PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937425

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937425

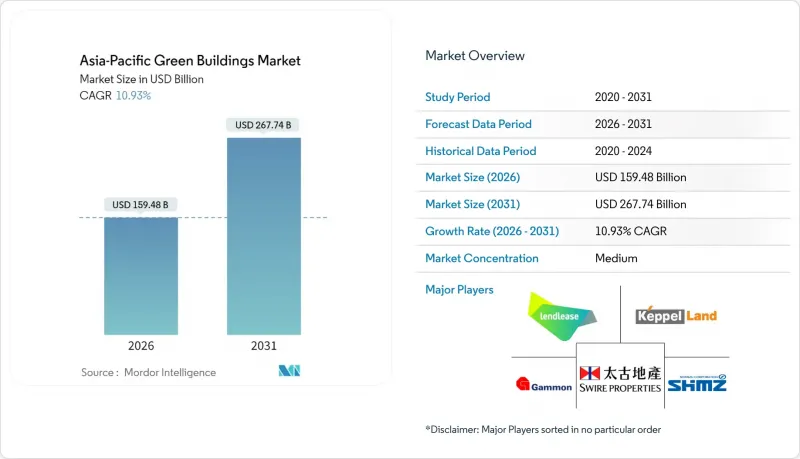

Asia-Pacific Green Buildings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific Green Buildings Market was valued at USD 143.77 billion in 2025 and estimated to grow from USD 159.48 billion in 2026 to reach USD 267.74 billion by 2031, at a CAGR of 10.93% during the forecast period (2026-2031).

Heightened policy stringency, sustained corporate net-zero pledges, and the tangible cost of energy volatility now position green specifications as baseline project requirements rather than premium add-ons. China retains scale leadership, while India's accelerating 13.02% CAGR underscores a geographic pivot toward fast-growing South Asian demand centers. Building systems integration, smart-HVAC adoption, and maturing green finance underpin robust supplier pipelines that dilute the impact of short-term supply chain friction. Competitive intensity remains moderate as certification hurdles favor incumbents, yet digital disruptors are reshaping value capture through performance-as-a-service models.

Asia-Pacific Green Buildings Market Trends and Insights

Strengthening Building-Energy Codes Drive Compliance-Led Growth

Mandatory codes such as China's GB 55015-2021, Japan's revised Building Energy Efficiency Act, and India's 2024 Energy Conservation Building Code enlarge the addressable pool of projects that must integrate green technologies by statute. Developers now incorporate performance modeling during concept design because non-compliance risks project approval delays, and resale limitations. Prefabricated facade makers and smart-HVAC suppliers consequently enjoy more stable order books, prompting capacity expansions that ease unit-cost pressures. Provincial authorities in China further subsidize post-occupancy energy audits, reinforcing the shift from construction-stage criteria to in-use performance metrics. The cumulative effect is a self-reinforcing ecosystem in which regulation, verification, and procurement standards accelerate the APAC Green Buildings market beyond voluntary adoption.

Corporate ESG Mandates Transform Portfolio Strategies

CapitaLand's net-zero carbon pledge and Swire Properties' USD 1.2 billion sustainability-linked loan exemplify how financing terms now hinge on measurable building performance. Executive compensation at leading Asian developers is tied to the Science Based Targets initiative milestones, embedding decarbonization goals in corporate governance. Large multinationals leverage standardized building assessment templates that cascade to local supply chains, forcing subcontractors to upgrade capabilities or face disqualification. Cross-portfolio procurement of high-efficiency chillers and smart sensors yields volume discounts, lowering adoption thresholds for smaller projects. The resulting network effects expand the APAC Green Buildings industry's serviceable obtainable market well beyond marquee flagship developments.

Capital Cost Premiums Constrain Secondary-Market Adoption

In Indonesia, cost premiums of up to 30% persist due to imported facade components and limited local testing facilities. Smaller banks price higher risk premiums into construction loans because resale benchmarks for certified buildings remain thin outside capital cities. Developers compromise on specification depth to preserve pro-forma returns, diluting environmental outcomes and market perception. Absent robust secondary-market data, valuation professionals default to conservative appraisal assumptions, perpetuating financing challenges. This dynamic tempers near-term APAC Green Buildings market penetration in price-sensitive locales.

Other drivers and restraints analyzed in the detailed report include:

- Energy Cost Volatility Accelerates Lifecycle Value Recognition

- Green Finance Mechanisms Enable Capital Formation

- Skills Gaps and Supply Chain Constraints Limit Execution Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Building Systems commanded 40.85% of the APAC Green Buildings market share in 2025, and the segment is expected to escalate at an 11.73% CAGR through 2031. This growth stems from intelligent HVAC platforms that apply artificial-intelligence algorithms for predictive maintenance and real-time load balancing, delivering measurable reductions in energy intensity. Suppliers integrate on-site solar, battery storage, and demand-response capabilities, enabling buildings to act as flexible grid participants rather than static consumers. Exterior Products follow in scale as building-envelope innovations combine thermal resistance with aesthetic versatility suited to diverse climatic zones. Interior Products advance occupant-wellness attributes, such as low-VOC materials and circadian lighting, aligning with post-pandemic health expectations. An emergent "Others" cluster, including building-integrated photovoltaics, underscores a pipeline of disruptive materials that will continue to reshape the APAC Green Buildings market.

Integrated platforms also lower commissioning complexity by consolidating controls under unified dashboards, a feature increasingly valued by facilities-management teams tasked with meeting escalating reporting obligations. Standardized digital twins facilitate remote performance auditing, strengthening post-handover service revenues for system vendors. As carbon-pricing schemes spread, tariff-optimized control algorithms become critical differentiators in procurement tenders, amplifying the competitive moat around integrated Building Systems providers. Although Exterior and Interior Products maintain momentum, their annual gains trail the flagship Systems category, which now represents the core revenue engine of the APAC Green Buildings market.

The Asia-Pacific Green Buildings Market Report is Segmented by Product Type (Exterior Products, Interior Products, Building Systems, Others), by End User (Residential - Apartments & Condominiums, Villas & Landed Houses; Commercial - Office, and More), by Construction Stage (New Construction, Renovation), and by Country (China, India, Japan, South Korea, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Lendlease

- Keppel Land

- Shimizu Corporation

- Swire Properties

- Gammon Construction

- CapitaLand

- Sino Group

- WSP

- Obayashi Corporation

- Sun Hung Kai Properties

- Mitsubishi Estate

- Daiwa House

- China State Construction Eng. Corp.

- CSCEC Green Building

- SK Ecoplant

- LIXIL Group

- Kingspan Group

- Tata Projects

- Gensler

- GreenA Consultants

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strengthening building-energy codes, green standards, and long-term decarbonization targets

- 4.2.2 Corporate ESG/net-zero commitments driving portfolio-wide upgrades

- 4.2.3 Energy price volatility and emphasis on lifecycle operating cost reductions

- 4.2.4 Expanding green finance (tax incentives, green bonds, sustainability-linked loans)

- 4.2.5 Market preference for certified assets, supporting rent and valuation premiums

- 4.3 Market Restraints

- 4.3.1 Higher upfront capital costs and uncertain payback in secondary markets

- 4.3.2 Skills shortages and uneven availability of certified materials/technologies

- 4.3.3 Fragmented regulations, split incentives, and inconsistent valuation practices across jurisdictions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Exterior Products

- 5.1.2 Interior Products

- 5.1.3 Building Systems

- 5.1.4 Others

- 5.2 By End User

- 5.2.1 Residential

- 5.2.1.1 Apartments & Condominiums

- 5.2.1.2 Villas & Landed Houses

- 5.2.2 Commercial

- 5.2.2.1 Office

- 5.2.2.2 Retail

- 5.2.2.3 Logistics

- 5.2.2.4 Institutional

- 5.2.2.5 Others (industrial real estate, hospitality real estate, etc.)

- 5.2.1 Residential

- 5.3 By Construction Stage

- 5.3.1 New Construction

- 5.3.2 Renovation

- 5.4 By Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Australia

- 5.4.6 Indonesia

- 5.4.7 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Lendlease

- 6.4.2 Keppel Land

- 6.4.3 Shimizu Corporation

- 6.4.4 Swire Properties

- 6.4.5 Gammon Construction

- 6.4.6 CapitaLand

- 6.4.7 Sino Group

- 6.4.8 WSP

- 6.4.9 Obayashi Corporation

- 6.4.10 Sun Hung Kai Properties

- 6.4.11 Mitsubishi Estate

- 6.4.12 Daiwa House

- 6.4.13 China State Construction Eng. Corp.

- 6.4.14 CSCEC Green Building

- 6.4.15 SK Ecoplant

- 6.4.16 LIXIL Group

- 6.4.17 Kingspan Group

- 6.4.18 Tata Projects

- 6.4.19 Gensler

- 6.4.20 GreenA Consultants

7 Market Opportunities & Future Outlook