PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934869

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934869

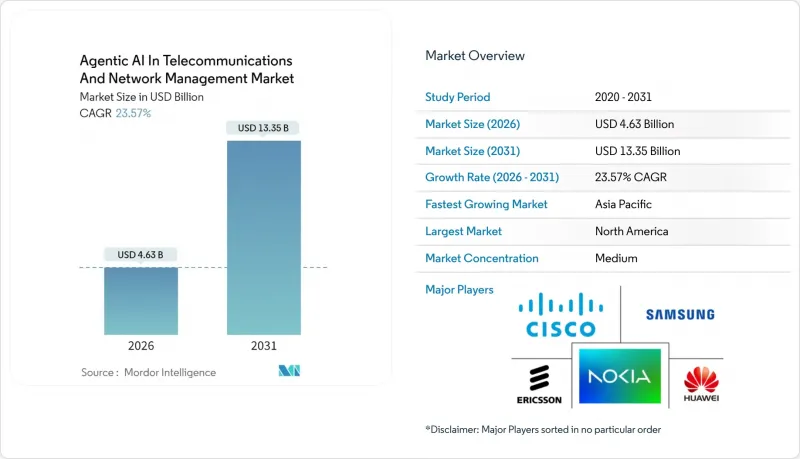

Agentic AI In Telecommunications And Network Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Agentic AI in Telecommunications and Network Management market is expected to grow from USD 3.75 billion in 2025 to USD 4.63 billion in 2026 and is forecast to reach USD 13.35 billion by 2031 at 23.57% CAGR over 2026-2031.

Operators are prioritizing autonomous orchestration because 5G and emerging 6G networks require real-time optimization across millions of variables that conventional rule-based systems cannot manage. Cloud-native platforms anchor early deployments, yet rapid migration toward edge and multi-access edge computing (MEC) is underway to shave inference latency. Fraud and security management is enjoying outsized attention as adversaries adopt AI, pushing operators to embed intelligent anomaly detection at every layer. Competitive intensity is rising as network equipment makers, hyperscalers, and AI specialists form multi-vendor coalitions that promise open interfaces and faster innovation cycles. Strategic mergers in fibre and cybersecurity hint at a future where integrated connectivity and AI security become table stakes for defending market positions.

Global Agentic AI In Telecommunications And Network Management Market Trends and Insights

Rising 5G/6G Network Complexity Driving Autonomous Orchestration

Escalating antenna counts, spectrum bands, and service-level requirements make manual optimisation unworkable, prompting operators to embed autonomous agents that learn network intent and enforce it continuously. Digital Nasional Berhad achieved 99.8% uptime and a 500% alarm reduction within six months of adopting Ericsson's intent-based platform. Research for 6G suggests the orchestration burden will multiply as non-terrestrial links join terrestrial cells, reinforcing the business case. Nokia's modelling shows autonomous networks can unlock USD 800 million in annual operator benefits through combined CAPEX, OPEX, and revenue effects. Those economics drive board-level urgency to convert proof-of-concepts into production deployments at scale.

Surging Data Traffic and Need for Predictive Network Optimisation

Hourly traffic spikes fuelled by live video and AI workloads now overwhelm conventional planning cycles. Verizon's deployment of radio-intelligent controllers delivers 15% energy savings by shifting capacity ahead of surges. Operators report 30-50% reductions in congestion events when predictive agents pre-allocate resources versus reactive steps. Edge data centres intensify the challenge because inference loads appear suddenly and locally. Consequently, predictive optimisation is no longer optional for safeguarding user experience and enterprise SLA commitments.

Data-Privacy and Regulatory Hurdles for Telco AI Initiatives

GDPR and impending EU AI Act rules force operators to add explainability layers and strict data-localisation controls that stretch project timelines. Federated learning offers compliance but can triple compute costs. Cross-border operators must juggle divergent frameworks that undercut scale economies. The uncertainty prompts phased deployments and higher dependence on privacy-preserving toolkits from hyperscalers that guarantee audit readiness.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Churn-Reducing Customer Analytics

- Operator CAPEX Shift Toward AI-Powered Open RAN and vRAN Roll-outs

- Acute Shortage of Telecom-Grade AI Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions and platforms accounted for 59.65% of 2025 spending as operators sought turnkey functionality that plugs into existing OSS/BSS. Services are projected to expand at a 26.99% CAGR, outpacing the overall Agentic AI in Telecommunications and Network Management market due to customisation workstreams. The Agentic AI in Telecommunications and Network Management market size for services is forecast to widen quickly as brownfield networks require domain-specific tuning. Integration specialists orchestrate data pipelines, develop domain models, and handle lifecycle governance, functions that many operators lack in-house. They also deliver managed optimisation that continuously aligns AI agents with shifting business KPIs. Professional services revenue, therefore, rises in tandem with AI maturity phases, embedding providers deep within operator operations and creating annuity streams that lift overall market visibility.

The Agentic AI in Telecommunications and Network Management market benefits from a symbiotic cycle between platform vendors and service partners. As platforms mature, they expose granular APIs that foster third-party modules, which in turn spur demand for integration and DevOps talent. This virtuous loop accelerates innovation velocity while allowing operators to maintain lean internal teams. Consequently, services will narrow but not erase the revenue gap with solutions, ensuring balanced growth across the component stack through 2031.

Cloud deployments retained a 57.62% share in 2025 because hyperscalers supply elastic compute for training massive models. However, MEC instances are set to post a 26.02% CAGR as use cases, such as autonomous vehicles and industrial automation, demand single-digit millisecond responses. The Agentic AI in Telecommunications and Network Management market share for edge is expected to rise sharply once operators standardise micro-data-centre footprints across base-station sites. Early adopters cite 15% energy savings and reduced backhaul when inference stays local. Policy engines in the cloud still coordinate learning, yet decision loops shrink at the edge, reinforcing a hybrid topography.

Notably, operators with stringent sovereignty rules rely on on-premises clouds inside national borders, preserving compliance while retaining hyperscale-like operations. This blend of cloud, edge, and on-premises outposts complicates lifecycle management, creating room for orchestration vendors that guarantee model consistency. Winning solutions will abstract location complexity, providing a single control plane across federation layers without compromising latency or security.

Agentic AI in Telecommunications and Network Management Market Report is Segmented by Component (Solutions/Platforms and Services), Deployment Mode (Cloud and More), Application (Customer Analytics and More), Network Domain (Core Network, Radio Access Network, and More), AI Technology (Machine Learning, Natural Language Processing, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.34% revenue share in 2025 owing to pervasive 5G, deep venture capital, and clear regulatory signals that reward experimentation. Verizon and T-Mobile partner with Google and NVIDIA to co-create optimisation engines that have already lifted sales conversions by 40% and trimmed energy bills. The region also commands the lion's share of AI patent filings in telecoms, giving local vendors an intellectual-property edge that travels well when licensing abroad. Government funding programmes that subsidise rural edge clouds further expand addressable sites, accelerating rollout velocity.

Asia-Pacific is projected to post a 25.78% CAGR to 2031, making it the fastest-expanding theatre. China's state-backed investments guarantee nationwide 5G coverage and seed advanced AI research labs that dovetail with operator needs. South Korea's leading telcos invested over USD 210 million in AI start-ups during 2024-2025 to secure exclusive access to emerging algorithms. India, propelled by surging smartphone adoption, demands AI-based spectral efficiency to serve dense urban clusters without exhaustive spectrum purchases. Regional collaborations, such as the Global Telco AI Alliance, spread proven frameworks across borders, compressing deployment cycles.

Europe ranks third in spending but first in privacy-preserving innovation as GDPR compliance drives adoption of federated learning. Operators often pilot explainable agents before turning them loose in production, lengthening timelines yet fostering trust. South America favours cost-efficient AI delivered via managed services to sidestep capex spikes, while the Middle East and Africa pursue AI-enabled energy optimisation to offset high power costs. Collectively, these markets demonstrate diverse entry paths, ensuring global suppliers tailor portfolios to local constraints.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- ZTE Corporation

- NEC Corporation

- Mavenir Systems, Inc.

- Parallel Wireless, Inc.

- Airspan Networks Holdings Inc.

- Rakuten Symphony Singapore Pte. Ltd.

- Amdocs Limited

- Netcracker Technology Corporation

- Ribbon Communications Inc.

- Casa Systems, Inc.

- Radisys Corporation

- Ciena Corporation

- VIAVI Solutions Inc.

- EXFO Inc.

- TEOCO Corporation

- Subex Limited

- Intracom S.A. Telecom Solutions

- MATRIXX Software, Inc.

- Sandvine Corporation

- DeepSig, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising 5G/6G network complexity driving autonomous orchestration

- 4.2.2 Surging data traffic and need for predictive network optimisation

- 4.2.3 Growing demand for churn-reducing customer analytics

- 4.2.4 Operator CAPEX shift toward AI-powered Open RAN and vRAN roll-outs

- 4.2.5 Emergence of sovereign AI data-centres operated by telcos

- 4.2.6 Adoption of agentic AI for autonomous field-service operations

- 4.3 Market Restraints

- 4.3.1 Data-privacy and regulatory hurdles for telco AI initiatives

- 4.3.2 Acute shortage of telecom-grade AI talent

- 4.3.3 Escalating inference energy costs at network edge

- 4.3.4 Vendor lock-in risk in proprietary AI-native network stacks

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions/Platforms

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premises

- 5.2.3 Edge/MEC

- 5.3 By Application

- 5.3.1 Customer Analytics

- 5.3.2 Network Optimisation and Orchestration

- 5.3.3 Fraud and Security Management

- 5.3.4 Virtual Assistants and CX Automation

- 5.3.5 Predictive Maintenance

- 5.3.6 Other Applications

- 5.4 By Network Domain

- 5.4.1 Core Network

- 5.4.2 Radio Access Network (RAN)

- 5.4.3 Transport/Backhaul

- 5.4.4 OSS/BSS

- 5.5 By AI Technology

- 5.5.1 Machine Learning

- 5.5.2 Natural Language Processing

- 5.5.3 Deep Learning

- 5.5.4 Generative AI

- 5.5.5 Reinforcement Learning

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Singapore

- 5.6.4.7 Malaysia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telefonaktiebolaget LM Ericsson

- 6.4.2 Huawei Technologies Co., Ltd.

- 6.4.3 Nokia Corporation

- 6.4.4 Samsung Electronics Co., Ltd.

- 6.4.5 Cisco Systems, Inc.

- 6.4.6 Juniper Networks, Inc.

- 6.4.7 ZTE Corporation

- 6.4.8 NEC Corporation

- 6.4.9 Mavenir Systems, Inc.

- 6.4.10 Parallel Wireless, Inc.

- 6.4.11 Airspan Networks Holdings Inc.

- 6.4.12 Rakuten Symphony Singapore Pte. Ltd.

- 6.4.13 Amdocs Limited

- 6.4.14 Netcracker Technology Corporation

- 6.4.15 Ribbon Communications Inc.

- 6.4.16 Casa Systems, Inc.

- 6.4.17 Radisys Corporation

- 6.4.18 Ciena Corporation

- 6.4.19 VIAVI Solutions Inc.

- 6.4.20 EXFO Inc.

- 6.4.21 TEOCO Corporation

- 6.4.22 Subex Limited

- 6.4.23 Intracom S.A. Telecom Solutions

- 6.4.24 MATRIXX Software, Inc.

- 6.4.25 Sandvine Corporation

- 6.4.26 DeepSig, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-Need Assessment