PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937410

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937410

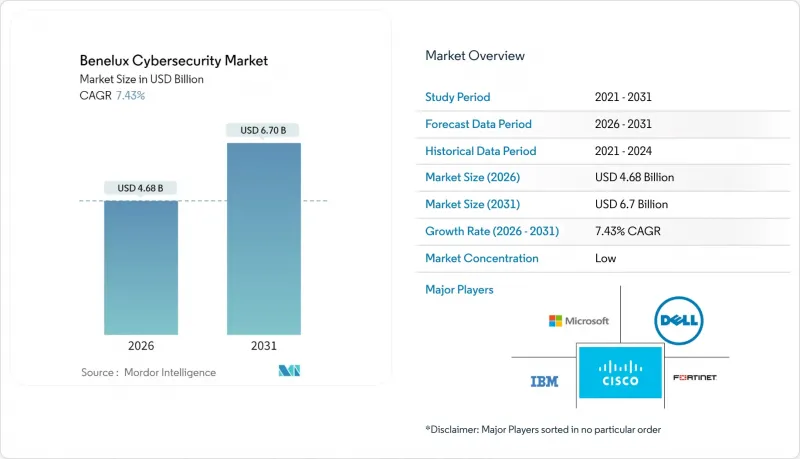

Benelux Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Benelux cybersecurity market size in 2026 is estimated at USD 4.68 billion, growing from 2025 value of USD 4.36 billion with 2031 projections showing USD 6.7 billion, growing at 7.43% CAGR over 2026-2031.

The headline pace is only moderate, yet it hides a marked rotation of spending from hardware appliances toward cloud-native monitoring and managed detection. The Netherlands commands the largest Benelux cybersecurity market share at 64.87% in 2024 thanks to Amsterdam's dense data-centre cluster that elevates both threat exposure and protection budgets. Luxembourg, encouraged by fresh RandD tax credits, delivers the fastest 12% CAGR through 2030, proving that fiscal policy can accelerate security adoption. Belgium's regulatory push under the NIS2 timeline adds a near-term lift as thousands of critical-sector operators must file risk-management plans.

Benelux Cybersecurity Market Trends and Insights

EU NIS2 directive incident-reporting mandate

The directive became effective in 2023 and Belgium's national law starts on 18 October 2024. Entities must register with the Centre for Cyber Security Belgium by March 2025, and most now allocate a larger share of IT budgets to risk management. Mandatory 24-hour incident reporting and supply-chain audits are forcing boards to adopt unified security frameworks, which raises spending on SIEM, vulnerability management, and compliance consulting. The requirement spans critical infrastructure, digital service providers, and many mid-sized firms, pushing the Benelux cybersecurity market toward services that shorten audit cycles. Companies also anticipate steeper penalties, reinforcing the case for continuous monitoring platforms.

Amsterdam data-centre density

Amsterdam hosts roughly 30% of Europe's colocation floor space and more than 330 cloud and network providers.Urban energy caps have frozen new permits, so operators focus on fortifying existing halls through workload protection, cloud-native application firewalls, and hardware root-of-trust modules. Dense interconnection multiplies breach blast radius, turning certification like ISO 27001 into a purchasing trigger. Local cloud availability zones lower data-sovereignty barriers, stimulating demand for tokenization and key-management services that integrate with multi-cloud estates.

Cyber-talent shortage

The region lacks more than 10,000 Dutch or French speaking analysts, and 72% of professionals deem the threat landscape the worst in five years. MSSPs pay premium wages to fill 24-hour rosters, inflating service prices that trickle down to buyers. Enterprises without deep pockets delay projects or scope them down, slowing the Benelux cybersecurity market's potential.

Other drivers and restraints analyzed in the detailed report include:

- FinTech and open-banking expansion

- Industrial-IoT uptake in Flemish plants

- Fragmented municipal versus federal procurement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions still account for 64.32% of the Benelux cybersecurity market in 2025 because every organization first must install firewalls, endpoint agents, and identity platforms to meet minimum NIS2 controls. Yet managed security services are set to rise 15.92% CAGR through 2031, twice the headline pace, as compliance auditing and 24X7 monitoring outstrip in-house staffing capacity. The scarcity of bilingual analysts hands MSSPs pricing power.

Professional-services demand peaks in Belgium, where the directive's 2024 go-live date compresses readiness windows. In the Netherlands, niche players bundle incident response retainers with cyber-insurance, locking in sticky annual revenue. Over time the shift implies that intellectual property and human capital will eclipse appliance sales as the value driver within the Benelux cybersecurity market.

On-premise still owns 54.48% of spending because finance, healthcare, and the public sector run COBOL or mainframe workloads that resist lift-and-shift migration. Nevertheless cloud security grows at 12.86% CAGR as local zones in Brussels and Amsterdam reduce latency and satisfy data-sovereignty rules. Energy-cost spikes make pay-as-you-go compute more attractive than expanding private racks.

Hybrid architecture acts as a stepping stone. Dutch banks increasingly keep core ledgers on-premise while moving analytics into the cloud, which requires unified key management and posture controls. Vendors that sell single subscription bundles across physical and virtual deployments ease licence migration, reinforcing customer loyalty and enlarging the Benelux cybersecurity market.

The Benelux Cybersecurity Market Report is Segmented by Offering (Solutions (Application Security, Cloud Security, and More), Services), Deployment Mode (Cloud, On-Premise), End-User Industry (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Retail and E-Commerce, and More), End-User Enterprise Size (Large Enterprises, Smes) and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IBM Corporation

- Cisco Systems Inc.

- Check Point Software Technologies Ltd.

- Fortinet Inc.

- Dell Technologies Inc.

- Intel Security (Trellix)

- F5 Inc.

- Palo Alto Networks Inc.

- Trend Micro Inc.

- Orange Cyberdefense (Orange S.A.)

- Thales Group

- Fox-IT (Part of NCC Group)

- OneSpan Inc.

- Darktrace plc

- Rapid7 Inc.

- CrowdStrike Holdings Inc.

- Sophos Ltd.

- Kaspersky Lab

- Barracuda Networks Inc.

- Arctic Wolf Networks Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU NIS 2 Directive Enforcing Incident-Reporting Across Benelux Critical Sectors

- 4.2.2 Amsterdam Data-Centre Boom Accelerating Cloud & Edge Security Spend

- 4.2.3 FinTech/Open-Banking Expansion Raising IAM & Zero-Trust Budgets

- 4.2.4 Industrial-IoT Uptake in Flemish Manufacturing Elevating OT-Security Demand

- 4.2.5 Logistics Corridors (Rotterdam-Antwerp) Requiring Supply-Chain Cyber Defence

- 4.2.6 Luxembourg R&D Tax Incentives Fueling SOC-as-a-Service Uptake

- 4.3 Market Restraints

- 4.3.1 Fragmented Municipal-vs-Federal Procurement Slowing Project Roll-outs

- 4.3.2 Shortage of Dutch/French-Speaking Cyber Analysts Inflating MSSP Costs

- 4.3.3 Legacy COBOL Systems in Belgian Public Sector Hindering Zero-Trust Adoption

- 4.3.4 High Dutch Data-Centre Energy Prices Squeezing Security Budgets

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security

- 5.1.1.8 End-point Security

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By End-user Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 IT and Telecom

- 5.4.4 Industrial and Defense

- 5.4.5 Retail and E-commerce

- 5.4.6 Energy and Utilities

- 5.4.7 Manufacturing

- 5.4.8 Others

- 5.5 By Country

- 5.5.1 Belgium

- 5.5.1.1 Netherlands

- 5.5.1.2 Luxembourg

- 5.5.1 Belgium

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Check Point Software Technologies Ltd.

- 6.4.4 Fortinet Inc.

- 6.4.5 Dell Technologies Inc.

- 6.4.6 Intel Security (Trellix)

- 6.4.7 F5 Inc.

- 6.4.8 Palo Alto Networks Inc.

- 6.4.9 Trend Micro Inc.

- 6.4.10 Orange Cyberdefense (Orange S.A.)

- 6.4.11 Thales Group

- 6.4.12 Fox-IT (Part of NCC Group)

- 6.4.13 OneSpan Inc.

- 6.4.14 Darktrace plc

- 6.4.15 Rapid7 Inc.

- 6.4.16 CrowdStrike Holdings Inc.

- 6.4.17 Sophos Ltd.

- 6.4.18 Kaspersky Lab

- 6.4.19 Barracuda Networks Inc.

- 6.4.20 Arctic Wolf Networks Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment