PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934899

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934899

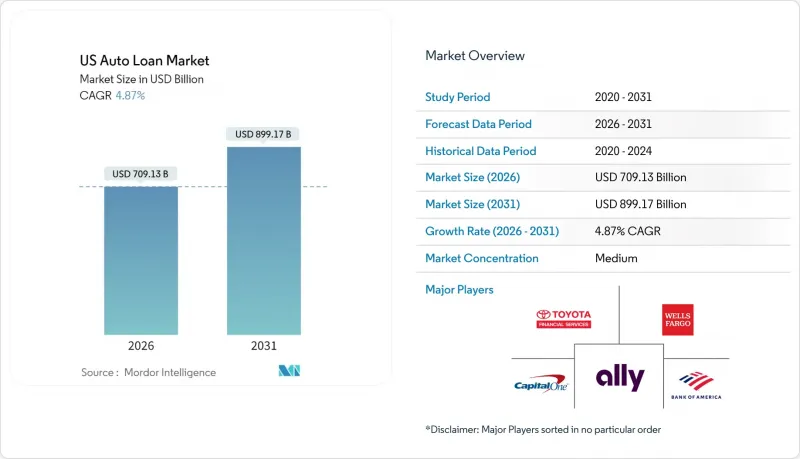

US Auto Loan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The US Auto Loan Market is expected to grow from USD 676.20 billion in 2025 to USD 709.13 billion in 2026 and is forecast to reach USD 899.17 billion by 2031 at 4.87% CAGR over 2026-2031.

Rising vehicle prices, lower federal funds rates, and rapid digitalization keep demand for vehicle financing steady, even as credit standards tighten. Used-vehicle financing maintains clear leadership because average new-vehicle prices have climbed beyond the reach of many middle-income households. Fintech entrants grow briskly on the back of alternative data underwriting that opens credit access to near-prime and sub-prime borrowers. Commercial vehicles attract heightened interest from fleets serving last-mile delivery, while light-truck popularity pushes average ticket size up. Longer loan tenures above five years are gaining traction as borrowers try to keep monthly instalments manageable despite higher total interest outlays.

US Auto Loan Market Trends and Insights

Rising Vehicle Prices Inflating Average Loan Amounts

Average transaction prices climbed above USD 48,000 in 2024, forcing borrowers to stretch repayment horizons beyond 72 months for affordability[. Lenders welcome the higher principal balances because lifetime interest income rises, yet they also raise reserves as loss severity grows when defaults occur. Higher pricing accelerates the consumer pivot toward used vehicles, where comparable utility is available at sizeable discounts. Supply shortages of critical components such as semiconductors continue to constrain new-vehicle output through 2025, keeping price pressure elevated. Lenders now rely more heavily on income-verification algorithms that flag price-to-income ratios breaching 15% to limit exposure.

Digitization of Loan Origination & Approval Processes

Machine-learning engines deliver credit decisions in under two minutes and cut manual underwriting costs by 30%, producing 10.2% higher loan profitability with 6.8% fewer defaults than human review. API links among lenders, dealerships, and e-commerce portals enable a single-screen "shop-and-finance" journey that slashes abandonment rates. Digital workflows also boost geographic reach, letting regional banks acquire customers several states away without branch infrastructure. During economic slowdowns, the cost advantage of cloud-native origination helps lenders protect net-interest margins against competitive discounting. Compliance modules within these platforms auto-update when federal guidance changes, reducing legal risk and audit findings.

Federal Reserve Rate Hikes Raising Borrowing Costs

Successive rate hikes pushed average auto-loan APRs beyond 7% by late 2024, shrinking the qualified borrower pool by roughly one-fifth. Sub-prime applicants now face double-digit pricing, driving many toward buy-here-pay-here outlets or ride-sharing alternatives. Lenders counter by lengthening terms to 84 months, though that undermines equity build-up and raises loan-to-value ratios above 110% at origination. Credit unions leverage cheaper deposit funding to hold rates lower than large banks, fuelling regional refinancing waves. Dealers respond with bigger manufacturer cash incentives that shift the cost burden back onto OEMs' captive finance subsidiaries.

Other drivers and restraints analyzed in the detailed report include:

- Growth in EV Sales Demanding New Financing Products

- Light-Truck Dominance Boosting Average Ticket Size

- Rising Delinquency & Default Rates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger-vehicle loans accounted for 86.25% of the US auto loan market size in 2025 because households still rely heavily on private mobility. Nonetheless, the commercial-vehicle slice is set to expand at a 6.08% CAGR through 2031 as e-commerce accelerates parcel volumes and gig-driving platforms proliferate. Demand concentrates on Class 3-5 trucks and cargo vans used for last-mile delivery, courier services, and mobile workshops. Specialized lenders integrate telematics into loan covenants, tracking duty cycles and encouraging preventive maintenance that preserves collateral value. Rising diesel expenses and emissions regulations encourage fleet electrification, opening an adjacent niche for battery-lease overlays.

Commercial underwriting straddles personal and business credit, requiring cash-flow analyses alongside FICO scores. Banks leverage treasury relationships with small firms to cross-sell equipment loans and business checking accounts, locking in sticky deposits. Fintechs deploy cash-flow scraping of real-time POS data to evaluate sole-proprietor applicants who lack traditional statements. Insurance add-ons that guarantee downtime coverage gain popularity, smoothing payment capacity if trucks sit idle. The US auto loan market size for commercial assets will therefore compound faster than passenger balances as logistics intensity rises across suburban and rural ZIP codes.

Cars-including sedans, hatchbacks, and crossovers-accounted for 87.35% of the US auto loan market size in 2025, yet pickup trucks and small vans will expand at 7.05% CAGR through 2031. Pent-up demand from semiconductor shortages means dealerships carry reservation lists that still roll into 2025 deliveries, sustaining pipeline visibility. Lifestyle marketing frames pickups as family haulers and weekend adventure gear, broadening their demographic appeal. Captive finance units respond with trim-level-specific residual-value tables that reward buyers choosing option packages with historically strong resale.

Fuel economy regulations push OEMs to fit smaller turbo engines and hybrid powertrains into pickups, slightly improving operating costs and making higher MSRPs more palatable. Secondary-market analytics show three-year-old crew-cab trucks retaining 65-70% of their original value, superior to large sedans at 50-55%, reducing lender loss severity. The US auto loan market share of pickups thus grows organically as risk-reward metrics stay attractive. Conversely, motorcycle and three-wheeler financing remains niche, limited by seasonal usage and insurer constraints.

The US Auto Loan Market Report is Segmented by Vehicle Type (Passenger Vehicle, Commercial Vehicle), Vehicle Model (Motorcycles/Scooters, Cars, and More), Ownership (New Vehicles, Used Vehicles), Provider Type (Banks, Non-Banking Financial Institutions, and More), and Tenure (Less Than 3 Years, 3-5 Years, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ally Financial

- Capital One Auto Finance

- Bank of America

- Toyota Financial Services

- Wells Fargo Dealer Services

- Chase Auto

- Santander Consumer USA

- GM Financial

- Ford Credit

- US Bank

- PNC Bank

- Nissan-Infiniti Finance

- TD Auto Finance

- Hyundai Capital America

- Subaru Motors Finance

- Credit Acceptance Corp

- CarMax Auto Finance

- DriveTime

- LendingTree

- Carvana Finance

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising vehicle prices inflating average loan amounts

- 4.2.2 Digitization of loan origination & approval processes

- 4.2.3 Growth in EV sales demanding new financing products

- 4.2.4 Light-truck dominance boosting average ticket size

- 4.2.5 Embedded finance within online car marketplaces

- 4.2.6 Telematics-based risk pricing unlocking sub-prime growth

- 4.3 Market Restraints

- 4.3.1 Federal-Reserve rate hikes raising borrowing costs

- 4.3.2 Rising delinquency & default rates

- 4.3.3 Mobility subscriptions reducing auto-ownership appetite

- 4.3.4 CFPB data-sharing & fee rules squeezing ancillary income

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicle

- 5.1.2 Commercial Vehicle

- 5.2 By Vehicle Model

- 5.2.1 Motorcycles/Scooters

- 5.2.2 Cars (Hatchbacks, Sedans, SUVs, etc.)

- 5.2.3 Pickups and Small Vans

- 5.2.4 Trucks and Buses

- 5.2.5 Others

- 5.3 By Ownership

- 5.3.1 New Vehicles

- 5.3.2 Used Vehicles

- 5.4 By Provider Type

- 5.4.1 Banks

- 5.4.2 Non-Banking Financial Institutions

- 5.4.3 Original Equipment Manufacturers

- 5.4.4 Other Provider Types (Fintech Companies)

- 5.5 By Tenure

- 5.5.1 Less than 3 Years

- 5.5.2 3-5 Years

- 5.5.3 More than 5 years

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Ally Financial

- 6.4.2 Capital One Auto Finance

- 6.4.3 Bank of America

- 6.4.4 Toyota Financial Services

- 6.4.5 Wells Fargo Dealer Services

- 6.4.6 Chase Auto

- 6.4.7 Santander Consumer USA

- 6.4.8 GM Financial

- 6.4.9 Ford Credit

- 6.4.10 US Bank

- 6.4.11 PNC Bank

- 6.4.12 Nissan-Infiniti Finance

- 6.4.13 TD Auto Finance

- 6.4.14 Hyundai Capital America

- 6.4.15 Subaru Motors Finance

- 6.4.16 Credit Acceptance Corp

- 6.4.17 CarMax Auto Finance

- 6.4.18 DriveTime

- 6.4.19 LendingTree

- 6.4.20 Carvana Finance

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment