PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939605

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939605

Africa Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

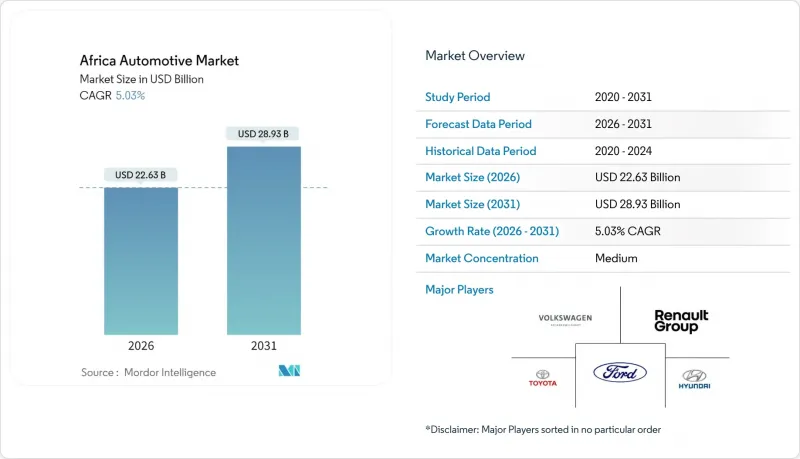

Africa automotive market size in 2026 is estimated at USD 22.63 billion, growing from 2025 value of USD 21.55 billion with 2031 projections showing USD 28.93 billion, growing at 5.03% CAGR over 2026-2031.

Rising urban middle-class spending, accelerated Chinese CKD/SKD investments, and AfCFTA tariff liberalization collectively set a positive demand trajectory for the Africa automotive market . Digital remittance platforms channeling diaspora funds into vehicle purchases and ride-hailing and last-mile delivery fleet expansion further widen addressable volumes. Regional OEMs benefit from policy incentives prioritizing local value addition, while miners' pilot programs for electric pickups in the copper-belt introduce a specialist commercial niche. Logistics bottlenecks, currency volatility, and grey-market used-car inflows remain the critical headwinds that can temper growth momentum in the Africa automotive market.

Africa Automotive Market Trends and Insights

Rising Passenger-Car Ownership Among Africa's Urban Middle Class

Vehicle ownership closely tracks income gains, and Africa's middle class is projected to swell toward 1.1 billion people by 2060. Driving incremental demand for personal mobility. Aspirational buyers gravitate toward entry-level and compact passenger models that balance affordability with urban practicality. Financing innovations such as longer-tenor auto loans and subscription models improve affordability, reinforcing the upward demand cycle across the Africa automotive market.

AfCFTA Tariff Reductions Stimulating Intra-Regional Trade

The African Continental Free Trade Area (AfCFTA) will phase out tariffs on 90% of goods, with most non-LDC nations obliged to comply within five years. Automotive OEMs stand to gain lower input costs on regional parts procurement, while clear rules of origin encourage local value addition that unlocks preferential tariffs. Forty-six countries have already submitted concession schedules, translating trade liberalization into tangible cost relief for CKD operations. Non-tariff barrier reforms-customs digitization, harmonized standards, and streamlined border procedures-are expected to release an extra USD 20 billion in trade value, a direct boon for the Africa automotive market.

Chronic Port Congestion and Inland Logistics Bottlenecks

Durban and Lagos ports rank among the world's slowest for automotive throughput, inflating dwell times and demurrage fees. Rail under-utilization and aging rolling stock shift traffic onto roads where high tolls and security risks push up landed vehicle costs. For CKD assemblers, inconsistent component arrivals disrupt just-in-time production, while exporters face missed sailing windows that erode supplier credibility. Unless ongoing corridor upgrades and single-window customs systems deliver measurable efficiencies, logistics friction will remain a drag on the Africa automotive market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Ride-Hailing and Last-Mile Delivery Fleets

- Mining-Sector EV Pilot Programs in Copper-Belt Nations

- Currency Volatility Elevating Import Costs for CKD Kits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars dominated the Africa automotive market with a 66.58% share in 2025, reflecting personal mobility's appeal across sprawling urban centers. However, freight growth under AfCFTA and booming e-commerce pivot attention toward vans, pickups, and heavy trucks that are forecast to outpace passenger models at an 8.36% CAGR. Light commercial vehicles benefit from last-mile parcel volumes, whereas medium and heavy trucks haul regionally traded goods under harmonized customs corridors. Mining firms quickly test battery-electric dumpers, signaling future substitution opportunities in heavy-duty fleets.

Commercial vehicle assemblers leverage government incentives that waive import duties on chassis and drivetrains, narrowing price gaps versus grey-market used imports. Global production reallocations also matter: Morocco surpassed South Africa in 2024 with 614,000 units, creating a deep supplier base that can pivot toward freight platforms. As logistics players formalize operations, fleet replenishment cycles shorten, sustaining momentum in this segment of the Africa automotive market.

Internal combustion engines retained a 90.68% share in 2025, underscoring affordable fuel and servicing ecosystems. Nevertheless, battery electrics are projected to post a 10.12% CAGR on the back of Chinese OEM launches and fiscal incentives in Rwanda, Kenya, and Egypt. Pre-owned hybrid imports from Japan seed early consumer familiarity with electrified drivetrains, while duty exemptions on EV components lower the total cost of ownership for commercial fleets.

Grid stability constraints slow rollout outside major metros, yet copper-belt mining sites deploy off-grid solar-battery hubs to power electric pickups. Over time, diminishing battery costs and wider charging corridors could unlock a steeper adoption curve, gradually trimming ICE dominance in the African automotive market.

The Africa Automotive Market Report is Segmented by Vehicle Type (Passenger Cars and Commercial Vehicles), Propulsion Type (ICE, and More), End-Use (Personal, Fleet and Leasing, and More), Sales Channel (CBU, SKD/CKD, and More), and by Country (South Africa, Morocco, Algeria, Egypt, Nigeria, Ghana, Kenya, Rest of Africa). Market Forecasts are Provided in Terms of Value (USD) and Volume in (Units).

List of Companies Covered in this Report:

- Toyota Motor Corporation

- Volkswagen AG

- Groupe Renault

- Hyundai Motor Company

- Ford Motor Company

- Daimler Truck AG

- Volvo Group

- Isuzu Motors Ltd

- Tata Motors Ltd

- Ashok Leyland

- Innoson Vehicle Manufacturing Co.

- Stellantis (Peugeot, Opel)

- Nissan Motor Co.

- Kia Corporation

- BAIC Group

- Chery Automobile Co.

- BYD Auto

- Geely Automobile Holdings

- Great Wall Motor (Haval)

- Guangzhou Automobile Group (GAC)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Passenger-Car Ownership Among Africa's Urban Middle Class

- 4.2.2 Growing Chinese OEM CKD/SKD Investments (E.G., BYD, Chery)

- 4.2.3 AFCFTA Tariff Reductions Stimulating Intra-Regional Trade

- 4.2.4 Expansion of Ride-Hailing and Last-Mile Delivery Fleets

- 4.2.5 Surge in Diaspora-Financed Vehicle Purchases Via Fintech Remittance Platforms

- 4.2.6 Mining-Sector EV Pilot Programs in Copper-Belt Nations Driving Demand for Electric Pickups

- 4.3 Market Restraints

- 4.3.1 Chronic Port Congestion and Inland Logistics Bottlenecks

- 4.3.2 Currency Volatility Elevating Import Costs for CKD Kits

- 4.3.3 Grey-Market Used-Vehicle Influx Curbing New-Car Demand

- 4.3.4 Shortage Of ISO-Certified Auto-Grade Steel Rolling Capacity in West Africa

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (ICE, Hybrid, BEV, FCEV)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in (USD) and Volume in (Units), 2019-2030)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Sedan

- 5.1.1.3 SUV & Crossover

- 5.1.1.4 MPV & Others

- 5.1.2 Commercial Vehicles

- 5.1.2.1 Light Commercial Vehicles (LCV)

- 5.1.2.2 Medium & Heavy Trucks

- 5.1.2.3 Buses & Coaches

- 5.1.1 Passenger Cars

- 5.2 By Propulsion Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Hybrid Electric Vehicle (HEV)

- 5.2.3 Battery Electric Vehicle (BEV)

- 5.2.4 Alternative Fuels (CNG/LPG, Flex-fuel, FCEV)

- 5.3 By End-Use

- 5.3.1 Personal Ownership

- 5.3.2 Fleet & Leasing

- 5.3.3 Ride-hailing / Mobility Service Providers

- 5.3.4 Government & Institutional

- 5.4 By Sales Channel

- 5.4.1 Completely Built-up Imports (CBU)

- 5.4.2 Semi/Completely Knocked-down Assembly (SKD/CKD)

- 5.4.3 Used-Vehicle Imports

- 5.5 By Country

- 5.5.1 South Africa

- 5.5.2 Morocco

- 5.5.3 Algeria

- 5.5.4 Egypt

- 5.5.5 Nigeria

- 5.5.6 Ghana

- 5.5.7 Kenya

- 5.5.8 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Toyota Motor Corporation

- 6.4.2 Volkswagen AG

- 6.4.3 Groupe Renault

- 6.4.4 Hyundai Motor Company

- 6.4.5 Ford Motor Company

- 6.4.6 Daimler Truck AG

- 6.4.7 Volvo Group

- 6.4.8 Isuzu Motors Ltd

- 6.4.9 Tata Motors Ltd

- 6.4.10 Ashok Leyland

- 6.4.11 Innoson Vehicle Manufacturing Co.

- 6.4.12 Stellantis (Peugeot, Opel)

- 6.4.13 Nissan Motor Co.

- 6.4.14 Kia Corporation

- 6.4.15 BAIC Group

- 6.4.16 Chery Automobile Co.

- 6.4.17 BYD Auto

- 6.4.18 Geely Automobile Holdings

- 6.4.19 Great Wall Motor (Haval)

- 6.4.20 Guangzhou Automobile Group (GAC)

7 Market Opportunities & Future Outlook