PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938979

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938979

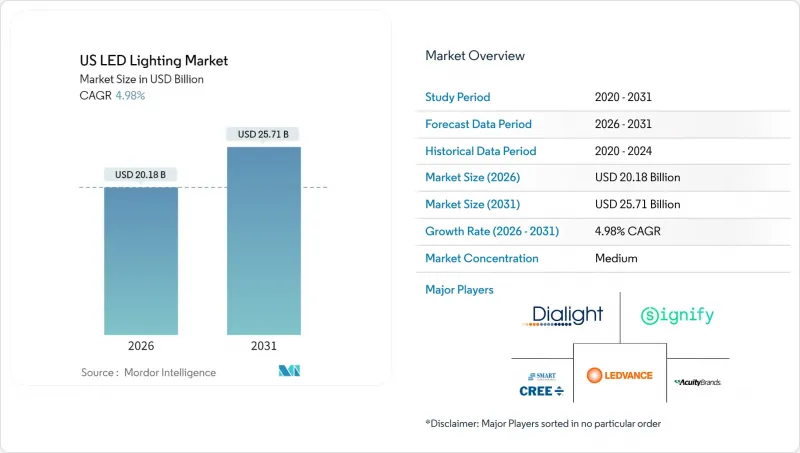

US LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States LED lighting market size in 2026 is estimated at USD 20.18 billion, growing from 2025 value of USD 19.22 billion with 2031 projections showing USD 25.71 billion, growing at 4.98% CAGR over 2026-2031.

Federal rules that eliminated incandescent and halogen lamps in 2023, followed by bans on most fluorescent tubes in California, Vermont, and Washington, created replacement demand that continues to lift unit volumes. Municipal building codes now give more credit for controllable fixtures than for bare efficacy gains, pushing architects to specify luminaires that include sensors and networked drivers. Fortune 500 companies are increasingly replacing legacy lighting to meet their carbon targets, even when payback calculations are unfavorable, redirecting procurement priorities toward verified emission reductions. At the same time, tariffs of 25% on Canadian and Mexican imports, along with an additional 10% surcharge on Chinese sub-components, are nudging manufacturers to diversify their suppliers or reshore sub-assembly, reshaping the competitive landscape.

US LED Lighting Market Trends and Insights

Accelerated Phase-Out of Legacy Lighting Standards

Federal rules that prohibit lamps delivering fewer than 45 lumens per watt have prompted consumers and businesses to shift toward LEDs that deliver 80-100 lumens per watt. California's fluorescent tube ban, effective in 2024, triggered early replacements in offices and retail spaces, reinforcing the dominance of retrofitting in the United States' LED lighting market. Because compliance is mandatory regardless of fixture age, the rule decouples upgrade timing from depreciation schedules. Domestic producers with shorter supply lines gained price leverage as tariffs inflated the costs of imported lamps.

Federal and State Incentive Programs for Energy Efficiency

The Inflation Reduction Act allocates USD 8.8 billion for Home Energy Rebates, which include up to USD 200 per household for qualified LED products. Commercial property owners can deduct up to USD 5.00 per square foot under Section 179D when installed systems surpass code-mandated efficiency, a provision that favors networked luminaires. Title 24 2025 in California will require daylight harvesting and advanced controls, accelerating the uptake of fixtures that ship with embedded sensors and wireless drivers.

Supply-Chain Volatility for Critical Substrates

Tariffs introduced in March 2025 raised duties on Canadian and Mexican imports to 25%, undermining cross-border maquiladora economics. Simultaneously, the surcharge on Chinese LED drivers increased to 20%, raising component costs by 10-15% for U.S. assemblers. Firms now rush to qualify suppliers in Vietnam and India, but the typical 18-month relocation timeline leaves them vulnerable to price fluctuations and inventory shortages.

Other drivers and restraints analyzed in the detailed report include:

- Corporate ESG-Driven Retrofitting Mandates

- Stricter Building-Energy Codes at Municipality Level

- Tariff Uncertainty on Chinese LED Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The luminaires category accounted for a dominant 62.95% share of the United States' LED lighting market in 2025, as architects and engineers specified fixtures with onboard sensors that meet occupancy and daylighting mandates. Growth continues steadily because integrated systems simplify commissioning and warranty. By contrast, lamps post a faster 6.72% CAGR, as they satisfy the immediate needs arising from the bans on incandescent and fluorescent bulbs. The retrofit-heavy nature of the United States LED lighting market keeps lamp volumes buoyant even though average selling prices trend downward.

Innovation in chip-on-board arrays and wireless control modules positions luminaires to capture incremental value as building owners seek granular energy data. Lamp vendors defend their market share through universal dimming compatibility and shatter-resistant coatings, targeting schools and healthcare facilities. Across both sub-segments, the United States LED lighting market size will expand as efficacy gains become increasingly thin, but adoption widens in specialty niches such as grow lights and human-centric lighting.

Wholesale retail retained 54.85% of sales in 2025, yet e-commerce is advancing at a 5.21% CAGR as contractors embrace direct-ship models. The shift is most evident in the residential DIY and small commercial space, where standardized SKUs fit parcel networks. Direct sales remain critical for large projects that require photometric design and rebate paperwork, but web portals are increasingly handling repeat orders for maintenance stock. Manufacturers with robust online configurators and live inventory data are capturing a larger share of the United States' LED lighting market.

Traditional distributors respond by bundling design-assist, rebate administration, and on-site startup services. Some have acquired software firms that manage asset registers and predictive maintenance, creating hybrid physical-digital value propositions. As tariff costs fluctuate, online platforms provide transparent pricing, influencing buyer behavior in a market that still values local service for complex builds.

The United States LED Lighting Market Report is Segmented by Product Type (Lamps, and Luminaires/Fixtures), Distribution Channel (Direct Sales, Wholesale/Retail, and E-Commerce), Installation Type (New Installation, and Retrofit Installation), Application (Commercial Offices, Retail Stores, and More), and End User (Indoor, Outdoor, and Automotive). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Acuity Brands Lighting Inc.

- Signify North America Corp.

- Cree LED Inc.

- GE Current, a Daintree company

- Hubbell Lighting Inc.

- Cooper Lighting Solutions LLC

- LSI Industries Inc.

- RAB Lighting Inc.

- MaxLite Inc.

- LEDVANCE LLC

- Revolution Lighting Technologies Inc.

- Dialight PLC (U.S. operations)

- Orion Energy Systems Inc.

- Energy Focus Inc.

- Musco Sports Lighting LLC

- Lithonia Lighting (Acuity Brands)

- NICOR Inc.

- Gillux Lighting LLC

- Lighting Science Group Corp.

- Growlite (Barron Lighting Group)

- Albeo Technologies Inc.

- Flex Lighting Solutions Inc.

- Sunoptics (Signify)

- Nora Lighting LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated phase-out of legacy lighting standards

- 4.2.2 Federal and state incentive programs for energy efficiency

- 4.2.3 Declining LED prices and higher luminous efficacy

- 4.2.4 Corporate ESG-driven retrofitting mandates

- 4.2.5 Micro-LED pilot production breakthroughs

- 4.2.6 Stricter building-energy codes at municipality level

- 4.3 Market Restraints

- 4.3.1 Supply-chain volatility for critical substrates

- 4.3.2 High upfront cost for specialty applications

- 4.3.3 Tariff uncertainty on Chinese LED components

- 4.3.4 Over-illumination concerns driving "dark-sky" ordinances

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Lamps

- 5.1.2 Luminaires / Fixtures

- 5.2 By Distribution Channel

- 5.2.1 Direct Sales

- 5.2.2 Wholesale Retail

- 5.2.3 E-commerce

- 5.3 By Installation Type

- 5.3.1 New Installation

- 5.3.2 Retrofit Installation

- 5.4 By Application

- 5.4.1 Commercial Offices

- 5.4.2 Retail Stores

- 5.4.3 Hospitality

- 5.4.4 Industrial

- 5.4.5 Highway and Roadway

- 5.4.6 Architectural

- 5.4.7 Public Places

- 5.4.8 Hospitals

- 5.4.9 Horticulture Gardens

- 5.4.10 Residential

- 5.4.11 Automotive

- 5.4.12 Others (Chemicals, Oil and Gas, Agriculture)

- 5.5 By End User

- 5.5.1 Indoor

- 5.5.2 Outdoor

- 5.5.3 Automotive

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Acuity Brands Lighting Inc.

- 6.4.2 Signify North America Corp.

- 6.4.3 Cree LED Inc.

- 6.4.4 GE Current, a Daintree company

- 6.4.5 Hubbell Lighting Inc.

- 6.4.6 Cooper Lighting Solutions LLC

- 6.4.7 LSI Industries Inc.

- 6.4.8 RAB Lighting Inc.

- 6.4.9 MaxLite Inc.

- 6.4.10 LEDVANCE LLC

- 6.4.11 Revolution Lighting Technologies Inc.

- 6.4.12 Dialight PLC (U.S. operations)

- 6.4.13 Orion Energy Systems Inc.

- 6.4.14 Energy Focus Inc.

- 6.4.15 Musco Sports Lighting LLC

- 6.4.16 Lithonia Lighting (Acuity Brands)

- 6.4.17 NICOR Inc.

- 6.4.18 Gillux Lighting LLC

- 6.4.19 Lighting Science Group Corp.

- 6.4.20 Growlite (Barron Lighting Group)

- 6.4.21 Albeo Technologies Inc.

- 6.4.22 Flex Lighting Solutions Inc.

- 6.4.23 Sunoptics (Signify)

- 6.4.24 Nora Lighting LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment