PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940742

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940742

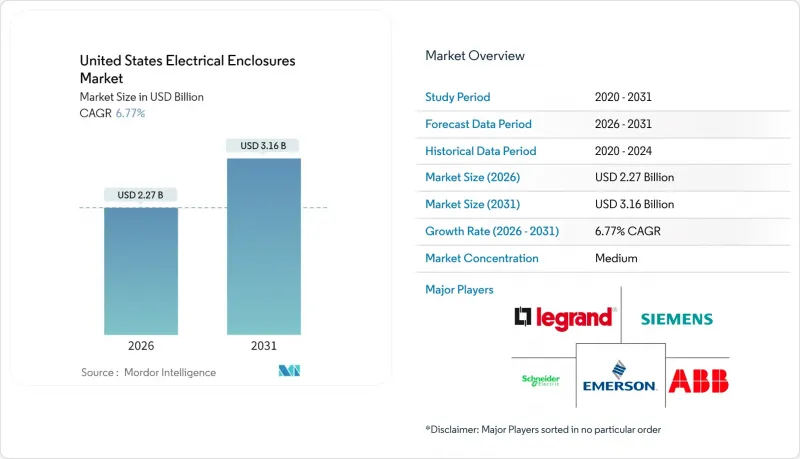

United States Electrical Enclosures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States Electrical Enclosures Market is expected to grow from USD 2.13 billion in 2025 to USD 2.27 billion in 2026 and is forecast to reach USD 3.16 billion by 2031 at 6.77% CAGR over 2026-2031.

Robust capital outlays for grid resilience, utility-scale solar projects, and electric truck charging depots are converging to sustain double-digit unit demand. Utilities alone budgeted USD 179 billion in 2024 for transmission and distribution hardware, a spending pool that directly specifies weather-sealed, cyber-secure cabinets. Data center construction running at a USD 29.99 billion annual rate is shifting the mix toward free-standing, large-volume housings suited for high-density power distribution. California's mandate for 157,000 medium- and heavy-duty chargers by 2030 underpins a new class of megawatt-rated enclosures. These infrastructure themes collectively expand the addressable market for US electrical enclosures across utilities, renewables, transportation, and digital infrastructure.

United States Electrical Enclosures Market Trends and Insights

Surging CAPEX in U.S. Grid-Hardening Programs

Utility owners are boosting five-year capital plans by USD 23.5 billion, with PPL alone lifting its budget 40% to USD 20 billion. Distribution substation spend hit USD 6.1 billion in 2023, more than tripling 2003 levels. Each retrofit specifies NEMA 4X or IP66 cabinets able to endure wind-borne debris and flood exposure while sheltering smart relays. Enhanced thermal management and EMI shielding now form baseline requirements, pushing average selling prices higher. As extreme-weather events intensify, utilities are locking in multi-year enclosure contracts, giving the US electrical enclosures market durable order visibility.

Rapid Build-Out of Utility-Scale Solar and Storage Farms

Department of Defense guide specs obligate NEMA 3R combiner boxes and NEMA 4X control cabinets that tolerate -25 °C to +57 °C ranges. Storage arrays impose stricter demands, including vented gas management sections and sealed electronics bays, as illustrated by Class I Div 2 systems from Solar Electric Supply. The boom in projects above 1 MW is enlarging physical footprints, spurring uptake of modular, stackable enclosures. Texas and Florida are setting procurement pace, and each gigawatt of solar capacity typically translates to 15,000-20,000 new cabinets. Consequently, the US electrical enclosures market is pivoting toward larger, pre-engineered assemblies with higher ingress-protection ratings.

Commodity Price Volatility for Steel and Aluminum

New 25% tariffs on Canadian and Mexican inputs drove average steel conduit costs up 14% by March 2025, while aluminum shortages pushed panel prices 22% higher. China's output cap at 45 million tonnes and drought-hit smelters lift global premiums, and the World Bank expects tightness to persist through 2025. U.S. producers face power rates almost double those in Canada, inflating conversion costs. Manufacturers are inserting escalation clauses and carrying larger raw-material inventories, which strains working capital and tempers the US electrical enclosures market expansion over the near term.

Other drivers and restraints analyzed in the detailed report include:

- Electrification of Commercial Vehicle Depots

- Federal Tax Incentives for Domestic Panel Manufacturing

- Sluggish Non-Residential Construction in 2024-2025

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metallic cabinets retained 70.54% command of the US electrical enclosures market in 2025, underpinned by steel's mechanical resilience and aluminum's EMI shielding. Stainless grades such as 316L headline offshore and food-processing orders, whereas carbon steel dominates volume buyers. The non-metallic cohort, expanding at 7.33% CAGR, features polycarbonate and glass-reinforced polymer housings that slash weight and eliminate corrosion. Emerging wireless instrumentation uses GRP to preserve 2.4 GHz signal fidelity, broadening utility in IIoT rollouts.

Polycarbonate boxes rated NEMA 4X and IP68 now serve coastal PV combiner arrays, delivering UV stability and silicone-gasket sealing at half the weight of steel. OEMs appreciate drop-in compatibility with UL 508A panel builds, minimizing redesign friction. As tariffs inflate metal input costs, price parity is approaching, expanding addressable applications. Continued diversification into composites promises to lift non-metallic penetration and reshape future material splits within the US electrical enclosures market.

Free-size or full-size (above 50 L) accounted for 33.01% of the shipments, mirroring distributed PLC and sensor duties in factories. Modular or configurable systems are projected to grow at a 7.55% CAGR, propelled by substation retrofits and data-center switchboards. AI workloads push rack power densities toward 600 kW, obliging 800 V HVDC distribution that demands bigger, thermally managed housings.

Utility segments adopt walk-in control shelters that bundle relays, batteries, and communications inside one structure, cutting field wiring time. Modular cabinet ecosystems let operators bolt incremental bays as loads grow, safeguarding capital budgets. This scalability theme cements the strategic value of large-format offerings and increases their revenue mix inside the US electrical enclosures market.

The United States Electrical Enclosures Market Report is Segmented by Material Type (Metallic, and Non-Metallic), Form Factor (Small, Compact, Free-Size, and Modular), Mounting Type (Wall-Mounted, Floor-Mounted, Underground, and Pole-Mounted), End-User Industry (Energy and Power, Oil and Gas, Industrial Manufacturing and Robotics, Data Centers and Telecom, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- ABB Ltd

- Eaton Corporation plc

- Hubbell Inc.

- nVent Electric plc

- Rittal GmbH and Co. KG

- Legrand SA

- Siemens AG

- Emerson Electric Co.

- Hammond Manufacturing Ltd.

- AZZ Inc.

- Adalet (Scott Fetzer Co.)

- Austin Electrical Enclosures, LLC

- Bison ProFab, Inc.

- Saginaw Control and Engineering, Inc.

- Stahlin Enclosures (Atkore Inc.)

- Allied Moulded Products, Inc.

- Pentair plc (Schroff)

- Integra Enclosures, LLC

- Fibox USA, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging CAPEX in U.S. grid-hardening programs

- 4.2.2 Rapid build-out of utility-scale solar and storage farms

- 4.2.3 Electrification of commercial vehicle depots

- 4.2.4 Federal tax incentives for domestic panel manufacturing

- 4.2.5 AI-enabled predictive maintenance enclosures

- 4.2.6 Growing demand for cyber-secure IIoT ready enclosures

- 4.3 Market Restraints

- 4.3.1 Commodity price volatility for steel and aluminum

- 4.3.2 Sluggish non-residential construction in 2024-2025

- 4.3.3 High certification costs for UL 508A/NEMA 4X smart enclosures

- 4.3.4 Limited interoperability standards for wireless sensors inside metal cabinets

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Electrical Enclosure Standards

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Intensity of Competitive Rivalry

- 4.8.5 Threat of Substitutes

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Metallic (Carbon Steel, Stainless Steel, Aluminum)

- 5.1.2 Non-metallic (Polycarbonate, Fiberglass, Polyester, ABS)

- 5.2 By Form Factor

- 5.2.1 Small (less than or equal to 10 L)

- 5.2.2 Compact (10-50 L)

- 5.2.3 Free-size / Full-size (above 50 L)

- 5.2.4 Modular / Configurable systems

- 5.3 By Mounting Type

- 5.3.1 Wall-mounted

- 5.3.2 Floor-mounted / Free-standing

- 5.3.3 Underground / Pad-mounted

- 5.3.4 Pole-mounted

- 5.4 By End-user Industry

- 5.4.1 Energy and Power

- 5.4.2 Oil and Gas

- 5.4.3 Industrial Manufacturing and Robotics

- 5.4.4 Metals and Mining

- 5.4.5 Transportation (Rail, Road, Air, EV-charging)

- 5.4.6 Data Centres and Telecom

- 5.4.7 Food and Beverage and Pharmaceuticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 ABB Ltd

- 6.4.3 Eaton Corporation plc

- 6.4.4 Hubbell Inc.

- 6.4.5 nVent Electric plc

- 6.4.6 Rittal GmbH and Co. KG

- 6.4.7 Legrand SA

- 6.4.8 Siemens AG

- 6.4.9 Emerson Electric Co.

- 6.4.10 Hammond Manufacturing Ltd.

- 6.4.11 AZZ Inc.

- 6.4.12 Adalet (Scott Fetzer Co.)

- 6.4.13 Austin Electrical Enclosures, LLC

- 6.4.14 Bison ProFab, Inc.

- 6.4.15 Saginaw Control and Engineering, Inc.

- 6.4.16 Stahlin Enclosures (Atkore Inc.)

- 6.4.17 Allied Moulded Products, Inc.

- 6.4.18 Pentair plc (Schroff)

- 6.4.19 Integra Enclosures, LLC

- 6.4.20 Fibox USA, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment