PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934885

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934885

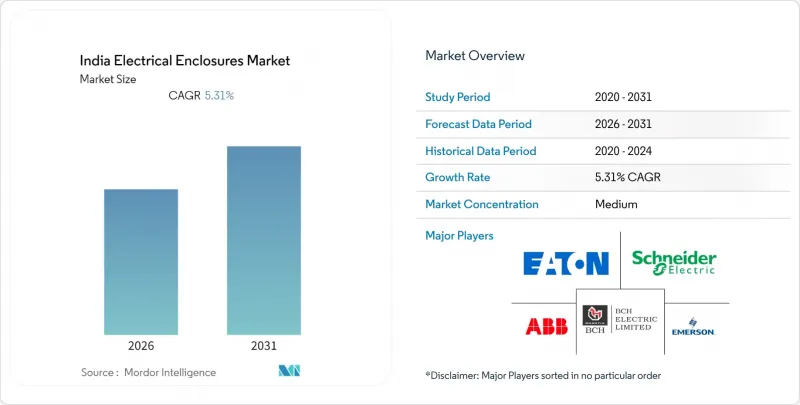

India Electrical Enclosures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India electrical enclosures market is expected to register a CAGR of 5.31% during the forecast period.

Rapid grid-modernization programs, hyperscale data-center expansion, and stringent fire-safety regulations are accelerating procurement of robust, smart, and weather-resistant enclosures. Accelerating state-utility CAPEX exceeding INR 1 lakh crore, particularly for 765 kV transmission corridors, is lifting unit volumes, while mix shifts toward higher-spec metallic designs sustains value growth. Hyperscale facilities scaling from 1,150 MW in 2024 to an expected 2,100 MW by 2027 are driving fresh demand for IP54-plus, thermally managed cabinets, especially in Mumbai, Chennai, and Hyderabad. Compliance with the National Building Code 2016 is stimulating retrofit orders across hospitals, schools, and public offices, and Indian Railways' 98% network electrification milestone is underpinning recurring maintenance demand. Together, these vectors create a multi-year runway for the India electrical enclosures market amid moderate competitive intensity and increasing localization incentives.

India Electrical Enclosures Market Trends and Insights

Surging Grid-Modernization CAPEX by State Utilities

State electricity boards are channelling record investments into high-voltage corridors, with the central allocation of INR 1 lakh crore for inter-state transmission alone. Gujarat's INR 15,000 crore upgrade plan typifies the scale, necessitating larger IP65-rated housings for protection relays along new 765 kV lines. Demand rises for galvanized steel and aluminium cabinets with advanced climate controls, propelling both volumes and average selling prices within the India electrical enclosures market. Vendors able to certify products under BIS IS 2147 and integrate smart-grid sensors see heightened tender success. As installations shift from indoor substations to space-saving outdoor yards, corrosion-resistant coatings and dual-door sealing emerge as key differentiators. The medium-term impact is significant, sustaining a solid order pipeline for principal OEMs.

Rising Hyperscale Data-Centre Buildouts

Total installed IT load is projected to grow from 1,150 MW in 2024 to 2,100 MW by 2027, doubling enclosure demand for high-density power distribution units, bus-ducts, and battery-backup switchboards. Hyperscale specifies modular steel frames with integrated thermal barriers and cable management to handle rack densities above 10 kW. Procurement cycles are rapid, favouring suppliers that keep local assembly lines agile and inventory buffered. Because uptime requirements exceed 99.999%, operators insist on IP54-plus sealing, dual-redundant cooling fans, and digital trip breakers pre-fitted into enclosures. Tier-1 cities remain the launch pads, but edge nodes in Tier-2 markets now drive incremental volumes. Short-term uplift is pronounced as pre-committed hyperscale capacity converts to civil works and electrical fitouts.

Steel and Aluminium Price Volatility

HRC steel swung by INR 3,000 per tonne during 2024 as anti-dumping duties on Chinese supply intersected with fluctuating coking-coal costs. Aluminium premiums tracked LME spikes driven by energy-price volatility. Smaller enclosure shops operating on quarterly rate contracts struggle to hedge, forcing margin resets or component downsizing. Some OEMs responded by redesigning side-panels at 1.6 mm thickness versus 2 mm, a trade-off that risks stiffness in larger cabinets. Elevated raw-material risk deters long-duration fixed-price bids, delaying awards on state-utility tenders. Although volatility should moderate past 2026, near-term headwinds shave 80 basis points off CAGR forecasts.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Fire-Safety Upgrades in Public Buildings (NBC-2016)

- Rapid Electrification of Indian Railways

- Proliferation of Counterfeit IP-Rated Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metallic housings held 70.85% India electrical enclosures market share in 2025, with galvanized steel dominating traction substations and high-current switchboards. The India electrical enclosures market size for metallic products was USD 186.39 million in 2025 and is projected to expand at 4.78% CAGR to 2031. Aluminium earns favour in rooftop solar combiner boxes where weight matters. Rising OPEX on anti-corrosion repainting is nudging coastal utilities toward fiberglass and polycarbonate alternatives that clock a 7.42% CAGR. Non-metallic cabinets also absorb less heat, benefitting data-hall aisle containment. Schneider's Kolkata polymer plant and ABB's Vadodara FRP line illustrate supplier bets on composite growth. Imported resin costs and BIS IS 14772 testing fees keep unit prices at a 15-20% premium, yet total-cost-of-ownership analyses still tilt some specifiers toward polymer choices in saline or chemical environments.

Second-generation engineering plastics are now meeting vertical-flame and UV-aging standards, underscoring their readiness for utility deployments. Polycarbonate molds allow ergonomic latch integration and transparent doors for quick visual inspection, perks that bolster occupational safety audits. Conversely, metallic cabinets remain unrivalled for electromagnetic shielding when sensitive SCADA relays share space with high-fault-current busbars. The balance of use-cases points to sustained metallic dominance but with growing composite niches in coastal and data infrastructure.

Wall-mount products accounted for 36.25% of 2025 shipments and remain indispensable for distribution-panel retrofits in commercial towers and metro stations. Their compact footprint, hinged doors, and rear cable entry simplify tenant fit-outs. Meanwhile, modular aisle-based systems are surging at 6.98% CAGR as hyperscale operators pre-fabricate skids populated with MCCBs, transformers, and monitoring PLCs off-site. Like-for-like price premiums of 25% are offset by 35% faster go-live timelines, a metric valued by colocation providers chasing occupancy SLAs.

Free-standing floor cabinets service substations, steel mills, and wastewater plants where heavy gear and large-cross-section busbars require bottom cable entry and plinth-mount anchoring. Junction-box volumes track rooftop solar rollouts, especially in Rajasthan and Gujarat. For OEMs, form-factor diversification underpins cross-selling: Schneider's Prisma-Plus lends wall-mount segments while the SM AirSeT draws floor-mount demand. System integrators increasingly issue framework bids bundling multiple form factors, rewarding suppliers with broad catalogues and standardized internal mounting grids.

The India Electrical Enclosures Market Report is Segmented by Material Type (Metallic, Non-Metallic), Form Factor (Wall-Mount, Floor-mount/Free-standing, Junction/Terminal Boxes, Modular/Custom), Mounting Type (Indoor, Outdoor), Application (Power Generation and Distribution, Transportation, Oil and Gas, Commercial Buildings and Data Centres, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- ABB Ltd.

- Siemens AG

- Eaton Corporation plc

- Emerson Electric Co.

- Legrand SA

- Hubbell Incorporated

- Rittal GmbH and Co. KG

- BCH Electric Ltd.

- Larsen and Toubro Limited

- Trinity Touch Pvt. Ltd.

- Fibox India Pvt. Ltd.

- Boxco Industries Ltd.

- Adswitch Limited

- Pentair Technical Solutions India Pvt. Ltd.

- VSM Plast

- GE TandD India Limited

- Panel Builders India Pvt. Ltd.

- Admac Systems

- Ensto India Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging grid-modernization CAPEX by state utilities

- 4.2.2 Rising hyperscale data-centre build-outs

- 4.2.3 Mandatory fire-safety upgrades in public buildings (NBC-2016)

- 4.2.4 Rapid electrification of Indian Railways

- 4.2.5 'Production-Linked Incentive' (PLI) push for switch-gear localisation

- 4.2.6 Growth of rooftop-solar OandM ecosystem

- 4.3 Market Restraints

- 4.3.1 Steel and aluminium price volatility

- 4.3.2 Proliferation of counterfeit IP-rated products

- 4.3.3 Fragmented state-level certification regimes

- 4.3.4 Supply-chain bottlenecks for silicone gaskets

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Metallic

- 5.1.2 Non-metallic

- 5.2 By Form Factor

- 5.2.1 Wall-mount

- 5.2.2 Floor-mount / Free-standing

- 5.2.3 Junction / Terminal boxes

- 5.2.4 Modular / Custom

- 5.3 By Mounting Type

- 5.3.1 Indoor

- 5.3.2 Outdoor

- 5.4 By Application

- 5.4.1 Power Generation and Distribution

- 5.4.2 Transportation (Rail, Metro, Airports)

- 5.4.3 Oil and Gas

- 5.4.4 Commercial Buildings and Data Centres

- 5.4.5 Process Industries (FandB, Pharma, Chemicals)

- 5.4.6 Others Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 ABB Ltd.

- 6.4.3 Siemens AG

- 6.4.4 Eaton Corporation plc

- 6.4.5 Emerson Electric Co.

- 6.4.6 Legrand SA

- 6.4.7 Hubbell Incorporated

- 6.4.8 Rittal GmbH and Co. KG

- 6.4.9 BCH Electric Ltd.

- 6.4.10 Larsen and Toubro Limited

- 6.4.11 Trinity Touch Pvt. Ltd.

- 6.4.12 Fibox India Pvt. Ltd.

- 6.4.13 Boxco Industries Ltd.

- 6.4.14 Adswitch Limited

- 6.4.15 Pentair Technical Solutions India Pvt. Ltd.

- 6.4.16 VSM Plast

- 6.4.17 GE TandD India Limited

- 6.4.18 Panel Builders India Pvt. Ltd.

- 6.4.19 Admac Systems

- 6.4.20 Ensto India Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment