PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939022

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939022

United States Energy Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

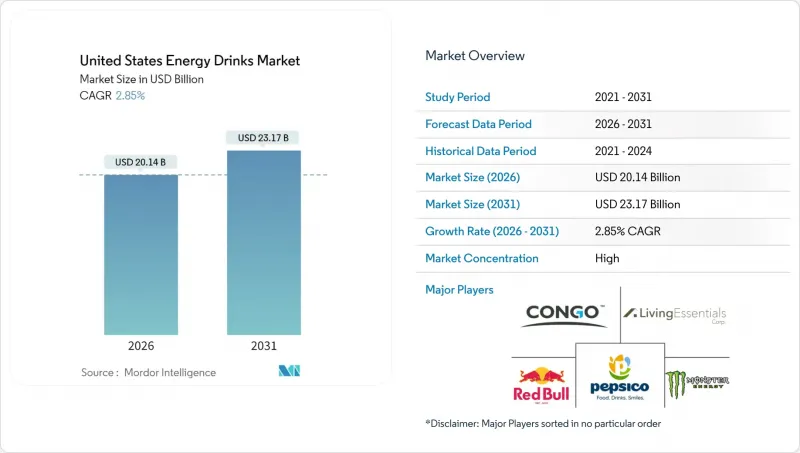

The United States energy drinks market was valued at USD 19.58 billion in 2025 and estimated to grow from USD 20.14 billion in 2026 to reach USD 23.17 billion by 2031, at a CAGR of 2.85% during the forecast period (2026-2031).

Ingredient innovation, regulatory attention on caffeine levels, and consumer shifts toward natural sweeteners collectively shape growth prospects for the US energy drinks market. Traditional formulations retain dominance because of established distribution contracts and deep brand equity, yet cleaner-label line extensions are narrowing the gap. Supply pressures on aluminum and organic raw materials elevate production costs, favoring vertically integrated players that can hedge commodity exposure. Meanwhile, zero-sugar and functional variants are broadening usage occasions and sustaining premium price tiers within the US energy drinks market.

United States Energy Drinks Market Trends and Insights

Increasing Demand for Convenient Energy Solutions

Consumers are increasingly gravitating toward portable alternatives to traditional caffeine sources, driving a notable shift in energy drink positioning. Energy drinks have achieved a significant gain of 1,100 basis points, while soft drinks have experienced a decline of 600 basis points, highlighting a direct substitution rather than an expansion of the overall category. This trend is supported by innovations such as single-serve formats and resealable packaging, which cater to diverse consumption scenarios, including commutes, fitness routines, and extended work hours. The convenience factor has also encouraged impulse purchases, allowing energy drinks to command premium pricing despite rising costs of commodity inputs. However, this growth trajectory is not without challenges. Regulatory restrictions in certain regions, such as limitations on product placement near checkout counters, and mandatory age verification requirements, which complicate quick-service transactions, pose significant hurdles to the convenience-driven appeal of energy drinks.

Growing Popularity as Cognitive Enhancers and Physical Performance Boosters

Brands are shifting their focus beyond basic energy provision, emphasizing premiumization and fostering consumer loyalty. By integrating nootropics like Lion's Mane mushroom and adaptogens, they are differentiating themselves from standard caffeine products. PepsiCo's Rockstar Focus, launching in 2024, exemplifies this trend. Priced at USD 2.99, it combines 200 mg of caffeine with cognitive-enhancing ingredients. The muscle recovery segment, growing at a 5.69% CAGR, is exploring crossover opportunities with sports nutrition, while cognitive enhancement appeals to professionals seeking productivity gains. This strategic approach not only creates barriers to private label competition but also supports premium pricing. However, it requires significant R&D investment and careful regulatory compliance. While this trend aligns with the broader wellness movement, it has attracted scrutiny from health authorities concerned about unverified cognitive claims.

Growing Health Concerns Over High Caffeine, Sugar, and Stimulant Content

Cardiovascular health concerns are intensifying regulatory scrutiny and consumer wariness, with the FDA monitoring adverse event reports and considering caffeine content limitations. According to the Centers for Disease Control and Prevention data from 2023, 919,032 people died from cardiovascular disease. Scientific studies linking high caffeine consumption to cardiovascular events in susceptible populations are driving policy discussions about age restrictions and warning label requirements. The health concern narrative particularly affects traditional high-caffeine formulations, creating market share pressure that benefits reformulated alternatives with natural stimulants and functional ingredients. Consumer education campaigns by health advocacy groups are raising awareness about caffeine dependency and sugar-related health impacts, potentially constraining consumption frequency among health-conscious demographics. This restraint disproportionately impacts traditional energy drink formulations while creating opportunities for brands positioned around wellness and functional benefits.

Other drivers and restraints analyzed in the detailed report include:

- Rising Health-Conscious Reformulation Trends

- Innovation in Product Formulations Including Organic Ingredients

- Increasing Regulatory and Labeling Pressures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, traditional energy drinks hold a 41.73% market share, supported by strong brand loyalty and extensive distribution networks. However, they face growing competition from health-oriented alternatives that are rapidly gaining momentum. Although natural and organic energy drinks currently have a smaller market presence, they are expanding at a robust 4.33% CAGR, a trend expected to continue through 2031. This growth is driven by consumers' increasing preference for cleaner ingredients and functional benefits that go beyond basic stimulation. According to the Organic Trade Association data from 2024, organic food sales in the United States were USD 65.4 billion. Meanwhile, sugar-free and low-calorie variants are capitalizing on advanced reformulation technologies to achieve taste parity with traditional options. Energy shots, in contrast, cater to specific occasions with their concentrated caffeine delivery. Additionally, niche segments are being addressed by other energy drinks, including functional and specialty formulations, through targeted positioning and premium pricing strategies.

This shift in product types highlights growing consumer health awareness and regulatory pressures that are driving reformulation efforts across the category. A notable example of innovation is KEY Energy's 2024 launch of a ketone-based formulation, supported by USD 4 million in seed funding, which delivers energy through metabolic pathways rather than relying on traditional caffeine. Established players are responding to these changes by expanding their product lines and pursuing strategic acquisitions. For instance, Monster's integration of Bang Energy has enabled access to zero-sugar offerings while appealing to a younger demographic. The competitive landscape increasingly favors companies with diversified portfolios that include both traditional and innovative formulations. This approach not only helps defend market share but also positions them to meet emerging consumer preferences effectively.

In 2025, metal cans account for 55.47% of the market share, supported by established supply chains, consumer familiarity, and their suitability for convenience stores. However, manufacturers are under margin pressure due to fluctuating aluminum prices. Glass bottles are experiencing a strong 6.89% CAGR growth forecasted through 2031, driven by their sustainability appeal, premium brand differentiation, and recyclability, which attract environmentally conscious consumers. PET bottles are preferred for applications requiring transparency and lightweight properties, while aseptic packages are ideal for natural and organic formulations that need extended shelf life without preservatives. Disposable cups remain limited to niche applications, primarily in foodservice and sampling scenarios.

The packaging landscape highlights a focus on sustainability and premium positioning strategies. Glass bottles, despite challenges such as logistics issues and breakage risks, achieve higher price points in the market. For example, Monster Beverage implemented aluminum hedging strategies in May 2023, demonstrating an approach to managing commodity risks amid global aluminum price fluctuations. However, the industry faces hurdles, including supply chain disruptions that have caused container shortages and increased freight costs. Additionally, sustainability regulations in various regions are driving demand for recyclable packaging formats. To address these challenges, companies are investing in packaging innovations and diversifying suppliers to mitigate cost volatility while meeting consumer expectations for sustainability and complying with regulatory requirements.

The United States Energy Drinks Market Report is Segmented by Product Type (Energy Shots, Natural/Organic Energy Drinks, Sugar-Free/Low-Calorie Energy Drinks, and More), Packaging Type (PET Bottles, Glass Bottles, Metal Can, Aseptic Packages, Disposable Cups), Distribution Channel (On-Trade, Off-Trade), Functionality (Endurance/Energy Boost, Muscle Recovery, Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Red Bull GmbH

- Monster Beverage Corp.

- PepsiCo Inc. (Rockstar)

- Celsius Holdings Inc.

- Keurig Dr Pepper (C4)

- Prime (Energy) / Congo Brands

- Living Essentials LLC (5-Hour)

- Bang Energy

- The Coca-Cola Company (Reign Storm)

- National Beverage Corp. (Rip It)

- Anheuser-Busch InBev (Hi-Ball)

- GURU Organic Energy

- Zevia LLC

- DAS Labs LLC (Buck ed-Up)

- N.V.E. Pharmaceuticals

- 7-Eleven Inc. (7-Select Fusion)

- Woodbolt Distribution (Xtend)

- Alani Nu

- Ghost Energy

- Zoa Energy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for convenient energy solutions

- 4.2.2 Growing popularity of energy drinks as cognitive enhancers, mood boosters, and physical performance

- 4.2.3 Rising health-conscious reformulation trends

- 4.2.4 Innovation in product formulations including organic ingredients

- 4.2.5 Digital adoption enhancing direct-to-consumer sales

- 4.2.6 Expanding product portfolio with zero-sugar and natural stimulant options

- 4.3 Market Restraints

- 4.3.1 Growing health concerns over high caffeine, sugar, and stimulant content

- 4.3.2 Increasing regulatory and labeling pressures

- 4.3.3 Challenges in sourcing consistent organic ingredients and maintaining product quality

- 4.3.4 Lack of consistent federal regulations causing confusion over product safety and usage

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Energy Shots

- 5.1.2 Natural / Organic Energy Drinks

- 5.1.3 Sugar-Free / Low-Calorie Energy Drinks

- 5.1.4 Traditional Energy Drinks

- 5.1.5 Other Energy Drinks

- 5.2 By Packaging Type

- 5.2.1 PET Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Metal Can

- 5.2.4 Aseptic packages (tetra pak, cartons, pouches)

- 5.2.5 Disposable Cups

- 5.3 By Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarket/Hypermarket

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Specialty Stores

- 5.3.2.4 Online Retail

- 5.3.2.5 Other Distribution Channels

- 5.4 By Functionality

- 5.4.1 Endurance/Energy Boost

- 5.4.2 Muscle Recovery

- 5.4.3 Other

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Red Bull GmbH

- 6.4.2 Monster Beverage Corp.

- 6.4.3 PepsiCo Inc. (Rockstar)

- 6.4.4 Celsius Holdings Inc.

- 6.4.5 Keurig Dr Pepper (C4)

- 6.4.6 Prime (Energy) / Congo Brands

- 6.4.7 Living Essentials LLC (5-Hour)

- 6.4.8 Bang Energy

- 6.4.9 The Coca-Cola Company (Reign Storm)

- 6.4.10 National Beverage Corp. (Rip It)

- 6.4.11 Anheuser-Busch InBev (Hi-Ball)

- 6.4.12 GURU Organic Energy

- 6.4.13 Zevia LLC

- 6.4.14 DAS Labs LLC (Buck ed-Up)

- 6.4.15 N.V.E. Pharmaceuticals

- 6.4.16 7-Eleven Inc. (7-Select Fusion)

- 6.4.17 Woodbolt Distribution (Xtend)

- 6.4.18 Alani Nu

- 6.4.19 Ghost Energy

- 6.4.20 Zoa Energy

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK