PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937348

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937348

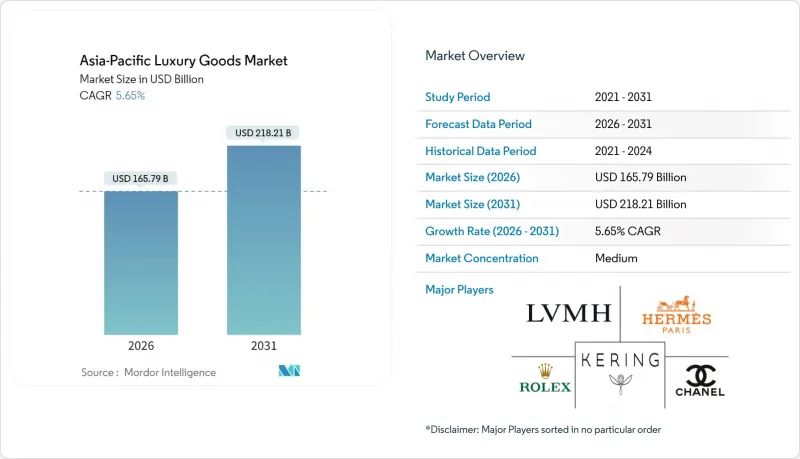

Asia-Pacific Luxury Goods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific Luxury Goods Market size in 2026 is estimated at USD 165.79 billion, growing from 2025 value of USD 156.93 billion with 2031 projections showing USD 218.21 billion, growing at 5.65% CAGR over 2026-2031.

Sustained expansion reflects deep-seated demographic shifts, with India and Southeast Asia adding large cohorts of first-time affluent shoppers, and a gradual growth in demand for jewelry products. According to the World Gold Council, the demand for gold across India was about 803 metric tons in 2024. This represented an increase of five percent in comparison to the previous year, when the gold demand was 761 metric tons. A favorable currency backdrop turns Japan into a regional shopping hub, lifting luxury sales in H1 2024 as tourists capitalize on the weak yen. Younger buyers account for a rising share of expenditure and increasingly value craftsmanship, environmental responsibility, and digital convenience. Brands respond with intensified omnichannel investments, selective price increases, and tighter control of inventory to protect exclusivity while capturing demand swings across geographies.

Asia-Pacific Luxury Goods Market Trends and Insights

Rising Brand Consciousness and Premiumization

The premiumization wave across Asia-Pacific reflects a sophisticated evolution beyond traditional status signaling toward quality-driven consumption. Chinese consumers increasingly favor high-quality products without prominent logos, indicating a maturation from conspicuous to conscious luxury consumption. This behavioral shift creates opportunities for heritage brands that emphasize craftsmanship over brand visibility, while challenging newer entrants reliant on logo-centric strategies. Government policy and tourism flows amplify that premiumisation: China's central and trade ministries have rolled out consumption-support measures and duty-free enhancements (the "International Consumption Season" and downtown duty-free policy changes) that boosted discretionary spending and duty-free luxury pull in 2024-25, while Japan's rapid inbound tourism recovery in 2024 materially raised tourist spending on high-end goods, both effects favour premium/luxury sales concentrated in core shopping destinations. For instance, according to the Japan National Tourism Organization, in 2024, the number of inbound visitors traveling to Japan amounted to approximately 36.87 million, setting a new record.

Sustainability and Ethical Preferences

Driven by heightened environmental awareness, luxury consumption patterns are undergoing a seismic shift. Regulatory frameworks, notably the EU's Corporate Sustainability Due Diligence Directive and Asia-Pacific's emerging ESG reporting mandates, are pushing luxury brands to prioritize transparency in their supply chains and to actively work on reducing their environmental footprints. In Asia, Singapore mandates climate-related disclosures for its listed companies, while Japan has bolstered its ESG reporting requirements. These regulations are not just bureaucratic hurdles; they're reshaping the very strategies of luxury brands. As consumers increasingly show a willingness to pay a premium for sustainable products, brands that champion sustainability are beginning to eclipse their traditional luxury counterparts in market share. This trend is especially pronounced among younger consumers, who are not just seeking luxury but are also championing environmental responsibility. Brands that genuinely weave sustainability into their core values are reaping significant competitive advantages.

Counterfeit Products and Brand Dilution

Despite bolstered enforcement mechanisms and tech solutions, luxury brands in the Asia-Pacific grapple with persistent intellectual property violations. Brands are increasingly turning to blockchain authentication and digital verification systems as part of their anti-counterfeiting investments. However, these sophisticated counterfeit operations swiftly adapt, often sidestepping these protective measures. The rise of online marketplaces further complicates brand protection, demanding constant monitoring and enforcement. This not only escalates operational costs but also diverts resources from growth pursuits. Moreover, uneven intellectual property enforcement across regions adds layers of compliance challenges, pushing brands to tailor their protection strategies for each jurisdiction. As counterfeit sophistication outpaces traditional authentication, educating consumers becomes paramount. This urgency drives brands to bolster investments in customer awareness initiatives and advanced verification technologies.

Other drivers and restraints analyzed in the detailed report include:

- Product Innovation and Customization

- Tourism and Duty-Free Shopping

- Intense Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Jewelry holds the largest market share at 24.40%, underscoring the Asia-Pacific's deep-rooted cultural ties to precious metals and gemstones, both as symbols of status and means of wealth preservation. Meanwhile, the Beauty and Personal Care segment is on a rapid ascent, boasting a 6.54% CAGR projected through 2031. This surge is fueled by a trend towards premiumization and a growing consumer sophistication in skincare and cosmetics. Notably, the Asia-Pacific beauty market commands a significant slice of the global pie, with digital sales poised to make significant inroads in China by 2027.

While Clothing and Apparel grapple with a shift in consumer focus towards experiential luxury, Footwear is riding high on the wave of athleisure trends and a burgeoning premium sneaker culture among younger audiences. Eyewear is witnessing consistent growth, buoyed by a blend of fashion-forward designs and a rising demand for luxury prescription eyewear. Leather Goods are thriving, especially in markets like South Korea, where sales of luxury handbags are on the rise, paralleling those of jewelry and timepieces. Department stores in the region are also noting upticks in luxury accessory sales. This evolving landscape hints at a broader shift: a move towards functional luxury and tailored beauty solutions, as traditional markers of status adapt to the changing values and lifestyles of consumers across the diverse Asia-Pacific region.

The Asia-Pacific Luxury Goods Market is Segmented by Product Type (Clothing and Apparel, Footwear, Eyewear, Leather Goods, Jewelry, Watches, and Beauty and Personal Care), End User (Men, Women, and Unisex), Distribution Channel (Single Brand Stores, Multi Brand Stores, Online Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- LVMH Moet Hennessy Louis Vuitton SE

- Kering SA

- Chanel SA

- Compagnie Financiere Richemont SA

- Hermes International SA

- Rolex SA

- Prada SpA

- Moncler SpA

- Tapestry Inc

- Burberry Group Plc

- Swatch Group Ltd, The

- The Estee Lauder Companies Inc

- L'Oreal Groupe

- Audemars Piguet & Cie

- Swatch Group Ltd, The

- Giorgio Armani SpA

- Ralph Lauren Corp

- Pandora A/S

- Titan Co Ltd

- AmorePacific Corp

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Brand Consciousness and Premiumization

- 4.2.2 Sustainability and Ethical Preferences

- 4.2.3 Product Innovation and Customization

- 4.2.4 Technology Integration in Retail

- 4.2.5 Tourism and Duty-Free Shopping

- 4.2.6 Growth of Aspirational Consumers and Younger Demographics

- 4.3 Market Restraints

- 4.3.1 Counterfeit Products and Brand Dilution

- 4.3.2 Intense Competition

- 4.3.3 Sustainability Costs and Practices

- 4.3.4 Regulatory and Compliance Challenges

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Clothing and Apparel

- 5.1.2 Footwear

- 5.1.3 Eyewear

- 5.1.4 Leather Goods

- 5.1.5 Jewelry

- 5.1.6 Watches

- 5.1.7 Beauty and Personal Care

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Unisex

- 5.3 By Distribution Channel

- 5.3.1 Single Brand Stores

- 5.3.2 Multi Brand Stores

- 5.3.3 Online Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 India

- 5.4.4 Thailand

- 5.4.5 Singapore

- 5.4.6 Indonesia

- 5.4.7 South Korea

- 5.4.8 Australia

- 5.4.9 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.2 Kering SA

- 6.4.3 Chanel SA

- 6.4.4 Compagnie Financiere Richemont SA

- 6.4.5 Hermes International SA

- 6.4.6 Rolex SA

- 6.4.7 Prada SpA

- 6.4.8 Moncler SpA

- 6.4.9 Tapestry Inc

- 6.4.10 Burberry Group Plc

- 6.4.11 Swatch Group Ltd, The

- 6.4.12 The Estee Lauder Companies Inc

- 6.4.13 L'Oreal Groupe

- 6.4.14 Audemars Piguet & Cie

- 6.4.15 Swatch Group Ltd, The

- 6.4.16 Giorgio Armani SpA

- 6.4.17 Ralph Lauren Corp

- 6.4.18 Pandora A/S

- 6.4.19 Titan Co Ltd

- 6.4.20 AmorePacific Corp

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK