PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937296

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937296

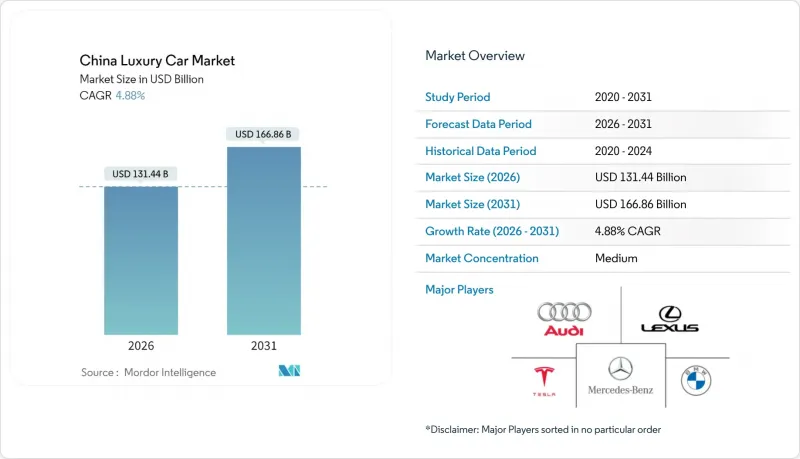

China Luxury Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The China luxury car market is expected to grow from USD 125.32 billion in 2025 to USD 131.44 billion in 2026 and is forecast to reach USD 166.86 billion by 2031 at 4.88% CAGR over 2026-2031.

This expansion is underpinned by accelerating electrification, rising disposable income in lower-tier cities, and policy support that favors new-energy vehicles. Demand momentum also stems from consumers who now view premium vehicles as mobile technology platforms, prompting manufacturers to elevate autonomous-driving capabilities and connected-services ecosystems. Competitive intensity has sharpened as domestic electric-luxury brands close traditional technology gaps, while foreign marques localize platforms to safeguard their positions within the China premium car market. Ongoing semiconductor localization and evolving tax regulations will continue to reshape margins, supply-chain strategies, and product-mix decisions across the value chain.

China Luxury Car Market Trends and Insights

Growing Consumer Wealth in Tier-2 and Tier-3 Cities

Household incomes in secondary urban centers are growing annually, outpacing tier-1 growth and spawning a new cohort of premium buyers who view vehicles as status symbols and technology showcases. Domestic brands such as Li Auto delivered 500,508 units in 2024, illustrating how aspirational families embrace large premium SUVs equipped with ADAS. Trade-in subsidies worth up to RMB 20,000 (~USD 2,800 ) have amplified purchasing power, allowing middle-class households to enter the China premium car market.

Expansion of Domestic EV-Luxury Brands

Domestic champions have combined battery-swapping networks, Level 2+ autonomy, and over-the-air upgrades to capture demand. NIO delivered 221,970 vehicles in 2024, and Li Auto reached half a million annual deliveries within five years of launch. Such growth reshapes the China premium car market by shifting the basis of competition from combustion-engine heritage to software ecosystems and service models .

Data-Security Regulation on Connected Vehicles

China's Data Security Law compels automakers to store vehicle-generated data domestically, inflating costs for foreign OEMs that must duplicate global cloud architectures. Limitations on cross-border data flows complicate over-the-air update pipelines, diminishing feature parity with global platforms and restraining differentiation in the China premium car market.

Other drivers and restraints analyzed in the detailed report include:

- L3 Autonomy Features Driving Higher ASP

- NFT-Based Digital Ownership Perks

- Premium Ride-Hailing Curbing Ownership Intent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs captured 63.12% of the Chinese premium car market 2025, underscoring consumer preference for commanding driving positions and family-oriented interiors. The SUV sub-segment will expand at a 6.25% CAGR through 2031 as battery-electric flagships like the NIO ES6 and Li Auto L9 dominate showroom traffic. Sedans maintain gravitas in executive transport, but incremental volume shifts to versatile multi-purpose vehicles designed for multi-generational households. GAC's forthcoming Level 3 rollout and Li MEGA's flexible seating highlight how automation and interior versatility set new luxury benchmarks.

The second-order effects include a stronger demand for long-wheelbase chassis and adaptive air-suspension packages that enhance ride comfort on variable road quality in lower-tier cities. Hatchbacks remain niche yet benefit from tight urban parking constraints, particularly in coastal megacities where congestion is severe. SUV leadership also advances battery-swapping adoption because larger underbodies accommodate standardized modules, reinforcing infrastructure network effects unique to the Chinese premium car market.

Internal-combustion vehicles still represented 61.95% of the 2025 volume, translating to the most significant current slice of the China premium car market size. Yet battery-electric models will climb at a 9.72% CAGR through 2031, propelled by purchase-tax exemptions, falling battery costs, and growing charger density nationwide. Plug-in hybrids serve as range-anxiety hedges, bridging coastal infrastructure gaps. Fuel-cell pilots remain experimental owing to hydrogen logistics, limiting near-term influence.

Battery-electric leadership amplifies software-centric value propositions-advanced driver-assistance, immersive infotainment, and continuous over-the-air updates-that combustion rivals cannot match. Domestic OEMs leverage vertically integrated power-electronics supply chains to reduce bill-of-materials and comply with chip-localization directives. Consequently, the China premium car market share for electric nameplates in the RMB 300,000-600,000 bracket is projected to exceed 55% by 2031, displacing turbocharged six-cylinder sedans historically favored by status-conscious executives.

The China Luxury Car Market Report is Segmented by Vehicle Body Style (Hatchbacks, Sedans, and More), Powertrain Type (Internal Combustion Engine Vehicles and Electric Vehicles), Brand Origin (Domestic Chinese Brands and Foreign Brands), and Sales Channel (Authorized Dealerships, Company-Owned Stores, and Online Direct-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Mercedes-Benz Group AG

- BMW Group

- Volkswagen Group (Audi AG)

- Lexus (Toyota Motor Corp.)

- Tesla Inc.

- Zhejiang Geely Holding (Zeekr)

- Dongfeng Motor Company

- China FAW Group (Hongqi)

- NIO Inc.

- Li Auto Inc.

- XPeng Motors

- SAIC-GM (Cadillac)

- GAC Aion

- Infiniti (Nissan Motor Co.)

- Acura (Honda Motor Co.)

- Porsche AG

- Jaguar Land Rover Ltd.

- Lincoln Motor Co. (Ford)

- Rolls-Royce Motor Cars

- Maserati S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Consumer Wealth in Tier-2 and Tier-3 Cities

- 4.2.2 Government NEV Incentives for the Premium Segment

- 4.2.3 Rising Demand for Premiumization and Brand Status

- 4.2.4 Expansion of Domestic EV-Luxury Brands (NIO, Li Auto)

- 4.2.5 L3 Autonomy Features Driving Higher ASP

- 4.2.6 NFT-Based Digital Ownership Perks

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost and Luxury Tax

- 4.3.2 Data-Security Regulation on Connected Vehicles

- 4.3.3 High-End Semiconductor Supply Constraints

- 4.3.4 Premium Ride-Hailing Curbing Ownership Intent

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Body Style

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sport-Utility Vehicles (SUVs)

- 5.1.4 Multi-purpose Vehicles (MPVs)

- 5.2 By Powertrain Type

- 5.2.1 Internal-Combustion (ICE) Vehicles

- 5.2.2 Electric Vehicles (BEV, PHEV, HEV, FCEV)

- 5.3 By Brand Origin

- 5.3.1 Domestic Chinese Brands

- 5.3.2 Foreign Brands

- 5.4 By Sales Channel

- 5.4.1 Authorized Dealerships

- 5.4.2 Company-Owned Stores

- 5.4.3 Online Direct-to-Consumer

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Mercedes-Benz Group AG

- 6.4.2 BMW Group

- 6.4.3 Volkswagen Group (Audi AG)

- 6.4.4 Lexus (Toyota Motor Corp.)

- 6.4.5 Tesla Inc.

- 6.4.6 Zhejiang Geely Holding (Zeekr)

- 6.4.7 Dongfeng Motor Company

- 6.4.8 China FAW Group (Hongqi)

- 6.4.9 NIO Inc.

- 6.4.10 Li Auto Inc.

- 6.4.11 XPeng Motors

- 6.4.12 SAIC-GM (Cadillac)

- 6.4.13 GAC Aion

- 6.4.14 Infiniti (Nissan Motor Co.)

- 6.4.15 Acura (Honda Motor Co.)

- 6.4.16 Porsche AG

- 6.4.17 Jaguar Land Rover Ltd.

- 6.4.18 Lincoln Motor Co. (Ford)

- 6.4.19 Rolls-Royce Motor Cars

- 6.4.20 Maserati S.p.A.

7 Market Opportunities & Future Outlook