PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937282

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937282

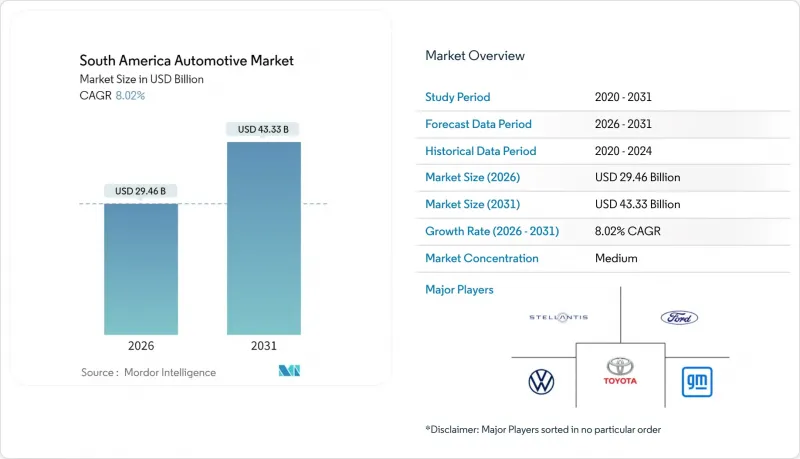

South America Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The South American automotive market is expected to grow from USD 27.28 billion in 2025 to USD 29.46 billion in 2026 and is forecast to reach USD 43.33 billion by 2031 at 8.02% CAGR over 2026-2031.

The South American automotive market continues to benefit from swift infrastructure spending, flexible-fuel policy enhancements such as Brazil's E30 mandate, and the proliferation of digital retail platforms that shorten purchase cycles and expand consumer reach. Elevated borrowing costs and semiconductor shortages continue to pose near-term headwinds, yet resilient household consumption and an expanding middle class underpin the region's long-term growth profile. Competitive intensity has risen as Stellantis commits EUR 5.6 billion through 2030, and Chinese OEMs localize production to avoid rising Mercosur tariffs, all of which is reshaping the product mix, technology adoption, and supplier ecosystems.

South America Automotive Market Trends and Insights

OEM Investments in Regional Vehicle Platforms

In South America, growing sales of traditional and electrified vehicles and heightened investments from major players like Volkswagen AG and Stellantis NV have increased profitability. Stellantis alone invested EUR 5.6 billion, the most significant single commitment in regional history . Volkswagen AG allocated USD 580 million to an Argentina-based Amarok program tailored to local duty-cycle needs. At the same time, Toyota Motor and BMW Group announced multi-year expansions focusing on hybrid and flex-fuel drivetrains. Joint projects such as the GM-Hyundai collaboration covering five models and targeting 800,000 annual sales illustrate a pivot toward shared cost structures and accelerated product cadence. These localized platforms reduce currency risk, meet regional regulatory norms, and leverage Mercosur tariff preferences, collectively enhancing the competitiveness of the South American automotive market.

Post-Pandemic Rebound in GDP and Consumer Credit Availability

Regional GDP is projected to increase by 2.5% in 2025, up from 1.9% the previous year, which is expected to lift household incomes and stimulate automotive lending, even as benchmark rates remain elevated . Brazil's economy expanded by 3.4% in 2024, with an unemployment rate of 6.5%, creating a supportive backdrop for vehicle purchases. Argentina's reforms have cut monthly inflation to 2.8%, unlocking new credit channels for auto buyers, while Colombia's manufacturing output is growing annually, reinforcing the momentum in the South American automotive market. Although financing costs remain restrained, easing monetary conditions across most central banks should gradually revive loan accessibility. Stronger macroeconomic fundamentals are expected to translate into higher showroom traffic and order backlogs throughout 2025.

Elevated Financing Rates and Inflation-Driven Vehicle Prices

Brazil's Selic rate climbed to 14.25% in 2025, pushing automotive loan coupons as high as and squeezing affordability. Although Argentina's inflation has moderated, peso volatility keeps lending spreads wide, while regional currency fluctuations cloud import-price visibility. OEMs now offer tenures and subsidized rates, but credit penetration still lags pre-pandemic norms. Consequently, near-term volumes in the South American automotive market may undershoot potential until monetary conditions ease.

Other drivers and restraints analyzed in the detailed report include:

- Chinese OEM Green-Field EV Plants Using Mercosur Tariff Breaks

- Digitally Enabled Used-Car Platforms Boosting Trade-Ins

- Semiconductor Supply Volatility for Local Assembly

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars accounted for 73.68% of the South American automotive market size in 2025 and are projected to expand at a 11.95% CAGR through 2031, benefiting from rising urbanization and middle-class income gains. SUVs and crossovers lead the surge, prized for higher seating positions and perceived safety, whereas compact sedans preserve a foothold due to fuel efficiency at premium pump prices. Though smaller in unit terms, commercial vehicles underpin logistics in agriculture and mining corridors, with light pickups favored by Brazilian farms and heavy trucks powering Chilean copper exports. Two-wheelers are proliferating in congested megacities as cost-effective mobility, while off-highway equipment enjoys tailwinds from public works spending.

The passenger-car momentum is reinforced by Stellantis' plan to launch more than 40 new products by 2030, many of them on localized platforms geared to flexible-fuel drivetrains. Financing promotions aim to mitigate loan-rate headwinds that otherwise dampen showroom traffic. Meanwhile, used-car digital platforms improve trade-in liquidity, lowering the effective upgrade cost and sustaining turnover. The vehicle-type mix underscores how the South American automotive market balances personal-mobility aspirations with commercial transport imperatives.

Internal-combustion engines retained 72.95% of the South American automotive market in 2025; however, battery electrics are accelerating at a 11.15% CAGR as fiscal incentives and localized Chinese production narrow the price gaps. Brazil's E30 scheme provides a cost-parity hedge for flex-fuel engines, reducing gasoline imports and increasing domestic ethanol demand. Hybrids serve as a bridge technology, especially ethanol-compatible variants that achieve greater emission reductions compared to gasoline equivalents.

Diesel retains relevance in heavy-duty routes that span thousands of kilometers, while CNG finds niche use in municipal fleets where refueling networks exist. Fuel-cell exploration is nascent but gaining attention following Hyundai's USD 1.1 billion hydrogen roadmap for Brazil. As import tariffs on C-segment BEVs rise to 35% by 2026, localized motor and battery plants are expected to protect affordability and accelerate adoption, gradually shifting the propulsion landscape of the South American automotive market.

The South America Automotive Market Report is Segmented by Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, and Off-Highway Vehicles), Propulsion Type (Internal-Combustion Engine and Electrified Vehicles), Sales Channel (OEM/Direct, Dealer/Retail, and More), End User (Individual/Private, SME Fleets, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Stellantis NV

- Volkswagen AG

- General Motors Company

- Toyota Motor Corporation

- Ford Motor Company

- Hyundai Motor Company

- Nissan Motor Co. Ltd.

- Honda Motor Co. Ltd.

- Renault S.A.

- Mercedes-Benz Group AG

- Kia Corporation

- BYD Company Limited

- Chery Automobile Co. Ltd.

- Great Wall Motor Co. Ltd.

- Geely Automobile Holdings

- BMW AG

- Volvo Car AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Pandemic Rebound in GDP and Consumer Credit Availability

- 4.2.2 Expansion of Flexible-Fuel Incentives in Brazil

- 4.2.3 OEM Investments in Regional Vehicle Platforms

- 4.2.4 Chinese OEM Green-Field EV Plants Using Mercosur Tariff Breaks

- 4.2.5 Digitally Enabled Used-Car Platforms Boosting Trade-Ins.

- 4.2.6 Mining-Royalty Funded EV Purchase Subsidies

- 4.3 Market Restraints

- 4.3.1 Elevated Financing Rates and Inflation-Driven Vehicle Prices

- 4.3.2 Semiconductor Supply Volatility for Local Assembly

- 4.3.3 Port Congestion Delaying CKD Kits and Battery Imports

- 4.3.4 Consumer Distrust in Inter-City Charging-Network Reliability

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchbacks

- 5.1.1.2 Sedans

- 5.1.1.3 SUVs and Crossovers

- 5.1.1.4 MPVs

- 5.1.2 Commercial Vehicles

- 5.1.2.1 Light Commercial Pick-ups

- 5.1.2.2 Light Commercial Vans

- 5.1.2.3 Heavy Trucks

- 5.1.2.4 Buses and Coaches

- 5.1.3 Two-Wheelers

- 5.1.3.1 Motorcycles

- 5.1.3.2 Scooters/Mopeds

- 5.1.4 Off-Highway Vehicles

- 5.1.4.1 Agricultural Tractors

- 5.1.4.2 Construction Equipment

- 5.1.1 Passenger Cars

- 5.2 By Propulsion Type

- 5.2.1 Internal-Combustion (ICE)

- 5.2.1.1 Gasoline

- 5.2.1.2 Diesel

- 5.2.1.3 Flexible-Fuel (Ethanol)

- 5.2.1.4 Natural Gas (CNG/LNG)

- 5.2.2 Electrified Vehicles

- 5.2.2.1 Battery-Electric (BEV)

- 5.2.2.2 Hybrid Electric (HEV)

- 5.2.2.3 Plug-in Hybrid (PHEV)

- 5.2.2.4 Fuel-Cell (FCEV)

- 5.2.1 Internal-Combustion (ICE)

- 5.3 By Sales Channel

- 5.3.1 OEM / Direct Sales

- 5.3.2 Dealer and Retail Sales

- 5.3.3 Fleet and Corporate Sales

- 5.3.4 Online Direct-to-Consumer

- 5.4 By End User

- 5.4.1 Individual / Private Consumers

- 5.4.2 Small and Medium Enterprise Fleets

- 5.4.3 Large Corporate Fleets

- 5.4.4 Government and Municipal Fleets

- 5.4.5 Mobility Operators (Ride-hailing, Car-sharing)

- 5.5 By Country

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Chile

- 5.5.4 Peru

- 5.5.5 Colombia

- 5.5.6 Ecuador

- 5.5.7 Rest of South America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Stellantis NV

- 6.4.2 Volkswagen AG

- 6.4.3 General Motors Company

- 6.4.4 Toyota Motor Corporation

- 6.4.5 Ford Motor Company

- 6.4.6 Hyundai Motor Company

- 6.4.7 Nissan Motor Co. Ltd.

- 6.4.8 Honda Motor Co. Ltd.

- 6.4.9 Renault S.A.

- 6.4.10 Mercedes-Benz Group AG

- 6.4.11 Kia Corporation

- 6.4.12 BYD Company Limited

- 6.4.13 Chery Automobile Co. Ltd.

- 6.4.14 Great Wall Motor Co. Ltd.

- 6.4.15 Geely Automobile Holdings

- 6.4.16 BMW AG

- 6.4.17 Volvo Car AB

7 Market Opportunities & Future Outlook