viscosity-Modifying

- 5.1.8 Others (Corrosion-inhibiting, Waterproofing, etc.)

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 South Korea

- 5.3.8 Thailand

- 5.3.9 Vietnam

- 5.3.10 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cementaid International

- 6.4.2 CICO Technologies

- 6.4.3 Guangdong Redwall New Materials Co.,Ltd

- 6.4.4 Jiangsu Subote New Materials Co., Ltd.

- 6.4.5 Kao Corporation

- 6.4.6 MAPEI S.p.A.

- 6.4.7 Master Builders Solutions Holdings GmbH

- 6.4.8 MC-Bauchemie

- 6.4.9 P.T. Penta-Chemicals Indonesia

- 6.4.10 Pidilite Industries Ltd.

- 6.4.11 RPM International

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 Xypex Chemical Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOS