PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937291

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937291

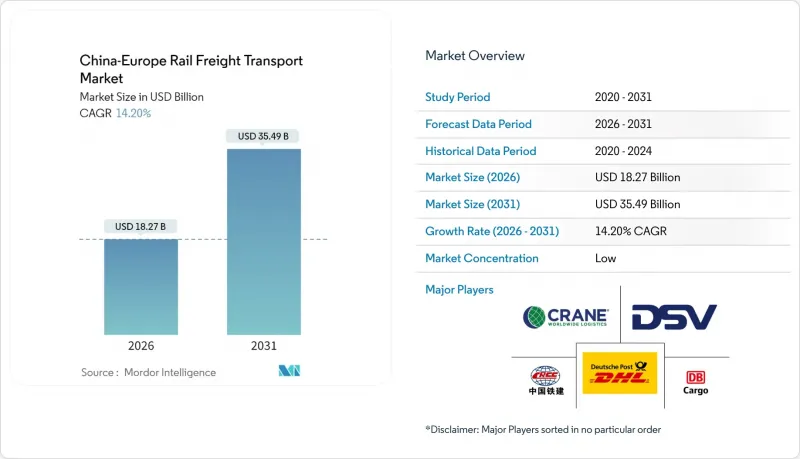

China-Europe Rail Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

China-Europe Rail Freight Transport Market size in 2026 is estimated at USD 18.27 billion, growing from 2025 value of USD 16 billion with 2031 projections showing USD 35.49 billion, growing at 14.2% CAGR over 2026-2031.

The acceleration of the market reflects deepening economic ties between Asian manufacturing hubs and European consumer markets, expanding Belt & Road Initiative (BRI) subsidies, and the growing need for mid-speed transit that sits between air and ocean freight options. As of November 2025, the trains have moved close to 12 million twenty-foot equivalent units (TEUs) of goods, reaching 232 cities across 26 European nations and over 100 cities in 11 Asian countries. Service providers continue to invest in digital platforms that streamline customs formalities, while temperature-controlled wagons open premium lanes for pharmaceutical and food shipments. Geopolitical shocks to sea lanes combined with industrial near-shoring in Central and Eastern Europe are redirecting discretionary cargo volumes toward rail, amplifying the China-Europe rail freight transport market's strategic relevance. Capacity upgrades at Kazakhstan's border and the forthcoming China-Kyrgyzstan-Uzbekistan railway promise material throughput gains that will sustain double-digit growth into the next decade.

China-Europe Rail Freight Transport Market Trends and Insights

Belt & Road Initiative Infrastructure Subsidies Drive Corridor Expansion

Large-scale BRI financing has unlocked USD 8 billion for the China-Kyrgyzstan-Uzbekistan railway, accelerating construction of a 900-kilometer shortcut that is expected to trim 7-8 days from transit times. Complementary upgrades-such as Russia's 366 billion-ruble (USD 4 billion) modernization of the Trans-Siberian and Baikal-Amur mainlines-highlight competitive pressures among transit nations vying for rail flows. The Asian Infrastructure Investment Bank calculates that USD 38 billion is required by 2030 for Eurasian track maintenance, signaling a long-term capex cycle that reinforces the China-Europe rail freight transport market's growth trajectory. Harmonized technical standards and digital customs pilots embedded in BRI projects reduce border friction and lift network fluidity, keeping the corridor attractive even as maritime freight rates normalize.

E-commerce Acceleration Transforms Cargo Mix and Service Requirements

Cross-border digital buyers increasingly choose rail for time-sensitive parcels; more than 50,000 product categories now ship by train compared with bulk commodities a decade ago. Transit of 16 days-roughly half the average sea voyage-supports just-in-time inventory strategies despite freight costs 1.5-2 times higher than ocean services. AI-enabled "Smart Customs" programs draw on 260 billion data records to automate documentation, shortening clearance windows and amplifying reliability for sellers chasing flash campaigns and seasonal peaks. As cargo steadily switches to higher-value, lower-weight merchandise, revenue per TEU has climbed even without equivalent volume growth, reinforcing a premium positioning for the China-Europe rail freight transport market.

Border Infrastructure Constraints Limit Throughput Expansion

Key junctions-including Khorgos and Brest-Malaszewicze-operate near design limits during peak seasons, causing dwell times that erode schedule reliability. Break-of-gauge transfers between 1,435 mm and 1,520 mm tracks add labor-intensive hours that digital paperwork alone cannot remove. Kazakhstan's third rail link promises 48 million tons of annual capacity by 2027 but provides little near-term relief. Until multilateral investments align, physical chokepoints will continue capping the China-Europe rail freight transport market's achievable growth.

Other drivers and restraints analyzed in the detailed report include:

- Supply Chain Diversification Accelerates Alternative Route Development

- Digital Platform Integration Enhances Operational Transparency

- Geopolitical Tensions Create Route Uncertainty and Cost Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Containerized loads commanded 71.35% of 2025 revenue, underpinning the largest slice of the China-Europe rail freight transport market share because standardized box formats streamline handling, reduce damage, and simplify cross-gauge transfers. Refrigerated units equipped with IoT probes now protect pharmaceuticals and perishable foods across the 11,000-kilometer corridor, a service niche that commands premium rates. Non-containerized consignments such as auto parts and heavy machinery are forecast to expand at a 6.12% CAGR through 2031, reflecting tailored wagon innovations that unlock higher-margin break-bulk opportunities.

Growth in e-commerce-driven apparel and electronics cargo underlines a structural tilt toward lighter, high-value goods, which favor rail's faster transit over ocean shipping. CRRC Corporation is rolling out dual-voltage locomotives and automated spreader cranes that lift transshipment productivity, reinforcing the container segment's advantages. As digital twins map real-time wagon status, operators can dynamically allocate empty boxes, further entrenching efficiency gains and supporting a steady rise in the China-Europe rail freight transport market size.

The China-Europe Rail Freight Transport Market Report is Segmented by Cargo Type (Containerized Intermodal, Non-Containerized, Liquid Bulk), by Service Type (Transportation, Services Allied To Transportation), and by Geography (Germany, Poland, Netherlands, Spain, France, United Kingdom, Italy, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- China Railway Corporation

- Deutsche Post DHL Group

- DB Cargo (Deutsche Bahn AG)

- Crane Worldwide Logistics

- DSV A/S

- Kuehne + Nagel

- Kerry Logistics Network

- Rail Cargo Group

- InterRail Group

- Nunner Logistics

- Hellmann Worldwide Logistics

- CEVA Logistics

- HLT International Logistics

- UTLC ERA

- United Parcel Service Inc

- Russian Railways (RZD)

- KORAIL

- Sinotrans Limited

- Dimerco

- Dachser

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Belt & Road Initiative (BRI) infrastructure subsidies

- 4.2.2 E-commerce demand for faster China-EU transit

- 4.2.3 Supply-chain diversification from ocean freight disruption

- 4.2.4 Digital freight platforms & real-time visibility adoption

- 4.2.5 Growth of temperature-controlled rail containers

- 4.2.6 EU-China green-freight corridor incentives

- 4.3 Market Restraints

- 4.3.1 Border-crossing congestion & capacity bottlenecks

- 4.3.2 Geopolitical tensions & sanctions on specific routes

- 4.3.3 Rail-gauge break-of-gauge costs in Central Asia

- 4.3.4 Competition from emerging Arctic sea routes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Insights on Dry Ports

- 4.9 Rail-Route Mapping & Infrastructure Developments

- 4.10 Impact of COVID-19 and Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Cargo Type (Value)

- 5.1.1 Containerized (Intermodal)

- 5.1.2 Non-containerized

- 5.1.3 Liquid Bulk

- 5.2 By Service Type (Value)

- 5.2.1 Transportation

- 5.2.2 Services Allied to Transportation

- 5.3 By European Destination Country (Value)

- 5.3.1 Germany

- 5.3.2 Poland

- 5.3.3 Netherlands

- 5.3.4 Spain

- 5.3.5 France

- 5.3.6 United Kingdom

- 5.3.7 Italy

- 5.3.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 China Railway Corporation

- 6.4.2 Deutsche Post DHL Group

- 6.4.3 DB Cargo (Deutsche Bahn AG)

- 6.4.4 Crane Worldwide Logistics

- 6.4.5 DSV A/S

- 6.4.6 Kuehne + Nagel

- 6.4.7 Kerry Logistics Network

- 6.4.8 Rail Cargo Group

- 6.4.9 InterRail Group

- 6.4.10 Nunner Logistics

- 6.4.11 Hellmann Worldwide Logistics

- 6.4.12 CEVA Logistics

- 6.4.13 HLT International Logistics

- 6.4.14 UTLC ERA

- 6.4.15 United Parcel Service Inc

- 6.4.16 Russian Railways (RZD)

- 6.4.17 KORAIL

- 6.4.18 Sinotrans Limited

- 6.4.19 Dimerco

- 6.4.20 Dachser

7 Market Opportunities & Future Outlook