PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937381

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937381

United States Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

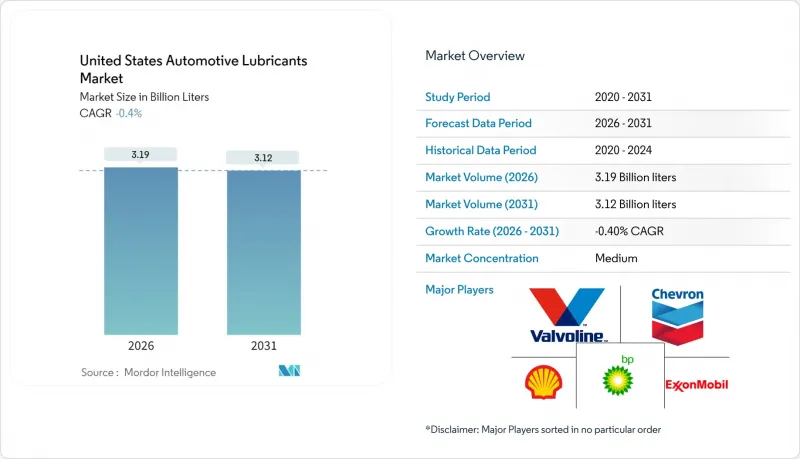

United States Automotive Lubricants Market size in 2026 is estimated at 3.19 billion liters, growing from 2025 value of 3.20 billion liters with 2031 projections showing 3.12 billion liters, growing at -0.40% CAGR over 2026-2031.

A combination of aggressive fuel-economy mandates, extended oil-drain technologies, and accelerating electrification continues to pressure total volumes even as it shifts the product mix toward high-margin synthetics. Commercial fleets deploy predictive analytics that can stretch oil-change intervals from 3,000 miles to as high as 15,000 miles, a move that reduces bulk demand but increases revenue per liter due to premium formulations. Original-equipment manufacturers (OEMs) embed proprietary lube standards in vehicle warranties, locking in factory-fill contracts for suppliers with deep research capabilities. Supply bottlenecks for Group III and Group IV base oils, combined with additive shortages, squeeze blender margins but also reinforce the pricing power of established brands that can guarantee quality and continuity of supply. Meanwhile, collaborative industry responses, such as the Lubricant Packaging Management Association formed by Valvoline, Chevron, Shell, and Castrol, illustrate how regulatory compliance has become a shared cost center rather than a competitive wedge

United States Automotive Lubricants Market Trends and Insights

Stringent CAFE/GHG Standards Driving Shift to Low-Viscosity Synthetics

Corporate Average Fuel Economy (CAFE) rules require fleet-wide efficiency improvements of 5% annually through 2026, prompting automakers to transition from 5W-30 to 0W-20 and even 0W-16 grades, each of which relies heavily on Group III or Group IV synthetics to maintain wear protection at thinner film thicknesses. The transition reduces per-vehicle lubricant demand by minimizing internal friction losses. However, the higher raw-material costs and sophisticated additive recipes inherent in these ultralow viscosities raise average selling prices, enhancing value capture for producers able to formulate to OEM-approved chemistries. California's early enforcement adds a regional accelerator, given its large share of new-vehicle registrations. Key suppliers such as ExxonMobil and Shell invest in advanced antioxidants and friction modifiers to stay ahead of specification upgrades. The net result is a margin-rich but volume-light environment that rewards innovation and regulatory foresight.

OEM Factory-Fill Specifications Expanding Premium Lubricant Demand

Vehicle makers increasingly embed branded fluid requirements into warranty language, effectively outsourcing part of their quality assurance to trusted lubricant partners. Programs such as General Motors' Dexos and Ford's WSS-M2C series force suppliers through extensive bench, engine-dyno, and field trials before approval. Castrol, for instance, supplies roughly three-quarters of global OEM factory fills, leveraging the brand advantage into high-margin service-fill sales. Hybrid powertrains complicate matters further by introducing water condensation during repeated start-stop cycles, requiring corrosion-inhibiting additive blends; Chevron recently secured a European patent covering such chemistry for hybrid engines. These technical hurdles deter new entrants and tighten the bond between OEMs and the established formulators capable of meeting exotic test matrices.

EV Power-Train Adoption Structurally Reducing ICE Engine-Oil Volumes

Battery-electric vehicle (BEV) sales increased significantly, accounting for a considerable share of national light-duty sales, eliminating crankcase oil demand in those cars outright. Plug-in hybrids further dilute the need by relying on electric drive for a portion of miles traveled, trimming lubricant usage by 30-50%. State zero-emission mandates, notably California's 2035 target for 100% ZEV sales, pull demand forward. Although specialized fluids for battery cooling and e-axle gears emerge, their unit volumes remain a fraction of what internal-combustion engines historically absorbed. To hedge, multi-segment suppliers diversify into industrial and marine lubricants or chase nascent EV fluid niches that demand silicon-based coolants and dielectric greases.

Other drivers and restraints analyzed in the detailed report include:

- Fleet Digitalization Enabling Data-Driven Oil-Life Extension Services

- Telematics-Linked Maintenance Contracts Boosting Aftermarket Volumes

- Extended Drain Intervals Cutting Per-Vehicle Lubricant Consumption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automotive engine oil retained 60.10% of the US automotive lubricants market share in 2025. The large installed base of gasoline and diesel engines guarantees a continuing, if tapering, need for routine crankcase service. Hybrid vehicles still consume engine oil, though in smaller quantities, preserving a core demand bedrock while OEM mandates for 0W-20 and 0W-16 grades lift the average price per quart. Within this category, full synthetics expand fastest because they meet low-viscosity and extended-life requirements simultaneously. In parallel, the US automotive lubricants market size for automatic transmission fluids contracts only slightly, buoyed by the complexity of modern multi-speed gearboxes that rely on proprietary friction-modifier blends. Manual transmission fluids and brake fluids, though smaller in absolute tonnage, decline at similar rates because hybrids and BEVs still require hydraulic brake systems that maintain stable demand for DOT 3 and DOT 4 fluids.

Synthetic grease applications bucked the downtrend after Lucas Oil brought an additional 25,000 square feet of grease capacity online in Indiana in 2024, focusing on calcium-sulfonate thickened Red 'N' Tacky products that bypassed lithium-soap supply constraints. The expansion not only alleviates pandemic-era shortages but also catalyzes aftermarket conversions from multipurpose lithium grease to higher-load alternatives favored by off-highway fleets. Meanwhile, the emerging niche for EV thermal-management fluids-glycol-based coolants augmented with nano-fillers-creates new research and development pathways but contributes little to headline volume, illustrating the asymmetry between future growth pockets and legacy decline.

The US Automotive Lubricants Market Report is Segmented by Product Type (Automotive Engine Oil, Manual Transmission Fluids, Automatic Transmission Fluids, Brake Fluids, Automotive Greases, and Other Product Types), and Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Two-Wheelers). The Market Forecasts are Provided in Terms of Volume (Litres).

List of Companies Covered in this Report:

- AMSOIL INC.

- Bardahl Manufacturing Corporation

- BP p.l.c.

- Chevron Corporation

- CITGO Petroleum Lubricants

- ENEOS Corporation

- ExxonMobil Corporation

- FUCHS

- Gulf Oil International

- HollyFrontier (Petro-Canada Lubricants)

- Idemitsu Lubricants America

- Lucas Oil Products, Inc.

- Motul

- Phillips 66 Company

- Shell plc

- TotalEnergies

- Saudi Arabian Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent CAFE/GHG standards driving shift to low-viscosity synthetics

- 4.2.2 OEM factory-fill specifications expanding premium lubricant demand

- 4.2.3 Fleet digitalisation enabling data-driven oil-life extension services

- 4.2.4 Telematics-linked maintenance contracts boosting aftermarket volumes

- 4.2.5 Bio-based additive breakthroughs lowering toxicity of spent oils

- 4.3 Market Restraints

- 4.3.1 EV power-train adoption structurally reducing ICE engine-oil volumes

- 4.3.2 Extended drain intervals cutting per-vehicle lubricant consumption

- 4.3.3 Volatile base-oil feedstock prices squeezing blender margins

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

- 4.6 Regulatory Framework

- 4.7 Automotive Industry Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Automotive Engine Oil

- 5.1.1.1 0W-XX

- 5.1.1.2 5W-XX

- 5.1.1.3 10W-XX

- 5.1.1.4 15W-XX

- 5.1.1.5 Monogrades

- 5.1.1.6 Other Grades

- 5.1.2 Manual Transmission Fluids (MTF)

- 5.1.3 Automatic Transmission Fluids (ATF)

- 5.1.4 Brake Fluids

- 5.1.5 Automotive Greases

- 5.1.6 Other Product Types (Power Steering Fluid etc.)

- 5.1.1 Automotive Engine Oil

- 5.2 By Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.2.3 Two-Wheelers

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Production Capacity, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AMSOIL INC.

- 6.4.2 Bardahl Manufacturing Corporation

- 6.4.3 BP p.l.c.

- 6.4.4 Chevron Corporation

- 6.4.5 CITGO Petroleum Lubricants

- 6.4.6 ENEOS Corporation

- 6.4.7 ExxonMobil Corporation

- 6.4.8 FUCHS

- 6.4.9 Gulf Oil International

- 6.4.10 HollyFrontier (Petro-Canada Lubricants)

- 6.4.11 Idemitsu Lubricants America

- 6.4.12 Lucas Oil Products, Inc.

- 6.4.13 Motul

- 6.4.14 Phillips 66 Company

- 6.4.15 Shell plc

- 6.4.16 TotalEnergies

- 6.4.17 Saudi Arabian Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs