PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937330

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937330

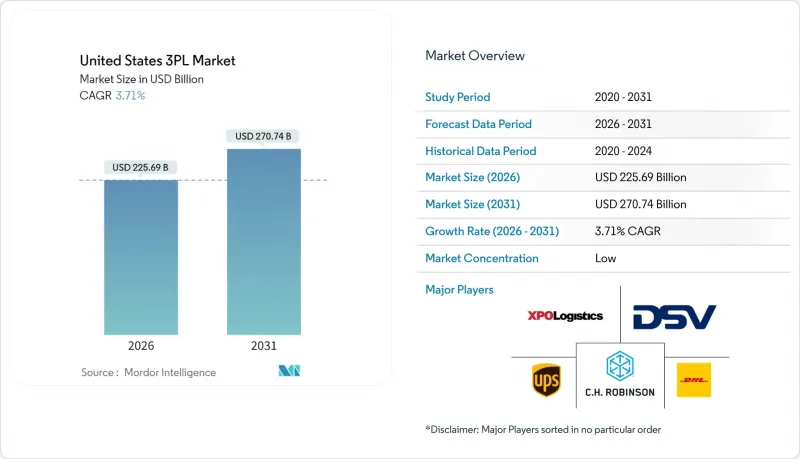

United States 3PL - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States 3PL Market is expected to grow from USD 217.62 billion in 2025 to USD 225.69 billion in 2026 and is forecast to reach USD 270.74 billion by 2031 at 3.71% CAGR over 2026-2031.

The steady expansion of the market reflects the sector's maturation, persistent supply-chain complexity, and ongoing nearshoring that pulls production and distribution closer to domestic consumers. Manufacturing customers remain the anchor segment, yet healthcare, e-commerce, and tech shippers now supply the fastest incremental revenue streams. Providers continue reallocating capital toward automation, warehouse robotics, and visibility software to counter labor scarcity and fuel price volatility. Consolidation accelerates through billion-dollar acquisitions while hybrid asset strategies spread risk in an uncertain freight-demand cycle. Competitive intensity, measured by a declining 83% shipper-3PL partnership success rate, underscores rising performance expectations in the United States third-party logistics market.

United States 3PL Market Trends and Insights

E-commerce & Omnichannel Boom

Persistent online spending-up 9.3% in 2024-anchors demand for dense national fulfillment networks, prompting DHL Supply Chain's acquisition of IDS Fulfillment that added 1.3 million sq ft of capacity. Brands diversify distribution away from coastal mega-centers toward micro-fulfillment nodes in secondary markets to compress delivery windows. Reverse-logistics complexity rises; DHL's Inmar Supply Chain Solutions deal created the largest North American returns platform, positioning providers for margin capture in circular commerce. Automation and autonomous delivery pilots continue reshaping last-mile cost structures, expanding opportunity for nimble specialists. Collectively, these dynamics keep the United States third-party logistics market on a firm multiyear growth footing.

Outsourcing for Cost & Focus on Core Competencies

Shippers concentrate on product development rather than logistics administration, transferring execution risk to scaled 3PLs. C.H. Robinson's Managed Solutions platform unifies TMS, 3PL, and 4PL services, leveraging 35 million annual shipments to deliver cost and visibility gains. Working-capital pressures push 80% of manufacturers to rebalance inventory, which in turn amplifies demand for sophisticated VAS warehousing. These structural shifts widen the service scope-and revenue pool-inside the United States third-party logistics market.

Labor Shortages in Trucking & Warehousing

Industry groups warn of a 1.2 million-driver deficit over the next decade, inflating wage bills and straining service reliability. Warehouses face similar scarcity, with 78% of shippers reporting persistent recruitment hurdles that cut into throughput. XPO's LTL 2.0 employee-engagement playbook lifted satisfaction scores 40%, hinting at cultural levers for retention. Providers also expand upskilling programs to meet growing automation and safety mandates. Until automation reaches full scale, labor scarcity remains the single largest drag on the United States third-party logistics market.

Other drivers and restraints analyzed in the detailed report include:

- Digital TMS/WMS & Automation Uptake

- Nearshoring-Driven Regional DCC Demand

- Cyber-Risk & Rising Insurance Premiums

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Domestic Transportation Management held 47.55% of the United States third-party logistics market share in 2025, showing that freight orchestration remains the bedrock service offering. Predictive pricing tools, lane-density analytics, and multimodal optimization now shape competitive positioning, enabling carriers to navigate volatile spot markets without surrendering margin. Conversely, Value-Added Warehousing & Distribution, advancing at 7.55% CAGR, is gaining strategic heft as e-commerce sellers demand inventory postponement, kitting, labeling, and same-day cutoffs. C.H. Robinson's Managed Solutions suite fuses these functions on a single dashboard, showcasing the converging service architecture that characterizes the United States third-party logistics market.

Warehouse investments also track cold-chain expansion: DHL, UPS, and Americold accelerated builds of FDA-compliant facilities with 2-8 °C zones and GDP-certified handling. Reverse-logistics units, fueled by apparel and electronics returns, added another dimension to service portfolios. Meanwhile, International Transportation Management battled capacity swings tied to trade policy and ocean-freight surcharges, yet retained relevance for global supply chains funneling inputs into nearshore plants. Altogether, bundled service models strengthen stickiness across the United States third-party logistics industry and support ongoing margin diversification.

The United States 3PL Market Report is Segmented by Service (Domestic Transportation Management, International Transportation Management, and More), by End User (Automotive, Energy and Utilities, Manufacturing, and More), by Logistics Model (Asset-Light, Asset-Heavy, Hybrid), and by Region (Northeast, Midwest, South, West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- C.H. Robinson Worldwide Inc.

- XPO Logistics

- United Parcel Service, Inc.

- DHL Group

- DSV

- Kuehne + Nagel Inc

- Hub Group, Inc.

- Ryder System, Inc.

- Expeditors International

- Lineage Logistics

- Americold Logistics

- Penske Logistics

- Schneider Logistics

- NFI Industries

- GXO Logistics

- Geodis

- CEVA Logistics

- CJ Logistics

- Saddle Creek Logistics Services

- J.B. Hunt Transport Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce & omnichannel boom

- 4.2.2 Outsourcing for cost & focus on core competencies

- 4.2.3 Digital TMS/WMS & automation uptake

- 4.2.4 Cold-chain & healthcare logistics surge

- 4.2.5 Nearshoring-driven regional DCC demand

- 4.2.6 Autonomous-truck freight corridors

- 4.3 Market Restraints

- 4.3.1 Labor shortages in trucking & warehousing

- 4.3.2 Fuel-price volatility

- 4.3.3 Cyber-risk & rising insurance premiums

- 4.3.4 Port-congestion surcharge uncertainty

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Demand from Adjacent Segments (CEP, Last-Mile, Cold-Chain)

- 4.9 General Trends in Warehousing

- 4.10 Impact of COVID-19 & Post-Pandemic Normalization

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service

- 5.1.1 Domestic Transportation Management (DTM)

- 5.1.1.1 Roadways

- 5.1.1.2 Railways

- 5.1.1.3 Airways

- 5.1.1.4 Waterways

- 5.1.2 International Transportation Management (ITM)

- 5.1.2.1 Roadways

- 5.1.2.2 Railways

- 5.1.2.3 Airways

- 5.1.2.4 Waterways

- 5.1.3 Value-Added Warehousing & Distribution (VAWD)

- 5.1.1 Domestic Transportation Management (DTM)

- 5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Energy & Utilities

- 5.2.3 Manufacturing

- 5.2.4 Life Sciences & Healthcare

- 5.2.5 Technology & Electronics

- 5.2.6 E-commerce

- 5.2.7 Consumer Goods & FMCG

- 5.2.8 Food & Beverages

- 5.2.9 Others

- 5.3 By Logistics Model

- 5.3.1 Asset-Light (Management-Based)

- 5.3.2 Asset-Heavy (Own Fleet & Warehouses)

- 5.3.3 Hybrid

- 5.4 By U.S. Region

- 5.4.1 Northeast

- 5.4.2 Midwest

- 5.4.3 South

- 5.4.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 C.H. Robinson Worldwide Inc.

- 6.4.2 XPO Logistics

- 6.4.3 United Parcel Service, Inc.

- 6.4.4 DHL Group

- 6.4.5 DSV

- 6.4.6 Kuehne + Nagel Inc

- 6.4.7 Hub Group, Inc.

- 6.4.8 Ryder System, Inc.

- 6.4.9 Expeditors International

- 6.4.10 Lineage Logistics

- 6.4.11 Americold Logistics

- 6.4.12 Penske Logistics

- 6.4.13 Schneider Logistics

- 6.4.14 NFI Industries

- 6.4.15 GXO Logistics

- 6.4.16 Geodis

- 6.4.17 CEVA Logistics

- 6.4.18 CJ Logistics

- 6.4.19 Saddle Creek Logistics Services

- 6.4.20 J.B. Hunt Transport Services

7 Market Opportunities & Future Outlook

8 Appendix