PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937382

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937382

Vietnam Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

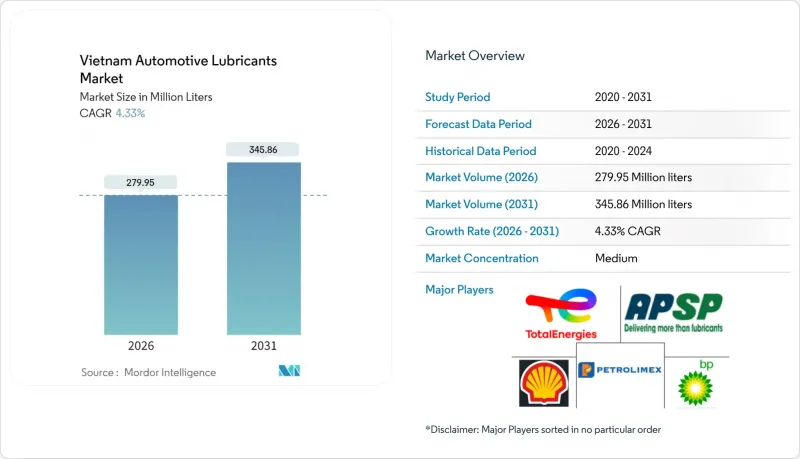

The Vietnam Automotive Lubricants Market was valued at 268.34 million liters in 2025 and estimated to grow from 279.95 million liters in 2026 to reach 345.86 million liters by 2031, at a CAGR of 4.33% during the forecast period (2026-2031).

Robust freight activity, an aging vehicle parc, and expanding e-commerce fleets underpin this growth, even as electrification policies begin to reshape long-term demand. Distribution dominance by Petrolimex, combined with localized blending investments from Shell, BP/Castrol, and Motul, sustains supply resiliency while intensifying competitive differentiation. The rapid adoption of premium synthetics, longer drain intervals mandated by OEMs, and stricter crackdowns on counterfeit products are increasing average selling prices and encouraging margin expansion. At the same time, Hanoi's impending ban on fossil-fuel motorcycles inside Ring Road 1 and Ho Chi Minh City's Low Emission Zone signal regulatory pressure on legacy two-wheeler demand.

Vietnam Automotive Lubricants Market Trends and Insights

Rising Vehicle Parc and Average Age Drive Sustained Lubricant Demand

National vehicle registrations continue to rise. A growing proportion of models are seven years or older, requiring more frequent oil replacements due to degradation and blow-by. Trucking remains fragmented; the majority of commercial vehicles are under 5 tons and average just five trucks per firm, which magnifies service incidents. These factors collectively sustain the Vietnam automotive lubricants market on an upward volume trajectory, despite the headwinds from the electrification trend.

Two-Wheeler Market Dynamics Shape Urban Lubricant Consumption

Although Vietnam became the world's second-largest electric two-wheeler market in 2025, Honda still projects selling 2.2 million ICE motorcycles that year. Routine oil services conducted at ubiquitous roadside washes yield high-frequency lubricant turnover. Legislated bans, such as Hanoi's 2026 exclusion of fossil-fuel motorcycles inside Ring Road 1, begin to narrow urban demand yet leave a vast in-use fleet elsewhere, allowing the Vietnam automotive lubricants market to retain two-wheeler volume support into 2030.

Electric Vehicle Adoption Accelerates ICE Displacement

VinFast shipped 97,399 battery EVs in 2024 and targets 150,700 units in 2025. Because BEVs eliminate engine oil usage and reduce transmission-fluid needs, the Vietnam automotive lubricants market faces structural demand erosion, especially in urban car fleets. Yet thermal-management coolants and specialized e-greases open new high-value niches.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce Logistics Fleet Expansion Drives Commercial Lubricant Growth

- OEM Extended-Drain Interval Specifications Reshape Product Mix

- Growing Counterfeit Lubricant Trade Undermines Market Integrity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automotive engine oil accounted for 52.88% of the Vietnam automotive lubricants market share in 2025. Embedded usage across cars, motorcycles, and trucks ensures volume leadership. However, automatic transmission fluid (ATF) displays the steepest growth trajectory at a 4.52% CAGR, benefiting from rising passenger-car automatic transmission penetration and intensified parts-warranty compliance. Manual transmission fluid still holds a share in light-duty trucks, whereas brake fluids maintain steady mid-single-digit contributions.

Persistent counterfeit activity forces branded suppliers to embed overt and covert security markers on premium SKUs, adding costs but preserving brand equity. Blenders also incorporate Group III base oils and high-performance additive chemistries to comply with API SP and Euro 6 requirements. Motul's Vietnamese plant has begun commercial trials of Re-Refined Base Oil blends, promising a reduction in carbon footprint compared to virgin Group II stocks. These innovations reinforce competitive positioning and align with evolving OEM partnerships inside the Vietnam automotive lubricants industry.

The Vietnam Automotive Lubricants Market Report is Segmented by Product Type (Automotive Engine Oil (0W-XX, 5W-XX, 10W-XX, 15W-XX, Monogrades, and Other Grades), Manual Transmission Fluids, Automatic Transmission Fluids, Brake Fluids, Automotive Greases, and Other Product Types), and Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Two-Wheelers). The Market Forecasts are Provided in Terms of Volume (Litres).

List of Companies Covered in this Report:

- AP SAIGON PETRO

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- GS Caltex Corporation

- Idemitsu Kosan Co. Ltd

- Mekong Petrochemical Jsc

- Motul

- Petrolimex (PLX)

- PETRONAS Lubricants International

- PVOIL

- Repsol Vietnam

- Shell Plc

- TotalEnergies

- Wolf Oil Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising vehicle parc and average age

- 4.2.2 Two-wheeler dominance in urban mobility

- 4.2.3 Surge in e-commerce logistics fleets

- 4.2.4 OEM extended-drain interval specifications

- 4.2.5 Rapid growth of ride-hailing motorbike rentals

- 4.3 Market Restraints

- 4.3.1 Rising EV adoption in passenger-car segment

- 4.3.2 Price-sensitive consumer base favouring low-grade mineral oils

- 4.3.3 Growing counterfeit lubricant trade

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

- 4.6 Regulatory Framework

- 4.7 Automotive Industry Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Automotive Engine Oil

- 5.1.1.1 0W-XX

- 5.1.1.2 5W-XX

- 5.1.1.3 10W-XX

- 5.1.1.4 15W-XX

- 5.1.1.5 Monogrades

- 5.1.1.6 Other Grades

- 5.1.2 Manual Transmission Fluids (MTF)

- 5.1.3 Automatic Transmission Fluids (ATF)

- 5.1.4 Brake Fluids

- 5.1.5 Automotive Greases

- 5.1.6 Other Product Types (Power Steering Fluid etc.)

- 5.1.1 Automotive Engine Oil

- 5.2 By Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.2.3 Two-Wheelers

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%) /Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Production Capacity, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AP SAIGON PETRO

- 6.4.2 BP p.l.c.

- 6.4.3 Chevron Corporation

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Fuchs Petrolub SE

- 6.4.6 GS Caltex Corporation

- 6.4.7 Idemitsu Kosan Co. Ltd

- 6.4.8 Mekong Petrochemical Jsc

- 6.4.9 Motul

- 6.4.10 Petrolimex (PLX)

- 6.4.11 PETRONAS Lubricants International

- 6.4.12 PVOIL

- 6.4.13 Repsol Vietnam

- 6.4.14 Shell Plc

- 6.4.15 TotalEnergies

- 6.4.16 Wolf Oil Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs