PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940673

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940673

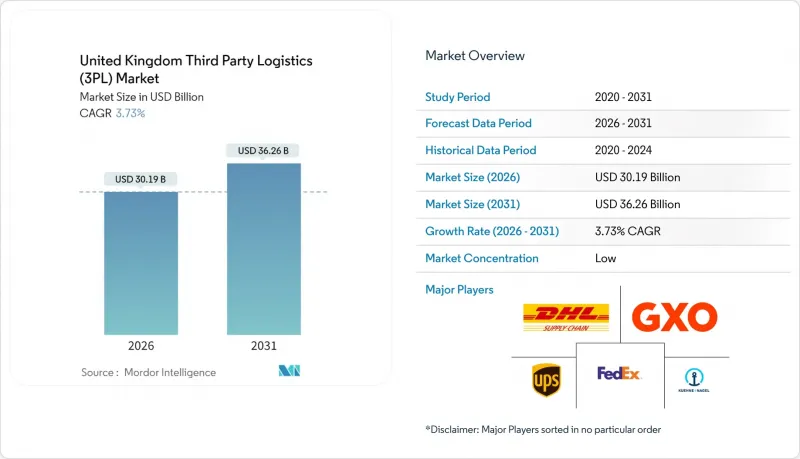

United Kingdom Third Party Logistics (3PL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom Third Party Logistics Market is expected to grow from USD 29.10 billion in 2025 to USD 30.19 billion in 2026 and is forecast to reach USD 36.26 billion by 2031 at 3.73% CAGR over 2026-2031.

The market size trajectory reflects the sector's gradual move from rapid expansion to steady maturation, shaped by Brexit-related customs friction, a deepening e-commerce culture, government decarbonization mandates, and persistent labor shortages. Businesses are migrating toward outsourced logistics partners because 3PLs can absorb regulatory shocks, aggregate technology investments, and deliver lower-carbon transport options at scale. Competitive intensity is rising as international players buy local specialists to secure port access and urban warehousing footprints, while domestic firms counter with automation and electric-fleet rollouts. Infrastructure upgrades across roads, rail, and truck stops provide new capacity yet also pressure operators to meet rising service expectations in direct-to-consumer fulfillment. Together, these forces underpin a market where resilience and flexibility determine long-term success.

United Kingdom Third Party Logistics (3PL) Market Trends and Insights

Explosive E-commerce Parcel Volumes

Online retail now represents 30% of all U.K. shopping. Rapid ordering frequencies compel 3PLs to enlarge urban micro-fulfillment footprints, evidenced by Amazon's Project Juniper network that cuts delivery windows to hours. DPD Group UK has already completed more than 2,500 autonomous last-mile deliveries in Milton Keynes, proving robotics can meet commercial service-level agreements. London's Portal Way hosts 260 dark kitchens that illustrate how quick-commerce models reshape warehousing demand. As retailers favor omnichannel fulfillment, operators that marry B2B distribution with direct-to-consumer parcel flows secure higher contract values and longer tenures.

Government Decarbonization Incentives for Freight

The government has earmarked USD 254 million for zero-emission HGV trials and set a 2040 deadline for phasing out new diesel trucks. Early movers gain bidding advantages; HIVED expanded its fully electric middle-mile fleet by ordering 11 Mercedes-Benz eActros units with 600 kWh batteries capable of 310-mile ranges. A further USD 20.96 million upgrade of 38 truck stops introduces high-capacity chargers and improved driver amenities, lowering range-anxiety barriers for electric haulage. Cold-chain transport emits 14.1 MtCO2e annually, making temperature-controlled electrification a regulatory priority. ISO 14001 certification is becoming table stakes in public-sector tenders, thereby rewarding 3PLs that invest early in sustainable assets.

Driver & Warehouse-Labor Shortage

The country is short 50,000 HGV drivers, with supply at 320,000 against demand for 370,000, limiting the expansion pace of the United Kingdom's third-party logistics market. The average driver age is 51, and 55% are within 50-65, signaling worsening attrition. Labor costs absorb more than 40% of 3PL operating spend and rose sharply after 19% of firms reported vacancies in early 2024. A USD 20.96 million fund to modernize 38 truck stops aims to improve job attractiveness, yet high housing costs in London and Manchester deter recruits. Warehouse labor gaps compound the issue as EU workers depart post-Brexit, pushing 3PLs toward robots and AI-driven slotting.

Other drivers and restraints analyzed in the detailed report include:

- Warehouse Automation & Robotics Adoption

- Post-Brexit Near-Shoring & Customs-Integrated 3PL Demand

- Brexit-Related Customs Friction & Paperwork

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The United Kingdom's third-party logistics market size attributable to Domestic Transportation Management stood at 41.45% share in 2025, mirroring the island nation's road-centric freight patterns. International Transportation Management remains critical for cross-border trade but wrestles with customs-driven volatility that depresses margins. Value-Added Warehousing & Distribution is accelerating at 7.01% CAGR as e-commerce clients outsource high-touch pick-pack, returns, and kitting tasks. Automated storage systems, climate-controlled chambers, and integrated customs areas turn warehouses into revenue-rich nodes rather than cost centers. Government road and rail upgrades worth USD 116.8 billion unlock intermodal plays, but the United Kingdom's third-party logistics market share for roads stays dominant through 2031 because urban consumption clusters hug motorway spines. Rail and short-sea players niche into renewable-energy projects requiring oversized-cargo moves, complementing rather than displacing trucking.

Growing enterprise reliance on warehousing has re-shaped contract structures. Clients demand variable-cost pricing tied to order lines, which suits the scalable nature of robotic picking. Cold-chain facilities earn premiums as climate-sensitive food and pharmaceutical flows expand. As automation compresses labor needs, operators redeploy headcount into value-added configuration and quality-check tasks. 3PLs that layer predictive analytics on inventory get preferred-supplier status, reinforcing consolidation trends.

The United Kingdom Third-Party Logistics Market Report is Segmented by Service (Domestic Transportation Management, International Transportation Management, and More), by End User (Automotive, Energy & Utilities, Manufacturing, Life Sciences & Healthcare, and More), by Logistics Model (Asset-Light, Asset-Heavy, Hybrid), and by Region (England, Scotland, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Group

- Kuehne + Nagel

- GXO Logistics

- FedEx

- United Parcel Service, Inc.

- DSV

- CEVA Logistics

- Yusen Logistics

- Rhenus Logistics

- Eddie Stobart Logistics

- Xpediator

- Bibby Distribution

- Torque Logistics

- Pointbid Logistics

- XPO Logistics

- Culina Group

- Geodis

- Parcel Hub

- Evri (Formerly Hermes)

- Walker Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive e-commerce parcel volumes

- 4.2.2 Government decarbonisation incentives for freight

- 4.2.3 Warehouse automation & robotics adoption

- 4.2.4 Post-Brexit near-shoring & customs-integrated 3PL demand

- 4.2.5 Subscription D2C models requiring micro-fulfilment

- 4.2.6 Product-security legislation boosting secure logistics

- 4.3 Market Restraints

- 4.3.1 Driver & warehouse-labour shortage

- 4.3.2 Brexit-related customs friction & paperwork

- 4.3.3 HGV-charging & grid-capacity limits for fleet electrification

- 4.3.4 Logistics-property tax rise (post-2026 revaluation)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Warehousing Market Trends

- 4.9 Demand from CEP, Last-mile, Cold-chain

- 4.10 Ecommerce Insights

- 4.11 Impact of COVID-19 & Post-pandemic Reset

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service

- 5.1.1 Domestic Transportation Management (DTM)

- 5.1.1.1 Roadways

- 5.1.1.2 Railways

- 5.1.1.3 Airways

- 5.1.1.4 Waterways

- 5.1.2 International Transportation Management (ITM)

- 5.1.2.1 Roadways

- 5.1.2.2 Railways

- 5.1.2.3 Airways

- 5.1.2.4 Waterways

- 5.1.3 Value-Added Warehousing & Distribution (VAWD)

- 5.1.1 Domestic Transportation Management (DTM)

- 5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Energy & Utilities

- 5.2.3 Manufacturing

- 5.2.4 Life Sciences & Healthcare

- 5.2.5 Technology & Electronics

- 5.2.6 E-commerce

- 5.2.7 Consumer Goods & FMCG

- 5.2.8 Food & Beverages

- 5.2.9 Others

- 5.3 By Logistics Model

- 5.3.1 Asset-Light (Management-Based)

- 5.3.2 Asset-Heavy (Own Fleet & Warehouses)

- 5.3.3 Hybrid

- 5.4 By UK Region

- 5.4.1 England

- 5.4.2 Scotland

- 5.4.3 Wales

- 5.4.4 Northern Ireland

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 DHL Group

- 6.4.2 Kuehne + Nagel

- 6.4.3 GXO Logistics

- 6.4.4 FedEx

- 6.4.5 United Parcel Service, Inc.

- 6.4.6 DSV

- 6.4.7 CEVA Logistics

- 6.4.8 Yusen Logistics

- 6.4.9 Rhenus Logistics

- 6.4.10 Eddie Stobart Logistics

- 6.4.11 Xpediator

- 6.4.12 Bibby Distribution

- 6.4.13 Torque Logistics

- 6.4.14 Pointbid Logistics

- 6.4.15 XPO Logistics

- 6.4.16 Culina Group

- 6.4.17 Geodis

- 6.4.18 Parcel Hub

- 6.4.19 Evri (Formerly Hermes)

- 6.4.20 Walker Logistics

7 Market Opportunities & Future Outlook