PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934889

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934889

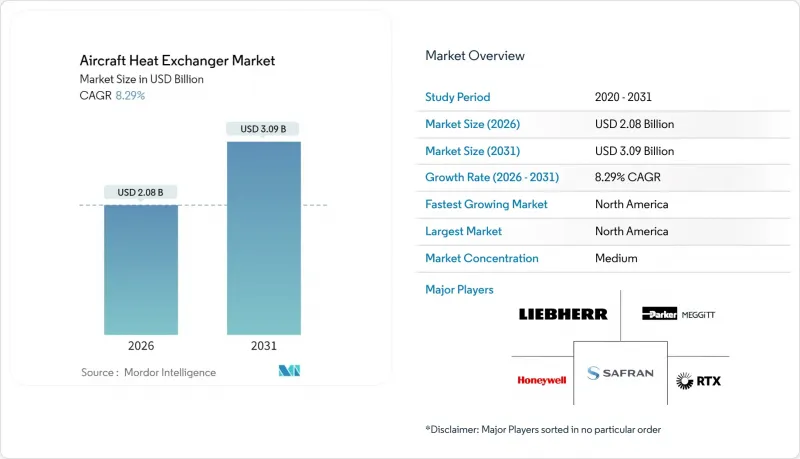

Aircraft Heat Exchanger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Aircraft heat exchanger market size in 2026 is estimated at USD 2.08 billion, growing from 2025 value of USD 1.92 billion with 2031 projections showing USD 3.09 billion, growing at 8.29% CAGR over 2026-2031.

Fleet modernization programs, stricter cabin-air quality regulations, and a shift toward hydrogen-electric and hybrid propulsion are expanding the aircraft heat exchanger market. At the same time, aftermarket retrofits are gaining prominence as airlines extend the life cycles of their assets. The flat-tube architecture facilitates adoption because it pairs high thermal efficiency with compact form factors, which are essential for weight-sensitive single-aisle jets. Engine systems maintain the largest revenue base, yet environmental control systems (ECS) show the fastest growth as carriers prioritize passenger well-being. North America dominates in terms of value and growth due to its dense aerospace manufacturing base and accelerating defense procurement.

Global Aircraft Heat Exchanger Market Trends and Insights

Ramp-up in narrowbody and regional jet production

Single-aisle jets comprise over three-quarters of the 44,000 aircraft deliveries Boeing foresees by 2043, keeping assembly lines busy and lifting demand for compact thermal-management components. Heat exchanger suppliers secure multiyear block orders early in production to avoid line stoppages, a lesson underscored by recent logistics bottlenecks. Flat-tube cores benefit most because their high surface-area-to-volume ratio suits space-constrained nacelles and slimline wings. Parallel investment in advanced manufacturing, such as automated vacuum brazing, supports higher output without compromising aerospace-grade tolerances. Overall, rising single-aisle throughput adds 2.1 percentage points to the forecast CAGR for the aircraft heat exchanger market.

Fleet-wide ECS retrofit programs for cabin air quality

Post-pandemic passenger expectations and evolving air-quality mandates spur carriers to retrofit environmental control systems rather than wait for new aircraft slots. CTT Systems' humidification kits, used by more than 60 airlines, demonstrate real-world traction. Retrofits typically integrate into overnight maintenance checks, generating immediate operational payback and increasing interest in modular heat-exchanger cartridges as airlines monetize "well-being" cabins. ECS innovation extends beyond humidity control to particulate filtration and active cabin-temperature zoning, each requiring additional heat load dissipation. These retrofit campaigns add 1.8 percentage points to long-term growth for the aircraft heat exchanger market.

Nickel and aluminium input-cost volatility

Raw materials account for up to two-thirds of the heat exchanger's cost, making it challenging to absorb tariff swings and commodity price fluctuations. The 25% tariff restored on certain metals in March 2025 elevates aerospace input prices in the US. Suppliers respond by dual-sourcing, hedging futures contracts, and qualifying alternative alloys; yet, margin pressure persists, trimming 1.4 percentage points off the aircraft heat exchanger market's CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Shift to high-temperature ceramic HX materials

- Hydrogen-electric propulsion waste-heat recovery

- Qualification bottlenecks for new HX designs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flat tube designs captured 64.42% of the aircraft heat exchanger market share in 2025, thanks to their superior surface area utilization and low pressure drop, which enables compact installations near engines and aircraft wings. Demand scales with single-aisle production, while additive manufacturing allows engineers to refine tube geometry, resulting in a mass reduction of up to 15%. The resulting 8.80% CAGR positions flat-tube units to reach USD 2.05 billion by 2031, accounting for most of the aircraft heat exchanger market size during the forecast period.

Plate-fin configurations remain indispensable for ultra-high-temperature or high-pressure environments, particularly on military platforms prioritizing robustness over minimal weight. Advances in silicon-carbide and graphite-foam fins extend their service window to 1,300 °C, opening new applications in next-generation turbine cores. As qualification hurdles are cleared, plate-fin devices are expected to maintain steady volumes, albeit at lower growth rates, retaining niche relevance in the broader aircraft heat exchanger market.

Fixed-wing programs accounted for 69.72% of 2025 revenue, primarily driven by commercial transports and tactical military jets. Substantial order backlogs, especially for fuel-efficient narrowbody models, propel a 8.97% CAGR, keeping fixed-wing platforms the anchor of the aircraft heat exchanger market size through 2031. Concurrently, next-generation fighters require a doubling of cooling capacity to support high-power avionics and directed-energy payloads.

Rotorcraft and tiltrotors provide steady, maintenance-driven demand, yet unmanned aerial vehicles (UAVs) show the fastest unit expansion. As defence forces extend loiter times beyond 40 hours, lightweight exchangers become mission-critical. Commercial drones for cargo and surveillance are also gaining traction; however, their absolute revenue contribution remains modest until urban air mobility (UAM) fleets scale up later in the decade.

The Aircraft Heat Exchanger Market Report is Segmented by Type (Plate-Fin and Flat Tube), Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, and More), Application (Environmental Control Systems, Engine Systems, Electronic Pod Cooling, and Hydraulic Cooling), Vendor (OEM and Aftermarket), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America enjoys unmatched scale in design, production, and sustainment activities, allowing suppliers to amortise development spending across civil and military programs. Government contracts for next-generation fighters and unmanned systems generate long-cycle demand, while commercial OEMs rely on domestic foundries and additive manufacturing bureaus for critical heat-transfer cores. Tariff-driven metal cost spikes raise near-term cost pressure, yet supply-chain localization initiatives partly offset this headwind.

Europe leverages Airbus's widebody backlog and leadership in sustainable aviation technology. Collaborative research, such as Liebherr-Airbus' electrical ECS, gives European suppliers an early mover advantage in bleed-less architectures. Partnerships between Safran and HAL, or Air Liquide, widen access to forged parts and hydrogen expertise, supporting robust mid-term growth despite comparatively lower defense outlays than those of the US.

Asia-Pacific region's rise stems from fleet expansion and localization policies. Indian MRO providers scale shop capacity, attracting GTF and LEAP engine overhauls that demand exchanger servicing. Chinese OEMs are investing in superalloy processing to support their indigenous engine programs, thereby gradually reducing their reliance on Western supply chains. While average selling prices are lower than in Western markets, volume expansion continues to drive regional revenue growth above 8.9%.

- Safran SA

- TAT Technologies Ltd.

- Honeywell International Inc.

- Parker-Hannifin Corporation

- Triumph Group, Inc.

- Wall Colmonoy Corporation

- Boyd Corporation

- THERMOVAC Aerospace Pvt. Ltd.

- AMETEK, Inc.

- RTX Corporation

- Unison Industries, LLC

- Intergalactic (General Electric Company)

- Sumitomo Precision Products Co., Ltd.

- Morpheus Designs

- Turbotec Products, Inc.

- Liebherr Group

- JAMCO Corporation

- Parfuse Corporation

- Signia Aerospace

- Sintavia, LLC

- Airmark Components

- Conflux Technology Pty Ltd.

- AddUp SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ramp-up in narrowbody and regional jet production

- 4.2.2 Fleet-wide ECS retrofit programs for cabin air-quality

- 4.2.3 Shift to high-temperature ceramic HX materials

- 4.2.4 Hydrogen-electric propulsion waste-heat recovery

- 4.2.5 Additive-manufactured micro-channel cores

- 4.2.6 Defense UAV endurance-extension initiatives

- 4.3 Market Restraints

- 4.3.1 Nickel and aluminum input-cost volatility

- 4.3.2 Qualification bottlenecks for new HX designs

- 4.3.3 Supply-chain consolidation raising OEM dependency

- 4.3.4 Weight-penalties versus integrated thermal-management

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Plate-Fin

- 5.1.2 Flat Tube

- 5.2 By Platform

- 5.2.1 Fixed-Wing Aircraft

- 5.2.2 Rotary-Wing Aircraft

- 5.2.3 Unmanned Aerial Vehicles

- 5.3 By Application

- 5.3.1 Environmental Control Systems

- 5.3.2 Engine Systems (Oil/Fuel/Air)

- 5.3.3 Electronic Pod Cooling

- 5.3.4 Hydraulic Cooling

- 5.4 By Vendor

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Safran SA

- 6.4.2 TAT Technologies Ltd.

- 6.4.3 Honeywell International Inc.

- 6.4.4 Parker-Hannifin Corporation

- 6.4.5 Triumph Group, Inc.

- 6.4.6 Wall Colmonoy Corporation

- 6.4.7 Boyd Corporation

- 6.4.8 THERMOVAC Aerospace Pvt. Ltd.

- 6.4.9 AMETEK, Inc.

- 6.4.10 RTX Corporation

- 6.4.11 Unison Industries, LLC

- 6.4.12 Intergalactic (General Electric Company)

- 6.4.13 Sumitomo Precision Products Co., Ltd.

- 6.4.14 Morpheus Designs

- 6.4.15 Turbotec Products, Inc.

- 6.4.16 Liebherr Group

- 6.4.17 JAMCO Corporation

- 6.4.18 Parfuse Corporation

- 6.4.19 Signia Aerospace

- 6.4.20 Sintavia, LLC

- 6.4.21 Airmark Components

- 6.4.22 Conflux Technology Pty Ltd.

- 6.4.23 AddUp SAS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment