PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934914

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934914

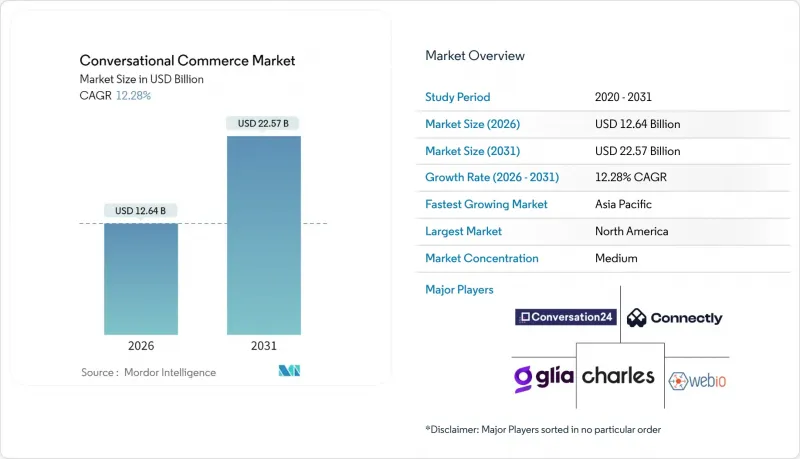

Conversational Commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Conversational Commerce Market was valued at USD 11.26 billion in 2025 and estimated to grow from USD 12.64 billion in 2026 to reach USD 22.57 billion by 2031, at a CAGR of 12.28% during the forecast period (2026-2031).

Rising consumer preference for in-chat transactions, expanding AI capabilities, and the unification of messaging standards are reshaping purchase journeys. Businesses now embed payments, product discovery, and support inside a single conversational thread, eliminating redirects that previously hampered conversion. High engagement rates have persuaded retailers, banks, and healthcare providers to prioritise conversational channels in their digital roadmaps. At the same time, technology suppliers are consolidating to control end-to-end ecosystems, a trend that amplifies platform power while intensifying competition for differentiated customer experiences.

Global Conversational Commerce Market Trends and Insights

Rapid WhatsApp Business Expansion Transforms Emerging Markets

In-chat payments embedded in WhatsApp are bringing millions of small merchants online almost overnight. Eliminating gateways speeds check-out and lifts conversion, especially in cash-dominant economies with limited card circulation. Payment interoperability inside the app also gives consumers a consistent experience across merchants, underscoring why large enterprises in India and Brazil plan widespread API adoption. The model is replicable in other high-smartphone, low-card regions, positioning WhatsApp as an express lane to digital commerce for micro and small sellers.

Voice Commerce Redefines Ambient Shopping Experiences

Smart speakers convert passive listening moments into purchase opportunities by allowing users to re-order staples or secure flash deals using short verbal prompts. Households that adopt voice assistants typically see weekly spending rise because frictionless re-ordering shortens decision windows. Brands gain incremental share of wallet by surfacing context-relevant offers during routine interactions such as cooking or commuting, creating new revenue touch points outside traditional web or app paths.

Regulatory Constraints Reshape Platform Economics

The Digital Markets Act compels designated gatekeepers to open their ecosystems and treat rival services on equal footing. Messaging platforms must now allow external payment and shopping widgets, diluting their control over transaction flows. Compliance investment diverts funds from product innovation and slows feature roll-outs, adding a structural drag to European revenue growth.

Other drivers and restraints analyzed in the detailed report include:

- RCS Adoption Creates Universal Rich Business Messaging Channel

- Live Video Commerce Creates Immersive Social Shopping Experiences

- Privacy Changes Disrupt Attribution Models

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chatbots delivered 63.25% of conversational commerce market share in 2025 by handling routine queries such as order status and store hours. Their deterministic scripts suit predictable tasks, keeping deployment cost low. However, intelligent virtual assistants are surging at a 15.17% CAGR, fuelled by transformer-based language models that sustain multi-turn dialogues and personalise recommendations. The shift positions IVAs for complex pre-purchase advisory and post-sale problem resolution, raising customer satisfaction and average order value.

North American enterprises pioneer IVA patents and pilot projects, resulting in earlier productivity gains. Retailers embed assistants across web, voice, and social channels to unify brand tone and context. As models become cheaper to fine-tune, smaller firms will add IVA layers atop existing chatbots, creating a continuum from FAQ to consultative selling within the same interface.

Software licences still represent 73.35% of 2025 revenue, reflecting widespread procurement of bot builders, NLP engines, and omni-channel orchestration suites. Yet rising implementation complexity is pushing services to expand at a 14.52% CAGR. Enterprises increasingly pay for strategic road-mapping, data integration, custom intent training, and performance optimisation.

The Shopwise proof-point shows that expert configuration can lift response accuracy to 95% and cut product discovery time by 71%, illustrating why enterprises view professional services as an insurance policy for ROI. Managed services also address talent shortages in conversational AI, enabling continuous improvement without overstretching in-house teams.

The Conversational Commerce Market Report Segmented Into by Type (Chatbots, Intelligent Virtual Assistants), Component (Software, Services), Deployment Model (Cloud, On-Premises), Organization Size (SMEs, Large Enterprises), End-User Industries (BFSI, IT and Telecom, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 33.65% of global revenue in 2025 thanks to high card penetration, advanced cloud adoption, and a vibrant AI innovation ecosystem. Banks integrate passwordless authentication and behavioural biometrics to secure conversational purchases, driving trust in the channel. Joint ventures such as the Perplexity-PayPal partnership illustrate the region's capacity to commercialise research rapidly, reinforcing its leadership position.

Asia Pacific is the demand powerhouse, forecast to achieve 16.45% CAGR through 2031. China's mastery of live-stream commerce has set a precedent for immersive chat shopping. India's merchants flock to WhatsApp Business as a turnkey storefront, embracing in-chat payments that accommodate diverse local wallets and real-time payment rails. Southeast Asia benefits from emergent language models tailored to Thai, Vietnamese, and Bahasa, which raise response accuracy and foster adoption in multilingual markets.

Europe's trajectory is shaped by regulatory forces that temper platform dominance while promoting richer messaging standards. Mandatory RCS support from mobile operators unlocks app-like experiences inside the inbox, fuelling consumer uptake. Voice commerce adoption is highest in the United Kingdom, where smart-speaker penetration exceeds regional averages. Germany leverages conversational interfaces for B2B service management, and Spain uses chatbots to streamline tourism bookings. Fragmented payment frameworks continue to restrict completion rates in parts of Africa, yet local fintech innovation and API harmonisation efforts aim to ease barriers over the long term.

- Amazon Web Services, Inc.

- Meta Platforms, Inc.

- Google LLC

- Microsoft Corporation

- IBM Corporation

- LivePerson, Inc.

- Jio Haptik Technologies Limited

- Quiq, Inc.

- Attentive Mobile, Inc.

- Octane AI, Inc.

- SleekFlow Technologies Limited

- Charles GmbH

- Connectly, Inc.

- Glia Technologies, Inc.

- Conversation24 Ltd.

- Webio Ltd.

- Respond.io Ltd.

- Yalo, Inc.

- Boost AI AS

- Sprinklr, Inc.

- Invoca, Inc.

- Inbenta Holdings Inc.

- CogniCor Technologies, Inc.

- SalesLoft, Inc.

- Wizard Commerce, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid roll-out of WhatsApp Business in India and Brazil enabling in-chat payments

- 4.2.2 Voice-enabled smart-speaker check-out penetration across US households

- 4.2.3 Mandatory RCS roll-outs by European MNOs unlocking rich messaging commerce

- 4.2.4 Live-video social commerce in China catalysing transactable chat sessions

- 4.2.5 Availability of foundation-model APIs lowering SME chatbot build cost drives the market

- 4.2.6 Bank-grade KYC plug-ins for messaging apps driving regulated BFSI use cases in North America

- 4.3 Market Restraints

- 4.3.1 EU Digital Markets Act limits platform self-preferencing of commerce flows

- 4.3.2 Apple iOS privacy updates reduce 3rd-party conversion tracking in messages

- 4.3.3 Fragmented payment standards in Africa depress completion rates

- 4.3.4 NLP accuracy gaps in low-resource Asian languages hinders the market

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macro-Economic Scenarios

- 4.9 Case Study Analysis

- 4.10 Key Trends

- 4.10.1 AI-powered chatbots

- 4.10.2 Personalisation and Data Analytics

- 4.10.3 Live Chat

- 4.10.4 Visual Commerce

- 4.10.5 Voice Commerce

- 4.10.6 Automated Text Messages

- 4.10.7 Proactive Chatbots for Brands

- 4.10.8 Interactive Buyer Guides

- 4.10.9 Promotional Activities

- 4.10.10 Social-media shopping feature upgrades

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Chatbots

- 5.1.2 Intelligent Virtual Assistants

- 5.2 By Component

- 5.2.1 Software / Solutions

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-Premises

- 5.4 By Organisation Size

- 5.4.1 Small and Medium-sized Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By End-user Industry

- 5.5.1 Banking, Financial Services and Insurance (BFSI)

- 5.5.2 Information Technology and Telecom

- 5.5.3 Healthcare

- 5.5.4 Travel and Hospitality

- 5.5.5 Retail and E-commerce

- 5.5.6 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emiartes

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Amazon Web Services, Inc.

- 6.4.2 Meta Platforms, Inc.

- 6.4.3 Google LLC

- 6.4.4 Microsoft Corporation

- 6.4.5 IBM Corporation

- 6.4.6 LivePerson, Inc.

- 6.4.7 Jio Haptik Technologies Limited

- 6.4.8 Quiq, Inc.

- 6.4.9 Attentive Mobile, Inc.

- 6.4.10 Octane AI, Inc.

- 6.4.11 SleekFlow Technologies Limited

- 6.4.12 Charles GmbH

- 6.4.13 Connectly, Inc.

- 6.4.14 Glia Technologies, Inc.

- 6.4.15 Conversation24 Ltd.

- 6.4.16 Webio Ltd.

- 6.4.17 Respond.io Ltd.

- 6.4.18 Yalo, Inc.

- 6.4.19 Boost AI AS

- 6.4.20 Sprinklr, Inc.

- 6.4.21 Invoca, Inc.

- 6.4.22 Inbenta Holdings Inc.

- 6.4.23 CogniCor Technologies, Inc.

- 6.4.24 SalesLoft, Inc.

- 6.4.25 Wizard Commerce, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment